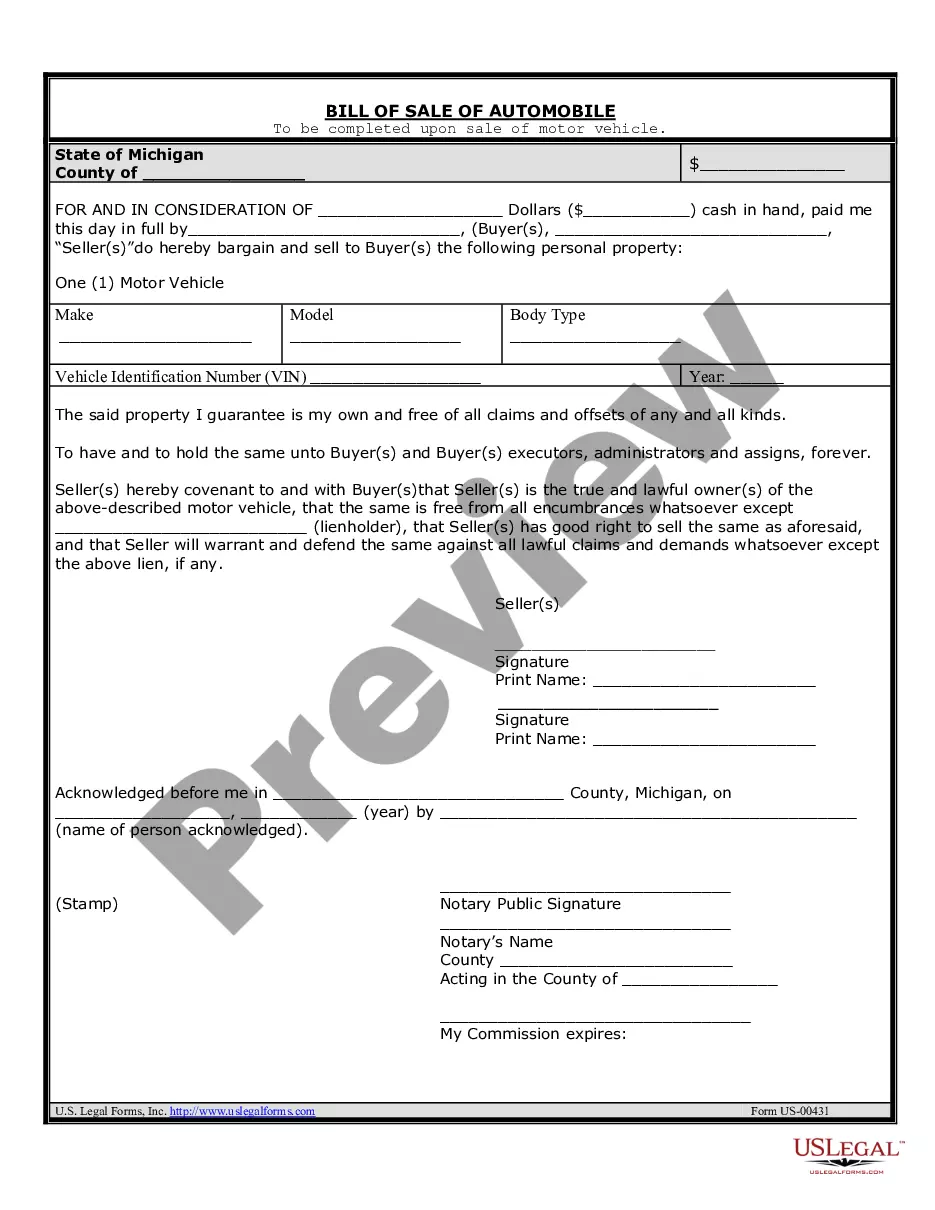

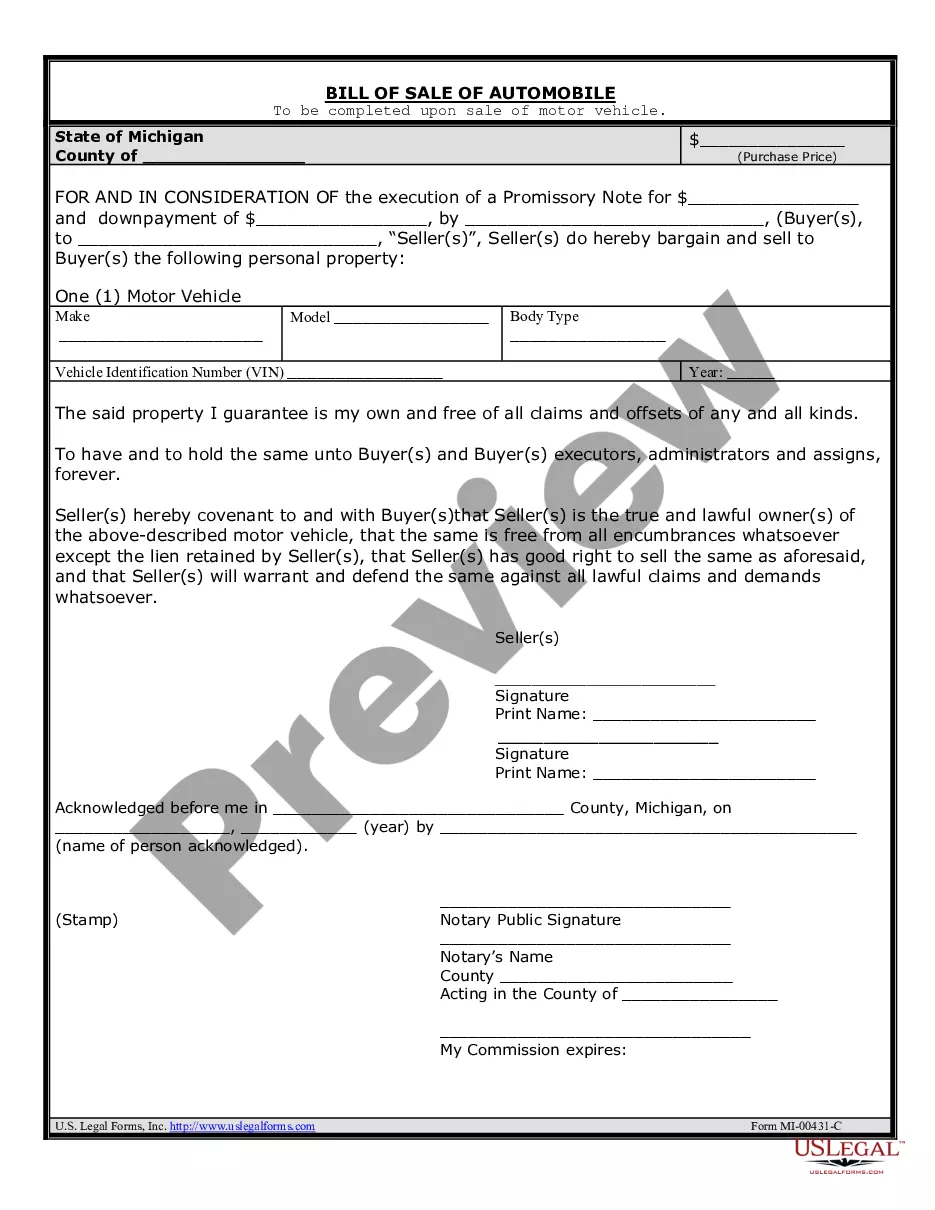

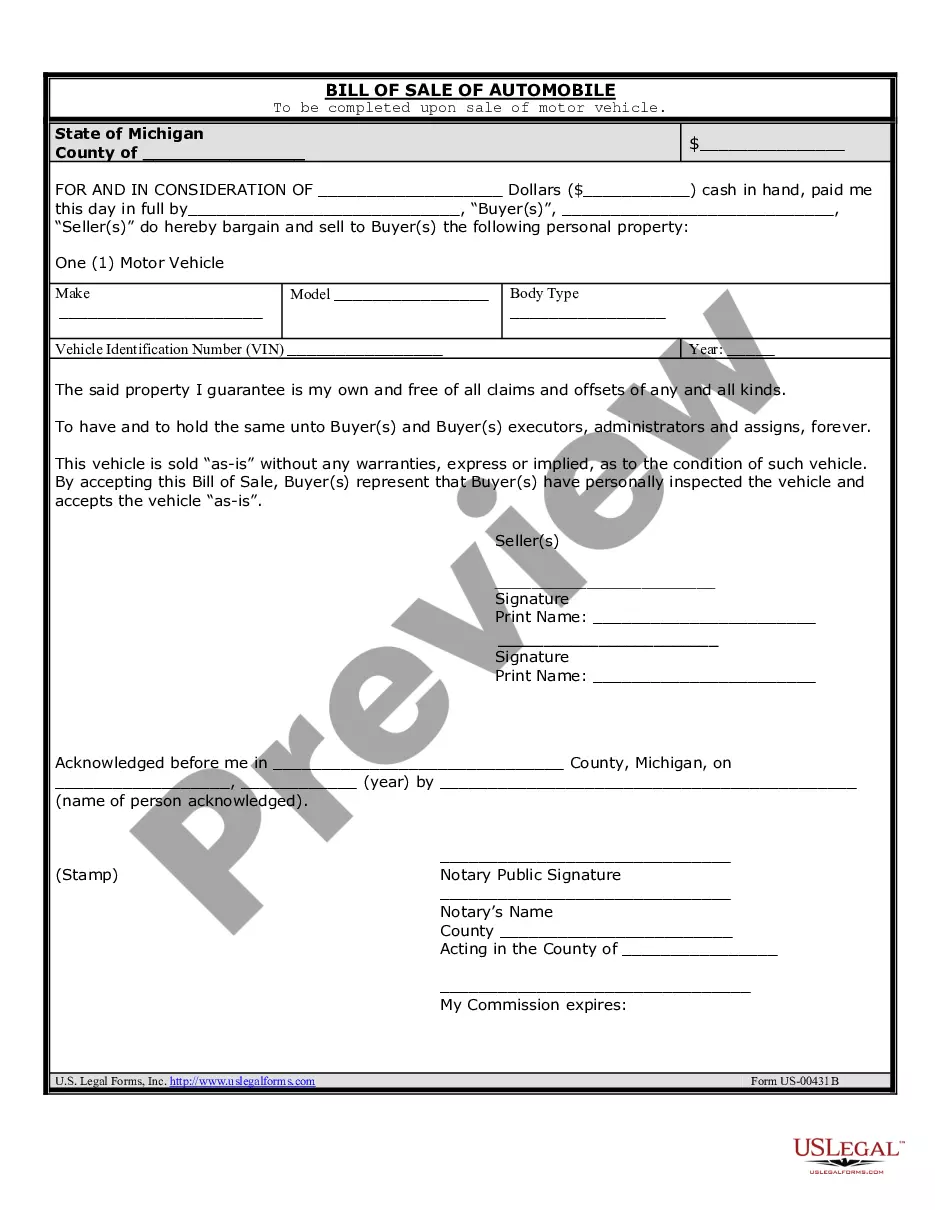

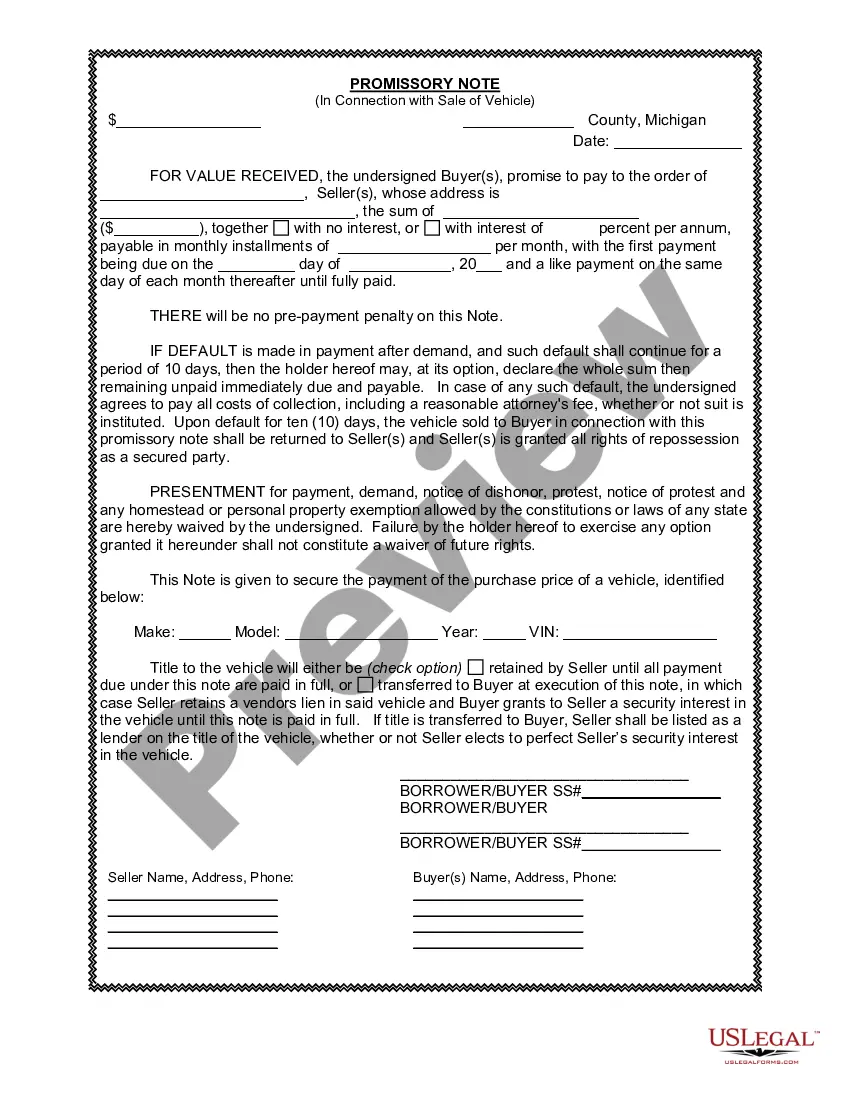

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Grand Rapids Michigan Promissory Note in connection with the sale of a vehicle or automobile refers to a legally binding document that outlines the terms and conditions of a loan agreement between a buyer and seller. This promissory note serves as a written contract, providing protection to both parties involved in the transaction. The key components of a Grand Rapids Michigan Promissory Note in connection with the sale of a vehicle or automobile include: 1. Parties Involved: The promissory note identifies the buyer, known as the borrower, and the seller, known as the lender or note holder. 2. Vehicle Details: The promissory note includes crucial information about the vehicle being sold, such as make, model, year, identification number, and any additional features or special conditions. 3. Loan Amount: The document states the total amount that the borrower commits to pay back, which includes the agreed-upon purchase price plus any additional fees, taxes, or interests. 4. Payment Terms: The promissory note outlines the schedule and method of payment, including the due date of each installment and acceptable payment methods (such as cash, check, or electronic transfer). 5. Interest Rate: If applicable, the promissory note will specify the agreed-upon interest rate, either as a fixed rate or a variable rate, which affects the total repayment amount. 6. Default Consequences: The document includes provisions that outline the consequences of default, such as late payment fees, repossession rights, and potential legal actions. 7. Security Agreement: In some cases, the promissory note may include a security agreement, granting the lender a security interest in the vehicle until the loan is fully repaid. Types of Grand Rapids Michigan Promissory Note in Connection with Sale of Vehicle or Automobile can be categorized based on their specific terms and conditions: 1. Installment Promissory Note: The borrower repays the loan in equal monthly installments over a fixed period, including principal and interest portions. 2. Balloon Promissory Note: The borrower makes regular payments over a shorter period, with a large final payment (balloon payment) due at the end of the term. 3. Variable Rate Promissory Note: The interest rate on the loan fluctuates based on market conditions, potentially affecting the borrower's monthly payments. 4. Secured Promissory Note: The lender holds a security interest in the vehicle, allowing them to repossess it in case of default. In conclusion, a Grand Rapids Michigan Promissory Note in connection with the sale of a vehicle or automobile serves as a legally enforceable contract that outlines the loan terms and protects both the buyer and seller. By providing specific repayment conditions, this document ensures a clear understanding of the financial obligations and consequences involved in the transaction.A Grand Rapids Michigan Promissory Note in connection with the sale of a vehicle or automobile refers to a legally binding document that outlines the terms and conditions of a loan agreement between a buyer and seller. This promissory note serves as a written contract, providing protection to both parties involved in the transaction. The key components of a Grand Rapids Michigan Promissory Note in connection with the sale of a vehicle or automobile include: 1. Parties Involved: The promissory note identifies the buyer, known as the borrower, and the seller, known as the lender or note holder. 2. Vehicle Details: The promissory note includes crucial information about the vehicle being sold, such as make, model, year, identification number, and any additional features or special conditions. 3. Loan Amount: The document states the total amount that the borrower commits to pay back, which includes the agreed-upon purchase price plus any additional fees, taxes, or interests. 4. Payment Terms: The promissory note outlines the schedule and method of payment, including the due date of each installment and acceptable payment methods (such as cash, check, or electronic transfer). 5. Interest Rate: If applicable, the promissory note will specify the agreed-upon interest rate, either as a fixed rate or a variable rate, which affects the total repayment amount. 6. Default Consequences: The document includes provisions that outline the consequences of default, such as late payment fees, repossession rights, and potential legal actions. 7. Security Agreement: In some cases, the promissory note may include a security agreement, granting the lender a security interest in the vehicle until the loan is fully repaid. Types of Grand Rapids Michigan Promissory Note in Connection with Sale of Vehicle or Automobile can be categorized based on their specific terms and conditions: 1. Installment Promissory Note: The borrower repays the loan in equal monthly installments over a fixed period, including principal and interest portions. 2. Balloon Promissory Note: The borrower makes regular payments over a shorter period, with a large final payment (balloon payment) due at the end of the term. 3. Variable Rate Promissory Note: The interest rate on the loan fluctuates based on market conditions, potentially affecting the borrower's monthly payments. 4. Secured Promissory Note: The lender holds a security interest in the vehicle, allowing them to repossess it in case of default. In conclusion, a Grand Rapids Michigan Promissory Note in connection with the sale of a vehicle or automobile serves as a legally enforceable contract that outlines the loan terms and protects both the buyer and seller. By providing specific repayment conditions, this document ensures a clear understanding of the financial obligations and consequences involved in the transaction.