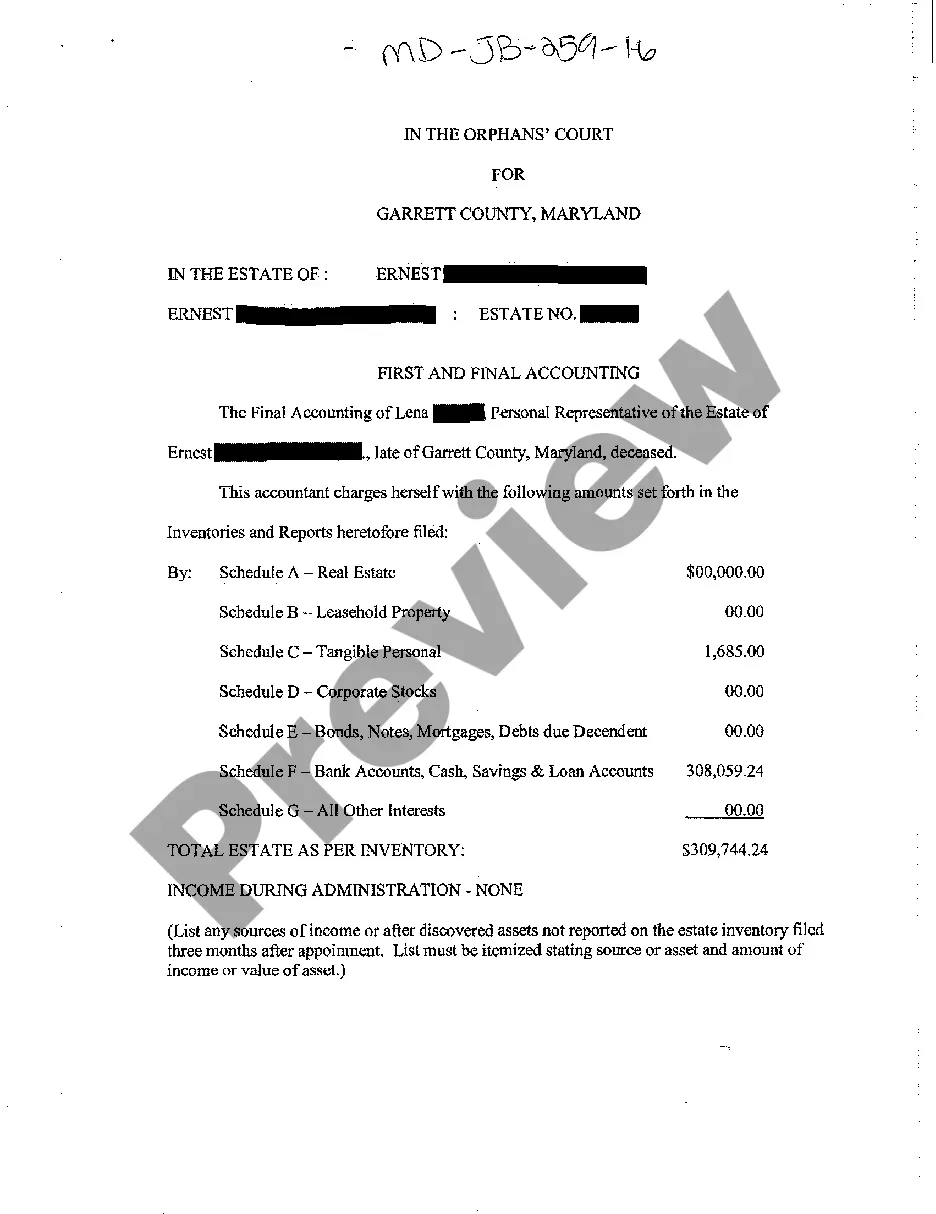

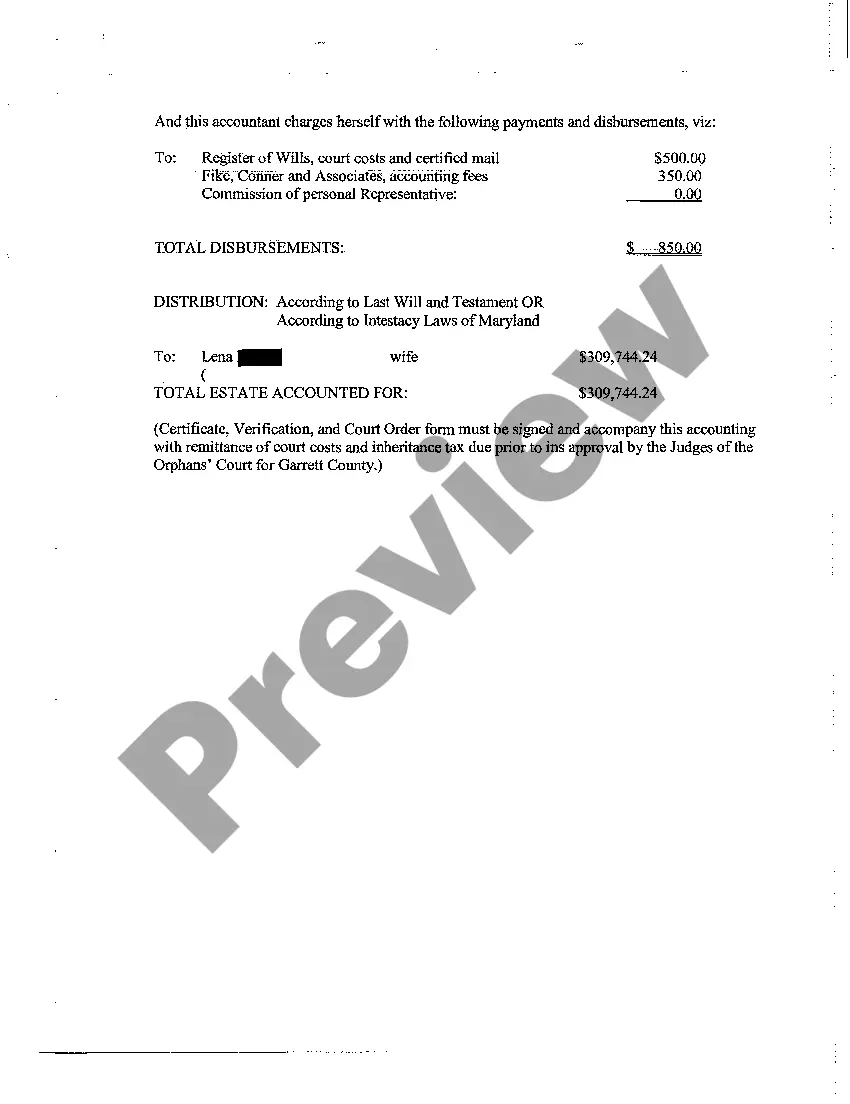

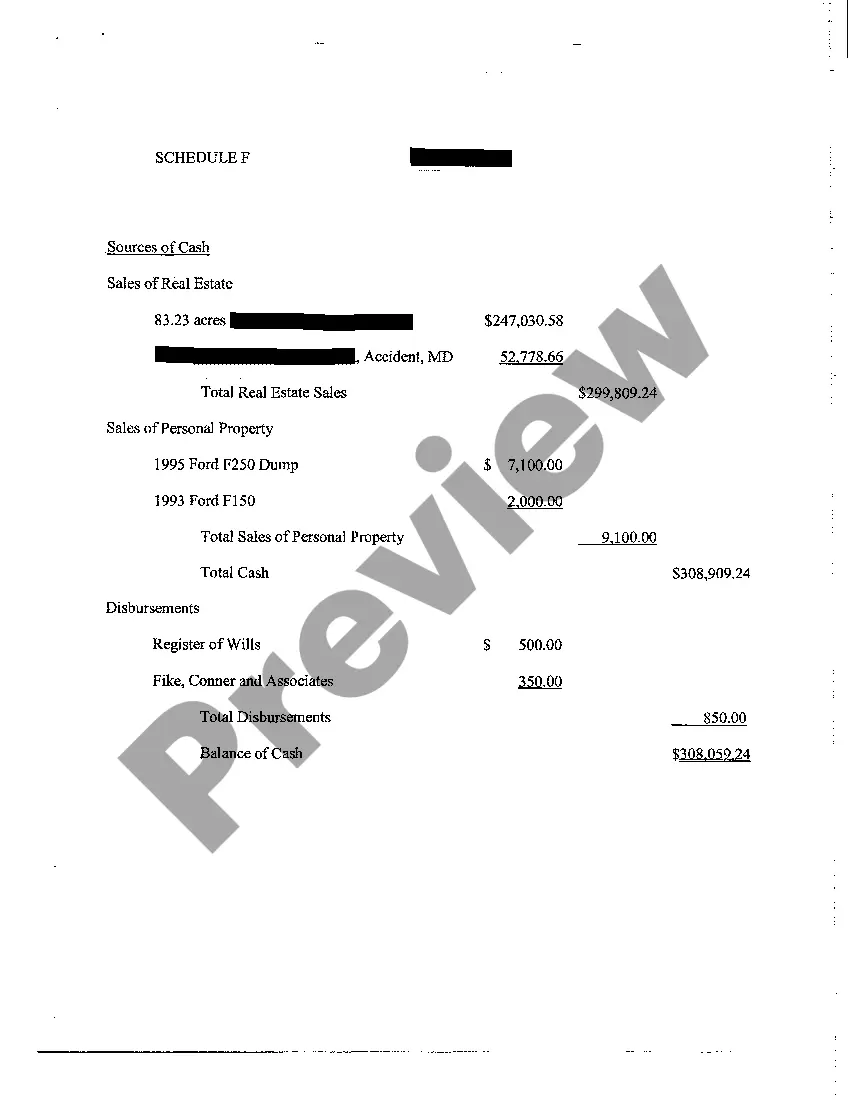

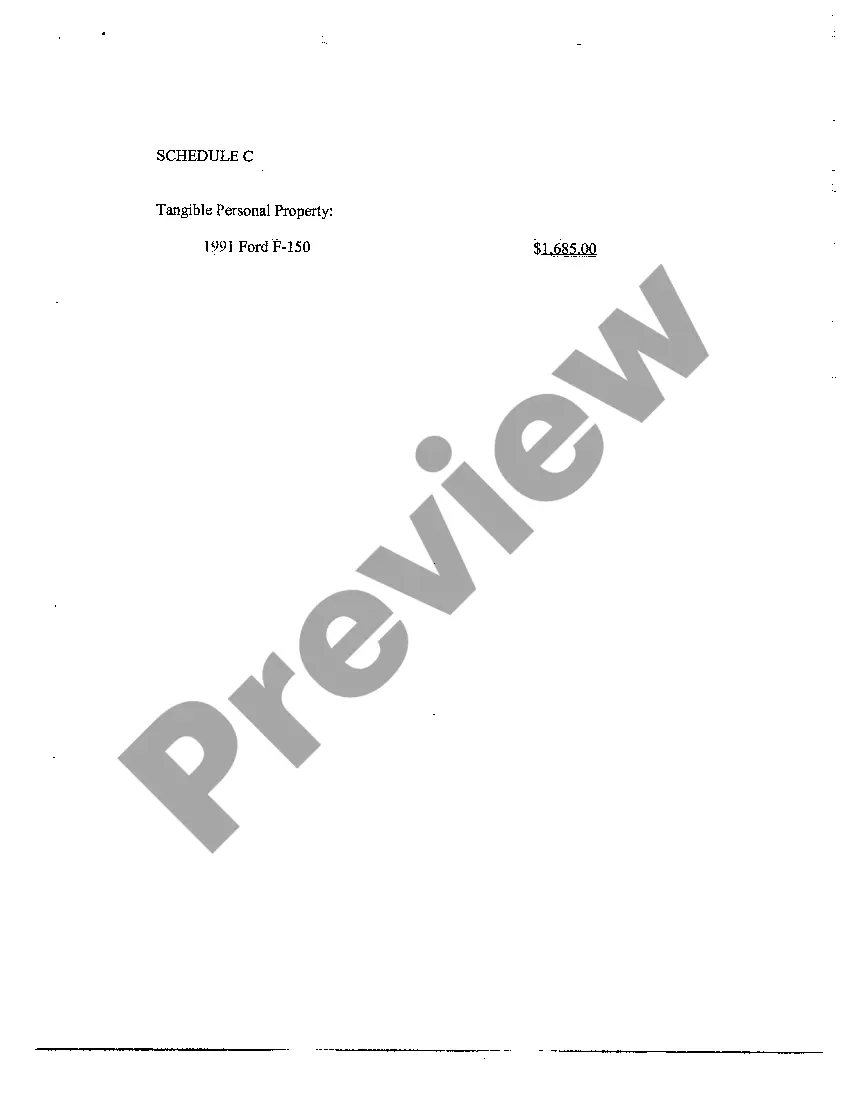

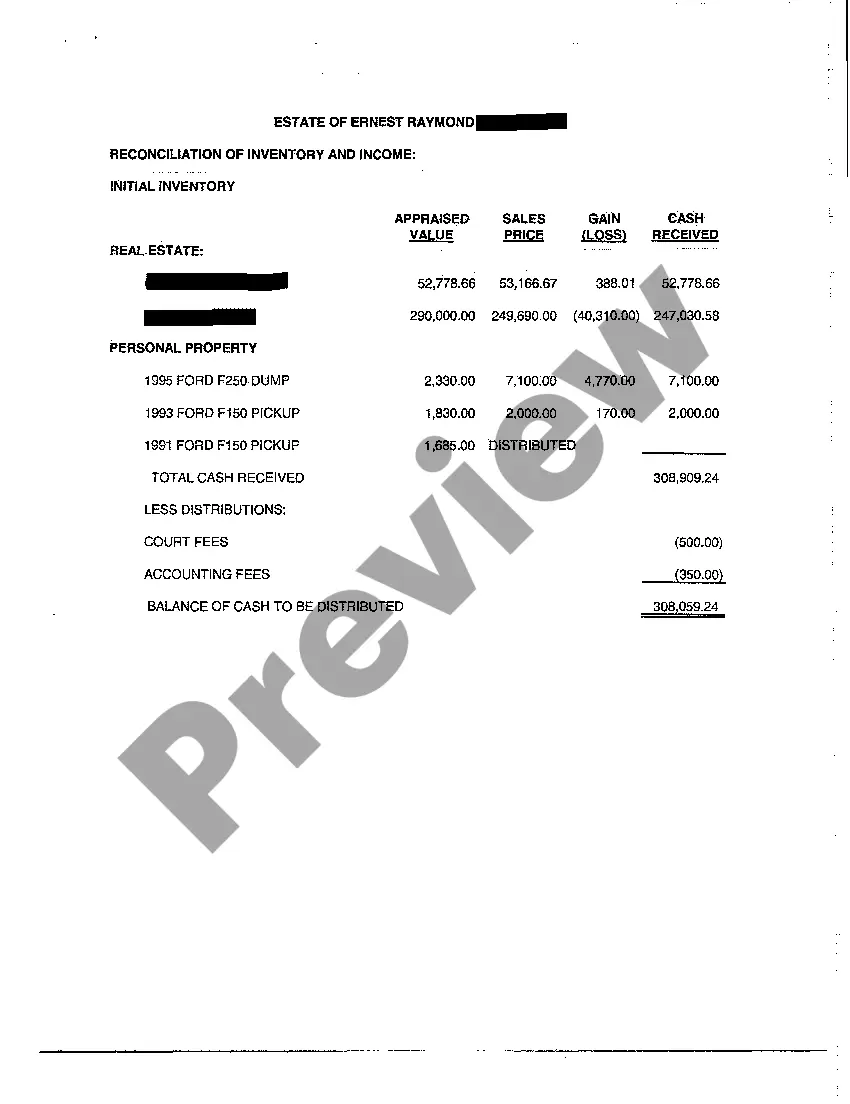

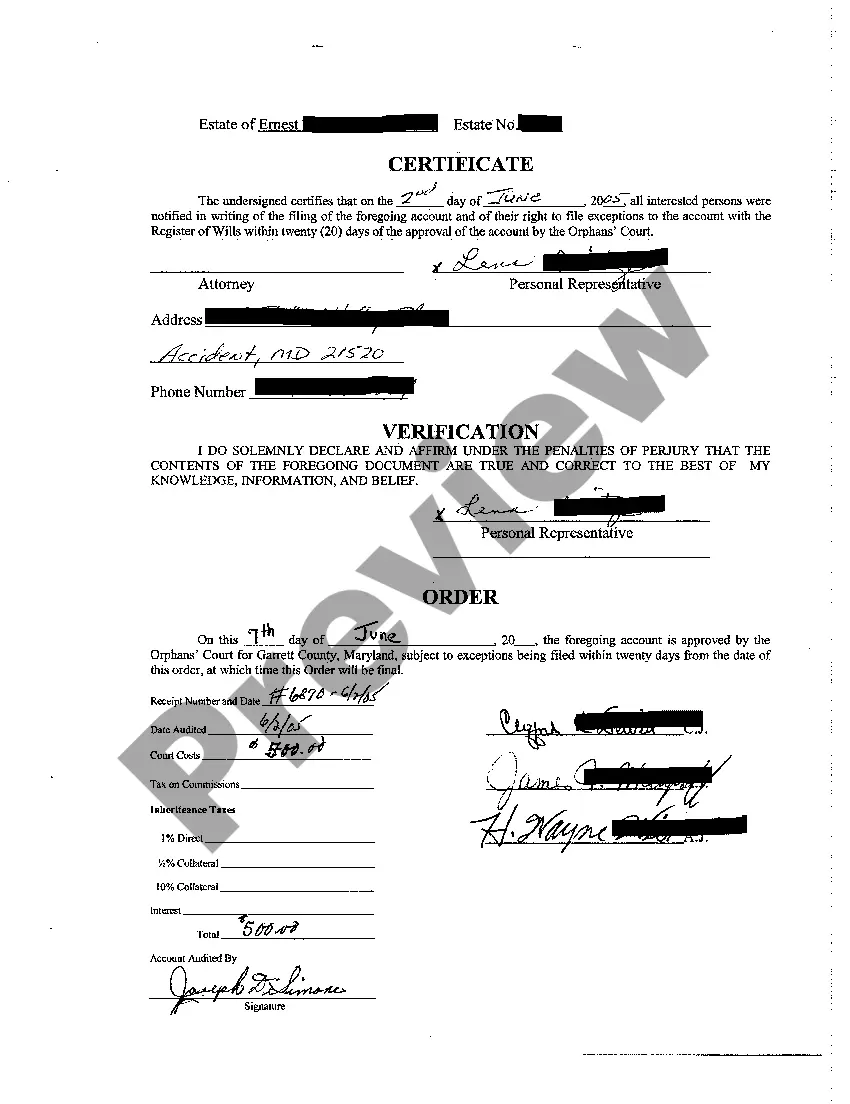

Montgomery Maryland First and Final Accounting refers to the legal process of presenting a comprehensive financial report for an estate during the probate process. It involves evaluating, documenting, and distributing the assets and liabilities of a deceased person's estate. This accounting is essential to ensure transparency and accountability in the settlement of the estate. In Montgomery, Maryland, there are primarily two types of First and Final Accounting: 1. Probate Estate First and Final Accounting: This type of accounting is required when a decedent's estate goes through the probate process. It involves a detailed examination of all assets, including real estate, bank accounts, investments, personal property, and any outstanding debts or liabilities. The accounting should list all income, expenses, and transactions related to the estate since the decedent's death. It also includes a distribution plan to allocate assets among beneficiaries, in accordance with the decedent's will or intestacy laws if there is no will. 2. Trust First and Final Accounting: In cases where a decedent had established a trust before their passing, a Trust First and Final Accounting is necessary. This type of accounting is required when the administration of the estate occurs outside the probate process. The trustee is responsible for compiling a detailed financial report that outlines all the trust assets, income, expenses, and any transactions. The accounting will also include a distribution plan, adhering to the provisions outlined in the trust document. The Montgomery Maryland First and Final Accounting process may involve the following key steps: 1. Inventory of Assets: A thorough evaluation and inventory of all the decedent's assets are conducted, including real estate, personal property, investments, bank accounts, and other financial holdings. 2. Debt and Liability Assessment: An assessment is made to identify any outstanding debts, taxes, or liabilities that need to be settled from the estate's assets. 3. Income and Expense Documentation: All income earned by the estate and any expenses incurred during the probate process or trust administration must be meticulously documented. 4. Distribution Plan: A comprehensive plan is prepared to distribute the assets among beneficiaries, in accordance with the decedent's will or trust document. This plan includes the calculations of each beneficiary's share. 5. Legal Compliance: The accounting report must comply with Montgomery, Maryland state laws and regulations. It should be prepared in a format acceptable to the probate court or trustee overseeing the estate. 6. Filing and Presentation: The First and Final Accounting report is filed with the appropriate probate court or presented to the trustee overseeing the trust administration process. In conclusion, Montgomery Maryland First and Final Accounting encompasses the detailed financial reporting and distribution of assets in a decedent's estate during the probate or trust administration process. It ensures transparency, compliance with laws, and fair distribution of assets to beneficiaries.

Montgomery Maryland First and Final Accounting

Description

How to fill out Montgomery Maryland First And Final Accounting?

Getting verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Montgomery Maryland First and Final Accounting gets as quick and easy as ABC.

For everyone already familiar with our service and has used it before, obtaining the Montgomery Maryland First and Final Accounting takes just a couple of clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. The process will take just a couple of more actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Look at the Preview mode and form description. Make sure you’ve selected the correct one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, utilize the Search tab above to obtain the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Montgomery Maryland First and Final Accounting. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!