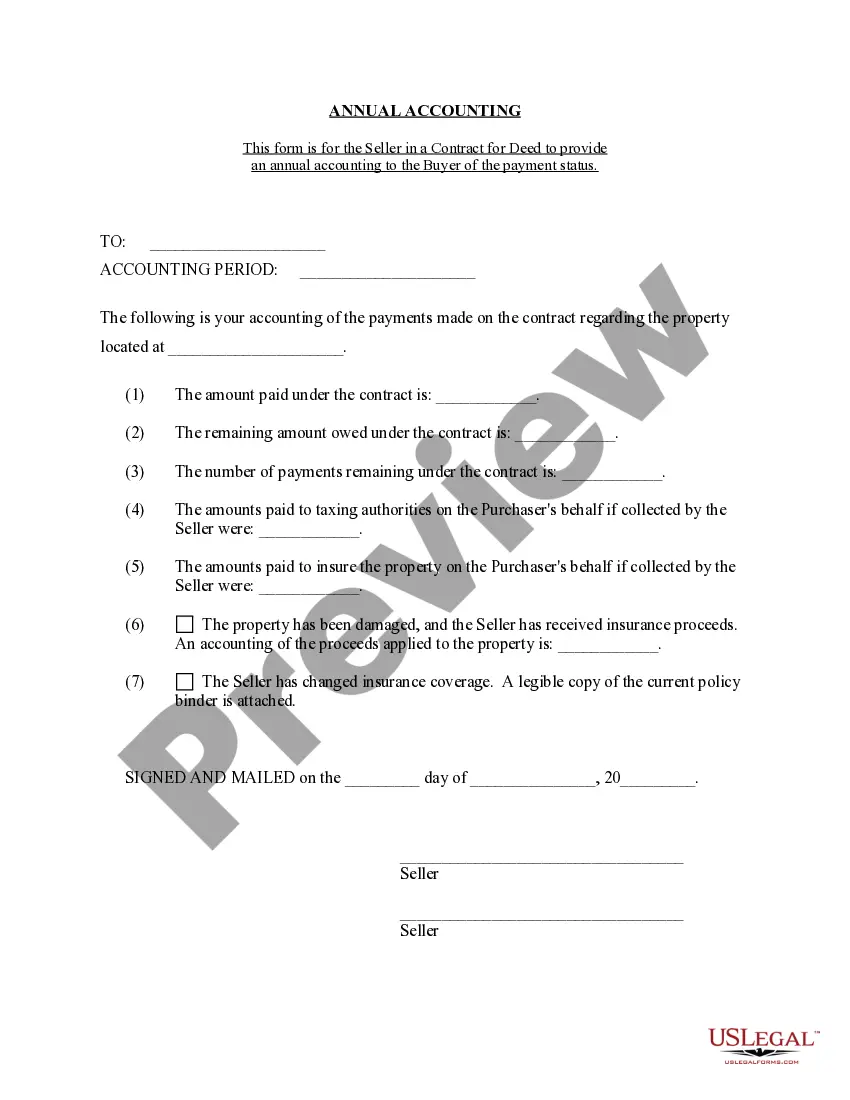

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

The Ann Arbor Michigan Contract for Deed Seller's Annual Accounting Statement is a comprehensive document that outlines the financial transactions and details related to properties sold through a contract for deed agreement in Ann Arbor, Michigan. This statement plays a vital role in providing transparency and clarity to both the seller and buyer of a property, ensuring a smooth transaction process. Keywords: Ann Arbor Michigan, Contract for Deed, Seller's Annual Accounting Statement, financial transactions, properties, transparency, clarity, smooth transaction process. Types of Ann Arbor Michigan Contract for Deed Seller's Annual Accounting Statement: 1. Standard Annual Accounting Statement: This is the most common type of statement used in Ann Arbor for properties sold through a contract for deed. It provides a summary of all financial transactions throughout the year, including payments received from the buyer, expenses incurred by the seller, and any outstanding balances. 2. Detailed Expense Accounting Statement: This type of statement includes a breakdown of all the expenses incurred by the seller throughout the year. It provides comprehensive information about property maintenance costs, insurance premiums, property taxes, and any other relevant expenses. 3. Income and Expenditure Statement: This statement focuses on the income earned and expenses paid by the seller, providing a detailed overview of the financial performance of the property. It includes information on monthly installment payments received from the buyer, interest earned, and any additional income generated by the property. 4. Outstanding Balance Statement: This statement concentrates on the outstanding balance owed by the buyer to the seller. It outlines the remaining amount to be paid, interest charges (if applicable), and any penalties or late fees incurred due to missed payments. 5. Amortization Schedule Statement: This statement provides a structured repayment plan, illustrating the allocation of principal and interest payments over the life of the contract for deed agreement. It enables the seller to track and report the reduction of principal balance and the accumulation of interest over time. By utilizing these various types of Ann Arbor Michigan Contract for Deed Seller's Annual Accounting Statements, sellers and buyers can effectively manage their financial obligations, ensure transparency, and maintain a healthy business relationship throughout the contract period.