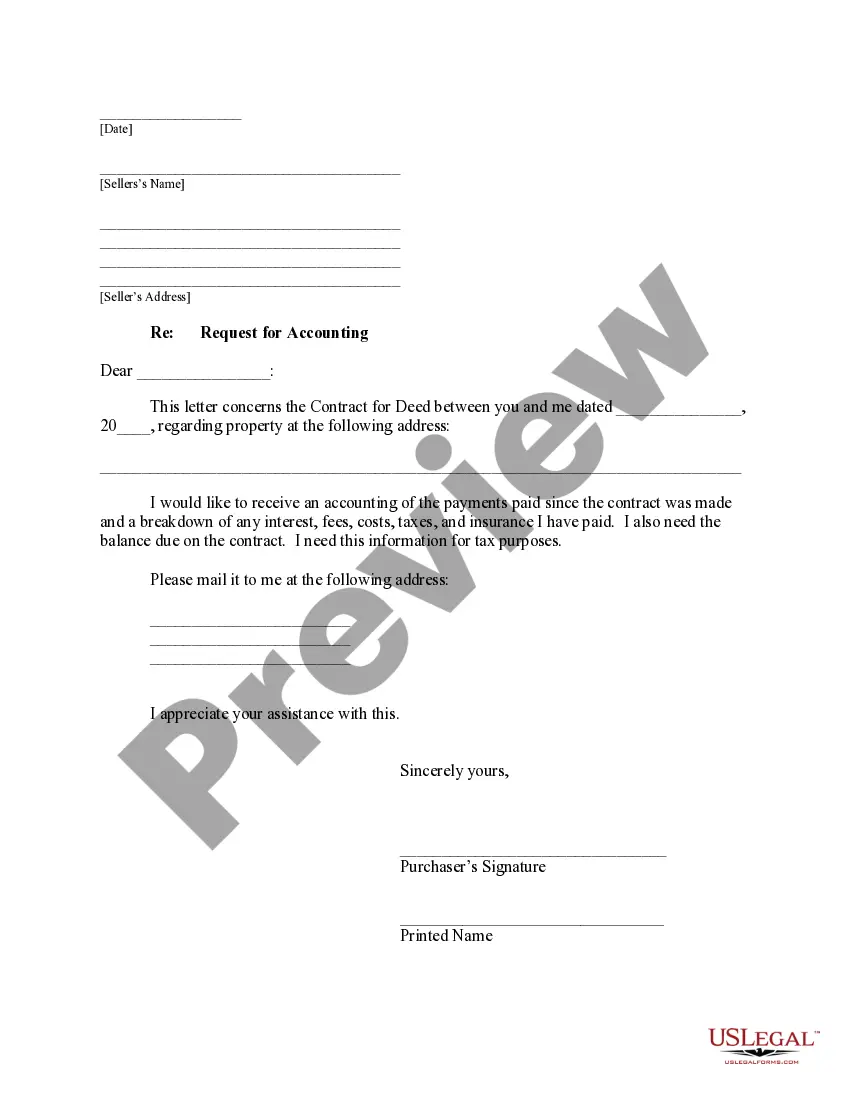

This is a Purchaser's Request of Accounting Statement from Seller. It is a request in writing to receive an accounting of the payments paid since the contract was made and a breakdown of any interest, fees, costs, taxes and insurance paid. It is also a request for the balance due on the contract.

Title: Grand Rapids Michigan Buyer's Request for Accounting from Seller under Contract for Deed Introduction: When entering into a real estate transaction in Grand Rapids, Michigan, under a contract for deed, buyers have the right to request an accounting from the seller. This request aims to obtain detailed financial information regarding the property's finances and ensures transparency throughout the purchase process. Discover more about the types of Buyer's Request for Accounting from Seller under Contract for Deed in Grand Rapids. 1. Financial Accounting Request: Under a contract for deed, buyers have the option to request a comprehensive financial accounting from the seller. This accounting includes details related to the property's income, expenses, taxes, and outstanding liabilities. By thoroughly reviewing this documentation, buyers can make informed decisions and assess the overall profitability and financial stability of the property. 2. Maintenance Accounting Request: Buyers may also choose to request a maintenance accounting from the seller. This type of request focuses on the property's maintenance history, repairs, and improvements. Gathering this data allows potential buyers to evaluate the property's condition, identify any potential issues, and budget for future maintenance expenses. 3. Tax and Insurance Accounting Request: To ensure complete transparency, buyers can request a tax and insurance accounting from the seller. This request provides detailed information on property taxes, insurance coverage, and any outstanding payments or claims. By reviewing this information, buyers can confirm that the property taxes have been paid, assess the adequacy of the insurance coverage, and minimize any potential financial risks. 4. Escrow and Deposit Accounting Request: Buyers might consider requesting an escrow and deposit accounting from the seller under a contract for deed. This type of accounting details the handling of any escrow funds or deposits throughout the transaction. It ensures that all funds have been correctly allocated, particularly towards the down payment or any future payments due to the seller. Conclusion: In Grand Rapids, Michigan, buyers have various types of accounting requests they can make from sellers under a contract for deed. By understanding and utilizing these options, buyers can gain a better understanding of the property's financial standing, maintenance history, tax and insurance matters, as well as the proper handling of escrow and deposit funds. Requesting these accounting promotes transparency, protects the buyer's interests, and facilitates a smooth real estate transaction.Title: Grand Rapids Michigan Buyer's Request for Accounting from Seller under Contract for Deed Introduction: When entering into a real estate transaction in Grand Rapids, Michigan, under a contract for deed, buyers have the right to request an accounting from the seller. This request aims to obtain detailed financial information regarding the property's finances and ensures transparency throughout the purchase process. Discover more about the types of Buyer's Request for Accounting from Seller under Contract for Deed in Grand Rapids. 1. Financial Accounting Request: Under a contract for deed, buyers have the option to request a comprehensive financial accounting from the seller. This accounting includes details related to the property's income, expenses, taxes, and outstanding liabilities. By thoroughly reviewing this documentation, buyers can make informed decisions and assess the overall profitability and financial stability of the property. 2. Maintenance Accounting Request: Buyers may also choose to request a maintenance accounting from the seller. This type of request focuses on the property's maintenance history, repairs, and improvements. Gathering this data allows potential buyers to evaluate the property's condition, identify any potential issues, and budget for future maintenance expenses. 3. Tax and Insurance Accounting Request: To ensure complete transparency, buyers can request a tax and insurance accounting from the seller. This request provides detailed information on property taxes, insurance coverage, and any outstanding payments or claims. By reviewing this information, buyers can confirm that the property taxes have been paid, assess the adequacy of the insurance coverage, and minimize any potential financial risks. 4. Escrow and Deposit Accounting Request: Buyers might consider requesting an escrow and deposit accounting from the seller under a contract for deed. This type of accounting details the handling of any escrow funds or deposits throughout the transaction. It ensures that all funds have been correctly allocated, particularly towards the down payment or any future payments due to the seller. Conclusion: In Grand Rapids, Michigan, buyers have various types of accounting requests they can make from sellers under a contract for deed. By understanding and utilizing these options, buyers can gain a better understanding of the property's financial standing, maintenance history, tax and insurance matters, as well as the proper handling of escrow and deposit funds. Requesting these accounting promotes transparency, protects the buyer's interests, and facilitates a smooth real estate transaction.