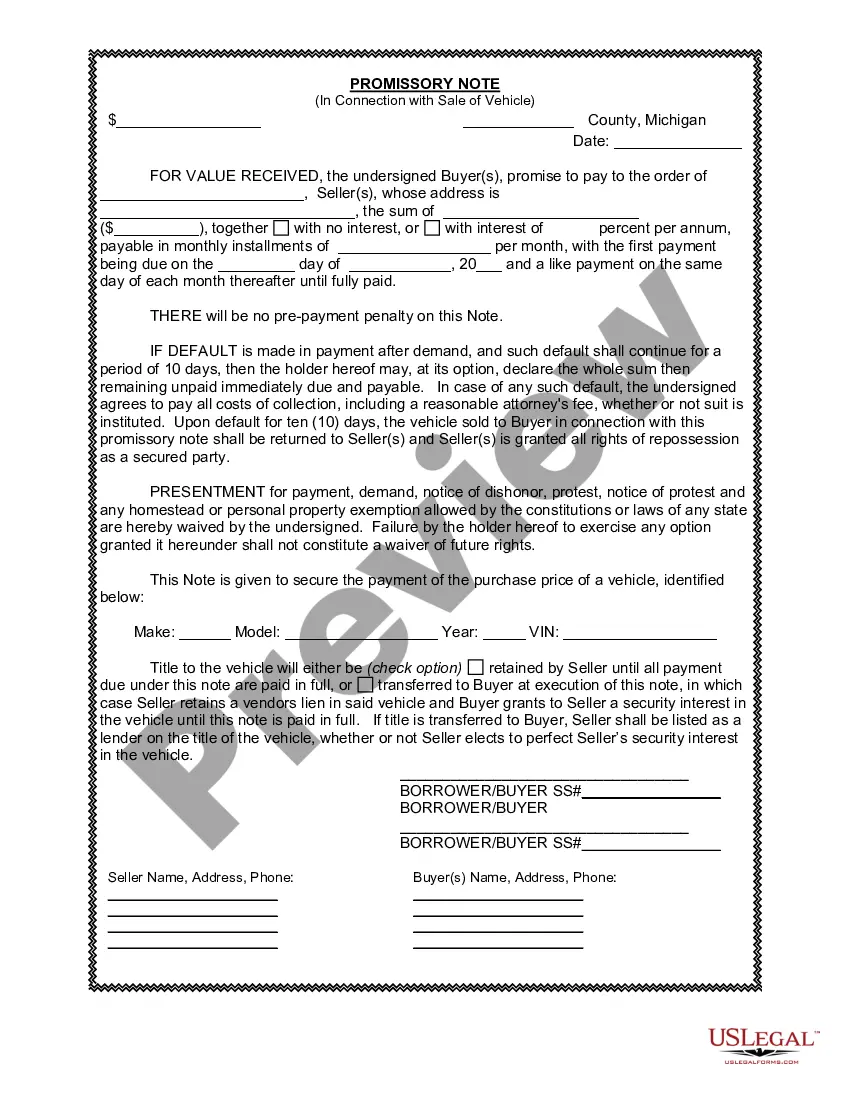

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

Ann Arbor Michigan Promissory Note in Connection with Sale of Vehicle or Automobile

Description

How to fill out Michigan Promissory Note In Connection With Sale Of Vehicle Or Automobile?

If you’ve previously utilized our service, Log In to your profile and download the Ann Arbor Michigan Promissory Note related to the Sale of Vehicle or Automobile onto your device by clicking the Download button. Ensure your subscription is active. If it’s not, renew it according to your payment plan.

If this is your initial experience with our service, follow these straightforward steps to obtain your file.

You have continuous access to every document you have purchased: you can find it in your profile under the My documents menu whenever you need to use it again. Make the most of the US Legal Forms service to swiftly find and save any template for your personal or professional requirements!

- Ensure you’ve found an appropriate document. Browse through the description and use the Preview option, if available, to verify if it satisfies your requirements. If it’s not suitable, utilize the Search tab above to find the right one.

- Purchase the template. Click the Buy Now button and select either a monthly or annual subscription plan.

- Create an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Receive your Ann Arbor Michigan Promissory Note related to the Sale of Vehicle or Automobile. Choose the file format for your document and save it onto your device.

- Complete your document. Print it or leverage professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

A promissory note can be used for different types of loans such as a mortgage, student loan, car loan, business loan or personal loan.

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it ? and yes, this happens ? the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

A promissory note is a promise to pay. So a bill of sale for an automobile with a promissory note is what you might expect from the (very long) name: A certification someone has bought, and promises to pay for, your car. In this case, likely in monthly installments.

Financial institutions such as banks and lenders often use promissory notes when issuing real estate mortgage loans or student loans. Companies or individuals also use promissory notes when issuing or taking on personal loans or corporate loans.

There is no legal requirement to have most Michigan promissory notes witnessed or notarized. However, a notary may be required for a promissory note related to a home loan. The borrower and any co-signer are required to sign and date the document for it to be executed.

Does a promissory note have to be notarized? A valid promissory note only needs the signatures of the participating parties involved in the agreement, not necessitating acknowledgment or being witnessed by a notary public to be legitimate.

A promissory note is a promise to pay. So a bill of sale for an automobile with a promissory note is what you might expect from the (very long) name: A certification someone has bought, and promises to pay for, your car. In this case, likely in monthly installments.