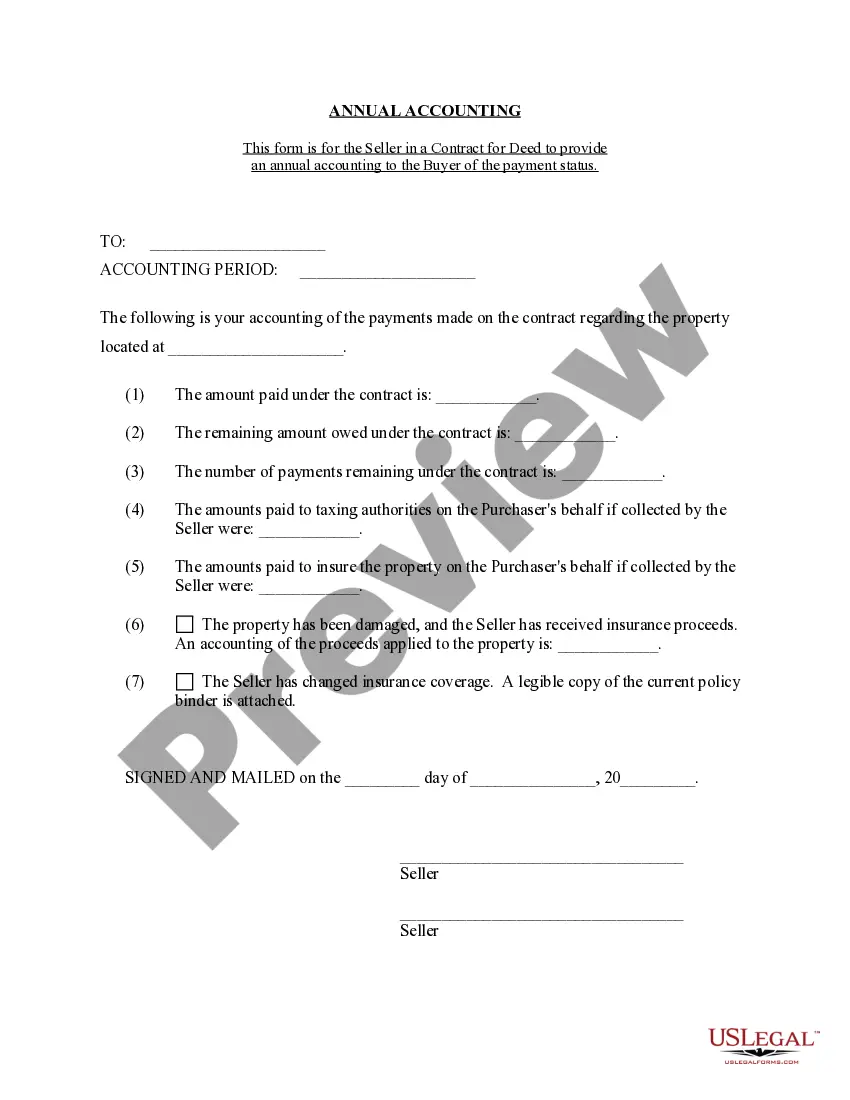

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Wayne Michigan Contract for Deed Seller's Annual Accounting Statement is a crucial document that outlines the financial information and transactions associated with a contract for deed sale in the Wayne, Michigan area. This statement serves as a comprehensive report that showcases the income, expenses, and overall financial status of the seller throughout the year. The annual accounting statement is designed to provide transparency and accountability between the buyer and seller in a contract for deed agreement. It is required by law to ensure that both parties are aware of the financial aspects and progress of the contract for deed transaction. The key elements covered within the Wayne Michigan Contract for Deed Seller's Annual Accounting Statement include: 1. Sales Revenue: This section highlights the total amount received from the buyer as payment for the property sold under the contract for deed arrangement. It includes any down payments, installment payments, and interest paid by the buyer during the specified period. 2. Expenses: The annual accounting statement will detail all the expenses incurred by the seller throughout the year. These may include property taxes, insurance costs, maintenance expenses, repairs, and any other costs associated with the property. 3. Interest Income: If the contract for deed agreement includes an interest component, this section outlines the interest income received by the seller during the accounting period. 4. Principal Reduction: The statement will provide information on the amount of principal reduction made by the buyer during the year, which contributes to the buyer's equity in the property. This demonstrates the progress made in paying off the contract for deed. 5. Outstanding Balance: The statement will clearly state the remaining balance owed by the buyer to the seller, helping both parties to track the ongoing financial obligations and the overall progress towards full ownership. It is important to note that variations of the Wayne Michigan Contract for Deed Seller's Annual Accounting Statement may exist depending on the specific terms and conditions agreed upon between the buyer and seller. Some variations may focus on additional details such as late payment penalties, escrow accounts, or other financial obligations within the contract for deed agreement. Ultimately, the Wayne Michigan Contract for Deed Seller's Annual Accounting Statement plays a crucial role in maintaining financial transparency, ensuring compliance with relevant laws, and facilitating effective communication between the buyer and seller in a contract for deed transaction.Wayne Michigan Contract for Deed Seller's Annual Accounting Statement is a crucial document that outlines the financial information and transactions associated with a contract for deed sale in the Wayne, Michigan area. This statement serves as a comprehensive report that showcases the income, expenses, and overall financial status of the seller throughout the year. The annual accounting statement is designed to provide transparency and accountability between the buyer and seller in a contract for deed agreement. It is required by law to ensure that both parties are aware of the financial aspects and progress of the contract for deed transaction. The key elements covered within the Wayne Michigan Contract for Deed Seller's Annual Accounting Statement include: 1. Sales Revenue: This section highlights the total amount received from the buyer as payment for the property sold under the contract for deed arrangement. It includes any down payments, installment payments, and interest paid by the buyer during the specified period. 2. Expenses: The annual accounting statement will detail all the expenses incurred by the seller throughout the year. These may include property taxes, insurance costs, maintenance expenses, repairs, and any other costs associated with the property. 3. Interest Income: If the contract for deed agreement includes an interest component, this section outlines the interest income received by the seller during the accounting period. 4. Principal Reduction: The statement will provide information on the amount of principal reduction made by the buyer during the year, which contributes to the buyer's equity in the property. This demonstrates the progress made in paying off the contract for deed. 5. Outstanding Balance: The statement will clearly state the remaining balance owed by the buyer to the seller, helping both parties to track the ongoing financial obligations and the overall progress towards full ownership. It is important to note that variations of the Wayne Michigan Contract for Deed Seller's Annual Accounting Statement may exist depending on the specific terms and conditions agreed upon between the buyer and seller. Some variations may focus on additional details such as late payment penalties, escrow accounts, or other financial obligations within the contract for deed agreement. Ultimately, the Wayne Michigan Contract for Deed Seller's Annual Accounting Statement plays a crucial role in maintaining financial transparency, ensuring compliance with relevant laws, and facilitating effective communication between the buyer and seller in a contract for deed transaction.