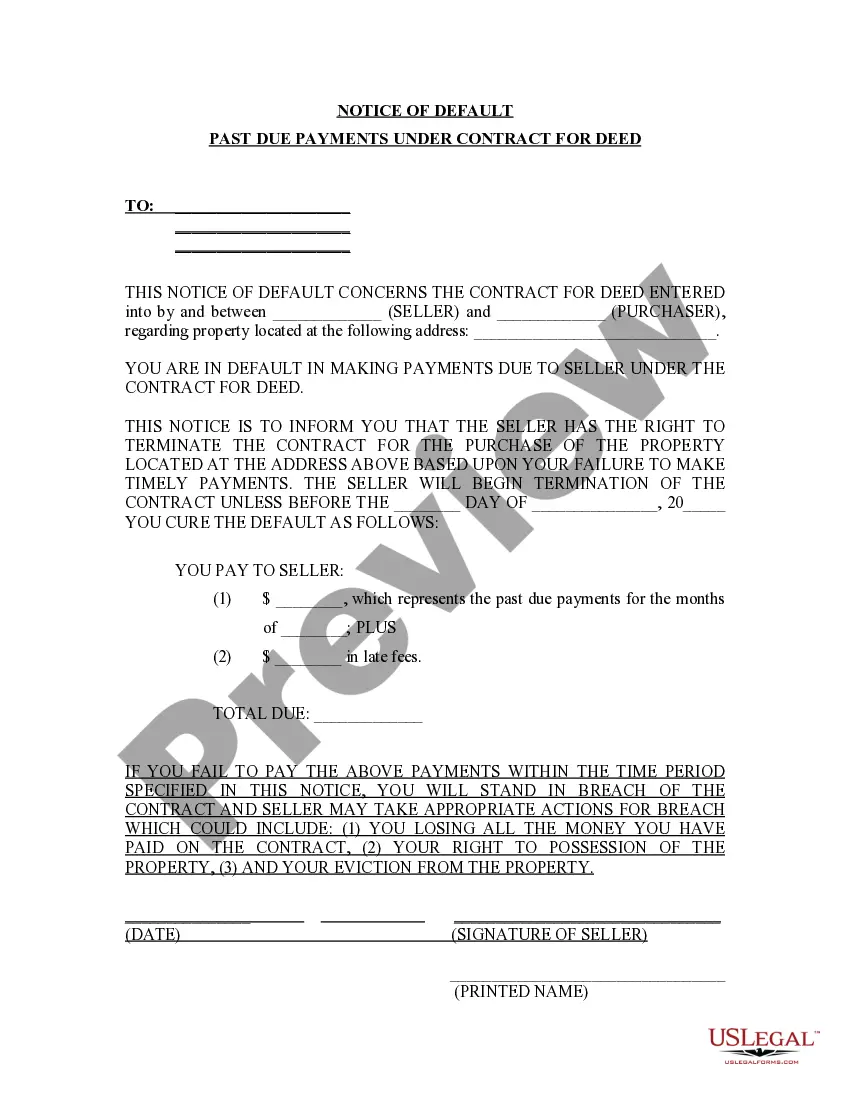

This Notice of Default Past Due Payments for Contract for Deed form acts as the Seller's initial notice to Purchaser of late payment toward the purchase price of the contract for deed property. Seller will use this document to provide the necessary notice to Purchaser that payment terms have not been met in accordance with the contract for deed, and failure to timely comply with demands of notice will result in default of the contract for deed.

Lansing, Michigan Notice of Default for Past Due Payments in connection with Contract for Deed is an essential legal document designed to protect the rights and interests of parties involved in a Contract for Deed agreement. This notice serves as a formal notification to the defaulting party that they have failed to make the necessary payments as outlined in the contract, triggering certain legal consequences. When a buyer and seller enter into a Contract for Deed in Lansing, Michigan, the buyer agrees to make periodic payments directly to the seller over an agreed-upon period. Failure to make these payments can result in a Notice of Default, which informs the defaulting party about their violation of the contract's payment terms and the need to rectify the situation promptly. There can be different types of Lansing, Michigan Notices of Default for Past Due Payments in connection with a Contract for Deed, including: 1. Notice of Default for First Late Payment: This type of notice is issued when the buyer fails to make their first payment on time. It serves as an initial warning to inform the defaulting party that they are in violation of the contractual agreement and must make the payment promptly to avoid further consequences. 2. Notice of Default for Multiple Late Payments: If the buyer persists in missing several consecutive payments, a Notice of Default for Multiple Late Payments may be served. This notice emphasizes the continued violation of the contract's payment terms and typically includes details of all missed payments along with the outstanding balance. 3. Notice of Default for Final Demand: When the buyer fails to rectify their late payments even after receiving previous notices, a Notice of Default for Final Demand may be issued. This notice typically demands immediate and full payment of all outstanding amounts, highlighting the possibility of legal action or other severe consequences if the defaulting party does not rectify the situation within a specified timeframe. It's crucial to understand that each type of Lansing, Michigan Notice of Default for Past Due Payments in connection with a Contract for Deed carries its own legal implications and potential consequences. Therefore, it is strongly advised for both parties involved in a Contract for Deed agreement to consult with a qualified attorney to understand their rights and obligations and to ensure compliance with the law. In conclusion, a Lansing, Michigan Notice of Default for Past Due Payments in connection with a Contract for Deed is a legal document serving as a formal notification to the defaulting party about their missed payments. By understanding the different types of default notices and their potential consequences, both parties can take appropriate actions to resolve any payment issues and maintain a fair and smooth transaction process.Lansing, Michigan Notice of Default for Past Due Payments in connection with Contract for Deed is an essential legal document designed to protect the rights and interests of parties involved in a Contract for Deed agreement. This notice serves as a formal notification to the defaulting party that they have failed to make the necessary payments as outlined in the contract, triggering certain legal consequences. When a buyer and seller enter into a Contract for Deed in Lansing, Michigan, the buyer agrees to make periodic payments directly to the seller over an agreed-upon period. Failure to make these payments can result in a Notice of Default, which informs the defaulting party about their violation of the contract's payment terms and the need to rectify the situation promptly. There can be different types of Lansing, Michigan Notices of Default for Past Due Payments in connection with a Contract for Deed, including: 1. Notice of Default for First Late Payment: This type of notice is issued when the buyer fails to make their first payment on time. It serves as an initial warning to inform the defaulting party that they are in violation of the contractual agreement and must make the payment promptly to avoid further consequences. 2. Notice of Default for Multiple Late Payments: If the buyer persists in missing several consecutive payments, a Notice of Default for Multiple Late Payments may be served. This notice emphasizes the continued violation of the contract's payment terms and typically includes details of all missed payments along with the outstanding balance. 3. Notice of Default for Final Demand: When the buyer fails to rectify their late payments even after receiving previous notices, a Notice of Default for Final Demand may be issued. This notice typically demands immediate and full payment of all outstanding amounts, highlighting the possibility of legal action or other severe consequences if the defaulting party does not rectify the situation within a specified timeframe. It's crucial to understand that each type of Lansing, Michigan Notice of Default for Past Due Payments in connection with a Contract for Deed carries its own legal implications and potential consequences. Therefore, it is strongly advised for both parties involved in a Contract for Deed agreement to consult with a qualified attorney to understand their rights and obligations and to ensure compliance with the law. In conclusion, a Lansing, Michigan Notice of Default for Past Due Payments in connection with a Contract for Deed is a legal document serving as a formal notification to the defaulting party about their missed payments. By understanding the different types of default notices and their potential consequences, both parties can take appropriate actions to resolve any payment issues and maintain a fair and smooth transaction process.