A Montgomery Maryland Installments Fixed Rate Promissory Note Secured by Personal Property is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This type of promissory note is commonly used in Montgomery County, Maryland, to secure a loan with personal property as collateral. The borrower promises to repay the loan in regular installments, at a fixed interest rate. This promissory note ensures that the lender has a legal recourse if the borrower defaults on the loan, as the personal property listed as collateral can be seized and sold to recover the outstanding debt. It provides a level of security for both parties involved and sets clear expectations regarding repayment. The Montgomery Maryland Installments Fixed Rate Promissory Note Secured by Personal Property may vary depending on the specific details of the loan. Different types may include: 1. Residential Property Promissory Note: This type of promissory note is used when the loan is secured by residential property, such as a house or a condominium. The borrower pledges their property as collateral to secure the loan. 2. Vehicle Promissory Note: If the loan is secured by a vehicle, such as a car, motorcycle, or boat, this type of promissory note would be appropriate. The borrower's vehicle is used as collateral to protect the lender's interests. 3. Business Equipment Promissory Note: In cases where the loan is secured by business equipment, such as machinery, office furniture, or technology devices, this type of promissory note comes into play. It allows the business owner to obtain the necessary funds while using the equipment as collateral. Furthermore, a Montgomery Maryland Installments Fixed Rate Promissory Note Secured by Personal Property will typically include essential elements, such as the loan amount, repayment schedule, interest rate, late payment penalties, default provisions, and details of the collateral. These elements ensure that both parties are aware of their rights and obligations throughout the loan term. It is vital to consult with a qualified attorney or a legal professional when drafting or entering into a Montgomery Maryland Installments Fixed Rate Promissory Note Secured by Personal Property. They can provide guidance and help tailor the document to meet specific legal requirements and ensure it protects the interests of both parties involved.

Montgomery Maryland Installments Fixed Rate Promissory Note Secured by Personal Property

Category:

State:

Maryland

County:

Montgomery

Control #:

MD-NOTESEC2

Format:

Word;

Rich Text

Instant download

Description

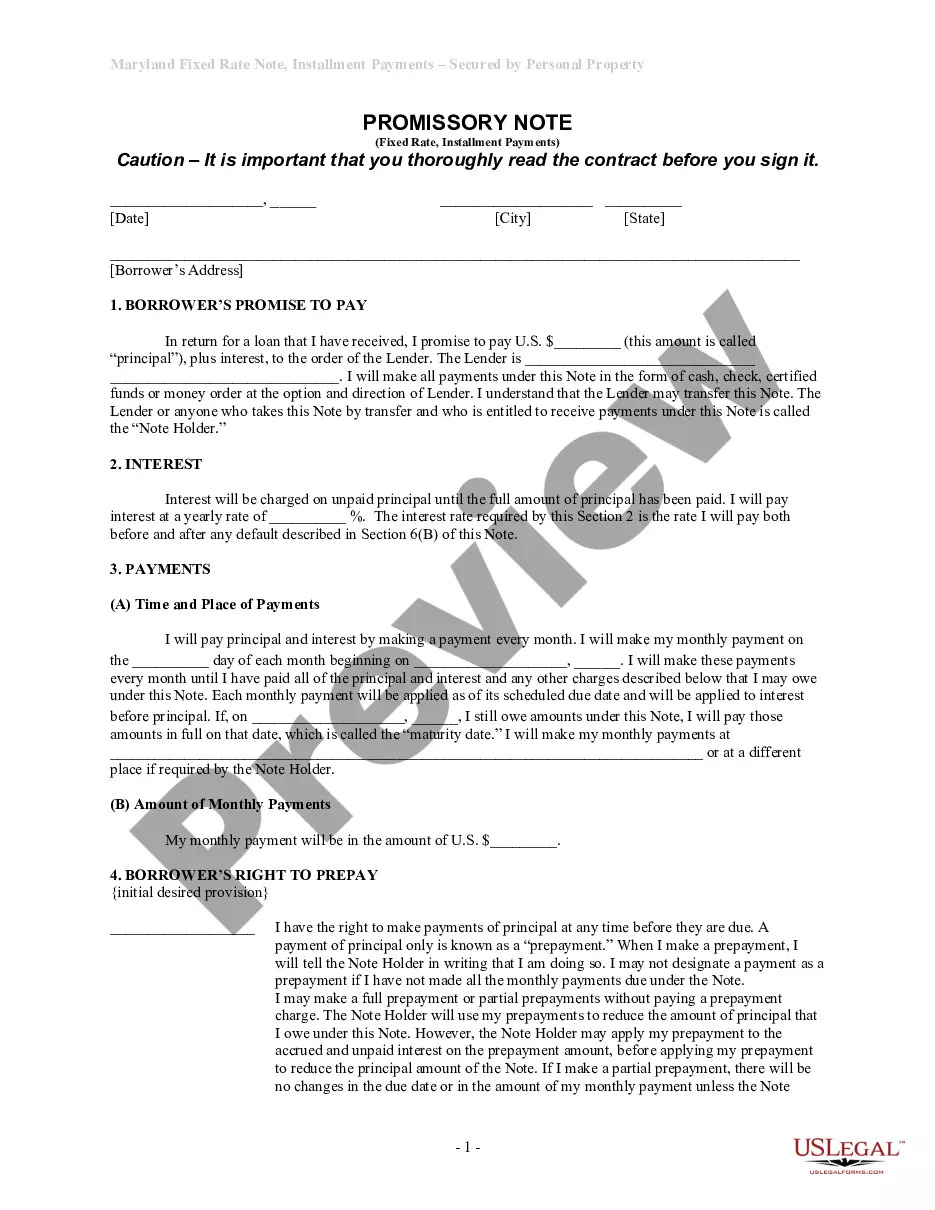

This is a form of Promissory Note for use where personal property is security for the loan. A separate security agreement is also required.

A Montgomery Maryland Installments Fixed Rate Promissory Note Secured by Personal Property is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This type of promissory note is commonly used in Montgomery County, Maryland, to secure a loan with personal property as collateral. The borrower promises to repay the loan in regular installments, at a fixed interest rate. This promissory note ensures that the lender has a legal recourse if the borrower defaults on the loan, as the personal property listed as collateral can be seized and sold to recover the outstanding debt. It provides a level of security for both parties involved and sets clear expectations regarding repayment. The Montgomery Maryland Installments Fixed Rate Promissory Note Secured by Personal Property may vary depending on the specific details of the loan. Different types may include: 1. Residential Property Promissory Note: This type of promissory note is used when the loan is secured by residential property, such as a house or a condominium. The borrower pledges their property as collateral to secure the loan. 2. Vehicle Promissory Note: If the loan is secured by a vehicle, such as a car, motorcycle, or boat, this type of promissory note would be appropriate. The borrower's vehicle is used as collateral to protect the lender's interests. 3. Business Equipment Promissory Note: In cases where the loan is secured by business equipment, such as machinery, office furniture, or technology devices, this type of promissory note comes into play. It allows the business owner to obtain the necessary funds while using the equipment as collateral. Furthermore, a Montgomery Maryland Installments Fixed Rate Promissory Note Secured by Personal Property will typically include essential elements, such as the loan amount, repayment schedule, interest rate, late payment penalties, default provisions, and details of the collateral. These elements ensure that both parties are aware of their rights and obligations throughout the loan term. It is vital to consult with a qualified attorney or a legal professional when drafting or entering into a Montgomery Maryland Installments Fixed Rate Promissory Note Secured by Personal Property. They can provide guidance and help tailor the document to meet specific legal requirements and ensure it protects the interests of both parties involved.

Free preview

How to fill out Montgomery Maryland Installments Fixed Rate Promissory Note Secured By Personal Property?

If you’ve already utilized our service before, log in to your account and save the Montgomery Maryland Installments Fixed Rate Promissory Note Secured by Personal Property on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your file:

- Make sure you’ve located a suitable document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Montgomery Maryland Installments Fixed Rate Promissory Note Secured by Personal Property. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!