Montgomery Maryland Claim Against Decedent's Estate refers to a legal process in which individuals or entities make claims against the estate of a deceased person in Montgomery County, Maryland. These claims arise when any party believes they are owed a debt or have a legal right to a particular asset from the deceased's estate, and they are seeking to recover their due. The claims against a decedent's estate in Montgomery Maryland can take various forms, including: 1. Creditor Claims: These claims are submitted by creditors who believe they are owed money by the deceased individual. It can involve outstanding loans, unpaid bills, or any other financial obligations that were not settled before the person's death. 2. Beneficiary Claims: Beneficiaries of the deceased person may file claims against the estate if they believe they were wrongly excluded from the will or if they believe the distribution of assets was not carried out as specified in the will. 3. Family Maintenance Claims: Certain family members, such as spouses or minor children, may file claims to seek support or maintenance from the decedent's estate if they can demonstrate a financial need. 4. Tax Claims: Government authorities may file claims against the estate to recover any unpaid taxes owed by the deceased person. These claims can include income tax, property tax, or any other tax the deceased might have owed. 5. Tort Claims: If the deceased person was involved in a legal dispute or faced allegations before their death, individuals who suffered harm as a result may file tort claims against the estate to seek compensation for damages. 6. Inheritance Rights Claims: Relatives who believe they have a legal right to inherit property or assets from the decedent but were not included in the will may file inheritance rights claims to assert their stake in the estate. 7. Partnership or Business Claims: Claims from business partners or co-owners who had financial dealings with the deceased person can also be made against the estate, aiming to recover any outstanding debts or unpaid shares. It is important to note that these claims must typically be filed within a specific timeframe after the decedent's death in accordance with relevant Maryland probate laws. The estate's executor or personal representative oversees the claims process, ensuring that fair and lawful distributions are made to all rightful claimants. If you believe you have a claim against a decedent's estate in Montgomery Maryland or any jurisdiction, it is strongly advised to consult with an experienced estate attorney who can guide you through the process and protect your rights.

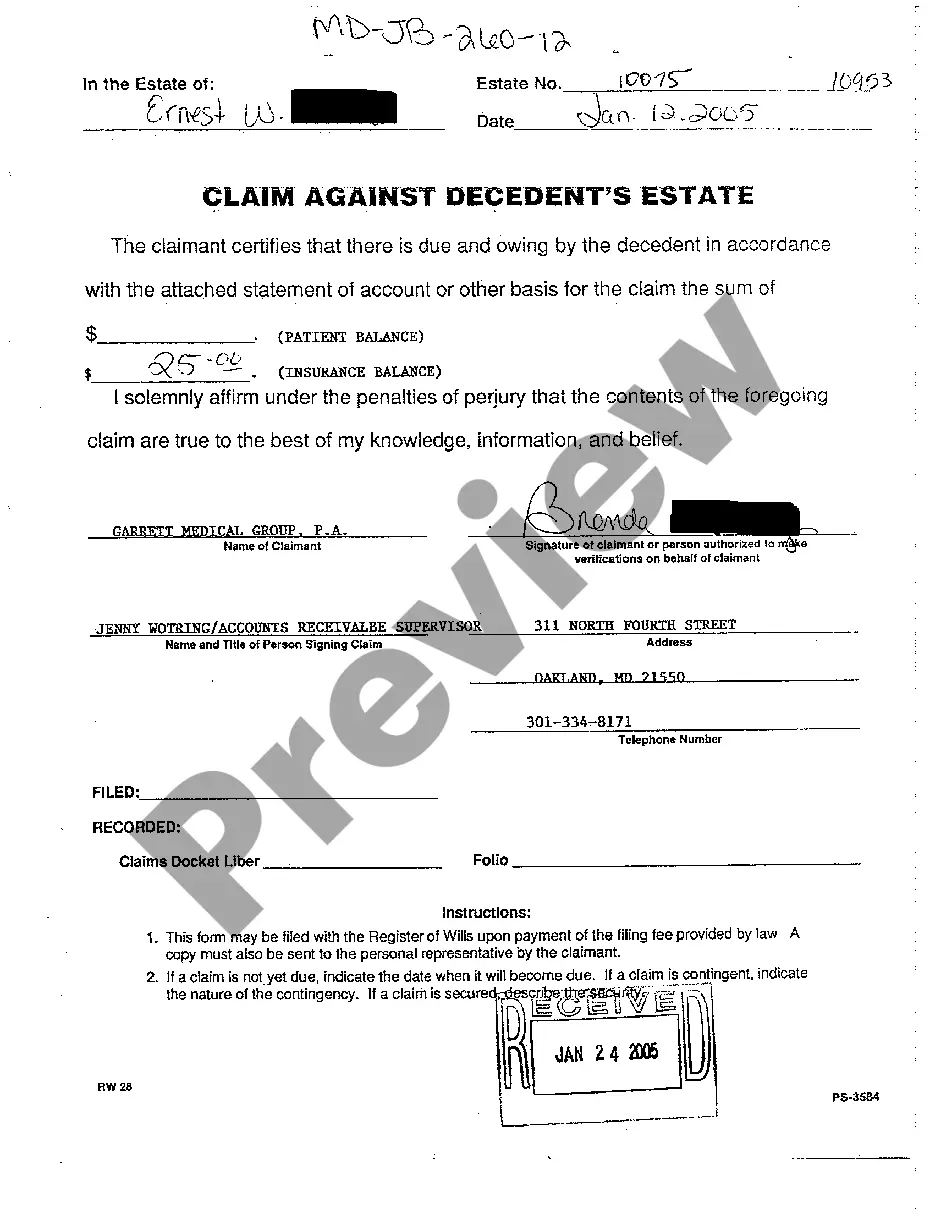

Montgomery Maryland Claim Against Decedent's Estate

Description

How to fill out Montgomery Maryland Claim Against Decedent's Estate?

If you are searching for a valid form, it’s impossible to choose a better platform than the US Legal Forms site – one of the most considerable libraries on the web. Here you can get a huge number of templates for business and personal purposes by types and regions, or key phrases. With our high-quality search feature, discovering the latest Montgomery Maryland Claim Against Decedent's Estate is as elementary as 1-2-3. Furthermore, the relevance of each and every record is verified by a team of skilled lawyers that regularly check the templates on our website and update them based on the newest state and county demands.

If you already know about our platform and have an account, all you should do to get the Montgomery Maryland Claim Against Decedent's Estate is to log in to your account and click the Download button.

If you make use of US Legal Forms the very first time, just follow the instructions listed below:

- Make sure you have discovered the form you need. Check its description and make use of the Preview feature (if available) to explore its content. If it doesn’t meet your needs, use the Search option at the top of the screen to find the proper file.

- Affirm your decision. Click the Buy now button. Following that, choose the preferred pricing plan and provide credentials to sign up for an account.

- Process the purchase. Utilize your bank card or PayPal account to complete the registration procedure.

- Get the template. Indicate the file format and download it to your system.

- Make changes. Fill out, modify, print, and sign the received Montgomery Maryland Claim Against Decedent's Estate.

Every single template you save in your account has no expiration date and is yours forever. You always have the ability to access them using the My Forms menu, so if you want to get an extra version for enhancing or printing, feel free to come back and download it once more at any time.

Take advantage of the US Legal Forms professional collection to gain access to the Montgomery Maryland Claim Against Decedent's Estate you were looking for and a huge number of other professional and state-specific samples on one website!