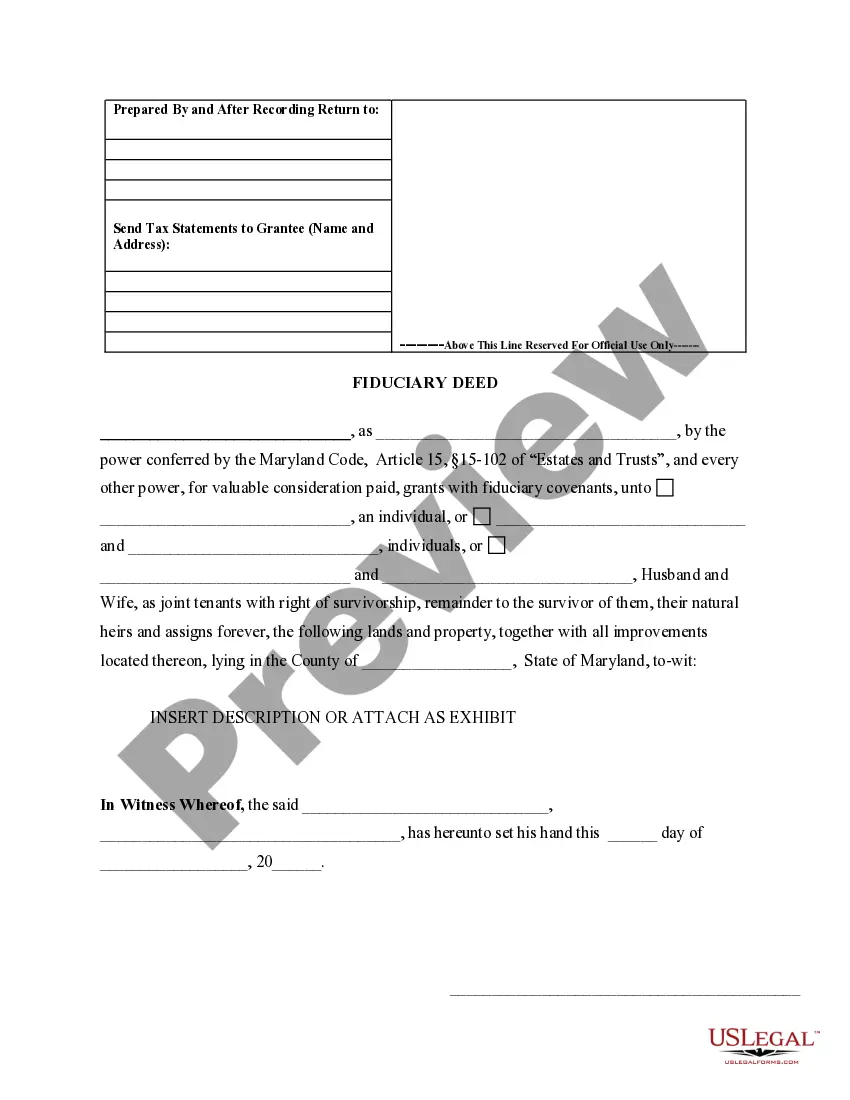

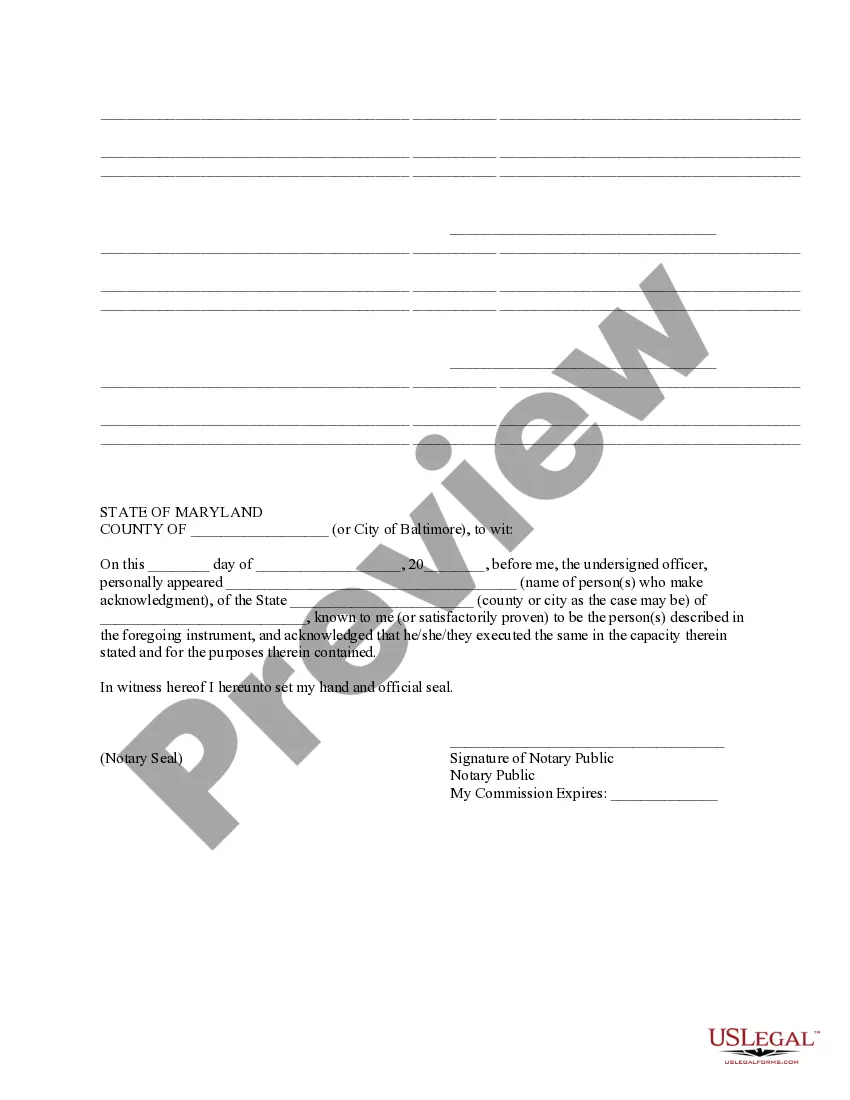

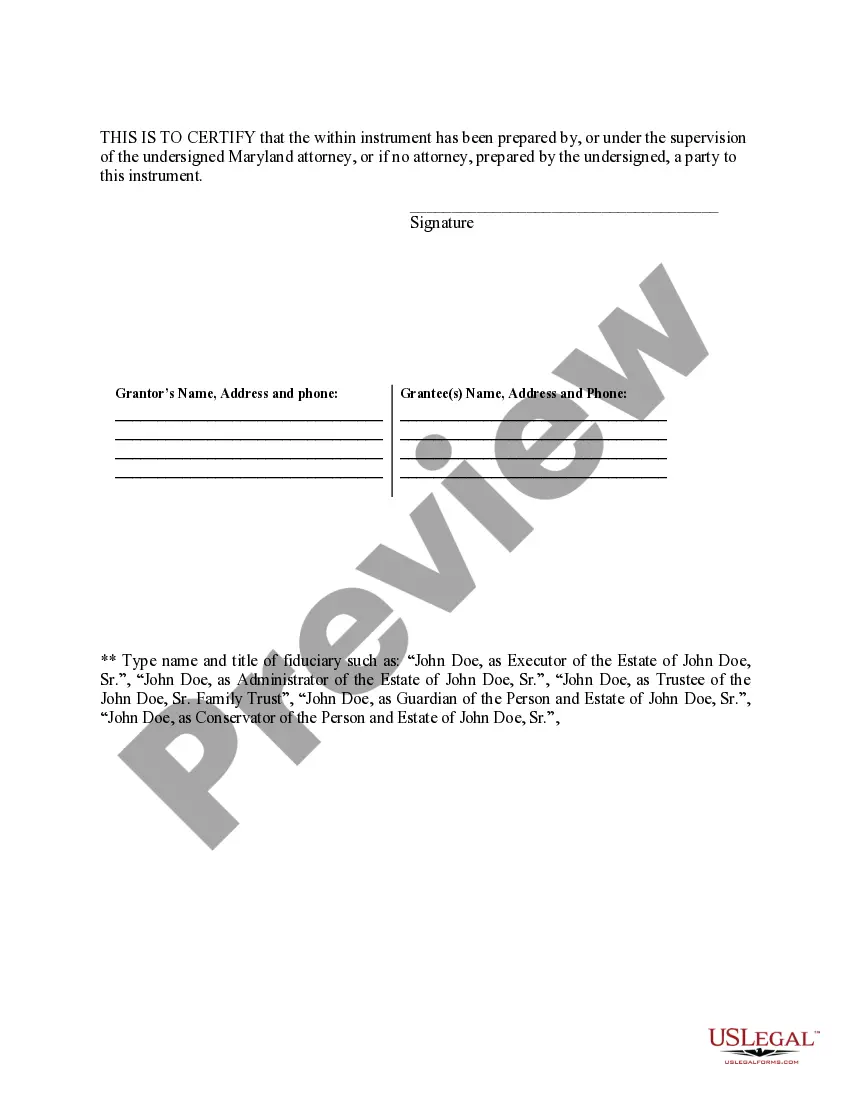

A Montgomery Maryland Fiduciary Deed is a legal document used by various fiduciaries, including Executors, Trustees, Trustees, Administrators, and other individuals who hold a fiduciary role, to transfer real estate property located in Montgomery County, Maryland. This specialized deed is designed to facilitate the transfer of ownership from the fiduciary to a specified individual or entity. Executors, for example, use this deed to transfer real estate holdings from the deceased person's estate to the beneficiaries as outlined in the will. Trustees may utilize this deed to transfer property held in a trust to the designated beneficiaries or to a subsequent trustee. Administrators employ it to transfer ownership of decedent's estate when no will is present, ensuring proper distribution to the rightful heirs. Different types of Montgomery Maryland Fiduciary Deeds can be identified based on the specific fiduciary role: 1. Executor's Fiduciary Deed: This type of deed is used by an Executor to transfer real property from the decedent's estate to the named beneficiaries or distribute it according to the will's instructions. 2. Trustee's Fiduciary Deed: Trustees employ this deed to transfer property held within a trust to beneficiaries according to the terms and conditions outlined in the trust agreement. 3. Trust or's Fiduciary Deed: A Trust or, who creates a trust, may use this deed to transfer ownership of the trust property to the Trustee(s) upon the establishment of the trust. 4. Administrator's Fiduciary Deed: If a person passes away without a will, an Administrator, appointed by the court, can use this deed to transfer ownership of the decedent's estate according to Maryland's intestacy laws. Regardless of the specific type, a Montgomery Maryland Fiduciary Deed must comply with the legal requirements established by the state of Maryland. This includes a thorough description of the property being transferred, the names and roles of the fiduciaries and beneficiaries involved, and the statement of consideration or exemption. It is crucial to consult with an attorney experienced in estate planning or real estate law to ensure compliance and a smooth transfer process.

Montgomery Maryland Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

How to fill out Montgomery Maryland Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Do you need a trustworthy and affordable legal forms supplier to buy the Montgomery Maryland Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries? US Legal Forms is your go-to option.

No matter if you need a basic agreement to set rules for cohabitating with your partner or a package of forms to advance your divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and framed based on the requirements of particular state and area.

To download the document, you need to log in account, find the needed template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased document templates at any time in the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Montgomery Maryland Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries conforms to the laws of your state and local area.

- Read the form’s description (if available) to find out who and what the document is intended for.

- Start the search over if the template isn’t good for your specific scenario.

Now you can register your account. Then select the subscription plan and proceed to payment. Once the payment is completed, download the Montgomery Maryland Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries in any available file format. You can get back to the website when you need and redownload the document free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about spending your valuable time learning about legal paperwork online once and for all.