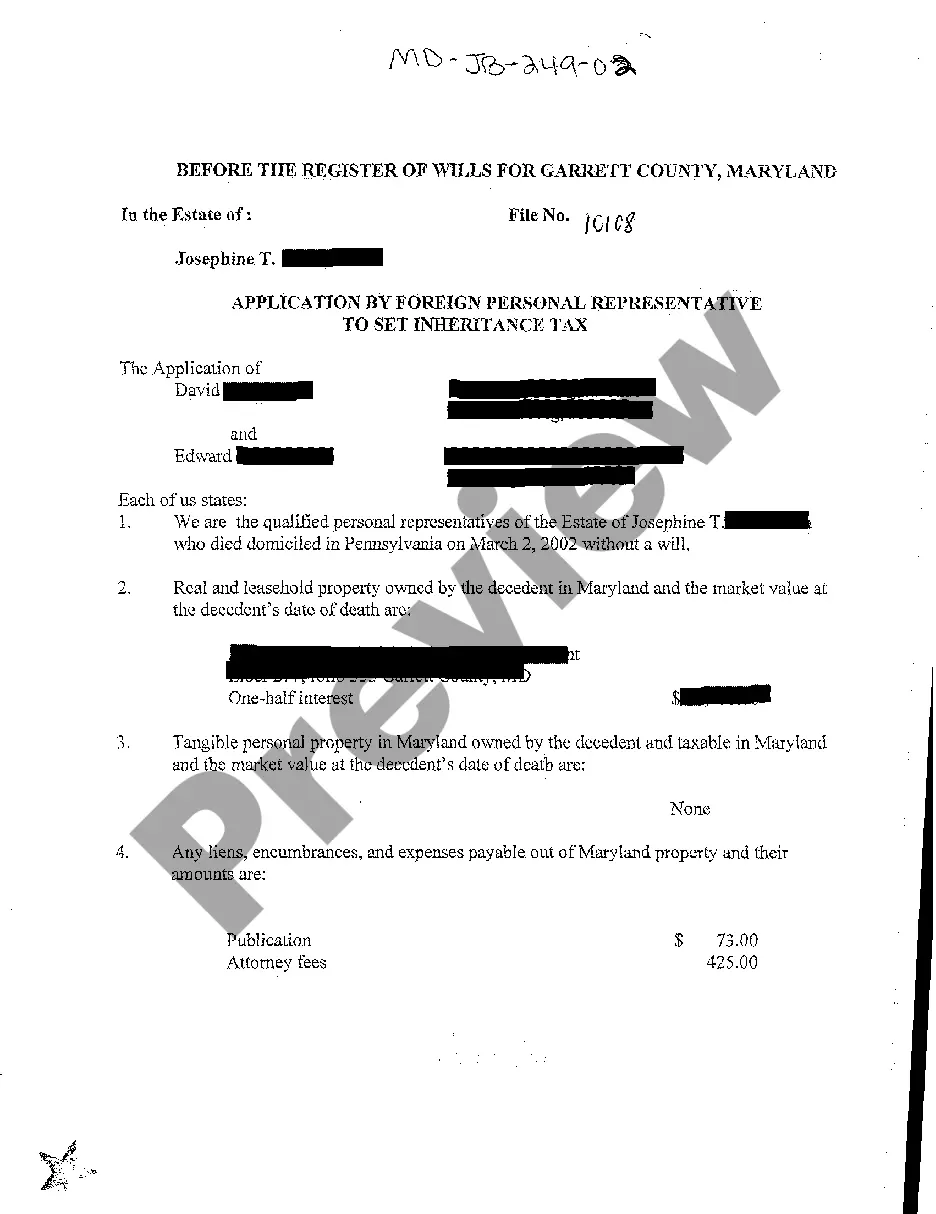

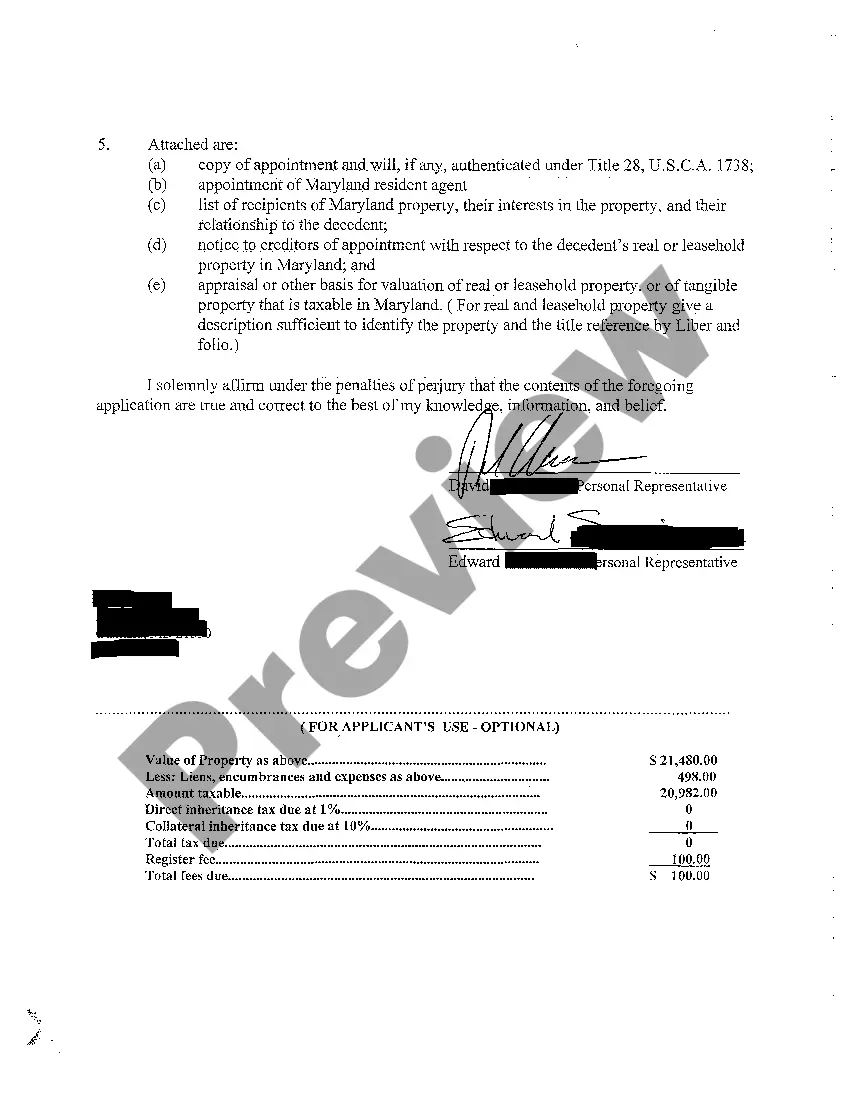

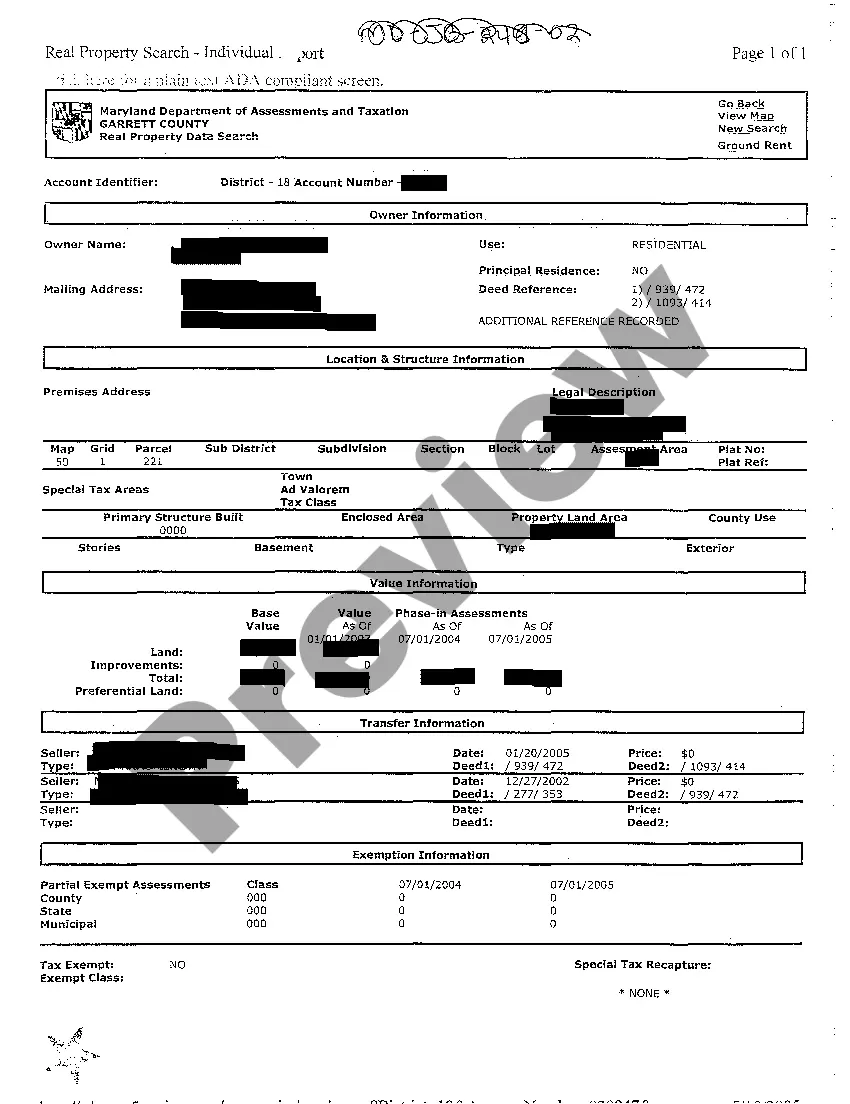

The Montgomery Maryland Application by Foreign Personal Representative to Set Inheritance Tax is a legal process that allows foreign personal representatives to handle the inheritance tax matters of a deceased individual in Montgomery County, Maryland. This application is specifically designed for those individuals who are not residents of Maryland but have been appointed as personal representatives to administer the estate of a deceased person who held assets in Montgomery County. The primary purpose of this application is to ensure that the tax obligations related to the inheritance of the deceased individual's assets are fulfilled in accordance with the laws and regulations of Montgomery County. It provides a framework for foreign personal representatives to navigate the complexities of the inheritance tax system and fulfill their responsibilities in an organized and legal manner. The Montgomery Maryland Application by Foreign Personal Representative to Set Inheritance Tax encompasses several steps and requirements to complete the process successfully. These include: 1. Appointment as Personal Representative: The foreign individual must have already been appointed as a personal representative by the appropriate court or jurisdiction outside of Maryland. 2. Verification of Assets: The personal representative is expected to identify, document, and verify all the assets held by the deceased in Montgomery County. This includes real estate properties, financial accounts, investments, and personal belongings. 3. Determination of Inheritance Tax Liability: The application requires a comprehensive assessment of the inheritance tax liability based on the value of the decedent's assets. The personal representative has to calculate the inheritance tax owed and ensure that all relevant information is provided to the Montgomery County Department of Finance. 4. Submission of Required Documents: The application process involves gathering and submitting various documents such as the Letter of Appointment, a certified copy of the will (if one exists), a report of assets, an estate tax return, and any other relevant documentation requested by the Montgomery County authorities. 5. Payment of Inheritance Tax: The foreign personal representative is responsible for settling the inheritance tax owed to Montgomery County. This payment should be made in a timely manner to avoid penalties or interest charges. It is worth noting that there are no distinct types of Montgomery Maryland Application by Foreign Personal Representative to Set Inheritance Tax. However, the application process may vary based on the specific circumstances of each case, such as the value and nature of the assets involved, the existence of a will, and any additional legal complexities. In summary, the Montgomery Maryland Application by Foreign Personal Representative to Set Inheritance Tax is a legal procedure designed to provide a structured framework for foreign personal representatives to fulfill their obligations regarding inheritance tax matters in Montgomery County, Maryland. It ensures compliance with local tax laws and facilitates the orderly administration of the deceased individual's estate.

Montgomery Maryland Application by Foreign Personal Representative to Set Inheritance Tax

Description

How to fill out Montgomery Maryland Application By Foreign Personal Representative To Set Inheritance Tax?

We always strive to reduce or avoid legal damage when dealing with nuanced legal or financial matters. To accomplish this, we sign up for legal solutions that, usually, are very costly. However, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of using services of legal counsel. We offer access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Montgomery Maryland Application by Foreign Personal Representative to Set Inheritance Tax or any other form quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again from within the My Forms tab.

The process is equally effortless if you’re unfamiliar with the website! You can create your account in a matter of minutes.

- Make sure to check if the Montgomery Maryland Application by Foreign Personal Representative to Set Inheritance Tax complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Montgomery Maryland Application by Foreign Personal Representative to Set Inheritance Tax is suitable for you, you can choose the subscription plan and proceed to payment.

- Then you can download the document in any available file format.

For over 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!