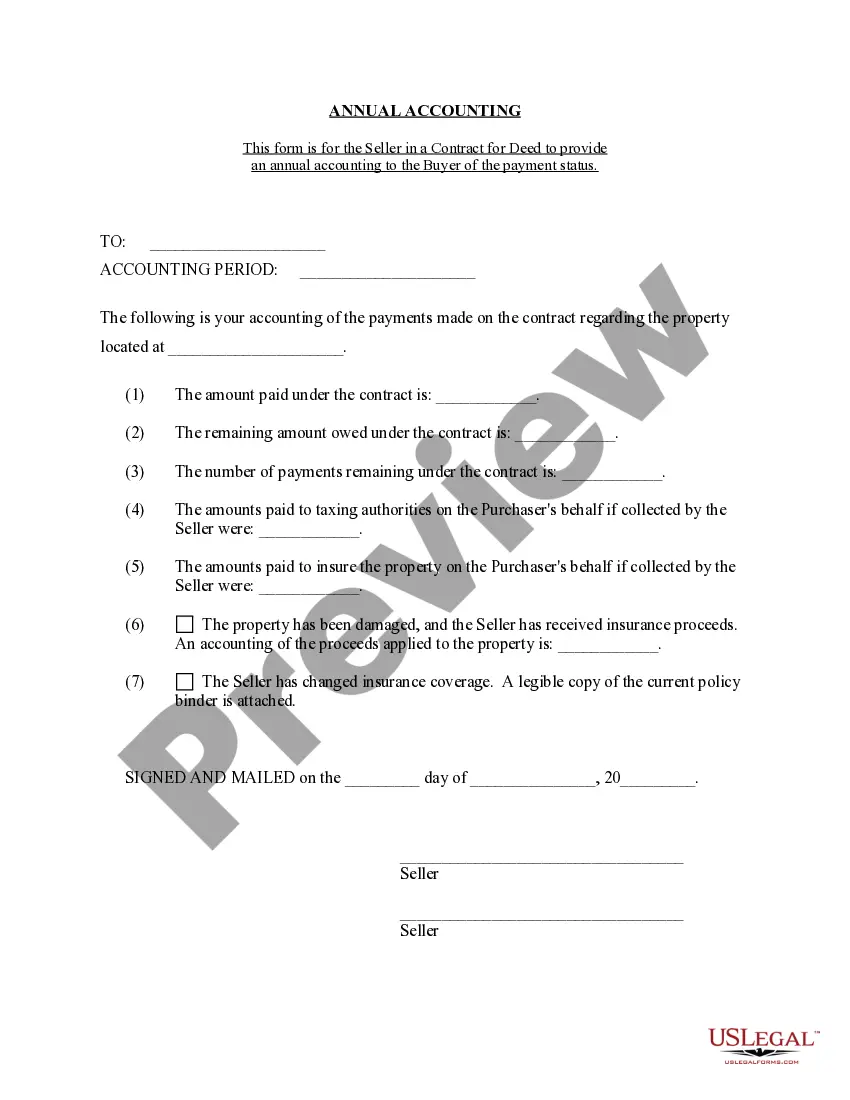

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

The Sterling Heights Michigan Contracts for Deed Seller's Annual Accounting Statement is a vital document that outlines the financial transactions and obligations between the buyer and seller in a contract for deed agreement. This statement provides a detailed breakdown of the seller's annual accounting, ensuring transparency and accountability in the contractual relationship. Typically, there are two main types of Sterling Heights Michigan Contracts for Deed Seller's Annual Accounting Statement: 1. Financial Summary: This type of statement offers a comprehensive overview of income and expenses related to the contract for deed. It includes details such as the total amount received from the buyer, any applicable fees, interest payments received, and other financial transactions. This summary helps ensure that both parties have a clear understanding of the financial aspects of the agreement. 2. Property Maintenance Summary: In addition to the financial summary, this type of statement includes detailed information on property maintenance and repairs. It outlines any expenses incurred by the seller for property upkeep, renovations, or repairs during the annual accounting period. This summary helps both parties track the condition of the property and ensures that necessary maintenance is being carried out. Keywords: Sterling Heights Michigan, Contract for Deed, Seller's Annual Accounting Statement, financial transactions, obligations, transparency, accountability, income, expenses, fees, interest payments, property maintenance, repairs, property upkeep, renovations.The Sterling Heights Michigan Contracts for Deed Seller's Annual Accounting Statement is a vital document that outlines the financial transactions and obligations between the buyer and seller in a contract for deed agreement. This statement provides a detailed breakdown of the seller's annual accounting, ensuring transparency and accountability in the contractual relationship. Typically, there are two main types of Sterling Heights Michigan Contracts for Deed Seller's Annual Accounting Statement: 1. Financial Summary: This type of statement offers a comprehensive overview of income and expenses related to the contract for deed. It includes details such as the total amount received from the buyer, any applicable fees, interest payments received, and other financial transactions. This summary helps ensure that both parties have a clear understanding of the financial aspects of the agreement. 2. Property Maintenance Summary: In addition to the financial summary, this type of statement includes detailed information on property maintenance and repairs. It outlines any expenses incurred by the seller for property upkeep, renovations, or repairs during the annual accounting period. This summary helps both parties track the condition of the property and ensures that necessary maintenance is being carried out. Keywords: Sterling Heights Michigan, Contract for Deed, Seller's Annual Accounting Statement, financial transactions, obligations, transparency, accountability, income, expenses, fees, interest payments, property maintenance, repairs, property upkeep, renovations.