Montgomery Maryland Reminder of Deadline for Filing Small Estate Account: A Comprehensive Guide In Montgomery, Maryland, individuals who have been designated as the personal representative of a small estate are responsible for ensuring that all necessary documents and paperwork are filed within the specified deadline. The deadline must be adhered to strictly to ensure a smooth and efficient administration of the estate. This article aims to provide a detailed description of the Montgomery Maryland Reminder of Deadline for Filing Small Estate Account, incorporating relevant keywords to enhance its usefulness. 1. Definition of Small Estate Account: A small estate account refers to an estate with a relatively low value, typically under a specific threshold set by Montgomery County, Maryland. The maximum threshold may differ based on the year and jurisdiction. 2. Types of Small Estate Accounts in Montgomery, Maryland: Understandably, not all small estates are the same, and different categories exist, including: — Intestate Small Estate: In cases where the deceased individual did not leave behind a valid will, their estate is distributed according to Maryland's intestacy laws, which determine the entitlement of the surviving family members. — Testate Small Estate: In instances where the deceased individual left behind a valid will, the estate will be distributed according to the instructions specified within the will. — Joint Tenancy Small Estate: This type of small estate involves jointly owned property or assets that will transfer directly to the co-owner(s) upon the death of one of the owners. The processing of joint tenancy assets is relatively straightforward. — Community Property Small Estate: In certain situations, where the deceased individual was married and their estate included community property, special considerations may apply. Consulting an attorney is advisable to navigate the complexities of community property laws. 3. Reminders and Deadlines for Filing Small Estate Account: It is crucial for the personal representative to understand the specific deadlines for filing the small estate account. While these deadlines may vary based on factors such as the nature of the estate and its value, they are generally time-sensitive. Some key reminders to consider include: — Prompt Filing: Immediately after the death of the individual, the personal representative must initiate the process of filing the small estate account to avoid any unnecessary delays or penalties. — Submission of Required Documents: Gathering all the necessary documents and ensuring their accuracy is essential. These documents may include a completed Inventory of Property, Affidavit of Debts and Funeral Expenses, and any relevant supporting documentation like death certificates. — Notifying Interested Parties: Proper notification should be provided to potential creditors, beneficiaries, heirs, and other parties with a lawful interest in the estate. This allows them the opportunity to contest any claims or raise objections within the legally prescribed timeframe. — Consultation with Legal Professionals: Given the intricate nature of probate law, it is always advisable for personal representatives to seek legal counsel and guidance to ensure compliance with all legal requirements and navigate any potential complexities. By following these reminders and adhering to the deadlines, the personal representative of the small estate in Montgomery, Maryland, can effectively manage the process and ensure a timely and efficient administration of the estate. In conclusion, this comprehensive guide outlines the Montgomery Maryland Reminder of Deadline for Filing Small Estate Account, covering various types of small estates and relevant considerations for personal representatives. Understanding the specific deadlines, submitting required documents, notifying interested parties, and seeking legal counsel are crucial steps for a smooth and successful small estate administration process in Montgomery, Maryland.

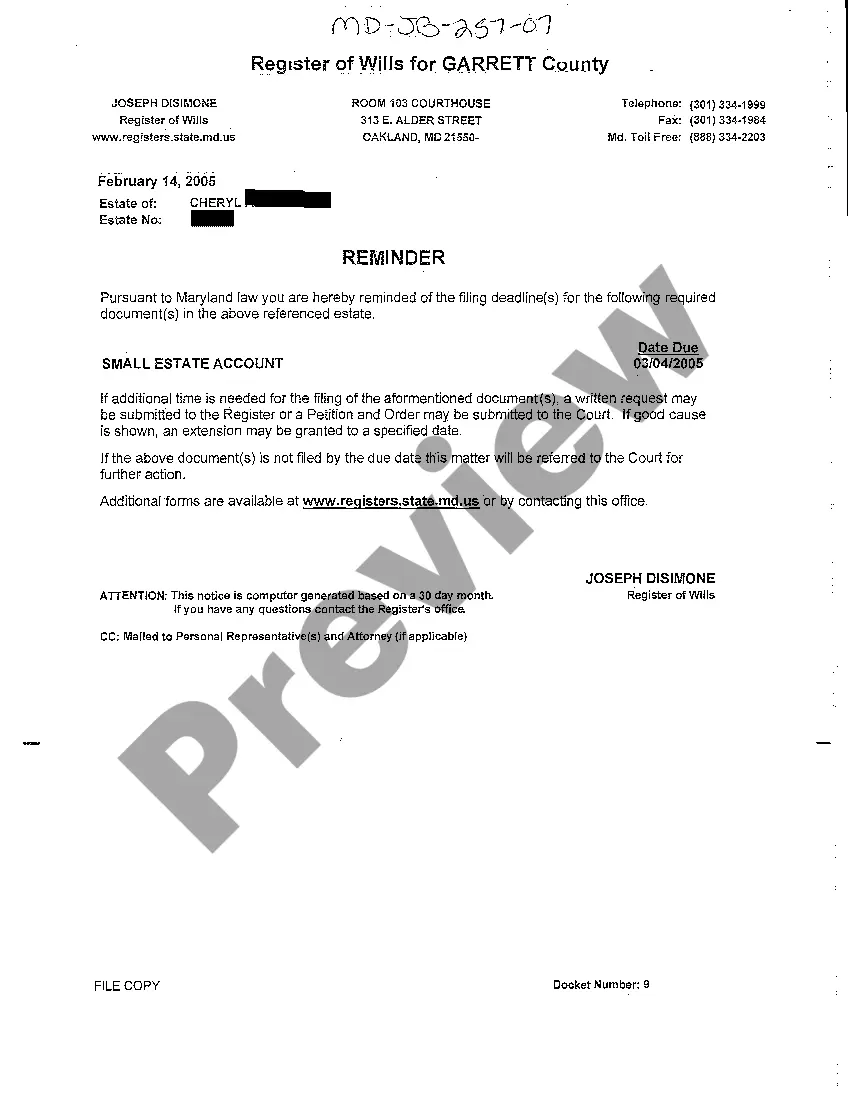

Montgomery Maryland Reminder of Deadline for Filing Small Estate Account

Description

How to fill out Montgomery Maryland Reminder Of Deadline For Filing Small Estate Account?

Make use of the US Legal Forms and have instant access to any form template you require. Our beneficial platform with a huge number of document templates allows you to find and get almost any document sample you need. You are able to save, complete, and certify the Montgomery Maryland Reminder of Deadline for Filing Small Estate Account in just a matter of minutes instead of browsing the web for many hours seeking an appropriate template.

Utilizing our collection is a wonderful strategy to improve the safety of your form submissions. Our professional legal professionals on a regular basis check all the documents to make sure that the forms are relevant for a particular region and compliant with new acts and polices.

How can you obtain the Montgomery Maryland Reminder of Deadline for Filing Small Estate Account? If you have a subscription, just log in to the account. The Download button will be enabled on all the documents you look at. Additionally, you can get all the previously saved files in the My Forms menu.

If you don’t have a profile yet, follow the instruction listed below:

- Open the page with the template you need. Ensure that it is the form you were looking for: verify its title and description, and utilize the Preview feature when it is available. Otherwise, use the Search field to find the needed one.

- Start the saving procedure. Select Buy Now and choose the pricing plan that suits you best. Then, create an account and pay for your order using a credit card or PayPal.

- Save the file. Indicate the format to get the Montgomery Maryland Reminder of Deadline for Filing Small Estate Account and edit and complete, or sign it for your needs.

US Legal Forms is one of the most considerable and trustworthy form libraries on the internet. We are always happy to assist you in virtually any legal procedure, even if it is just downloading the Montgomery Maryland Reminder of Deadline for Filing Small Estate Account.

Feel free to take full advantage of our form catalog and make your document experience as straightforward as possible!

Form popularity

FAQ

6 months from the date of the decedent's death; or. 2 months after the personal representative delivers a copy of the ?Notice of Appointment, Notice to Creditors, Notice to Unknown Heirs? form.

An executor will never be legally forced to pay out to the beneficiaries of a will until one year has passed from the date of death: this is called the 'executor's year'.

Please note that claims must be filed within 6 months from the date of death. 3.18. A deceased relative has 'Unclaimed Property'.

The process, which is to be completed within twelve months, is available only if all residuary legatees or heirs are exempt from inheritance tax or the decedent's personal representative and all trustees of any trusts are limited to the decedents Personal Representative, spouse and children, and if the estate is

There is no time limit in applying for Probate. Unlike some legal processes, such as applying for compensation, your application will not be disqualified because it is late.

6 months from the date of the decedent's death; or. 2 months after the personal representative delivers a copy of the ?Notice of Appointment, Notice to Creditors, Notice to Unknown Heirs? form.

To open a small estate, the personal representative must file several forms at the Register of Wills office where the decedent had his or her permanent home or was ?domiciled.? The addresses to these offices, along with other contact information, can be found on the Register of Wills homepage.

There is not any legal timeframe for applying for probate, however much of the estate administration will not be possible until this is received, so it is generally one of the first things that is done. In the case of some small estates, probate may not be necessary. This will depend on the amount of assets held.

Starting from the date of death, the executors have 12 months before they have to start distributing the estate. This allows time to gather information on the estate and check for potential claims. The executors have no obligation to distribute the estate before the end of the year.

The state law in Maryland doesn't give a time limit for filing a will after someone dies, but it does say it must be filed promptly. However, probate doesn't have to be opened at the same time. If someone fails to file the will, they can be sued.