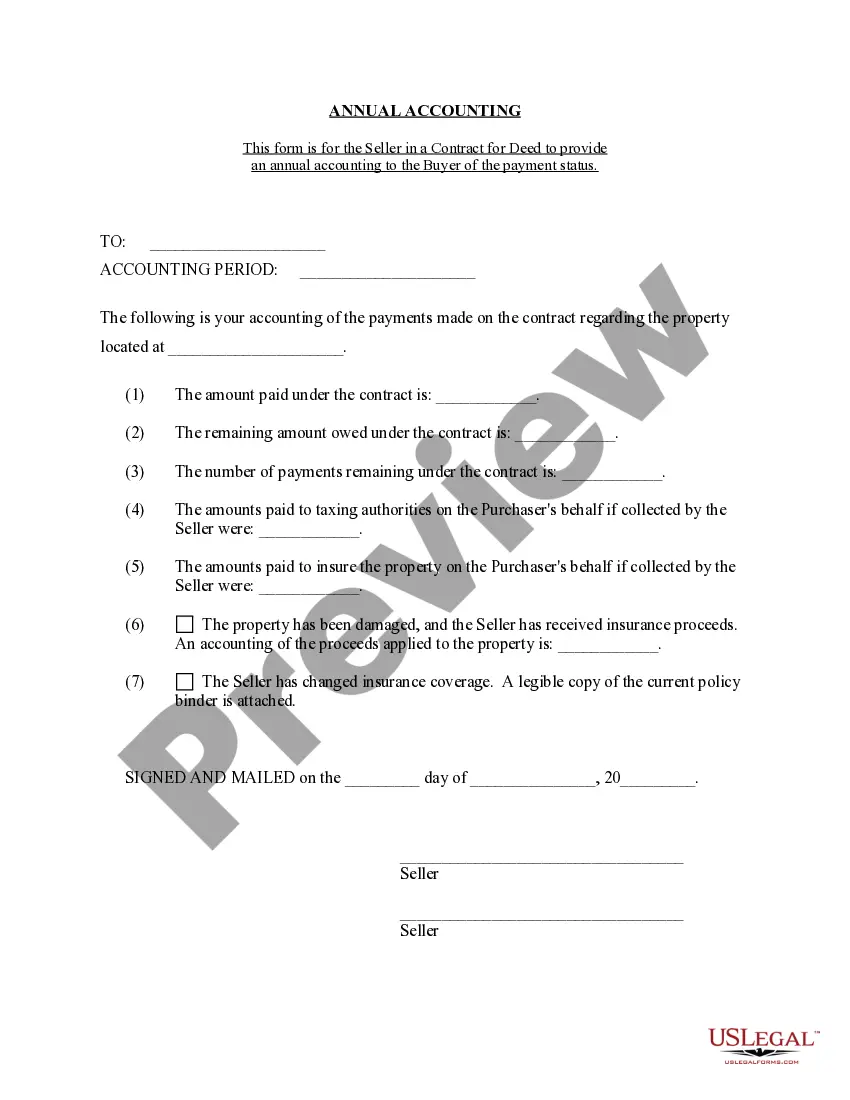

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

The Detroit Michigan Contract for Deed Seller's Annual Accounting Statement is a legally binding document provided by the seller of real estate through a contract for deed or land contract transaction. It serves as an annual summary report of the financial transactions and obligations pertaining to the contract for deed agreement. This accounting statement outlines the financial activities related to the contract for deed during a specific reporting period, which is usually a year. It provides detailed information regarding the payments received from the buyer, expenses incurred by the seller, and any outstanding balances or obligations. The statement typically includes the following relevant keywords: 1. Payments Received: This section outlines the total amount of money received from the buyer during the reporting period, disaggregated by principal payments, interest payments, and any additional charges or fees. 2. Expenses Incurred: This section details any expenses incurred by the seller in relation to the property covered under the contract for deed. Examples of such expenses may include property taxes, insurance premiums, maintenance costs, or repairs. 3. Outstanding Balances: This section presents the outstanding balance of the contract for deed, including the remaining principal balance, accrued interest, and any other charges or fees that may be due from the buyer. 4. Escrow Account: If an escrow account was established as part of the contract for deed agreement, this section provides information about the current balance in the account and any relevant transactions during the reporting period. 5. Insurance and Taxes: If the seller is responsible for ensuring property insurance or paying property taxes on behalf of the buyer, this section will include relevant information about the coverage, premiums paid, and any adjustments made during the reporting period. 6. Additional Obligations: This section lists any other obligations or terms specified in the contract for deed agreement, such as buyer's responsibilities for repairs, improvements, or property-related expenses. Different types of Detroit Michigan Contract for Deed Seller's Annual Accounting Statements may exist, depending on the specific requirements or variations in contractual agreements. However, the above-mentioned keywords generally apply to all types, emphasizing the need for comprehensive financial disclosure regarding the contract for deed transaction.The Detroit Michigan Contract for Deed Seller's Annual Accounting Statement is a legally binding document provided by the seller of real estate through a contract for deed or land contract transaction. It serves as an annual summary report of the financial transactions and obligations pertaining to the contract for deed agreement. This accounting statement outlines the financial activities related to the contract for deed during a specific reporting period, which is usually a year. It provides detailed information regarding the payments received from the buyer, expenses incurred by the seller, and any outstanding balances or obligations. The statement typically includes the following relevant keywords: 1. Payments Received: This section outlines the total amount of money received from the buyer during the reporting period, disaggregated by principal payments, interest payments, and any additional charges or fees. 2. Expenses Incurred: This section details any expenses incurred by the seller in relation to the property covered under the contract for deed. Examples of such expenses may include property taxes, insurance premiums, maintenance costs, or repairs. 3. Outstanding Balances: This section presents the outstanding balance of the contract for deed, including the remaining principal balance, accrued interest, and any other charges or fees that may be due from the buyer. 4. Escrow Account: If an escrow account was established as part of the contract for deed agreement, this section provides information about the current balance in the account and any relevant transactions during the reporting period. 5. Insurance and Taxes: If the seller is responsible for ensuring property insurance or paying property taxes on behalf of the buyer, this section will include relevant information about the coverage, premiums paid, and any adjustments made during the reporting period. 6. Additional Obligations: This section lists any other obligations or terms specified in the contract for deed agreement, such as buyer's responsibilities for repairs, improvements, or property-related expenses. Different types of Detroit Michigan Contract for Deed Seller's Annual Accounting Statements may exist, depending on the specific requirements or variations in contractual agreements. However, the above-mentioned keywords generally apply to all types, emphasizing the need for comprehensive financial disclosure regarding the contract for deed transaction.