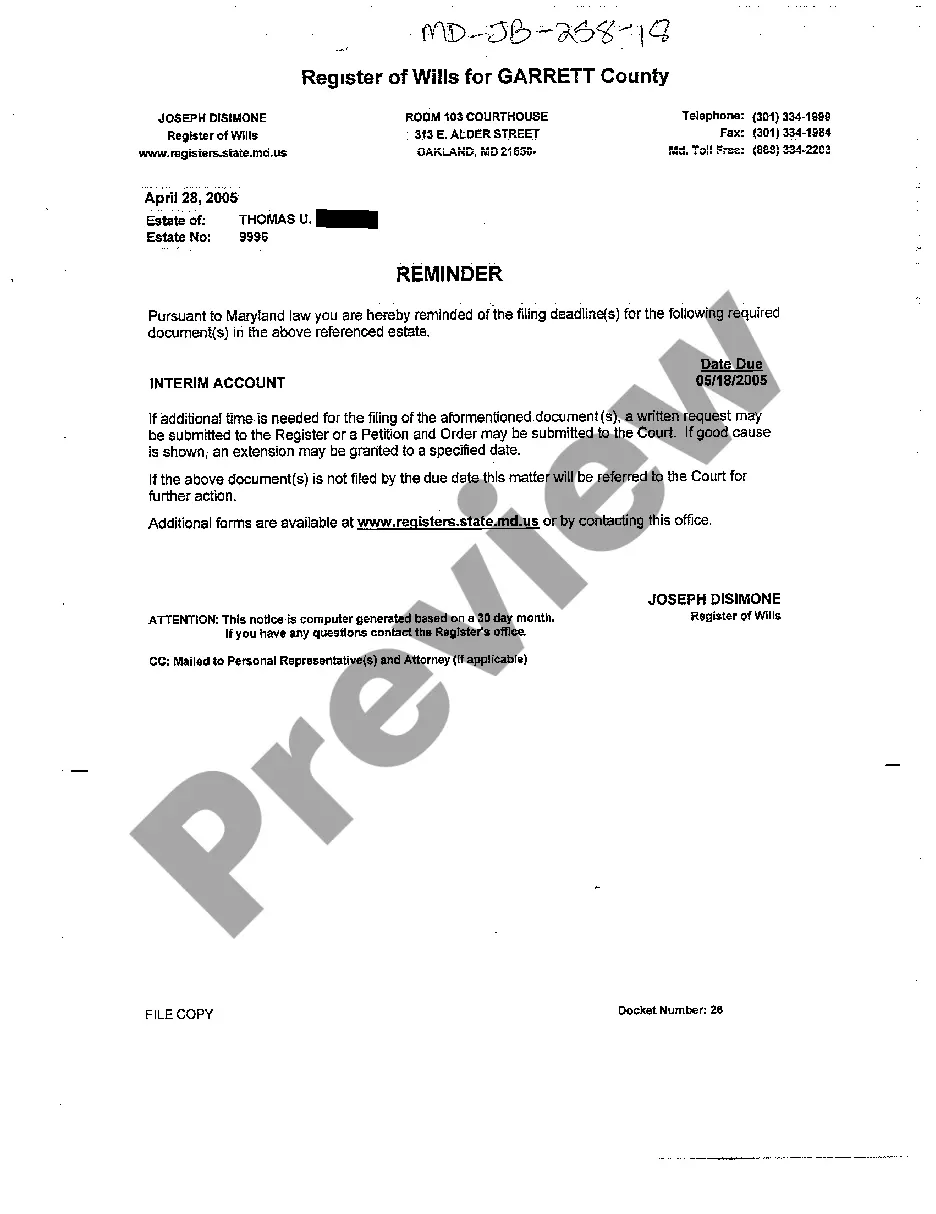

Title: Important Dates and Guidelines for Filing Interim Account in Montgomery, Maryland Description: Are you a resident or business owner in Montgomery, Maryland? It's essential to stay informed about the deadlines and requirements for filing your interim account. In this detailed description, we will take you through the process and provide important deadlines, clarifying any potential confusion. In Montgomery, Maryland, residents and businesses are required to file interim accounts to ensure accurate financial records. These accounts serve as a reflection of revenue and expenditures during a specific period within the fiscal year. Filing these accounts promptly is crucial to avoid penalties and maintain compliance with local regulations. Types of Montgomery Maryland Reminder of Deadline for Filing Interim Accounts: 1. Individual Taxpayer Interim Account: Individual taxpayers, including self-employed individuals and freelancers, are obligated to file interim accounts in Montgomery, Maryland. These accounts outline income and expenses generated within a specific timeframe. Accurate reporting ensures compliance with tax regulations and helps calculate any potential tax liability efficiently. Therefore, it is vital to mark the deadline for filing individual interim accounts on your calendar. 2. Business Entity Interim Account: Various business entities, such as sole proprietorship, partnerships, corporations, and limited liability companies (LCS), must file their interim accounts by the designated deadline. Business interim accounts provide a detailed overview of revenue, expenses, assets, and liabilities during a specified period. Accurate financial reporting assists in tax planning, auditing, and demonstrates compliance with the Montgomery, Maryland regulations. Remember these important deadlines for filing your interim account in Montgomery, Maryland: — Individual Taxpayer Interim Account deadline: [specific date]. — Business Entity Interim Account deadline: [specific date]. To ensure smooth and hassle-free filing, gather all the necessary documentation, such as income statements, expense records, supporting receipts, and statements of assets and liabilities. Accurate record-keeping and timely filing of interim accounts are fundamental for your financial well-being and compliance. Furthermore, encourage yourself to file well in advance of the deadlines to avoid any last-minute rush. Filing late or failing to submit accurate and complete information can lead to fines or penalties that may affect your personal or business finances. Keep in touch with the Montgomery, Maryland tax authorities and stay updated with any changes or further guidance related to filing interim accounts. For a comprehensive understanding of the process, consult professional accountants or tax advisors who specialize in Montgomery, Maryland tax regulations to ensure compliance and minimize potential risks. Don't let the deadline for filing your interim account catch you off guard! Stay on track and mark your calendar for the important dates. Filing your accounts promptly ensures you maintain a good standing and peace of mind when it comes to financial obligations in Montgomery, Maryland.

Montgomery Maryland Reminder of Deadline for Filing Interim Account

Description

How to fill out Montgomery Maryland Reminder Of Deadline For Filing Interim Account?

We always strive to minimize or prevent legal issues when dealing with nuanced legal or financial matters. To do so, we apply for attorney solutions that, usually, are extremely costly. However, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without turning to an attorney. We offer access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Montgomery Maryland Reminder of Deadline for Filing Interim Account or any other form quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again in the My Forms tab.

The process is just as effortless if you’re unfamiliar with the platform! You can create your account in a matter of minutes.

- Make sure to check if the Montgomery Maryland Reminder of Deadline for Filing Interim Account complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Montgomery Maryland Reminder of Deadline for Filing Interim Account would work for your case, you can pick the subscription option and proceed to payment.

- Then you can download the document in any available file format.

For more than 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!