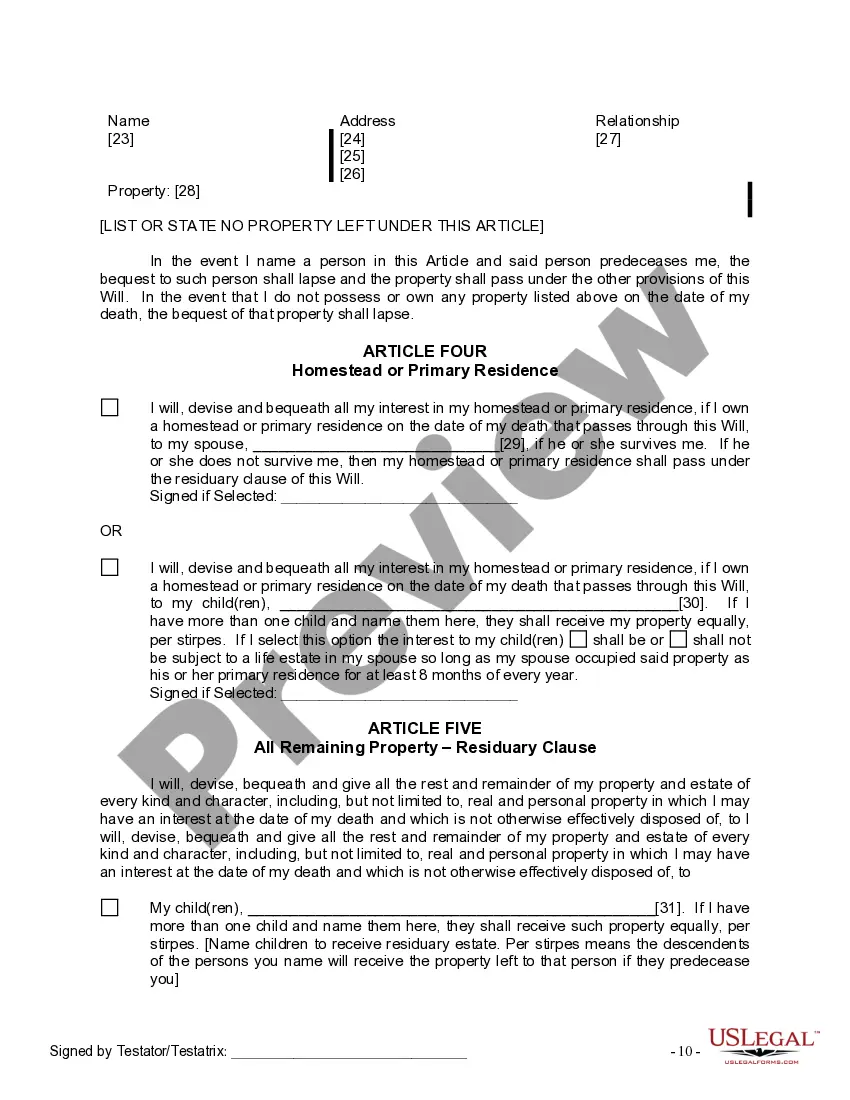

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will. A Montgomery Maryland Legal Last Will and Testament for a Married Person with Minor Children from a Prior Marriage is a legal document that specifies how assets and estate will be distributed after the individual's death. This particular type of will is designed for individuals who are married but have children from a previous relationship. It ensures that the rights and interests of both the spouse and the children are protected. Key elements to include in the will: 1. Guardianship: The will allows the testator (the person creating the will) to nominate a guardian(s) for their minor children in the event of both parents' death. This decision is crucial as it ensures that the children will be cared for by a trusted individual of the testator's choosing. 2. Distribution of Assets: The will outlines how the testator's property, assets, and finances will be distributed among their surviving spouse and minor children. It may specify percentages or specific assets to be allocated to each beneficiary. 3. Trusts for Children: It is common for a Montgomery Maryland Legal Last Will and Testament to establish trusts for minor children. These trusts can ensure that the assets are appropriately managed until the children reach a certain age when they can take full control. 4. Protection of Surviving Spouse: Similar to other wills, this type of legal document ensures that the surviving spouse is adequately provided for. It may grant them a portion of the estate, such as a life estate in the marital home or specific assets, to guarantee their financial security. Different types of Montgomery Maryland Legal Last Will and Testament for Married person with Minor Children from Prior Marriage: 1. Simple Will: This is a basic will that covers the essential aspects like guardianship and asset distribution. It may not involve complex trusts or provisions. 2. Testamentary Trust Will: This type of will creates a trust upon the testator's death, ensuring that the assets are managed by a designated trustee until the children reach a specified age or milestone. 3. Pour-Over Will: A pour-over will often is used in conjunction with a revocable living trust. It allows any remaining assets outside the trust to be transferred or "poured over" into the trust upon the testator's death. 4. Mutual Will: This will is typically created by married partners to ensure that their assets are distributed according to their joint wishes. It is legally binding and ensures that the surviving spouse receives certain assets, while the children from a previous marriage receive their rightful share. Creating a Montgomery Maryland Legal Last Will and Testament for a Married Person with Minor Children from a Prior Marriage is crucial to protect the interests and financial future of both the surviving spouse and the children. It is advisable to consult with an experienced estate planning attorney to ensure that all legal requirements and personal preferences are appropriately addressed.

A Montgomery Maryland Legal Last Will and Testament for a Married Person with Minor Children from a Prior Marriage is a legal document that specifies how assets and estate will be distributed after the individual's death. This particular type of will is designed for individuals who are married but have children from a previous relationship. It ensures that the rights and interests of both the spouse and the children are protected. Key elements to include in the will: 1. Guardianship: The will allows the testator (the person creating the will) to nominate a guardian(s) for their minor children in the event of both parents' death. This decision is crucial as it ensures that the children will be cared for by a trusted individual of the testator's choosing. 2. Distribution of Assets: The will outlines how the testator's property, assets, and finances will be distributed among their surviving spouse and minor children. It may specify percentages or specific assets to be allocated to each beneficiary. 3. Trusts for Children: It is common for a Montgomery Maryland Legal Last Will and Testament to establish trusts for minor children. These trusts can ensure that the assets are appropriately managed until the children reach a certain age when they can take full control. 4. Protection of Surviving Spouse: Similar to other wills, this type of legal document ensures that the surviving spouse is adequately provided for. It may grant them a portion of the estate, such as a life estate in the marital home or specific assets, to guarantee their financial security. Different types of Montgomery Maryland Legal Last Will and Testament for Married person with Minor Children from Prior Marriage: 1. Simple Will: This is a basic will that covers the essential aspects like guardianship and asset distribution. It may not involve complex trusts or provisions. 2. Testamentary Trust Will: This type of will creates a trust upon the testator's death, ensuring that the assets are managed by a designated trustee until the children reach a specified age or milestone. 3. Pour-Over Will: A pour-over will often is used in conjunction with a revocable living trust. It allows any remaining assets outside the trust to be transferred or "poured over" into the trust upon the testator's death. 4. Mutual Will: This will is typically created by married partners to ensure that their assets are distributed according to their joint wishes. It is legally binding and ensures that the surviving spouse receives certain assets, while the children from a previous marriage receive their rightful share. Creating a Montgomery Maryland Legal Last Will and Testament for a Married Person with Minor Children from a Prior Marriage is crucial to protect the interests and financial future of both the surviving spouse and the children. It is advisable to consult with an experienced estate planning attorney to ensure that all legal requirements and personal preferences are appropriately addressed.