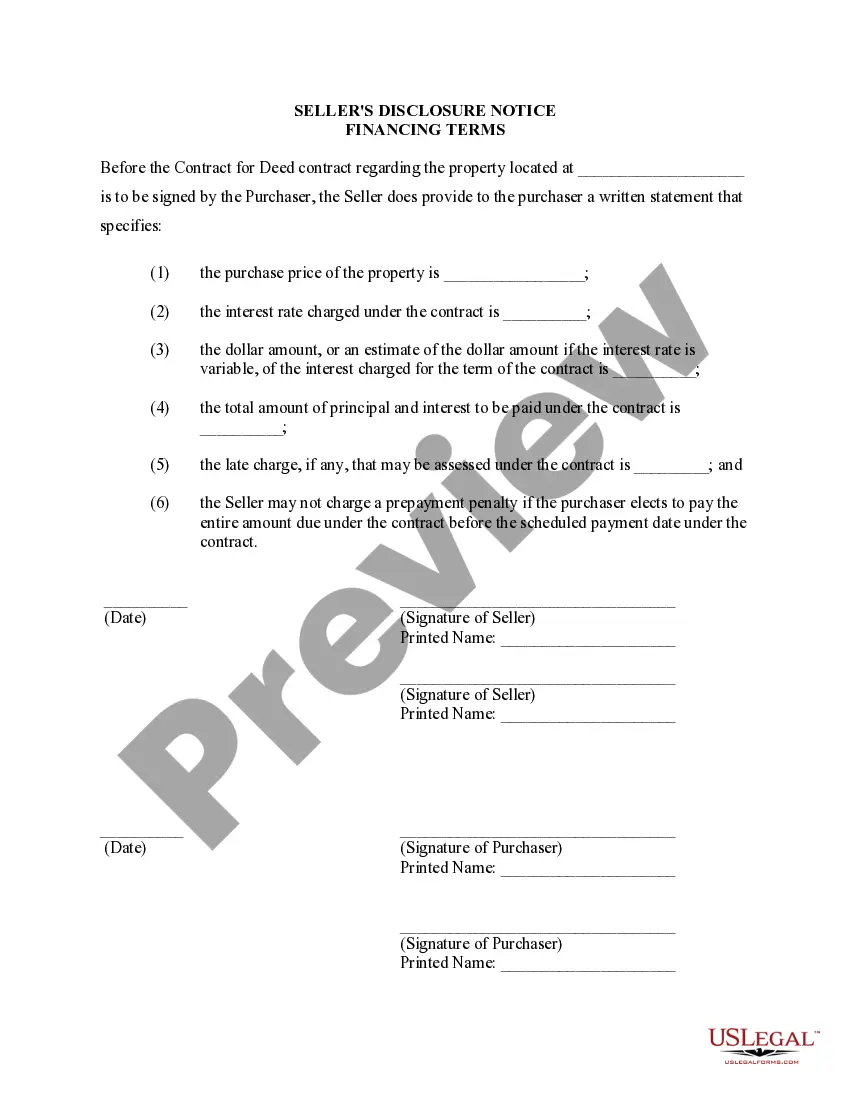

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

Oakland Michigan Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract: The seller's disclosure of financing terms for residential property in connection with a contract or agreement for deed, also known as a land contract, is a crucial document that outlines the specific terms, conditions, and obligations related to the financing arrangement. This disclosure provides potential buyers with a detailed overview of the financial aspects involved in purchasing a property through a land contract. In Oakland, Michigan, there are different types of seller's disclosures of financing terms for residential property in connection with a contract or agreement for deed. These variations may include: 1. Basic Financing Terms: This type of disclosure outlines the basic financial terms, such as the purchase price, down payment amount, interest rate, and repayment schedule. It may also include information about penalty charges for late payments or prepayment options. 2. Escrow Account: Some seller's disclosures may specify the use of an escrow account to manage the payments made by the buyer. This account holds funds designated for property taxes, insurance premiums, or any other recurring fees associated with the property. 3. Structural Condition Disclosure: In some cases, sellers may include a disclosure regarding the property's structural condition or any known defects. This information helps buyers make an informed decision about the property's current condition and potential risks. 4. Termination and Default Conditions: This type of disclosure covers the conditions under which either party can terminate or default the land contract. It may highlight specific events, such as failure to make payments, breach of contract, or violation of other terms, and the subsequent consequences. 5. Improvements and Repairs: Sellers may include information about any planned improvements or repairs scheduled to be completed before the transfer of ownership. This disclosure provides clarity on the condition of the property and the responsibilities of both parties concerning these updates. 6. Arbitration or Mediation Clause: Certain seller's disclosures may include a clause specifying the parties' agreement to resolve disputes through arbitration or mediation instead of litigation. This clause helps streamline the dispute resolution process, saving time and costs for both parties. Overall, the Oakland Michigan Seller's Disclosure of Financing Terms for Residential Property in connection with a contract or agreement for deed plays a vital role in ensuring transparency and mutual understanding between the buyer and seller. It provides essential information about the financial obligations, property condition, and termination conditions, enabling buyers to make informed decisions about their purchase.Oakland Michigan Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract: The seller's disclosure of financing terms for residential property in connection with a contract or agreement for deed, also known as a land contract, is a crucial document that outlines the specific terms, conditions, and obligations related to the financing arrangement. This disclosure provides potential buyers with a detailed overview of the financial aspects involved in purchasing a property through a land contract. In Oakland, Michigan, there are different types of seller's disclosures of financing terms for residential property in connection with a contract or agreement for deed. These variations may include: 1. Basic Financing Terms: This type of disclosure outlines the basic financial terms, such as the purchase price, down payment amount, interest rate, and repayment schedule. It may also include information about penalty charges for late payments or prepayment options. 2. Escrow Account: Some seller's disclosures may specify the use of an escrow account to manage the payments made by the buyer. This account holds funds designated for property taxes, insurance premiums, or any other recurring fees associated with the property. 3. Structural Condition Disclosure: In some cases, sellers may include a disclosure regarding the property's structural condition or any known defects. This information helps buyers make an informed decision about the property's current condition and potential risks. 4. Termination and Default Conditions: This type of disclosure covers the conditions under which either party can terminate or default the land contract. It may highlight specific events, such as failure to make payments, breach of contract, or violation of other terms, and the subsequent consequences. 5. Improvements and Repairs: Sellers may include information about any planned improvements or repairs scheduled to be completed before the transfer of ownership. This disclosure provides clarity on the condition of the property and the responsibilities of both parties concerning these updates. 6. Arbitration or Mediation Clause: Certain seller's disclosures may include a clause specifying the parties' agreement to resolve disputes through arbitration or mediation instead of litigation. This clause helps streamline the dispute resolution process, saving time and costs for both parties. Overall, the Oakland Michigan Seller's Disclosure of Financing Terms for Residential Property in connection with a contract or agreement for deed plays a vital role in ensuring transparency and mutual understanding between the buyer and seller. It provides essential information about the financial obligations, property condition, and termination conditions, enabling buyers to make informed decisions about their purchase.