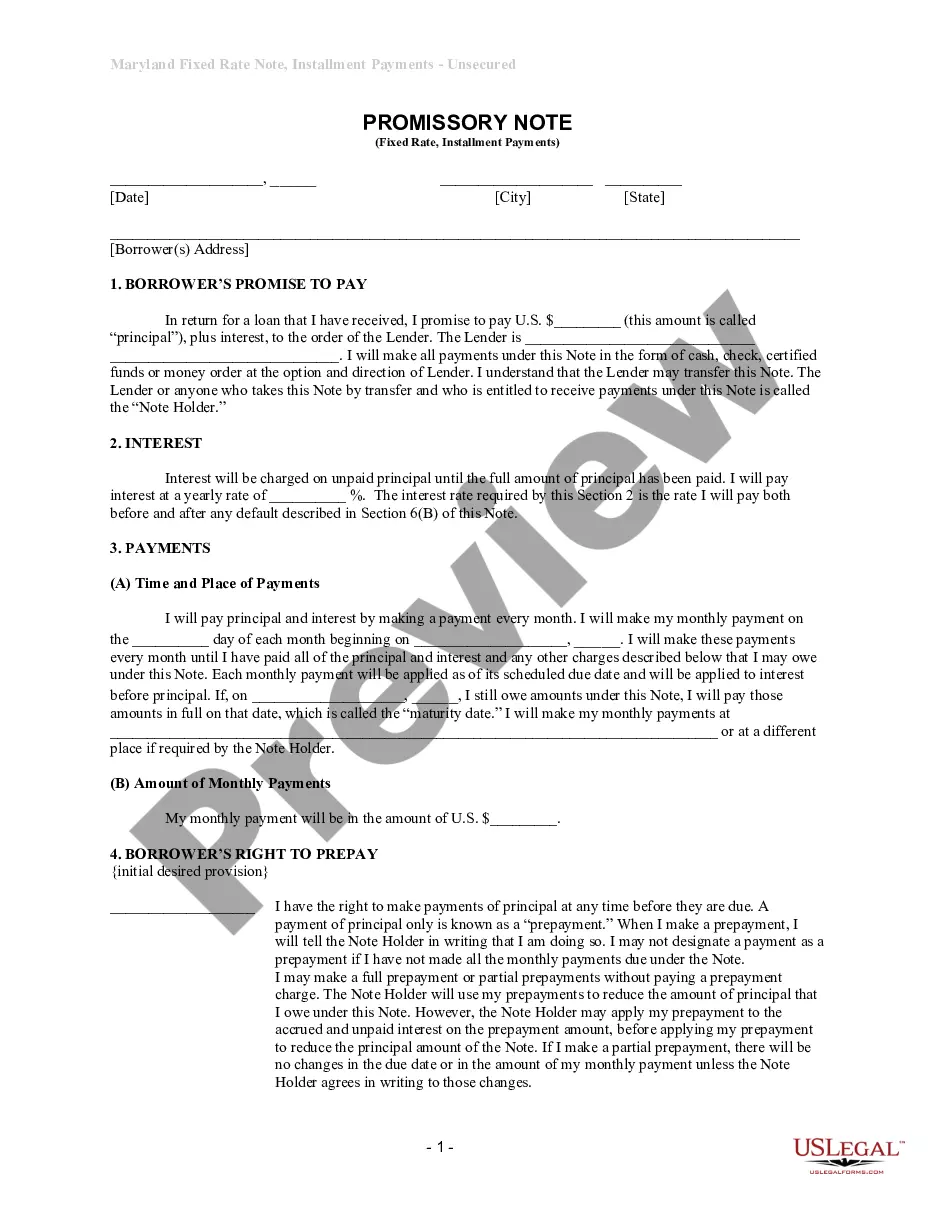

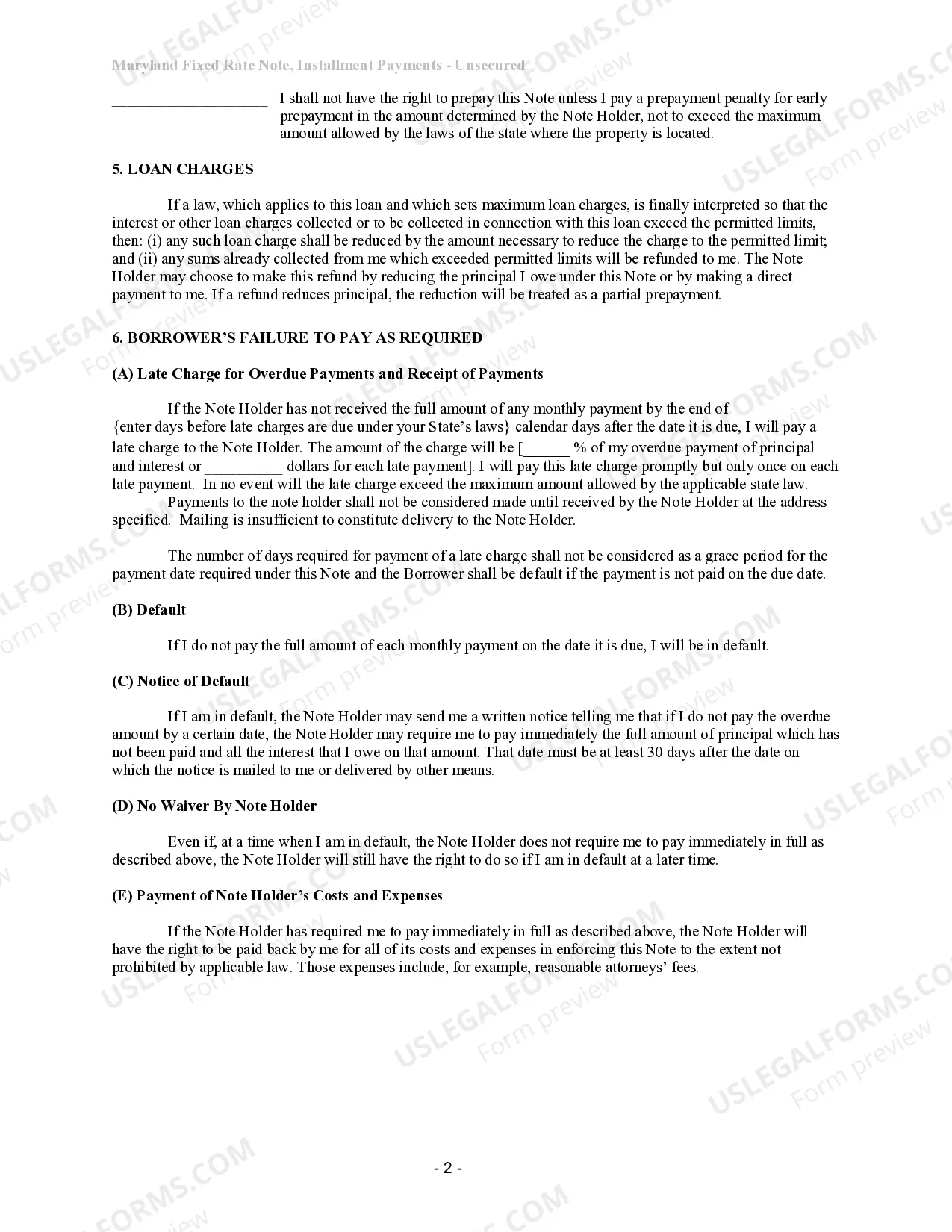

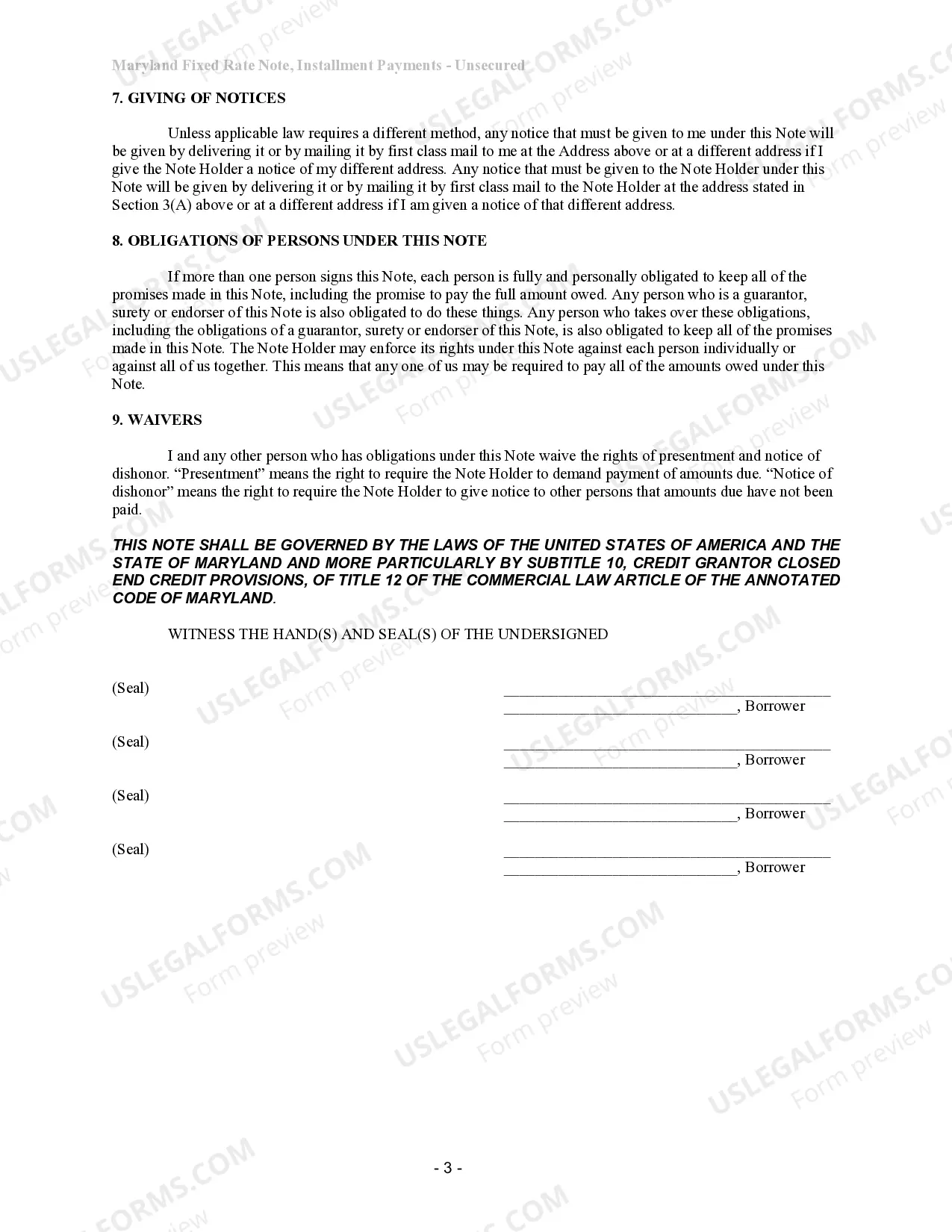

Title: All You Need to Know about Montgomery, Maryland Unsecured Installment Payment Promissory Note for Fixed Rate Introduction: The Montgomery, Maryland Unsecured Installment Payment Promissory Note for Fixed Rate is a legal agreement that outlines the terms and conditions of a loan between a lender and a borrower. This note is specifically designed for unsecured loans and provides a structured repayment plan with a predetermined interest rate. In Montgomery, Maryland, there are various types of Unsecured Installment Payment Promissory Notes for Fixed Rate, each tailored to suit different needs. Types of Montgomery, Maryland Unsecured Installment Payment Promissory Notes for Fixed Rate: 1. Personal Unsecured Installment Payment Promissory Note for Fixed Rate: This type of promissory note is used for personal loans where individuals borrow money for personal expenses, education, vacations, or any other non-business related purposes. The borrower agrees to repay the loan amount with a fixed interest rate over a specific period through regular installments. 2. Business Unsecured Installment Payment Promissory Note for Fixed Rate: Ideal for financing business activities, this promissory note is used when a business or business owner borrows money to meet various requirements like expansion, inventory purchase, equipment purchase, or working capital. The repayment schedule is determined through regular installments, including interest, over a fixed period. 3. Auto Unsecured Installment Payment Promissory Note for Fixed Rate: Designed explicitly for auto financing, this promissory note is utilized when an individual wishes to purchase a vehicle and requires financial assistance. The borrower agrees to repay the loan amount with a fixed interest rate over a specific period through regular installments. 4. Student Unsecured Installment Payment Promissory Note for Fixed Rate: This type of promissory note is commonly employed for student loans. It enables students to borrow money to fund their education, covering tuition fees, accommodation costs, or other educational expenses. The borrowers commit to repay the loan amount and interest through fixed installments within a predetermined duration. Key Components of the Montgomery, Maryland Unsecured Installment Payment Promissory Note for Fixed Rate: 1. Borrower and Lender Information: Includes the full names, addresses, and contact details of the borrower and lender involved in the agreement. 2. Loan Amount and Interest Rate: Specifies the principal loan amount requested by the borrower and the fixed interest rate that will be charged throughout the repayment period. 3. Repayment Schedule: Outlines the agreed-upon repayment schedule, including the frequency of installments (monthly, quarterly, etc.), the due dates of each installment, and the duration of the loan. 4. Late Payment Terms: Clarifies the penalties or additional charges that may be imposed in case of late payments, ensuring prompt repayment. 5. Default and Prepayment Terms: Defines the conditions under which the borrower is considered in default of the agreement, as well as any prepayment options available. Conclusion: The Montgomery, Maryland Unsecured Installment Payment Promissory Note for Fixed Rate serves as a legally binding contract between the lender and borrower, establishing a clear repayment plan for the loan amount plus interest. By understanding the different types of promissory notes available and their respective conditions, borrowers can make informed decisions and lenders can ensure the security of their investment.

Montgomery Note

Description

How to fill out Montgomery Maryland Unsecured Installment Payment Promissory Note For Fixed Rate?

We always strive to minimize or avoid legal damage when dealing with nuanced legal or financial affairs. To do so, we sign up for attorney solutions that, as a rule, are very expensive. However, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based catalog of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without turning to legal counsel. We offer access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Montgomery Maryland Unsecured Installment Payment Promissory Note for Fixed Rate or any other document quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it in the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the website! You can create your account in a matter of minutes.

- Make sure to check if the Montgomery Maryland Unsecured Installment Payment Promissory Note for Fixed Rate complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Montgomery Maryland Unsecured Installment Payment Promissory Note for Fixed Rate is proper for you, you can choose the subscription option and make a payment.

- Then you can download the document in any suitable file format.

For over 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!