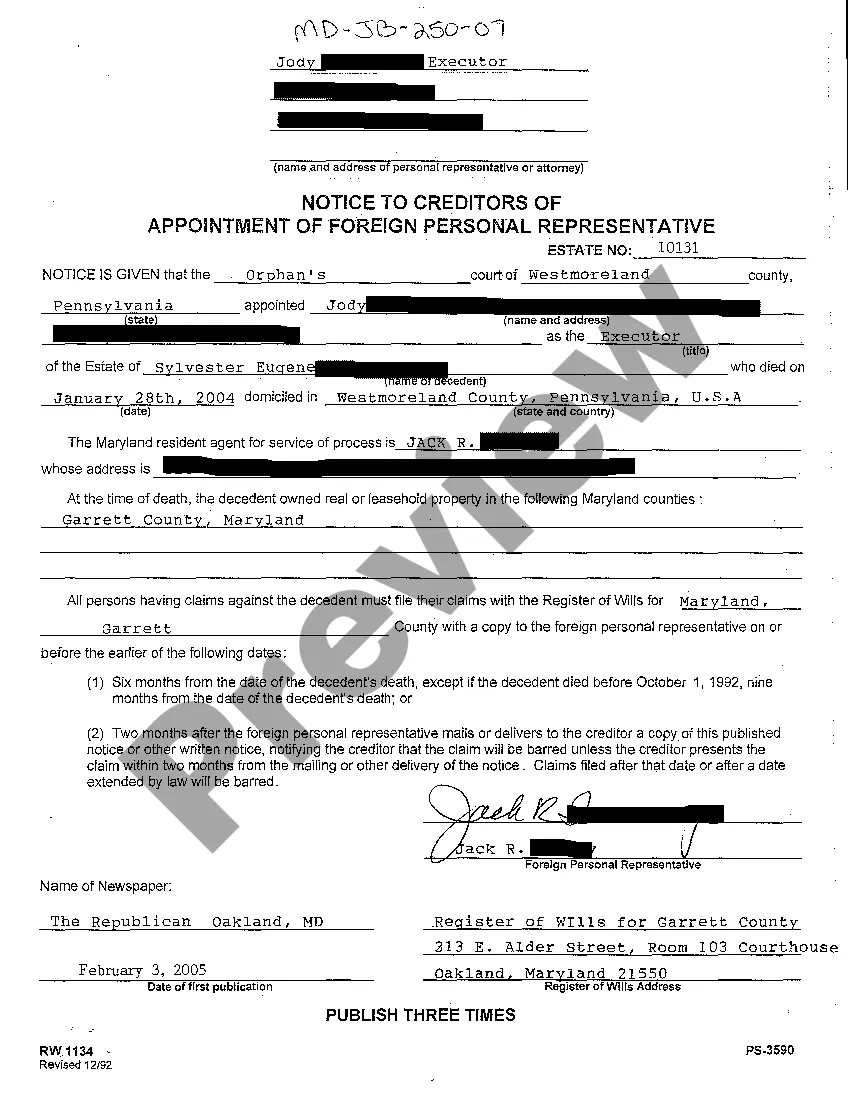

The Montgomery Maryland Notice to Creditors of Appointment of Foreign Personal Representative is a legal document that notifies creditors of the appointment of a foreign personal representative in Montgomery County, Maryland. This document is important in ensuring that all debts owed by the deceased person are properly addressed and settled. When someone who is not a resident of Maryland, but has assets in the state, passes away, a foreign personal representative may be appointed to handle their estate. The notice to creditors is then published to inform any potential creditors about this appointment. One type of Montgomery Maryland Notice to Creditors of Appointment of Foreign Personal Representative is for probate estates. In probate estates, the deceased person's assets are distributed to their beneficiaries or heirs after the payment of debts and taxes. The notice serves as a formal notification to creditors that they need to submit their claims against the estate within a specified timeframe. Another type of notice is for non-probate estates. Non-probate estates include assets that are not subject to the probate process, such as jointly held property, assets with beneficiary designations, or assets in a living trust. The notice informs creditors that they should present their claims to the appointed foreign personal representative for payment. The Montgomery Maryland Notice to Creditors of Appointment of Foreign Personal Representative typically includes the following information: 1. Identification of the deceased person: The full name, date of death, and county of residence of the decedent are mentioned. 2. Appointment of foreign personal representative: The name, address, and contact information of the appointed foreign personal representative are provided. This ensures that creditors know who to contact regarding any outstanding debts. 3. Timeframe for submitting creditor claims: The notice stipulates the deadline for creditors to submit their claims against the estate. This timeframe is usually a few months from the publication of the notice. 4. Instructions for creditors: The notice directs creditors to submit their claims in writing, stating the amount owed, the nature of the debt, and any supporting documentation. It may also provide information on where to mail or deliver the claim. 5. Contact information: The notice provides contact information for the foreign personal representative or their attorney, including their mailing address and phone number. Creditors can use this information to communicate with the appointed representative. The Montgomery Maryland Notice to Creditors of Appointment of Foreign Personal Representative is a critical step in the probate or administration process. It ensures that creditors are given an opportunity to present their claims against the deceased person's estate and safeguards the interests of both creditors and beneficiaries.

Montgomery Maryland Notice to Creditors of Appointment of Foreign Personal Representative

Description

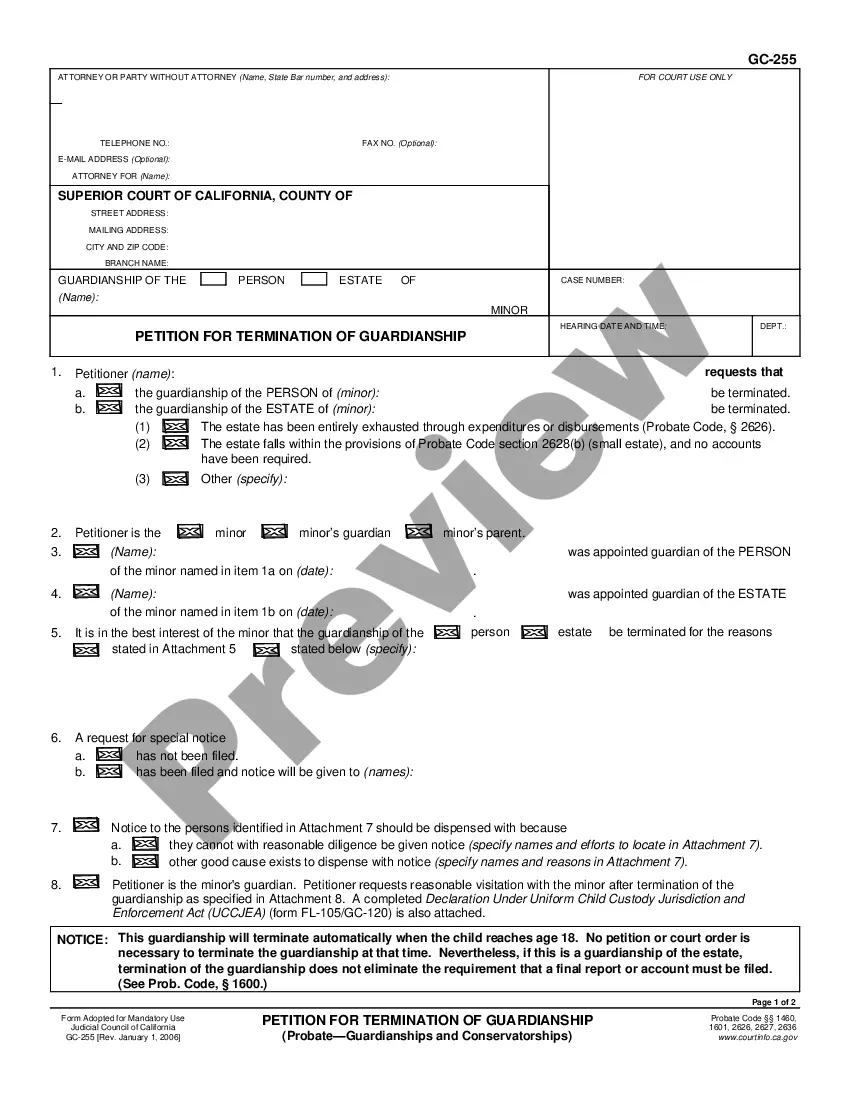

How to fill out Montgomery Maryland Notice To Creditors Of Appointment Of Foreign Personal Representative?

Locating verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Montgomery Maryland Notice to Creditors of Appointment of Foreign Personal Representative gets as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, obtaining the Montgomery Maryland Notice to Creditors of Appointment of Foreign Personal Representative takes just a few clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a couple of more actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make certain you’ve picked the right one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to get the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Montgomery Maryland Notice to Creditors of Appointment of Foreign Personal Representative. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!

Form popularity

FAQ

Under Maryland Law, the decedent's Will must be filed in the jurisdiction of domicile. 3.2. When does an estate have to be opened ? An estate must be opened if the decedent died owning property of any kind in his/her name alone, or as a tenant in common.

It should be noted that other individuals in Maryland law that do have priority to serve as well as largest creditors of a decedent's estate. It is not just family members that may petition when opening an estate, the largest creditor may also petition as well.

The general rule is that a creditor must present any claim within 6 months after the decedent's death However, the personal representative can mail or deliver notice to creditor that creditor's claim will be ?barred? (prohibited by law) unless the creditor presents the claim within 30 days (for a small estate) from the

In deciding, Maryland gives first priority to: Persons named in the will. If no one is appointed by will, then surviving spouse. If no surviving spouse, then surviving children. If no surviving spouse or children, then parents. If no surviving spouse, children, or parents, then siblings.

2.1 The personal representative is entitled to ?reasonable compensation for services.? Statutory commissions for personal representatives are expressed as a maximum: not to exceed $1,800 plus 3.6% of the excess over $20,000 unless a larger amount is provided by the will.

The process, which is to be completed within twelve months, is available only if all residuary legatees or heirs are exempt from inheritance tax or the decedent's personal representative and all trustees of any trusts are limited to the decedents Personal Representative, spouse and children, and if the estate is

The above-mentioned section boils down to the creditor being able to report the estate himself and at the same time the creditor can request to be appointed executor or even nominate someone to be appointed as executor.

Starting from the date of death, the executors have 12 months before they have to start distributing the estate. This allows time to gather information on the estate and check for potential claims. The executors have no obligation to distribute the estate before the end of the year.

If you do distribute an estate before the end of the 10 month period, you may be personally liable as the Executor for any loss incurred as a result.

An executor will never be legally forced to pay out to the beneficiaries of a will until one year has passed from the date of death: this is called the 'executor's year'.