The Montgomery Maryland Administrative Probate Order Admitting Will for Probate and Appointing Personal Representative is a legal document that plays a crucial role in the probate process. This detailed description will provide insights into the purpose, procedure, and different types of administrative probate orders relevant to Montgomery, Maryland. Probate is the legal process through which a deceased person's assets are distributed to their beneficiaries or heirs and their debts settled. When a person passes away, their estate typically goes through probate court to ensure that their wishes, as mentioned in their will, are carried out correctly and fairly. The Montgomery Maryland Administrative Probate Order Admitting Will for Probate and Appointing Personal Representative specifically addresses the admission of a will to probate and the appointment of a personal representative (also known as an executor or administrator) to administer the estate. This order validates the will and authorizes the named personal representative to fulfill their duties according to the law. The administrative probate order is issued after the proper legal procedures have taken place. These procedures include filing the will with the Montgomery County Register of Wills, notifying interested parties, and providing the necessary documentation to prove the will's validity. There are two main types of Montgomery Maryland Administrative Probate Order Admitting Will for Probate and Appointing Personal Representative: testate and intestate. 1. Testate Administrative Probate Order: This order is applicable when a valid will exists, and the deceased person (testator) has clearly outlined their wishes regarding the distribution of their assets and the appointment of a personal representative. This order validates the will, admits it to probate, and appoints the named personal representative to oversee the estate administration. 2. Intestate Administrative Probate Order: When an individual passes away without a valid will, they are considered intestate. In such cases, Maryland's intestacy laws determine the distribution of the deceased person's assets. The intestate administrative probate order appoints a personal representative to administer the estate and distribute the assets according to the intestacy laws. In both types of administrative probate orders, the personal representative has various responsibilities, including collecting and inventorying assets, paying debts and taxes, filing necessary paperwork, and distributing assets to beneficiaries or heirs as instructed by the will or intestacy laws. The Montgomery Maryland Administrative Probate Order Admitting Will for Probate and Appointing Personal Representative is a critical legal document that ensures the orderly transfer of assets and the proper administration of an estate. By following the prescribed procedures and appointing a trustworthy personal representative, the wishes of the deceased can be fulfilled, and the distribution of assets can be carried out fairly and lawfully.

Montgomery Maryland Administrative Probate Order Admitting Will for Probate and Appointing Personal Representative

State:

Maryland

County:

Montgomery

Control #:

MD-JB-261-06

Format:

PDF

Instant download

This form is available by subscription

Description

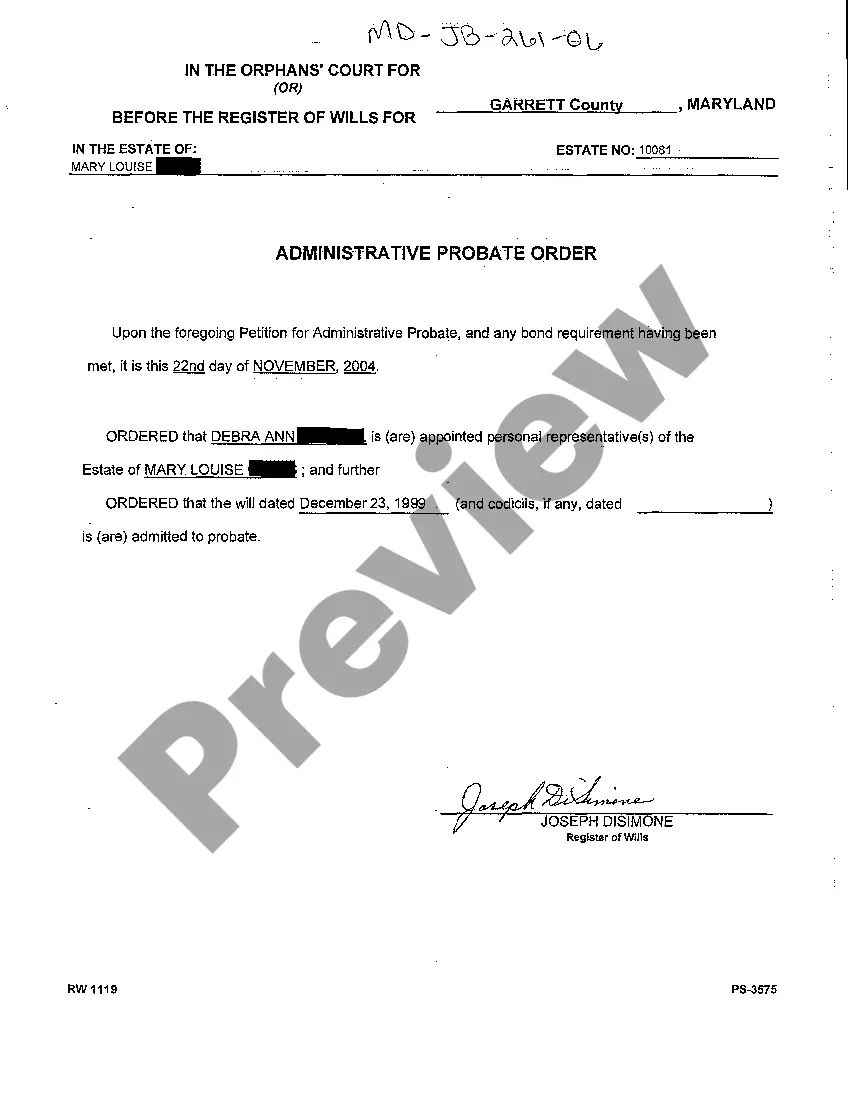

A06 Administrative Probate Order Admitting Will for Probate and Appointing Personal Representative

The Montgomery Maryland Administrative Probate Order Admitting Will for Probate and Appointing Personal Representative is a legal document that plays a crucial role in the probate process. This detailed description will provide insights into the purpose, procedure, and different types of administrative probate orders relevant to Montgomery, Maryland. Probate is the legal process through which a deceased person's assets are distributed to their beneficiaries or heirs and their debts settled. When a person passes away, their estate typically goes through probate court to ensure that their wishes, as mentioned in their will, are carried out correctly and fairly. The Montgomery Maryland Administrative Probate Order Admitting Will for Probate and Appointing Personal Representative specifically addresses the admission of a will to probate and the appointment of a personal representative (also known as an executor or administrator) to administer the estate. This order validates the will and authorizes the named personal representative to fulfill their duties according to the law. The administrative probate order is issued after the proper legal procedures have taken place. These procedures include filing the will with the Montgomery County Register of Wills, notifying interested parties, and providing the necessary documentation to prove the will's validity. There are two main types of Montgomery Maryland Administrative Probate Order Admitting Will for Probate and Appointing Personal Representative: testate and intestate. 1. Testate Administrative Probate Order: This order is applicable when a valid will exists, and the deceased person (testator) has clearly outlined their wishes regarding the distribution of their assets and the appointment of a personal representative. This order validates the will, admits it to probate, and appoints the named personal representative to oversee the estate administration. 2. Intestate Administrative Probate Order: When an individual passes away without a valid will, they are considered intestate. In such cases, Maryland's intestacy laws determine the distribution of the deceased person's assets. The intestate administrative probate order appoints a personal representative to administer the estate and distribute the assets according to the intestacy laws. In both types of administrative probate orders, the personal representative has various responsibilities, including collecting and inventorying assets, paying debts and taxes, filing necessary paperwork, and distributing assets to beneficiaries or heirs as instructed by the will or intestacy laws. The Montgomery Maryland Administrative Probate Order Admitting Will for Probate and Appointing Personal Representative is a critical legal document that ensures the orderly transfer of assets and the proper administration of an estate. By following the prescribed procedures and appointing a trustworthy personal representative, the wishes of the deceased can be fulfilled, and the distribution of assets can be carried out fairly and lawfully.

How to fill out Montgomery Maryland Administrative Probate Order Admitting Will For Probate And Appointing Personal Representative?

If you’ve already utilized our service before, log in to your account and save the Montgomery Maryland Administrative Probate Order Admitting Will for Probate and Appointing Personal Representative on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Ensure you’ve located an appropriate document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Montgomery Maryland Administrative Probate Order Admitting Will for Probate and Appointing Personal Representative. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!