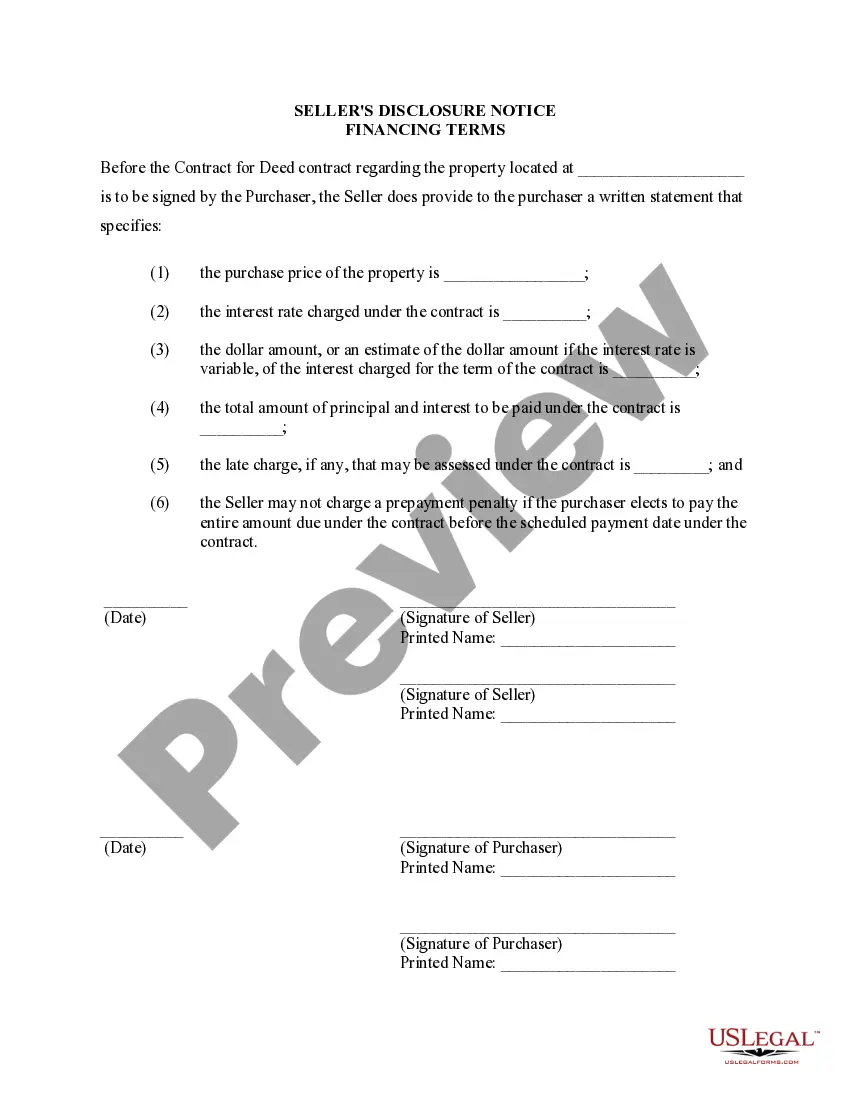

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

Ann Arbor Michigan Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Michigan Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

Locating validated forms tailored to your local regulations can be challenging unless you utilize the US Legal Forms repository.

This is an online collection of over 85,000 legal forms catering to both personal and professional requirements, as well as various real-world situations.

All documents are systematically categorized based on usage area and jurisdiction, making it straightforward to find the Ann Arbor Michigan Seller's Disclosure of Financing Terms for Residential Property related to Contract or Agreement for Deed, also known as a Land Contract.

Purchase the document. Click on the Buy Now button and choose the subscription plan that suits you. You must create an account to access the library’s assets. Complete your transaction. Provide your credit card information or utilize your PayPal account to pay for the subscription. Download the Ann Arbor Michigan Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract. Save the template on your device to fill it out and access it later in the My documents section of your profile whenever you need it again. Maintaining organized paperwork that complies with legal standards is crucial. Leverage the US Legal Forms repository to consistently have essential document templates readily available for any requirement!

- For users already acquainted with our repository and who have accessed it previously, acquiring the Ann Arbor Michigan Seller's Disclosure of Financing Terms for Residential Property associated with Contract or Agreement for Deed, or Land Contract, only requires a few clicks.

- Simply Log In to your account, select the document, and click Download to store it on your device. This process may require just a few extra steps for new users.

- Follow the guidelines below to commence with the most comprehensive online form collection.

- Examine the Preview mode and form description. Ensure you’ve selected the appropriate one that fulfills your needs and aligns entirely with your local jurisdiction standards.

- Look for another template, if necessary. If you identify any inaccuracies, use the Search tab above to find the correct one. If it meets your requirements, proceed to the next step.

Form popularity

FAQ

A land contract in Michigan grants buyers an equitable title to gain immediate control over the property. However, the legal title remains with the property owner until the fulfillment of the land contract. Furthermore, the interest rates on land contracts in Michigan cannot exceed 11%.

Michigan disclosure laws require a seller to disclose what is personally known about the home, including any imperfections. This could include things like lead-based paint, water damage, hazardous conditions, pest damage, past repairs, past insurance claims, etc.

Most land contracts have a forfeiture clause. A forfeiture clause usually says that if the buyer breaches the contract, the seller can keep all money paid to it. The seller can also take back possession of the home. The seller cannot forfeit the contract without a forfeiture clause.

Land contract cons. Higher interest rates ? Since the seller is taking most of the risk, they may insist on a higher interest rate than a traditional mortgage. Ownership is unclear ? The seller retains the property title until the land contract is paid in full.

Property sellers are usually required to disclose negative information about a property. It is usually wise to always disclose issues with your home, whether you are legally bound to or not. The seller must follow local, state, and federal laws regarding disclosures when selling their home.

In Michigan, the seller of a residential property has an obligation to disclose certain information to the buyer of the property in what is commonly referred to as a ?Seller's Disclosure Statement.? The Seller Disclosure Act, MCL 565.951, et seq.

A land contract in Michigan grants buyers an equitable title to gain immediate control over the property. However, the legal title remains with the property owner until the fulfillment of the land contract. Furthermore, the interest rates on land contracts in Michigan cannot exceed 11%.

Land contracts are legal in Michigan and are enforced like any other contract. To be enforceable, the contract must be in writing. If either party to the contract fails to meet his obligations, the other party can sue for breach of contract.

The Michigan land contract process is as follows: Most land contracts will require the buyer to make a down payment of 10% or more of the purchase price. Then, the seller will have to make installment payments for a set period of time. The terms can vary, but most agreements are between two and four years.

Any ongoing problems with neighbours, including boundary disputes. Any neighbours known to have been served an Anti Social Behaviour Order (ASBO) Whether there have been any known burglaries in the neighbourhood recently. Whether any murders or suicides have occurred in the property recently.