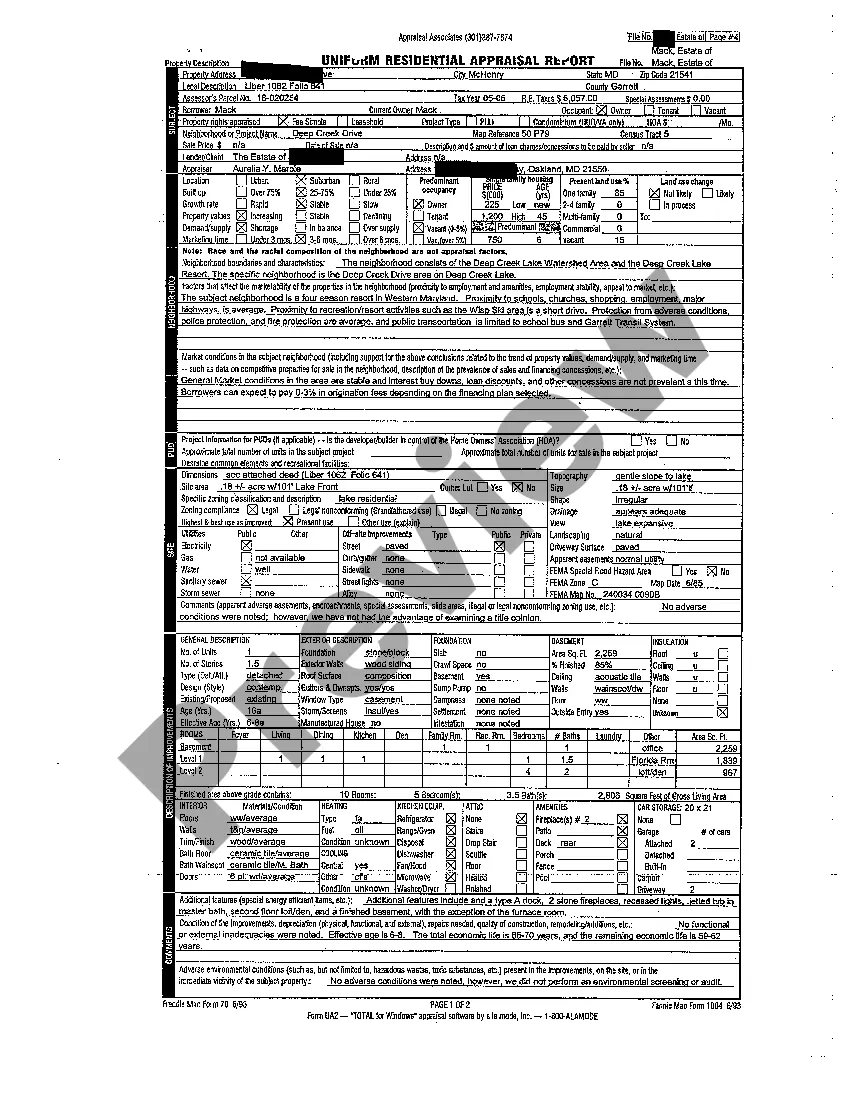

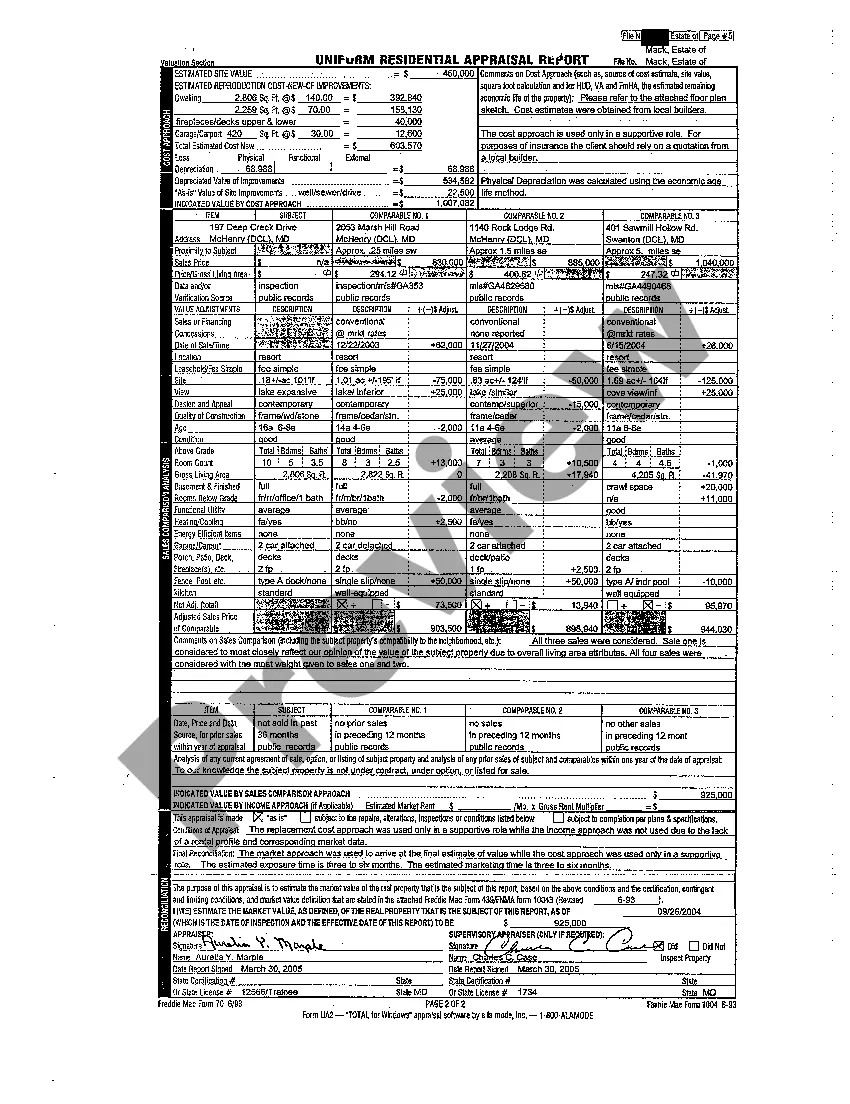

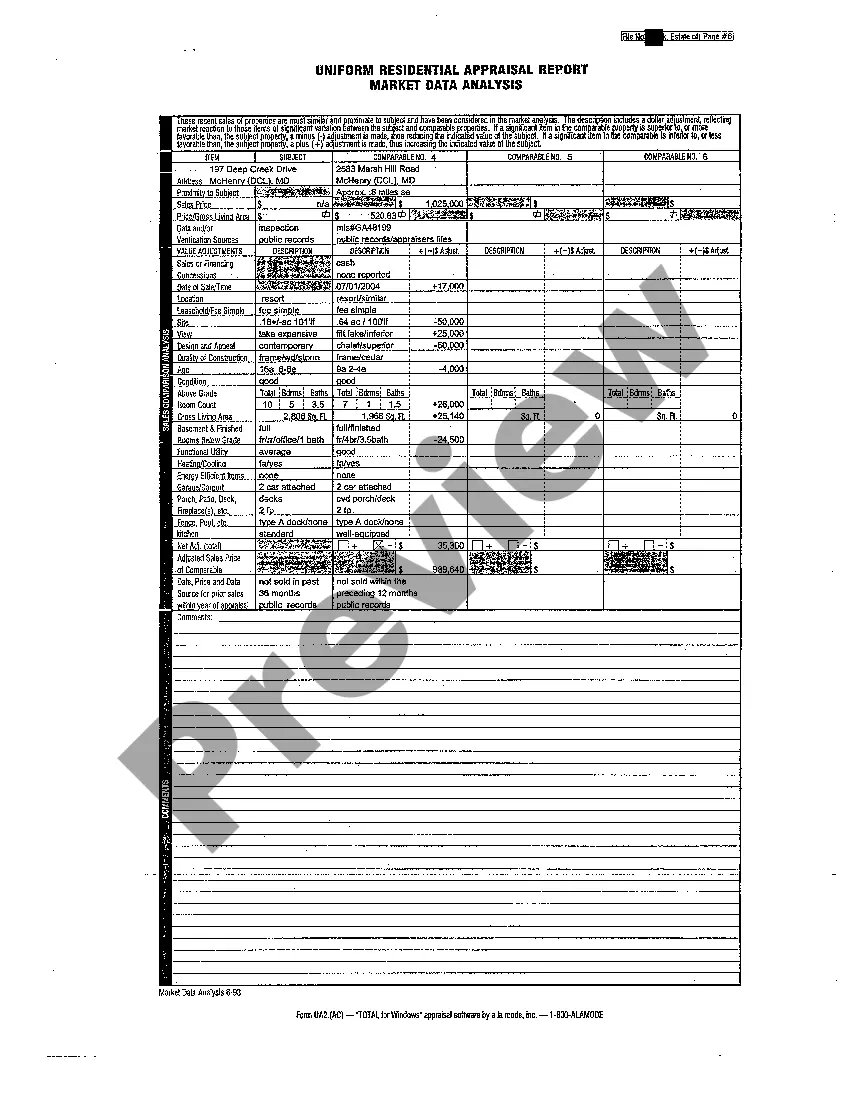

Montgomery Maryland Appraisal of Decedent's Real Property is a comprehensive evaluation process conducted to determine the value of a deceased individual's real estate assets located in Montgomery County, Maryland. This appraisal is a critical step in the probate process, where the assets of the deceased are accounted for, managed, and distributed according to applicable laws and regulations. During the Montgomery Maryland Appraisal of Decedent's Real Property, a certified appraiser thoroughly inspects the property, assesses its condition, and considers various factors that might influence its value. These factors can include the property's location, size, improvements, age, amenities, comparable properties in the area, market trends, and any unique characteristics that might affect its desirability. There can be different types of Montgomery Maryland Appraisal of Decedent's Real Property, depending on the specific requirements. Some common types include: 1. Residential Appraisal: This type of appraisal focuses on single-family homes, condominiums, townhouses, or any residential property owned by the decedent. The appraiser determines the fair market value based on factors specific to residential properties, such as the number of bedrooms, bathrooms, living spaces, lot size, and the overall condition. 2. Commercial Appraisal: In cases where the decedent owned commercial real estate such as office buildings, retail spaces, warehouses, or industrial properties, a commercial appraisal is conducted. The appraiser considers factors like the income potential, rental rates, location, condition, and market demand for similar commercial properties in Montgomery County. 3. Vacant Land Appraisal: If the deceased owned undeveloped land or vacant lots, a vacant land appraisal is necessary. This type of appraisal assesses the value of the land based on factors like location, zoning restrictions, development potential, access to utilities, and any environmental considerations. Throughout the Montgomery Maryland Appraisal of Decedent's Real Property process, the appraiser thoroughly examines all relevant documents, such as surveys, title reports, property tax records, and any existing leases or rental agreements. Their goal is to provide an accurate and unbiased assessment of the property's value, which is crucial for estate planning, tax purposes, potential sales, or equitable distribution among beneficiaries. It's important to consult with qualified professionals experienced in Montgomery Maryland Appraisal of Decedent's Real Property to ensure an accurate and reliable appraisal that complies with legal requirements.

Montgomery Maryland Appraisal of Decedent's Real Property

Description

How to fill out Montgomery Maryland Appraisal Of Decedent's Real Property?

Benefit from the US Legal Forms and have instant access to any form you want. Our beneficial platform with a large number of templates simplifies the way to find and get almost any document sample you will need. You are able to export, complete, and sign the Montgomery Maryland Appraisal of Decedent's Real Property in just a matter of minutes instead of browsing the web for many hours trying to find an appropriate template.

Utilizing our collection is a superb strategy to improve the safety of your document submissions. Our professional lawyers regularly check all the documents to make certain that the templates are appropriate for a particular state and compliant with new acts and polices.

How do you get the Montgomery Maryland Appraisal of Decedent's Real Property? If you already have a subscription, just log in to the account. The Download button will appear on all the samples you view. Moreover, you can get all the previously saved records in the My Forms menu.

If you haven’t registered a profile yet, stick to the instructions listed below:

- Find the template you require. Ensure that it is the template you were looking for: verify its title and description, and utilize the Preview function when it is available. Otherwise, use the Search field to look for the appropriate one.

- Start the downloading process. Select Buy Now and select the pricing plan that suits you best. Then, sign up for an account and process your order using a credit card or PayPal.

- Save the document. Select the format to obtain the Montgomery Maryland Appraisal of Decedent's Real Property and edit and complete, or sign it for your needs.

US Legal Forms is probably the most significant and trustworthy document libraries on the internet. We are always happy to assist you in virtually any legal process, even if it is just downloading the Montgomery Maryland Appraisal of Decedent's Real Property.

Feel free to take full advantage of our form catalog and make your document experience as efficient as possible!

Form popularity

FAQ

Generally, unless the estate includes real property which needs to be sold, requires the filing of a U.S. Estate Tax Return, or is tied up in litigation, a regular estate proceeding may be closed after the period for filing creditor claims expires (six months from the date of death).

Obtain a Will From Probate Court The best way to view the will is to get the probate court file number. The executor can give you this information. You may also be able to access the file number by phone, online, or in person at the courthouse by providing the deceased's name and date of death.

Executor Fees in Maryland Maryland executor fees, by law, should not exceed certain amounts. Reasonable compensation is not to exceed 9% if less than $20,000; and $1,800 plus 3.6% of the excess over $20,000.

6 months from the date of the decedent's death; or. 2 months after the personal representative delivers a copy of the ?Notice of Appointment, Notice to Creditors, Notice to Unknown Heirs? form.

The process, which is to be completed within twelve months, is available only if all residuary legatees or heirs are exempt from inheritance tax or the decedent's personal representative and all trustees of any trusts are limited to the decedents Personal Representative, spouse and children, and if the estate is

The registry is strictly confidential until the death of the testator. Upon the death of the testator, a copy can be provided to anyone who presents a death certificate, affidavit of death and heirship or other satisfactory evidence of the testator's death.

Mississippi probate records include dockets, wills, settlements, petitions, letters, guardianships, claims, and minutes. Probate records of Mississippi have been kept by the chancery courts or probate courts. You can obtain copies of the records by contacting the clerk's office in each county courthouse.

Most estates need to be probated, so most Wills do become part of the public record. Probate is the process through which the assets of an estate are distributed ? to creditors, to pay taxes, and to heirs.

Starting from the date of death, the executors have 12 months before they have to start distributing the estate. This allows time to gather information on the estate and check for potential claims. The executors have no obligation to distribute the estate before the end of the year.

An executor will never be legally forced to pay out to the beneficiaries of a will until one year has passed from the date of death: this is called the 'executor's year'.