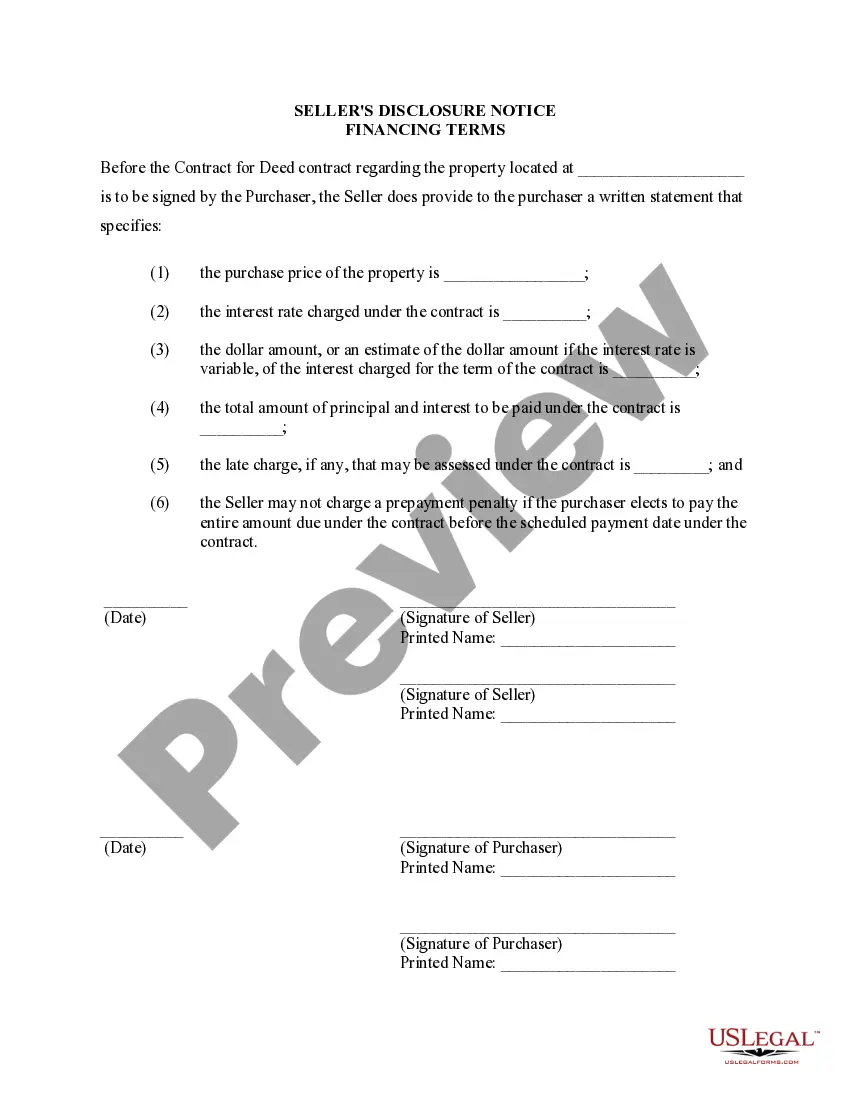

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

Lansing Michigan Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Michigan Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

Are you in search of a trustworthy and budget-friendly provider of legal forms to acquire the Lansing Michigan Seller's Disclosure of Financing Terms for Residential Property related to a Contract or Agreement for Deed, also known as a Land Contract? US Legal Forms stands as your preferred choice.

Whether you require a simple agreement to establish rules for living with your companion or a collection of documents to facilitate your divorce process in court, we have you covered. Our platform offers over 85,000 current legal document templates for both personal and business purposes.

All templates we provide are not one-size-fits-all and are designed according to the specifications of individual states and counties.

To download the document, you must Log In to your account, locate the desired form, and click the Download button adjacent to it. Please note that you can access and download your previously acquired templates at any point within the My documents section.

You can now create your account. Then choose a subscription plan and proceed to payment. After completing the payment, download the Lansing Michigan Seller's Disclosure of Financing Terms for Residential Property related to a Contract or Agreement for Deed, also known as the Land Contract, in any available format.

You may revisit the website to redownload the form at no additional charge whenever you need it. Finding current legal forms has never been simpler. Try US Legal Forms today and stop wasting your valuable time searching for legal paperwork online.

- Is this your first time visiting our site? No problem.

- You can create an account in just a few minutes, but first, ensure you do the following.

- Verify if the Lansing Michigan Seller's Disclosure of Financing Terms for Residential Property related to a Contract or Agreement for Deed, also referred to as a Land Contract, aligns with the laws of your designated state and locality.

- Review the form's description (if available) to understand who and what the form is meant for.

- Restart the search if the form does not fit your particular situation.

Form popularity

FAQ

In Michigan, the seller of a residential property has an obligation to disclose certain information to the buyer of the property in what is commonly referred to as a ?Seller's Disclosure Statement.? The Seller Disclosure Act, MCL 565.951, et seq.

For a sale to close properly in Utah, the seller must, legally, disclose certain conditions about the home to the prospective buyer. No seller wants to face legal repercussions for inadequately disclosing property defects.

In Michigan, the seller of a residential property has an obligation to disclose certain information to the buyer of the property in what is commonly referred to as a ?Seller's Disclosure Statement.? The Seller Disclosure Act, MCL 565.951, et seq.

A Seller's Disclosure is a legal document that requires sellers to provide previously undisclosed details about the property's condition that prospective buyers may find unfavorable. This document is also known as a property disclosure, and it's important for both those buying a house and for those selling a house.

YES. e law requires an agency disclosure form only if the property in question includes one to four residential dwelling units or a residential building site.

Any ongoing problems with neighbours, including boundary disputes. Any neighbours known to have been served an Anti Social Behaviour Order (ASBO) Whether there have been any known burglaries in the neighbourhood recently. Whether any murders or suicides have occurred in the property recently.

Yes. In Michigan, the seller's disclosure is a standard form prescribed under the state laws which all sellers are supposed to complete. This form is to be submitted to any buyer before the sale agreement is executed.

Property sellers are usually required to disclose negative information about a property. It is usually wise to always disclose issues with your home, whether you are legally bound to or not. The seller must follow local, state, and federal laws regarding disclosures when selling their home.

New Jersey Sellers Must Disclose Known, Latent, Material Defects. In order to protect buyers from unwittingly purchasing real estate with hidden defects, a New Jersey home seller has a duty under the common law to tell prospective buyers about known, latent (concealed) material defects in the property.

A Michigan property disclosure statement is a form through which sellers must report the condition of their residential real estate to potential buyers. The items specified may include pending legal cases, unpaid fees, property defects, or damage from flooding or fires.