Title: Montgomery Maryland Reminder of Deadline for Filing Inventory — Important Dates and Requirements Introduction: In Montgomery County, Maryland, business owners and individuals are required to file an inventory of their assets by a designated deadline. This mandatory process ensures accurate record-keeping, property valuation, and compliance with local regulations. This article serves as a reminder of the upcoming deadline and provides details on the various types of Montgomery Maryland Reminder of Deadline for Filing Inventory. Main body: 1. Montgomery Maryland Business Inventory Filing Reminder: — As a business owner in Montgomery County, it is crucial to be aware of the annual inventory filing requirement. — The deadline for submitting your business inventory for assessment is typically on or before [specific date], as determined by the Maryland Department of Assessments and Taxation (MEAT). — Complying with this deadline ensures proper valuation of business assets, which helps determine property taxes and other financial obligations. 2. Montgomery Maryland Personal Property Inventory Filing Reminder: — As a resident of Montgomery County, you must also be aware of the personal property inventory filing deadline. — Personal property includes assets such as furniture, vehicles, jewelry, and any valuable belongings. — The [specific date] is typically set as the deadline for submitting your comprehensive inventory to MEAT. — Ensure accuratreportinavoidindidid penalties and maintain compliance with local tax regulations. 3. Maryland Department of Assessments and Taxation Requirements: — When filing your inventory, make sure to provide a detailed and comprehensive list of assets, including their value and acquisition date. — Attach supporting documentation like purchase receipts, invoices, or appraisals to substantiate the declared values. — Maintain proper organization and categorization of your inventory, making it easier for tax assessors to review and process your submission. 4. Consequences of Missing the Inventory Filing Deadline: — Failing to meet the deadline for inventory filing may lead to penalties and fines imposed by the Maryland Department of Assessments and Taxation. — Proper compliance with the set deadline ensures accurate tax assessments, preventing potential disputes or discrepancies later on. Conclusion: Being diligent and proactive about the Montgomery Maryland Reminder of Deadline for Filing Inventory is crucial for both businesses and individuals in Montgomery County. By submitting a comprehensive inventory on time, one can avoid unnecessary penalties, maintain compliance, and ensure fair tax assessments. Stay informed about the specific requirements and deadlines by regularly checking the Maryland Department of Assessments and Taxation website or consulting with a local tax professional to ensure a smooth and successful filing process.

Montgomery Maryland Reminder of Deadline for Filing Inventory

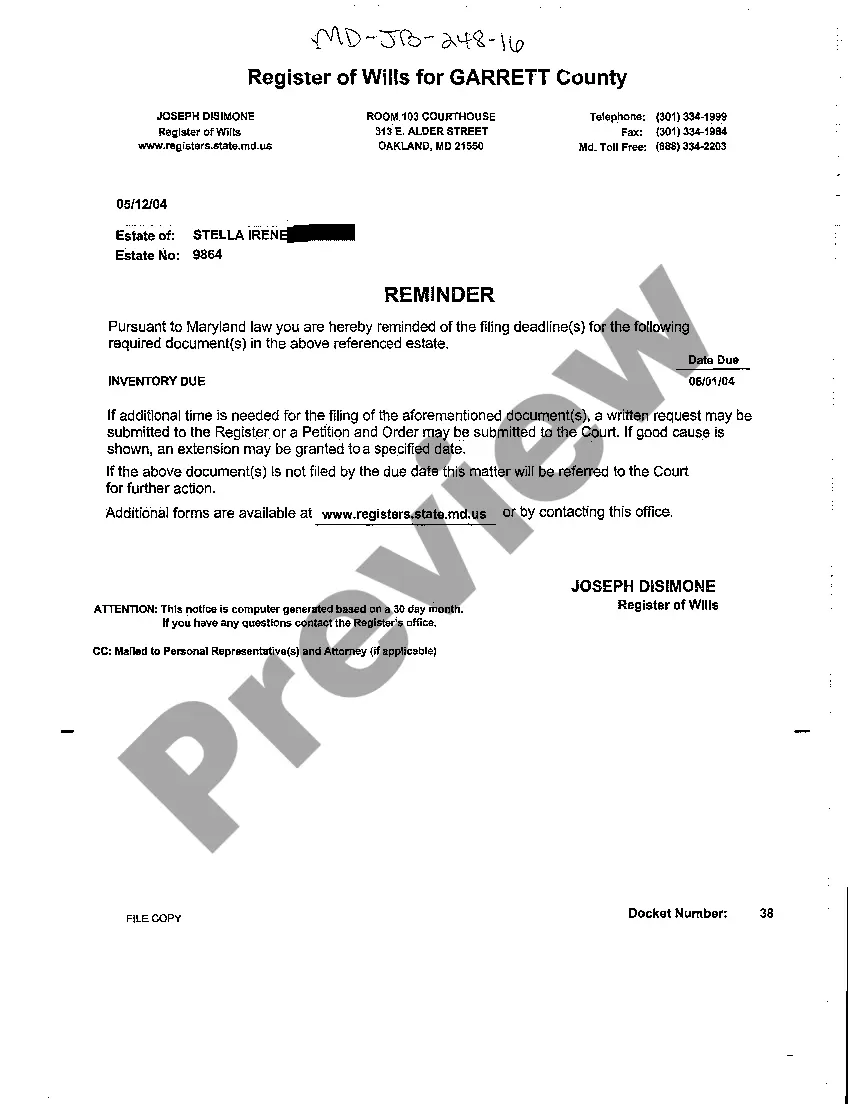

Description

How to fill out Montgomery Maryland Reminder Of Deadline For Filing Inventory?

Getting verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Montgomery Maryland Reminder of Deadline for Filing Inventory gets as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the Montgomery Maryland Reminder of Deadline for Filing Inventory takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a couple of additional steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Look at the Preview mode and form description. Make sure you’ve picked the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to get the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Montgomery Maryland Reminder of Deadline for Filing Inventory. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!