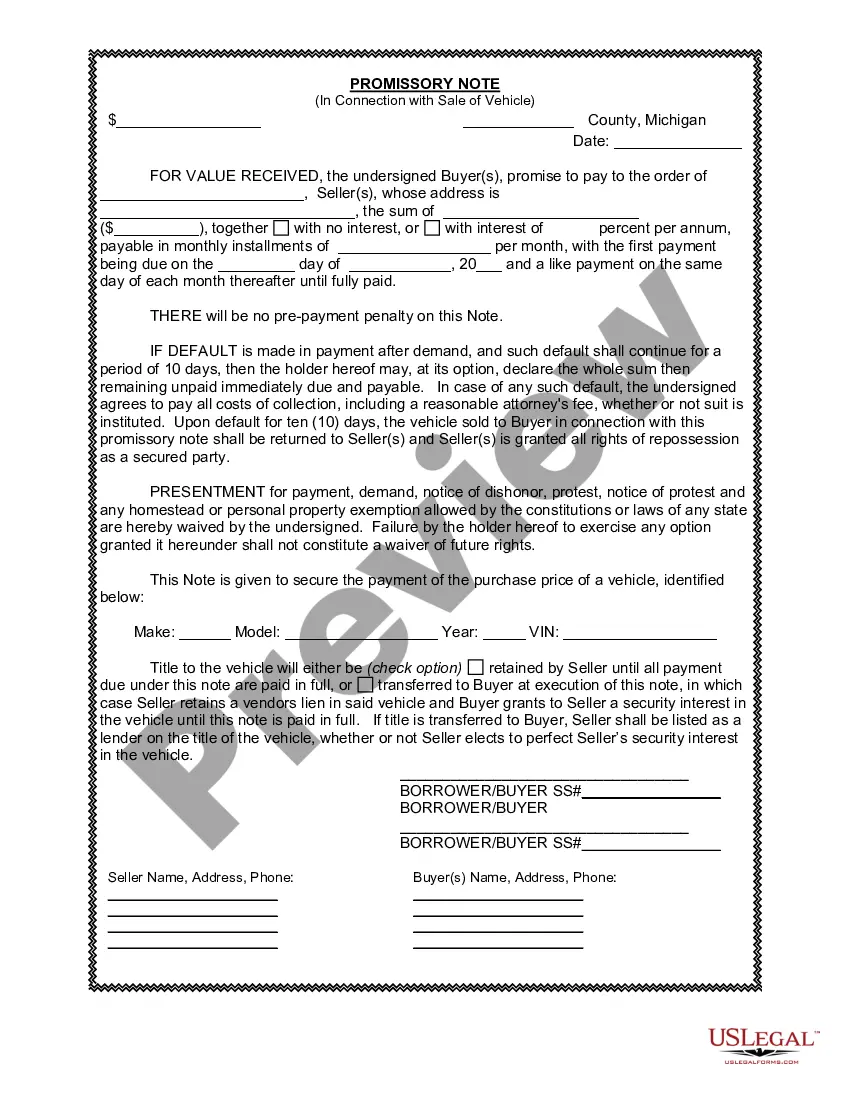

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A promissory note is a legal document commonly used in Detroit, Michigan, as a written agreement between parties involved in the sale of a vehicle or automobile. It serves as a binding contract that outlines the terms and conditions of the payment agreement between the buyer and the seller. The promissory note is essential for both parties as it ensures transparency, clarity, and legal protection throughout the transaction. The Detroit Michigan Promissory Note in Connection with Sale of Vehicle or Automobile specifies various key details, including the identities of the buyer and seller, the description of the vehicle being sold, the purchase price, and the agreed-upon payment terms. This document may also address other relevant terms and conditions, such as the interest rate (if applicable), penalties for late payments, and the consequences of defaulting on the loan. In Detroit, Michigan, there may be different types or variations of promissory notes used within the context of the sale of vehicles or automobiles. Here are a few examples: 1. Secured Promissory Note: This type of promissory note may involve the use of collateral. The seller takes a security interest in the vehicle being sold, which means that if the buyer fails to repay the agreed amount, the seller has the right to repossess the vehicle as spelled out in the promissory note. 2. Balloon Payment Promissory Note: This type of note enables the buyer to make smaller regular payments over an agreed-upon period, with a final "balloon payment" due at the end. The balloon payment is typically larger than the previous payments and represents the remaining outstanding balance. 3. Installment Promissory Note: This type of note divides the purchase price and any applicable interest into a series of equal installments. The buyer agrees to make regular payments, typically monthly, until the note is fully paid. These are just a few examples of the types of promissory notes used in connection with the sale of vehicles or automobiles in Detroit, Michigan. However, the specific terms and conditions of a promissory note may vary depending on the agreement reached between the buyer and the seller. It is crucial for both parties to carefully read and understand the terms of the promissory note before signing, as it will serve as a legally binding contract governing the sale and payment arrangement.A promissory note is a legal document commonly used in Detroit, Michigan, as a written agreement between parties involved in the sale of a vehicle or automobile. It serves as a binding contract that outlines the terms and conditions of the payment agreement between the buyer and the seller. The promissory note is essential for both parties as it ensures transparency, clarity, and legal protection throughout the transaction. The Detroit Michigan Promissory Note in Connection with Sale of Vehicle or Automobile specifies various key details, including the identities of the buyer and seller, the description of the vehicle being sold, the purchase price, and the agreed-upon payment terms. This document may also address other relevant terms and conditions, such as the interest rate (if applicable), penalties for late payments, and the consequences of defaulting on the loan. In Detroit, Michigan, there may be different types or variations of promissory notes used within the context of the sale of vehicles or automobiles. Here are a few examples: 1. Secured Promissory Note: This type of promissory note may involve the use of collateral. The seller takes a security interest in the vehicle being sold, which means that if the buyer fails to repay the agreed amount, the seller has the right to repossess the vehicle as spelled out in the promissory note. 2. Balloon Payment Promissory Note: This type of note enables the buyer to make smaller regular payments over an agreed-upon period, with a final "balloon payment" due at the end. The balloon payment is typically larger than the previous payments and represents the remaining outstanding balance. 3. Installment Promissory Note: This type of note divides the purchase price and any applicable interest into a series of equal installments. The buyer agrees to make regular payments, typically monthly, until the note is fully paid. These are just a few examples of the types of promissory notes used in connection with the sale of vehicles or automobiles in Detroit, Michigan. However, the specific terms and conditions of a promissory note may vary depending on the agreement reached between the buyer and the seller. It is crucial for both parties to carefully read and understand the terms of the promissory note before signing, as it will serve as a legally binding contract governing the sale and payment arrangement.