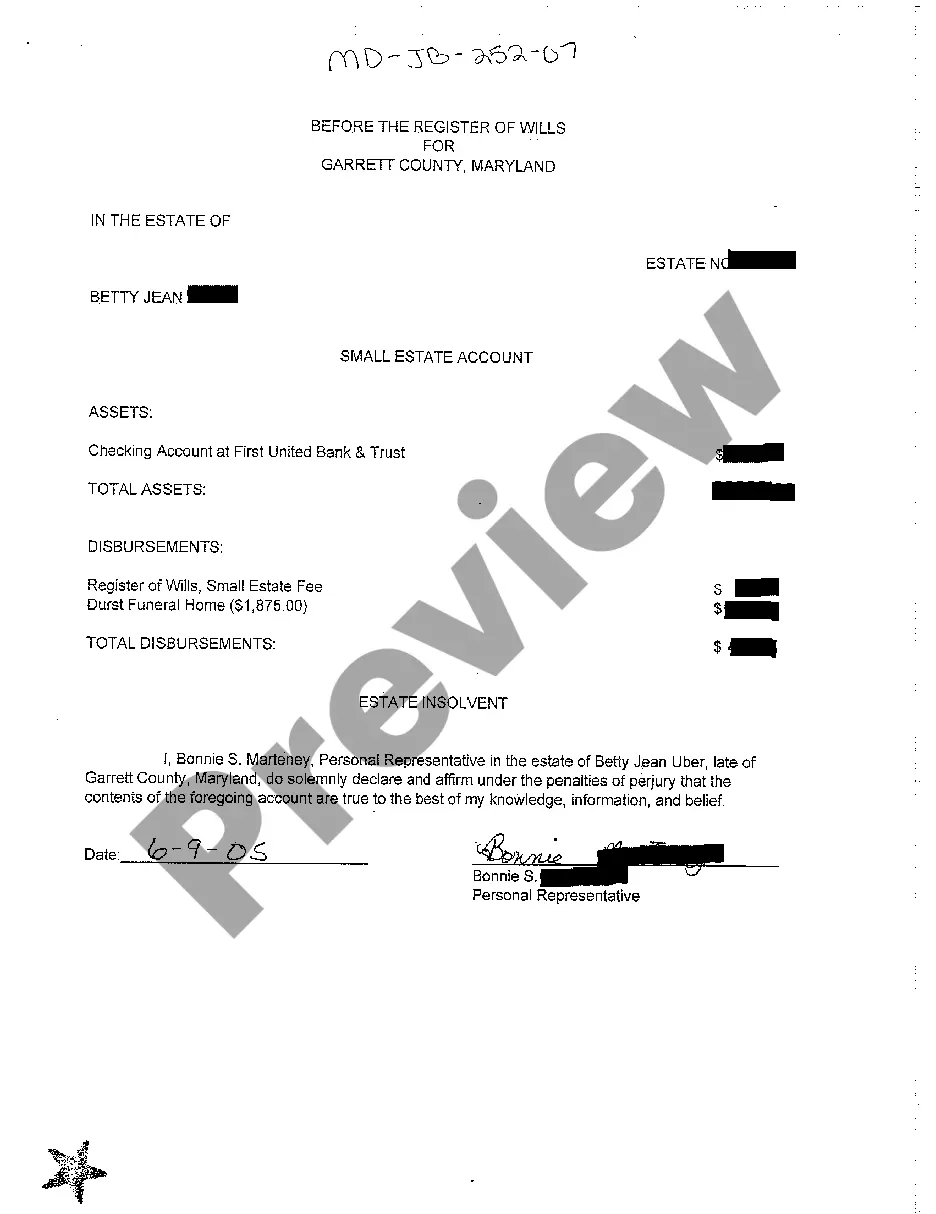

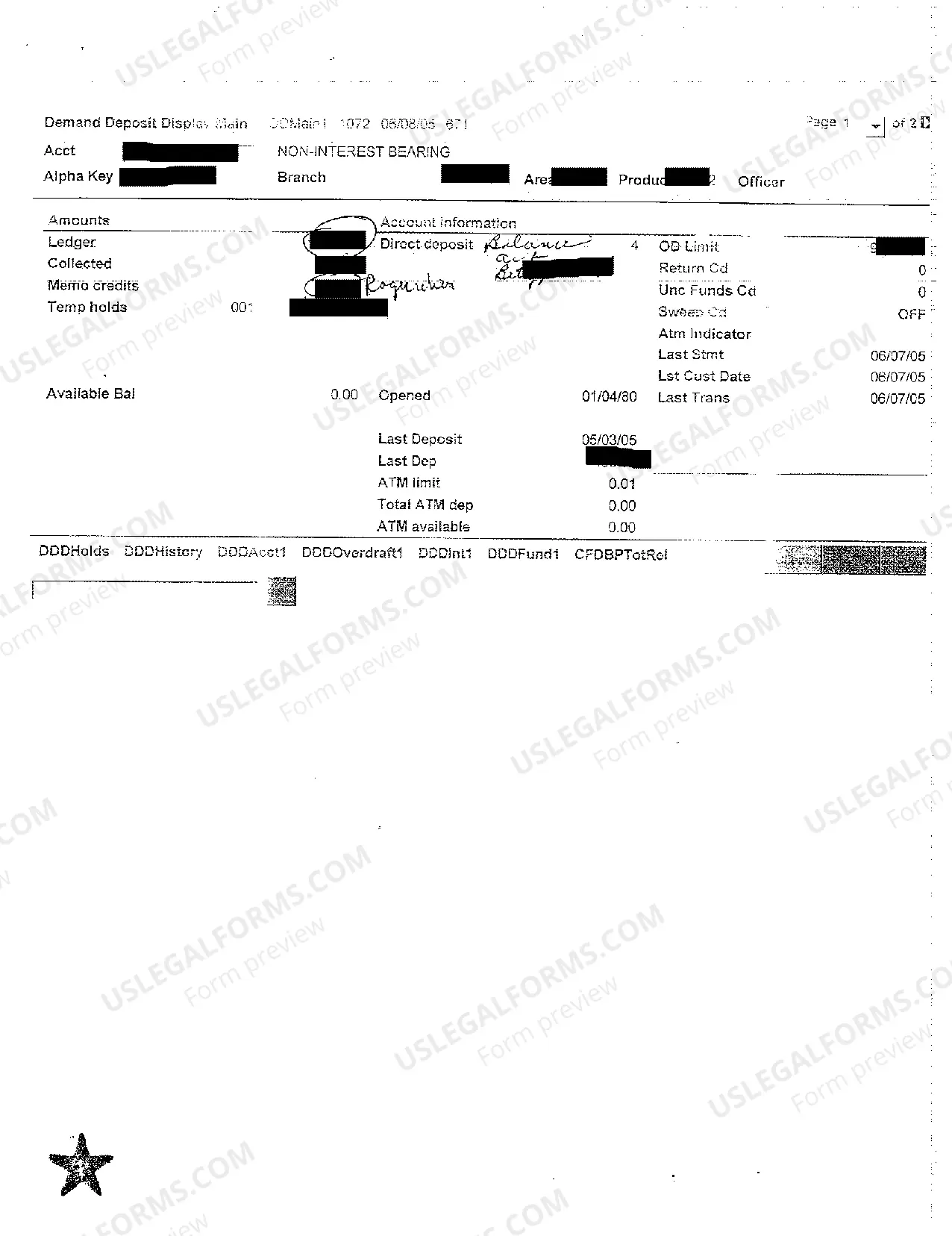

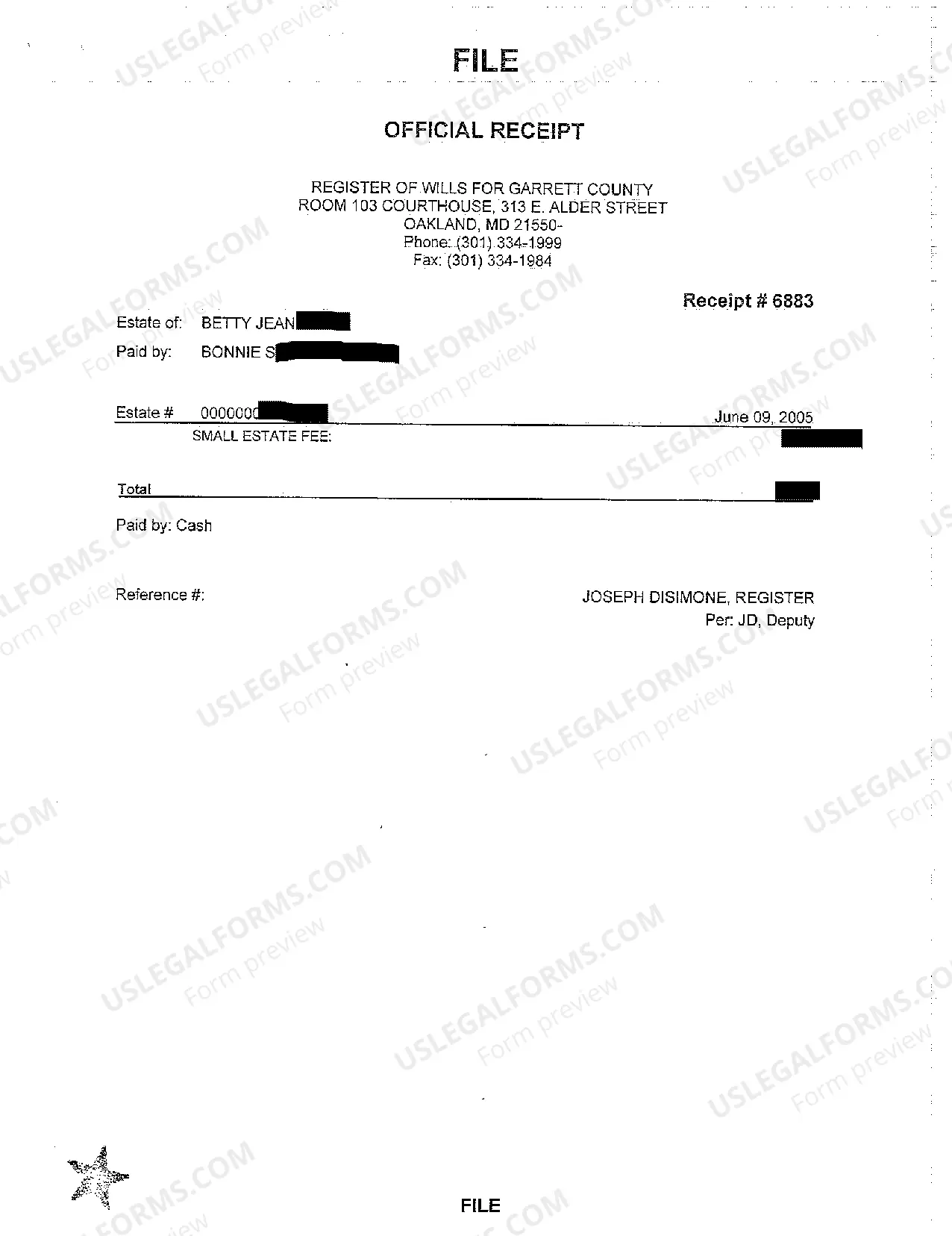

Montgomery Maryland Small Estate Account is a legal mechanism designed to simplify the probate process for small estates in Montgomery County, Maryland. This account allows the efficient transfer of assets from a deceased person to their rightful heirs or beneficiaries with minimal court involvement and expenses. To qualify for a Montgomery Maryland Small Estate Account, the total value of the decedent's assets should not exceed a certain threshold set by the state law. As of 2021, this threshold is $50,000 in Maryland. If the value of the estate surpasses this limit, alternative probate procedures may need to be followed. There are different types of Montgomery Maryland Small Estate Accounts available depending on the circumstances of the estate: 1. Affidavit Small Estate — This is the most common type of small estate account. When the value of the estate is below the specified threshold, the decedent's personal representative (executor or administrator) can file an affidavit with the Register of Wills, providing information about the assets and their distribution. The Register of Wills reviews the affidavit and, if approved, permits the transfer of assets to the designated beneficiaries. 2. Jointly Held Assets — If the deceased person held assets jointly with another person, such as a spouse or business partner, those assets may pass automatically to the surviving co-owner without the need for a small estate account. 3. Pay-on-Death Designation — In certain cases, individuals may have designated a beneficiary to receive specific assets upon their death. These assets, such as bank accounts or retirement accounts, can be transferred directly to the named beneficiary without probate. 4. Transfer on Death Deed — Another option is to establish a transfer-on-death (TOD) deed for real estate. This allows the property to transfer to the designated beneficiary upon the owner's death, avoiding probate. When establishing a Montgomery Maryland Small Estate Account, it is important to consult with an attorney or estate planning professional to understand the specific requirements and procedures involved. Additionally, gathering the necessary documentation, such as the death certificate, evidence of ownership for assets, and any relevant supporting documents, will facilitate the process. Overall, a Montgomery Maryland Small Estate Account provides a simplified and cost-effective way to transfer assets for small estates in the county, ensuring a smoother transition of the decedent's property to their beneficiaries or heirs.

Montgomery Maryland Small Estate Account

Description

How to fill out Montgomery Maryland Small Estate Account?

We always strive to reduce or prevent legal damage when dealing with nuanced law-related or financial matters. To do so, we sign up for legal services that, as a rule, are extremely expensive. Nevertheless, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of updated DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without using services of a lawyer. We provide access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Montgomery Maryland Small Estate Account or any other form quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it from within the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the platform! You can register your account within minutes.

- Make sure to check if the Montgomery Maryland Small Estate Account complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Montgomery Maryland Small Estate Account would work for you, you can pick the subscription plan and make a payment.

- Then you can download the form in any available file format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!

Form popularity

FAQ

A Maryland small estate affidavit is a document used by an individual who believes they have legal rights to all or part of a deceased loved one's estate.... Step 1 ? Complete Documents. Gather and complete the following forms:Step 2 ? File With the Office of the Register of Wills.Step 3 ? Publish.

To open a small estate, the personal representative must file several forms at the Register of Wills office where the decedent had his or her permanent home or was ?domiciled.? The addresses to these offices, along with other contact information, can be found on the Register of Wills homepage.

There is no time limit to open an estate in Maryland, but once you do, the clock starts ticking. Determine if you have a small or regular estate, as the forms and timelines differ for each. Small estate ? the assets subject to administration are valued at $50,000 and under, unless spouse is sole heir, then $100,000.

Small Estate - property of the decedent subject to administration in Maryland is established to have a value of $50,000 or less ($100,000 or less if the spouse is the sole heir).

There is no need for probate or letters of administration unless there are other assets that are not jointly owned. The property might have a mortgage. However, if the partners are tenants in common, the surviving partner does not automatically inherit the other person's share.

Maryland offers a simplified probate procedure for smaller estates. The simplified procedure is available if the property subject to probate has a value of $50,000 or less. If the surviving spouse is the only beneficiary, the cap goes up to $100,000 or less.

Under Maryland Law, the decedent's Will must be filed in the jurisdiction of domicile. 3.2. When does an estate have to be opened ? An estate must be opened if the decedent died owning property of any kind in his/her name alone, or as a tenant in common.

Small Estate - property of the decedent subject to administration in Maryland is established to have a value of $50,000 or less ($100,000 or less if the spouse is the sole heir).

A creditor may present a claim against an estate by filing it in the Register of Wills office and serving a copy on the personal representative or filing a lawsuit.