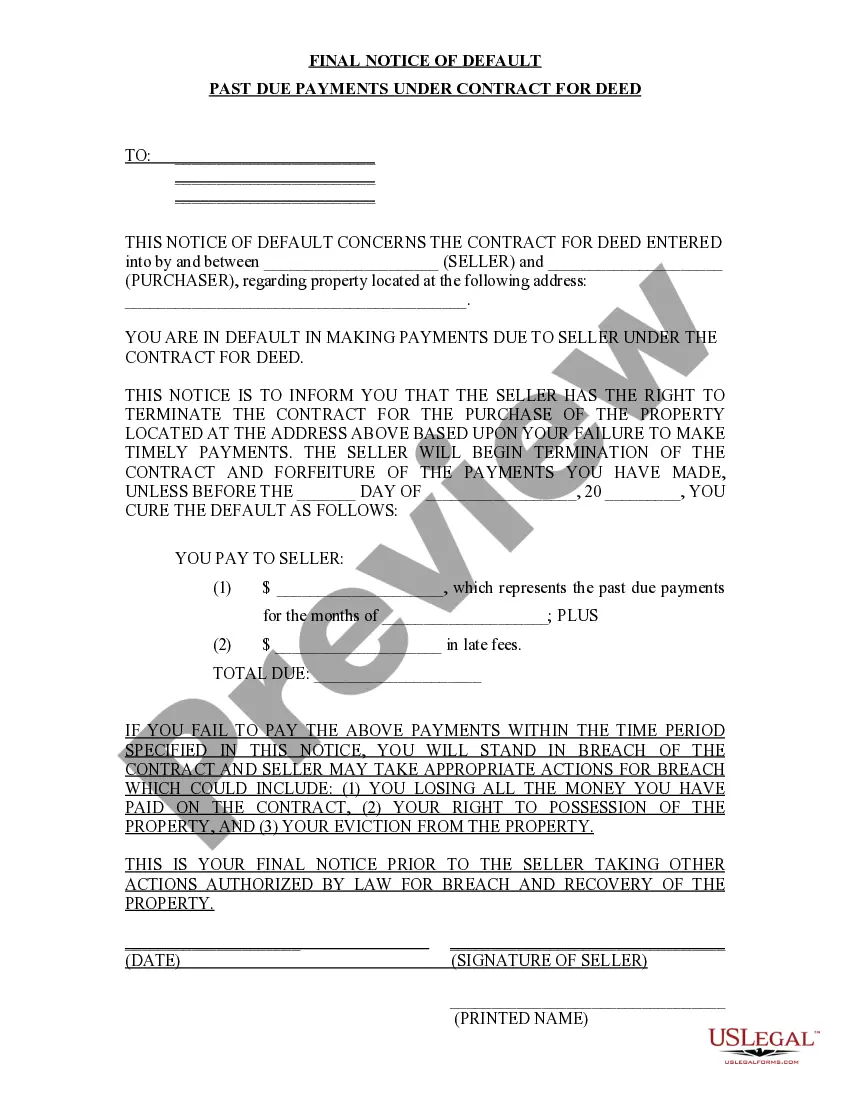

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

A Detroit Michigan Final Notice of Default for Past Due Payments in connection with a Contract for Deed is a formal written notification sent by a lender or seller to a buyer who has failed to make timely payments in accordance with the terms of a Contract for Deed agreement. The Final Notice of Default is the culmination of a series of steps in the default process, usually initiated after the buyer has missed multiple payments or consistently made late payments. It serves as a last warning to the buyer, advising them of the consequences if the outstanding payments are not made within a specified timeframe. The notice should include key details such as the buyer's name, address, and the specific property or contract number pertaining to the Contract for Deed agreement. It should clearly outline the amount of past due payments, including late fees and any other charges applicable as per the terms of the contract. Relevant keywords that can typically be found in a Final Notice of Default: 1. Default: This term indicates that the buyer has failed to fulfill their financial obligations under the Contract for Deed, usually by missing payments or consistently making them late. 2. Past Due Payments: Refers to the outstanding amount that the buyer owes to the lender or seller, including any accrued interest, late fees, or other penalties. 3. Final Notice: Indicates that this notice is the last opportunity for the buyer to resolve the default before more serious actions are taken. 4. Contract for Deed: Refers to the specific agreement between the buyer and seller, outlining the terms of the property sale, including payment amounts, interest rates, and other conditions. Different types of Final Notices of Default may exist based on the specific circumstances and terms outlined in the Contract for Deed agreement. For example: a. Final Notice of Default with Intent to Terminate: If the buyer fails to respond or rectify the default within the stated timeframe, this type of notice may be sent to inform the buyer that the seller intends to terminate the contract and pursue legal action to recover the property. b. Final Notice of Default with Optional Remedies: In some cases, the notice may provide the buyer with alternative payment options or suggest potential remedies to bring the account current and avoid further action. c. Final Notice of Default with Foreclosure Warning: If the buyer's non-payment persists despite previous notices, this notice may include a warning that the seller or lender intends to commence foreclosure proceedings, potentially resulting in the loss of the buyer's ownership rights in the property. It is important to note that the specific language and contents of a Final Notice of Default may vary depending on the individual circumstances and the legal requirements of Detroit, Michigan. It is advisable for buyers and sellers involved in a Contract for Deed agreement to consult legal counsel to fully understand their rights and obligations.A Detroit Michigan Final Notice of Default for Past Due Payments in connection with a Contract for Deed is a formal written notification sent by a lender or seller to a buyer who has failed to make timely payments in accordance with the terms of a Contract for Deed agreement. The Final Notice of Default is the culmination of a series of steps in the default process, usually initiated after the buyer has missed multiple payments or consistently made late payments. It serves as a last warning to the buyer, advising them of the consequences if the outstanding payments are not made within a specified timeframe. The notice should include key details such as the buyer's name, address, and the specific property or contract number pertaining to the Contract for Deed agreement. It should clearly outline the amount of past due payments, including late fees and any other charges applicable as per the terms of the contract. Relevant keywords that can typically be found in a Final Notice of Default: 1. Default: This term indicates that the buyer has failed to fulfill their financial obligations under the Contract for Deed, usually by missing payments or consistently making them late. 2. Past Due Payments: Refers to the outstanding amount that the buyer owes to the lender or seller, including any accrued interest, late fees, or other penalties. 3. Final Notice: Indicates that this notice is the last opportunity for the buyer to resolve the default before more serious actions are taken. 4. Contract for Deed: Refers to the specific agreement between the buyer and seller, outlining the terms of the property sale, including payment amounts, interest rates, and other conditions. Different types of Final Notices of Default may exist based on the specific circumstances and terms outlined in the Contract for Deed agreement. For example: a. Final Notice of Default with Intent to Terminate: If the buyer fails to respond or rectify the default within the stated timeframe, this type of notice may be sent to inform the buyer that the seller intends to terminate the contract and pursue legal action to recover the property. b. Final Notice of Default with Optional Remedies: In some cases, the notice may provide the buyer with alternative payment options or suggest potential remedies to bring the account current and avoid further action. c. Final Notice of Default with Foreclosure Warning: If the buyer's non-payment persists despite previous notices, this notice may include a warning that the seller or lender intends to commence foreclosure proceedings, potentially resulting in the loss of the buyer's ownership rights in the property. It is important to note that the specific language and contents of a Final Notice of Default may vary depending on the individual circumstances and the legal requirements of Detroit, Michigan. It is advisable for buyers and sellers involved in a Contract for Deed agreement to consult legal counsel to fully understand their rights and obligations.