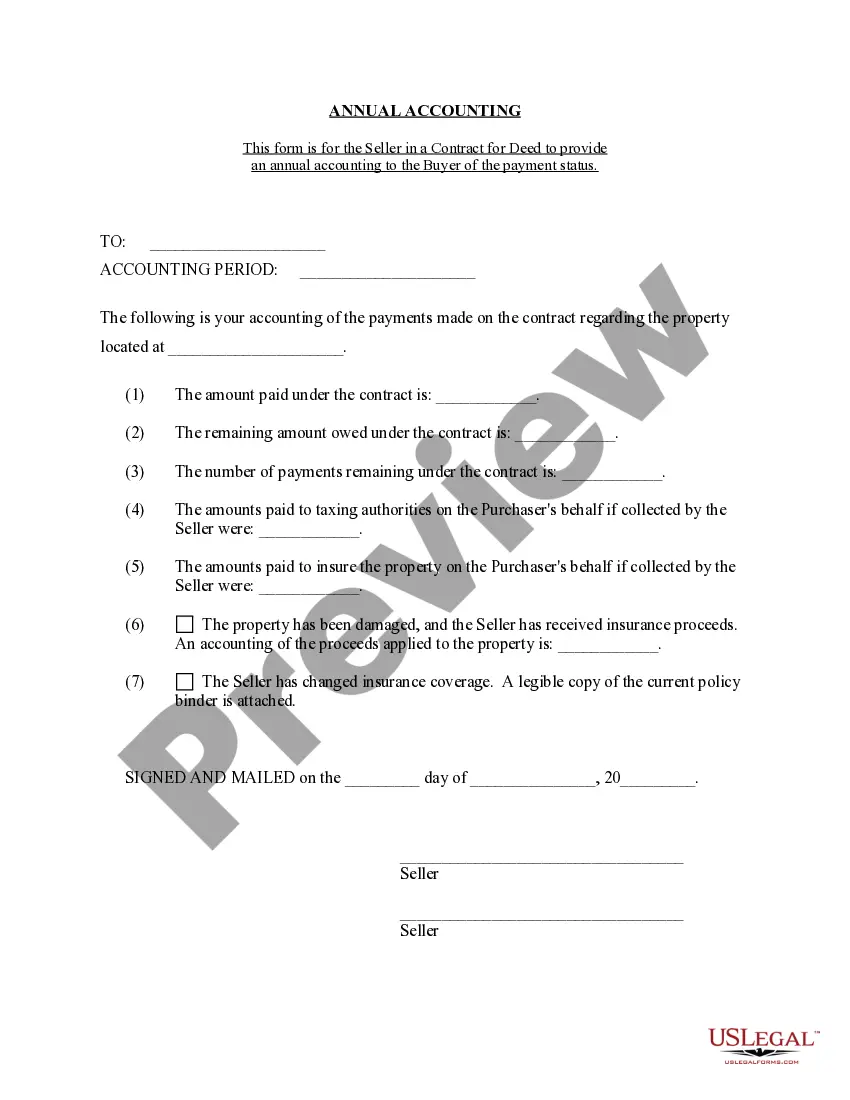

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

The Oakland Michigan Contract for Deed Seller's Annual Accounting Statement is a document that provides a detailed overview of the financial transactions and records of a seller who has entered into a contract for deed agreement in the Oakland County area of Michigan. This statement serves as an important financial record and ensures transparency between the seller and the buyer. The statement typically includes various sections and information such as: 1. Seller's Information: This section includes the name, address, contact details, and any other relevant information of the seller who is providing the accounting statement. 2. Contract for Deed Details: Here, the specifics of the contract for deed agreement are outlined, including the date of the agreement, property address, purchase price, down payment, interest rate, and payment terms. 3. Payment Summary: This part of the statement presents a summary of all the payments made by the buyer during the accounting period. It includes the payment amounts, dates received, any late fees or penalties assessed, and the remaining balance on the contract. 4. Expenses: The statement details any expenses incurred by the seller, such as property taxes, insurance premiums, maintenance costs, or repairs during the accounting period. These expenses are typically deducted from the payments received from the buyer. 5. Interest Earned: If the contract for deed includes an interest component, this section outlines the interest earned by the seller during the accounting period. The statement may include the interest rate applied, calculation method, and the total interest earned. 6. Additional Charges: If there are any additional charges or fees associated with the contract for deed agreement, such as recording fees or legal costs, they will be itemized and detailed in this section. 7. Total Income: This part summarizes the total income received by the seller, including the payments made by the buyer, interest earned, and any additional charges, providing a comprehensive financial overview for the accounting period. Different types of Oakland Michigan Contract for Deed Seller's Annual Accounting Statements may vary depending on the specific terms and conditions outlined in the contract for deed agreement. However, their purpose remains the same — to provide a transparent and accurate representation of the financial transactions between the seller and buyer in Oakland County, Michigan.

The Oakland Michigan Contract for Deed Seller's Annual Accounting Statement is a document that provides a detailed overview of the financial transactions and records of a seller who has entered into a contract for deed agreement in the Oakland County area of Michigan. This statement serves as an important financial record and ensures transparency between the seller and the buyer. The statement typically includes various sections and information such as: 1. Seller's Information: This section includes the name, address, contact details, and any other relevant information of the seller who is providing the accounting statement. 2. Contract for Deed Details: Here, the specifics of the contract for deed agreement are outlined, including the date of the agreement, property address, purchase price, down payment, interest rate, and payment terms. 3. Payment Summary: This part of the statement presents a summary of all the payments made by the buyer during the accounting period. It includes the payment amounts, dates received, any late fees or penalties assessed, and the remaining balance on the contract. 4. Expenses: The statement details any expenses incurred by the seller, such as property taxes, insurance premiums, maintenance costs, or repairs during the accounting period. These expenses are typically deducted from the payments received from the buyer. 5. Interest Earned: If the contract for deed includes an interest component, this section outlines the interest earned by the seller during the accounting period. The statement may include the interest rate applied, calculation method, and the total interest earned. 6. Additional Charges: If there are any additional charges or fees associated with the contract for deed agreement, such as recording fees or legal costs, they will be itemized and detailed in this section. 7. Total Income: This part summarizes the total income received by the seller, including the payments made by the buyer, interest earned, and any additional charges, providing a comprehensive financial overview for the accounting period. Different types of Oakland Michigan Contract for Deed Seller's Annual Accounting Statements may vary depending on the specific terms and conditions outlined in the contract for deed agreement. However, their purpose remains the same — to provide a transparent and accurate representation of the financial transactions between the seller and buyer in Oakland County, Michigan.