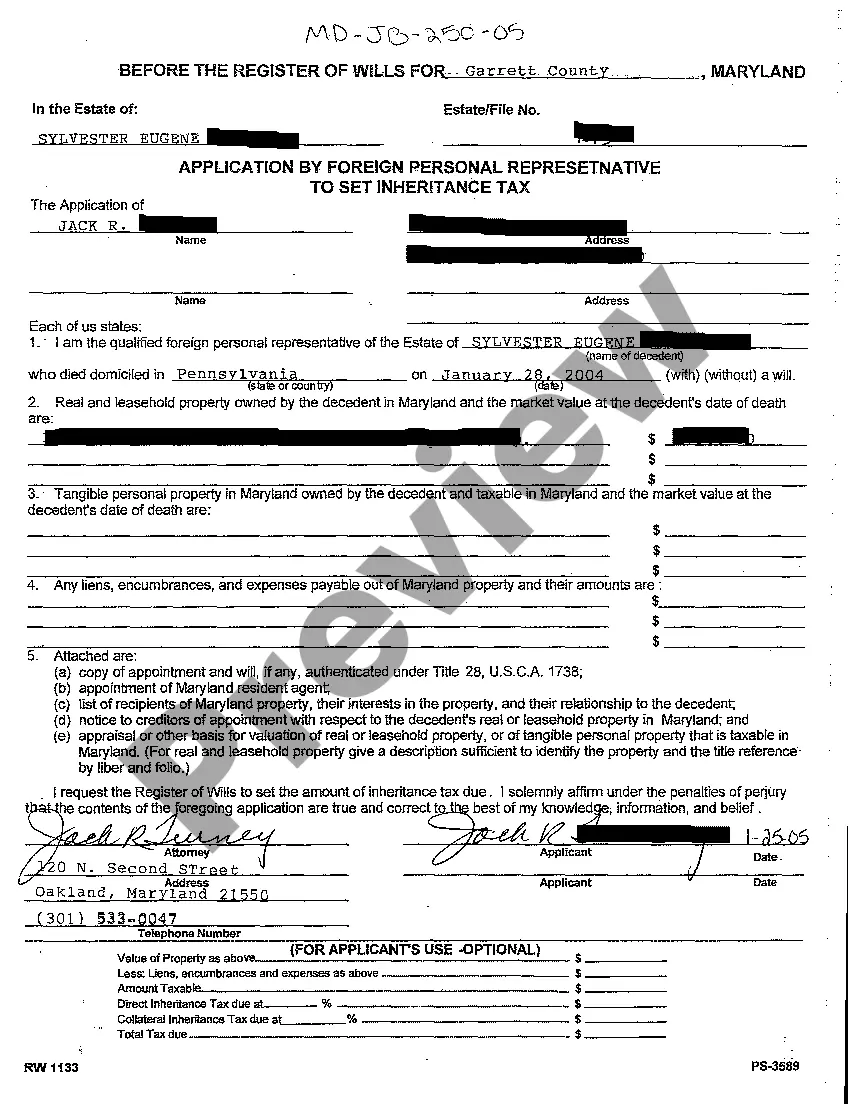

The Montgomery Maryland Application by Foreign Personal Representative to Set Inheritance Tax is a legal process that takes place when a foreign personal representative seeks to settle the inheritance tax of a decedent's estate in Montgomery County, Maryland. This application is required by law to ensure proper taxation and distribution of assets in accordance with state regulations. The Montgomery Maryland Application by Foreign Personal Representative to Set Inheritance Tax includes several important steps and requirements. Firstly, the foreign personal representative must obtain legal authority or recognition from the Montgomery County Orphans' Court to act on behalf of the estate. This typically involves submitting relevant documentation, such as certified copies of the foreign personal representative's appointment or letters of administration. Once the foreign personal representative has obtained the necessary authority, they can proceed with filing the Application by Foreign Personal Representative to Set Inheritance Tax with the Montgomery County Department of Finance, specifically the Division of Revenue. Keywords: Montgomery Maryland, Application by Foreign Personal Representative, Set Inheritance Tax, Montgomery County, Maryland, foreign personal representative, decedent's estate, taxation, assets, state regulations, Montgomery County Orphans' Court, legal authority, recognition, estate, documentation, appointment, letters of administration, filing, Department of Finance, Division of Revenue. Different types or variations of the Montgomery Maryland Application by Foreign Personal Representative to Set Inheritance Tax may include: 1. Regular Application by Foreign Personal Representative: This refers to the standard procedure followed by foreign personal representatives who are seeking to settle the inheritance tax of an estate in Montgomery County, Maryland. 2. Expedited Application by Foreign Personal Representative: In certain cases where time is of the essence or there are extenuating circumstances, a foreign personal representative may opt for an expedited application process. This entails additional documentation or justification to prove the need for swift resolution. 3. Joint Application by Multiple Foreign Personal Representatives: If there are multiple foreign personal representatives involved in the settlement process, they may file a joint application to streamline the taxation and distribution procedures. 4. Application by Foreign Personal Representative for Small Estate: In situations where the estate's value falls below a certain threshold, often determined by state law, a foreign personal representative may qualify for a simplified application process designed for small estates.

Montgomery Maryland Application by Foreign Personal Representative to Set Inheritance Tax

Description

How to fill out Montgomery Maryland Application By Foreign Personal Representative To Set Inheritance Tax?

Regardless of social or professional status, filling out legal documents is an unfortunate necessity in today’s professional environment. Very often, it’s practically impossible for someone without any law background to draft such papers cfrom the ground up, mainly because of the convoluted jargon and legal nuances they entail. This is where US Legal Forms comes to the rescue. Our service offers a huge collection with over 85,000 ready-to-use state-specific documents that work for pretty much any legal scenario. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

Whether you require the Montgomery Maryland Application by Foreign Personal Representative to Set Inheritance Tax or any other document that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the Montgomery Maryland Application by Foreign Personal Representative to Set Inheritance Tax in minutes using our trustworthy service. In case you are presently an existing customer, you can go ahead and log in to your account to download the appropriate form.

Nevertheless, if you are new to our library, ensure that you follow these steps prior to downloading the Montgomery Maryland Application by Foreign Personal Representative to Set Inheritance Tax:

- Be sure the template you have found is specific to your area because the rules of one state or area do not work for another state or area.

- Review the form and go through a quick outline (if available) of scenarios the paper can be used for.

- If the form you selected doesn’t meet your needs, you can start over and search for the needed document.

- Click Buy now and pick the subscription option you prefer the best.

- Log in to your account login information or create one from scratch.

- Pick the payment gateway and proceed to download the Montgomery Maryland Application by Foreign Personal Representative to Set Inheritance Tax once the payment is done.

You’re all set! Now you can go ahead and print the form or complete it online. If you have any issues locating your purchased documents, you can easily find them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.