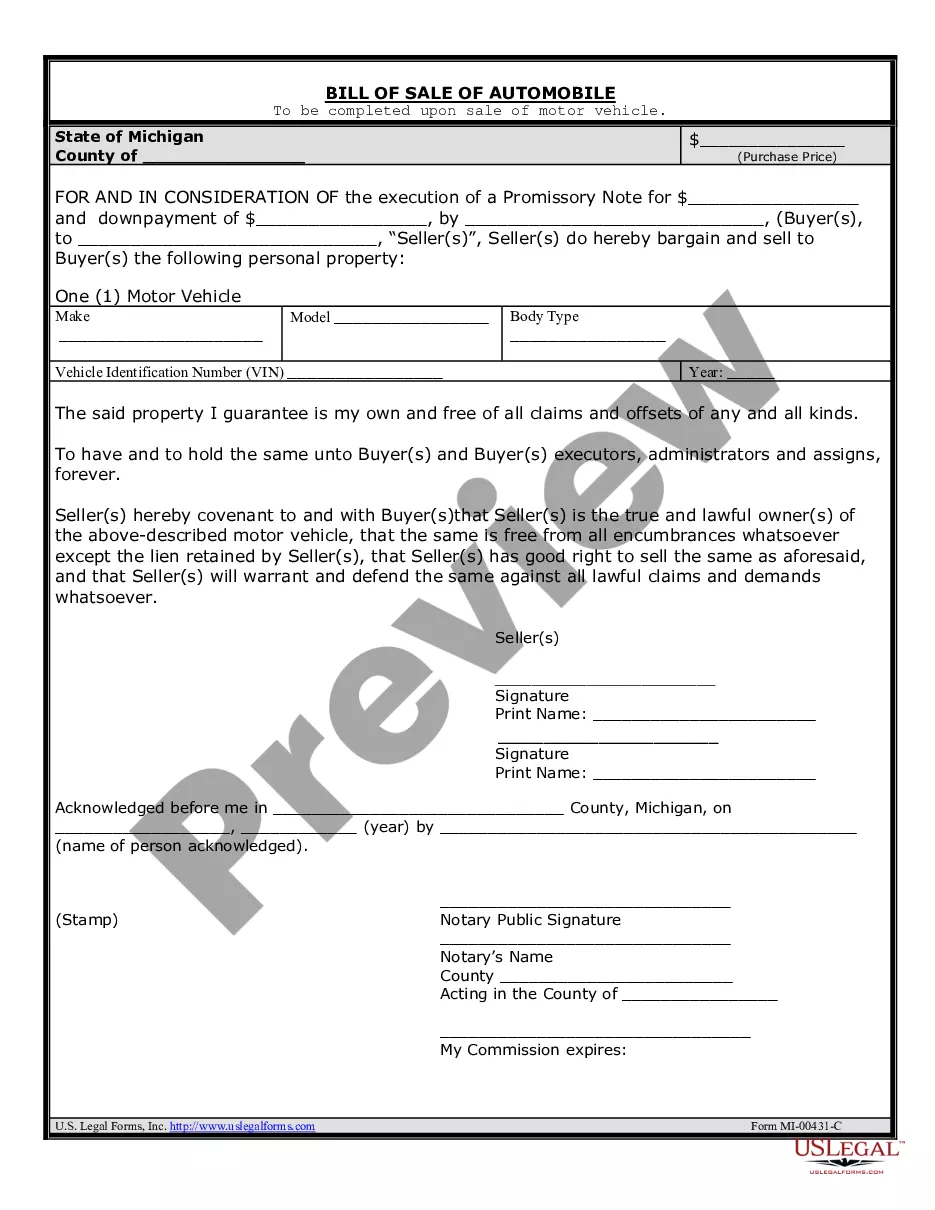

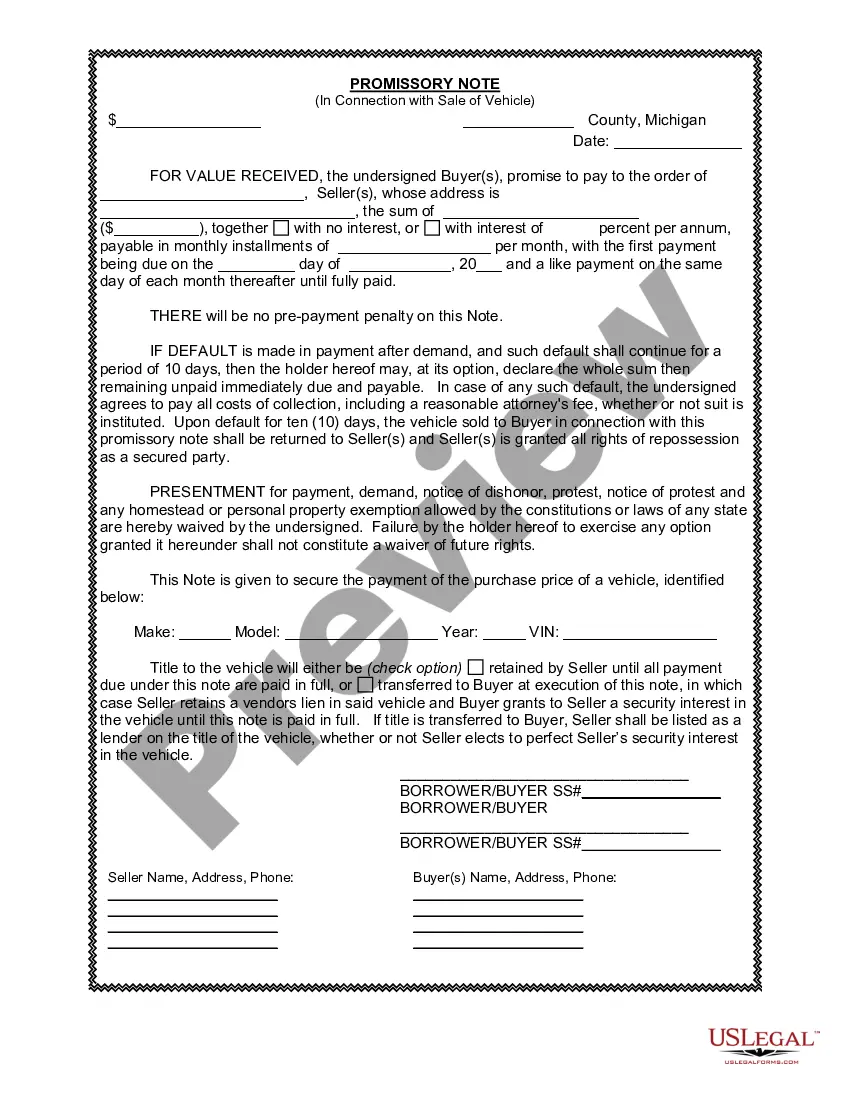

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

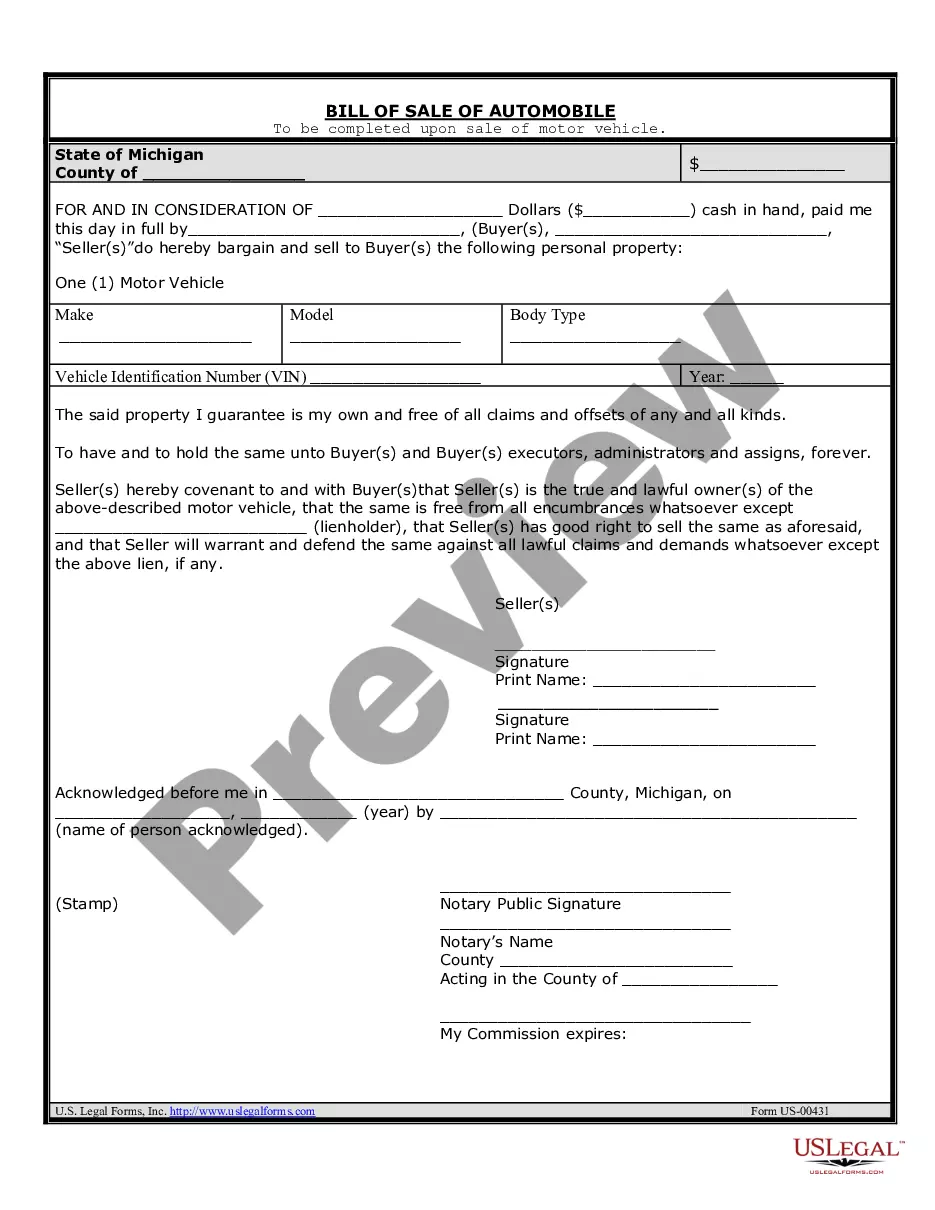

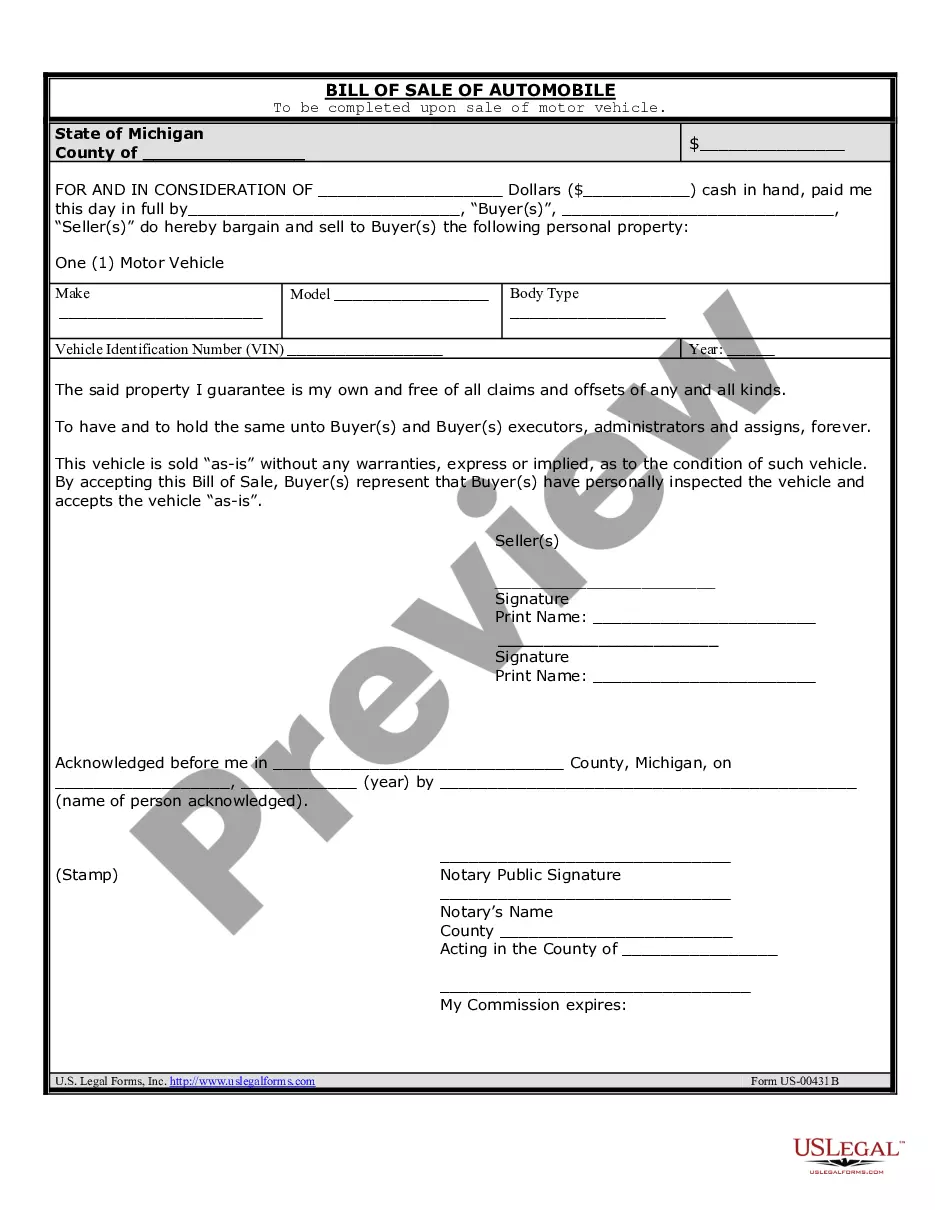

Oakland Michigan Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a financial agreement between the buyer and seller of a vehicle in Oakland County, Michigan. It serves as a legally binding contract, ensuring that both parties understand their rights and obligations regarding the sale and any associated loan payment plans. The promissory note will typically include details such as the names and contact information of the buyer and seller, the vehicle's description (including make, model, year, and Vehicle Identification Number), the purchase price, and the agreed-upon payment terms. These terms may include the frequency of payments (monthly, bi-weekly, etc.), the interest rate applied to the loan amount, and the duration of the payment plan. By signing the promissory note, the buyer agrees to repay the seller or the financing institution the amount borrowed to purchase the vehicle and any accrued interest within the specified timeframe. This note also specifies the consequences of defaulting on payment, such as potential repossession of the vehicle or legal action to recover the outstanding balance. Different types of Oakland Michigan Promissory Notes in Connection with Sale of Vehicle or Automobile may include variations based on the nature of the payment arrangement. For example: 1. Installment Promissory Note: This type of promissory note outlines a structured payment plan, specifying a set number of equal payments over a defined period. It is commonly used when a vehicle's purchase price exceeds the buyer's immediate financial means. 2. Balloon Promissory Note: In this type, the buyer makes smaller regular payments over a set period, with a large "balloon" payment due at the end of the term. This arrangement is beneficial for buyers anticipating a significant financial gain or expecting a lump sum payment in the future. 3. Acceleration Promissory Note: If both parties agree, this type allows the seller or financing institution to demand immediate repayment of the full outstanding balance if the buyer fails to make scheduled payments or breaches any other terms of the contract. 4. Secured Promissory Note: In certain cases, the promissory note may be secured by the vehicle itself, meaning that if the buyer defaults on payment, the seller has the right to repossess the vehicle to recover their losses. It is crucial for both buyers and sellers in Oakland County, Michigan, to seek legal advice and ensure that the Oakland Michigan Promissory Note in Connection with Sale of Vehicle or Automobile accurately reflects their agreed-upon terms and complies with all applicable laws and regulations. This document serves as a means of protecting the rights and interests of both parties throughout the vehicle sale transaction.