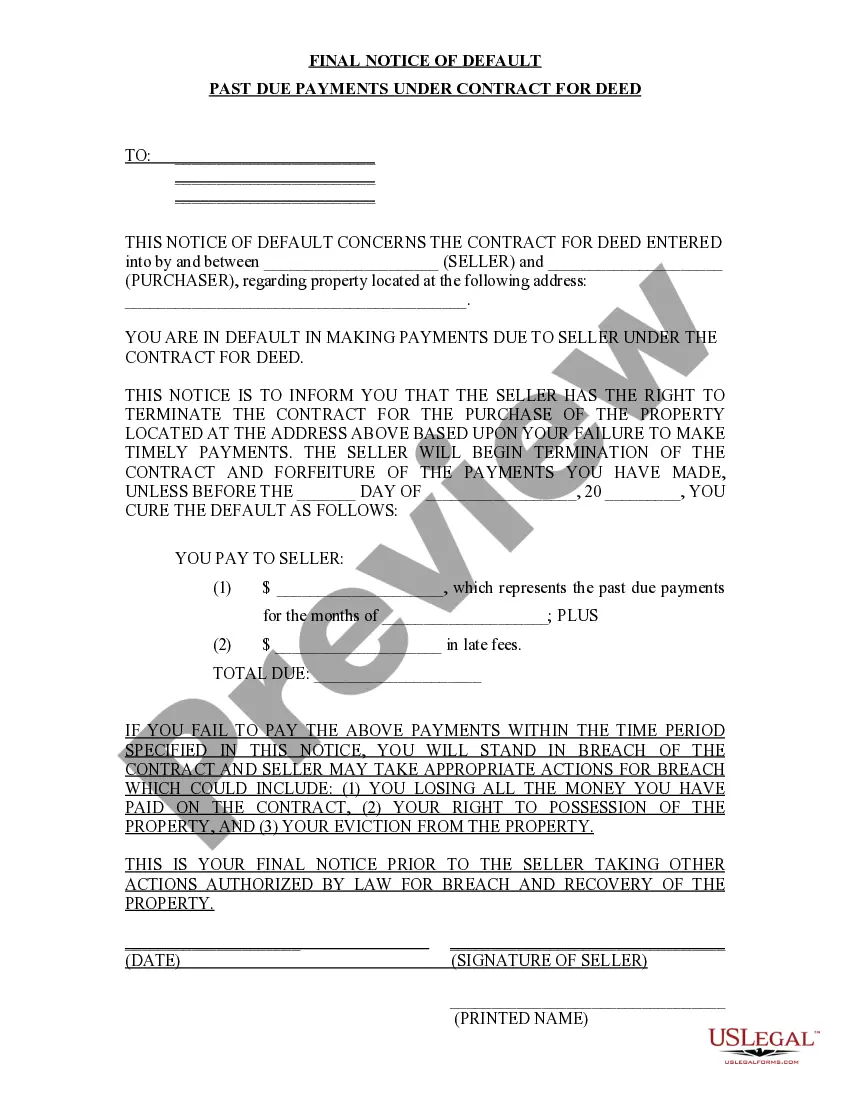

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

Title: Understanding the Grand Rapids, Michigan Final Notice of Default for Past Due Payments in Connection with Contract for Deed Introduction: In Grand Rapids, Michigan, a Final Notice of Default for Past Due Payments in connection with a Contract for Deed is an important legal document that serves as a notification to a buyer that they have fallen behind on their contractual obligations. This notice is sent by the seller or their representative to inform the buyer of the defaulted payments and the potential consequences if timely action is not taken to rectify the situation. This article aims to provide a detailed description of this notice, its purpose, and the potential types of notices that can be issued in such cases. Description of a Grand Rapids Michigan Final Notice of Default for Past Due Payments in connection with a Contract for Deed: A Final Notice of Default for Past Due Payments in connection with a Contract for Deed is typically issued when a buyer has failed to make their agreed-upon payments for a certain period, usually stated within the contract itself. The notice aims to bring to the buyer's attention that they are in breach of the contract and that legal actions may be pursued if corrective measures are not taken promptly. These notices are an important part of the process to protect the rights and interests of both parties involved. Key Elements of a Final Notice of Default: 1. Title: The notice should clearly be labeled as a "Final Notice of Default" to emphasize the gravity of the situation and the imminent consequences of non-payment. 2. Identification: The notice must accurately identify both the buyer and the seller, including their legal names, addresses, and contact information. 3. Contract Details: The notice should mention the specific contract for deed agreement being referenced, including the date of the contract, the property address, and any other critical terms and conditions. 4. Statement of Default: The notice must explicitly state that the buyer is in default due to their failure to make timely payments as agreed upon in the contract. 5. Amount Owed: The notice should provide detailed information regarding the total outstanding balance, including a breakdown of missed payments, penalties, interest, or any other associated fees. 6. Cure or Remedial Action: The notice must clearly state a specific timeframe within which the buyer must either cure the default by making the required outstanding payments or take appropriate actions to resolve the situation. 7. Consequences of Non-Compliance: The notice should outline the potential legal actions that the seller may take if the buyer fails to address the default within the stated timeframe, such as foreclosure proceedings or legal claims for breach of contract. 8. Contact Information: The seller or their representative's contact details, such as name, address, phone number, and email, should be clearly provided to allow the buyer to communicate and rectify the default. Types of Final Notices of Default for Past Due Payments in connection with a Contract for Deed: While the specific terminology may vary, there can be variations of the Final Notice of Default, depending upon the severity of the default and the contract terms. Some potential types of notices include: 1. "Notice of Late Payment": Issued when a buyer has missed one or more payments but has not yet fallen significantly behind. 2. "Notice of Default": Sent when a buyer has consistently failed to make payments for a specific period, usually stated in the contract. 3. "Final Notice of Default": This is the most severe notice, issued when a buyer has repeatedly missed payments and has not taken appropriate actions to rectify the situation, indicating imminent legal consequences if no resolution is achieved within a specified timeframe. Conclusion: A Grand Rapids Michigan Final Notice of Default for Past Due Payments in connection with a Contract for Deed is a crucial legal document that notifies a defaulting buyer of their breach of obligations and the potential consequences if corrective measures are not taken promptly. It serves to protect the rights of both parties involved and emphasizes the need for urgent action to resolve the default. Understanding the content and implications of this notice is essential for buyers and sellers engaging in a contract for deed agreement in Grand Rapids, Michigan.Title: Understanding the Grand Rapids, Michigan Final Notice of Default for Past Due Payments in Connection with Contract for Deed Introduction: In Grand Rapids, Michigan, a Final Notice of Default for Past Due Payments in connection with a Contract for Deed is an important legal document that serves as a notification to a buyer that they have fallen behind on their contractual obligations. This notice is sent by the seller or their representative to inform the buyer of the defaulted payments and the potential consequences if timely action is not taken to rectify the situation. This article aims to provide a detailed description of this notice, its purpose, and the potential types of notices that can be issued in such cases. Description of a Grand Rapids Michigan Final Notice of Default for Past Due Payments in connection with a Contract for Deed: A Final Notice of Default for Past Due Payments in connection with a Contract for Deed is typically issued when a buyer has failed to make their agreed-upon payments for a certain period, usually stated within the contract itself. The notice aims to bring to the buyer's attention that they are in breach of the contract and that legal actions may be pursued if corrective measures are not taken promptly. These notices are an important part of the process to protect the rights and interests of both parties involved. Key Elements of a Final Notice of Default: 1. Title: The notice should clearly be labeled as a "Final Notice of Default" to emphasize the gravity of the situation and the imminent consequences of non-payment. 2. Identification: The notice must accurately identify both the buyer and the seller, including their legal names, addresses, and contact information. 3. Contract Details: The notice should mention the specific contract for deed agreement being referenced, including the date of the contract, the property address, and any other critical terms and conditions. 4. Statement of Default: The notice must explicitly state that the buyer is in default due to their failure to make timely payments as agreed upon in the contract. 5. Amount Owed: The notice should provide detailed information regarding the total outstanding balance, including a breakdown of missed payments, penalties, interest, or any other associated fees. 6. Cure or Remedial Action: The notice must clearly state a specific timeframe within which the buyer must either cure the default by making the required outstanding payments or take appropriate actions to resolve the situation. 7. Consequences of Non-Compliance: The notice should outline the potential legal actions that the seller may take if the buyer fails to address the default within the stated timeframe, such as foreclosure proceedings or legal claims for breach of contract. 8. Contact Information: The seller or their representative's contact details, such as name, address, phone number, and email, should be clearly provided to allow the buyer to communicate and rectify the default. Types of Final Notices of Default for Past Due Payments in connection with a Contract for Deed: While the specific terminology may vary, there can be variations of the Final Notice of Default, depending upon the severity of the default and the contract terms. Some potential types of notices include: 1. "Notice of Late Payment": Issued when a buyer has missed one or more payments but has not yet fallen significantly behind. 2. "Notice of Default": Sent when a buyer has consistently failed to make payments for a specific period, usually stated in the contract. 3. "Final Notice of Default": This is the most severe notice, issued when a buyer has repeatedly missed payments and has not taken appropriate actions to rectify the situation, indicating imminent legal consequences if no resolution is achieved within a specified timeframe. Conclusion: A Grand Rapids Michigan Final Notice of Default for Past Due Payments in connection with a Contract for Deed is a crucial legal document that notifies a defaulting buyer of their breach of obligations and the potential consequences if corrective measures are not taken promptly. It serves to protect the rights of both parties involved and emphasizes the need for urgent action to resolve the default. Understanding the content and implications of this notice is essential for buyers and sellers engaging in a contract for deed agreement in Grand Rapids, Michigan.