The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

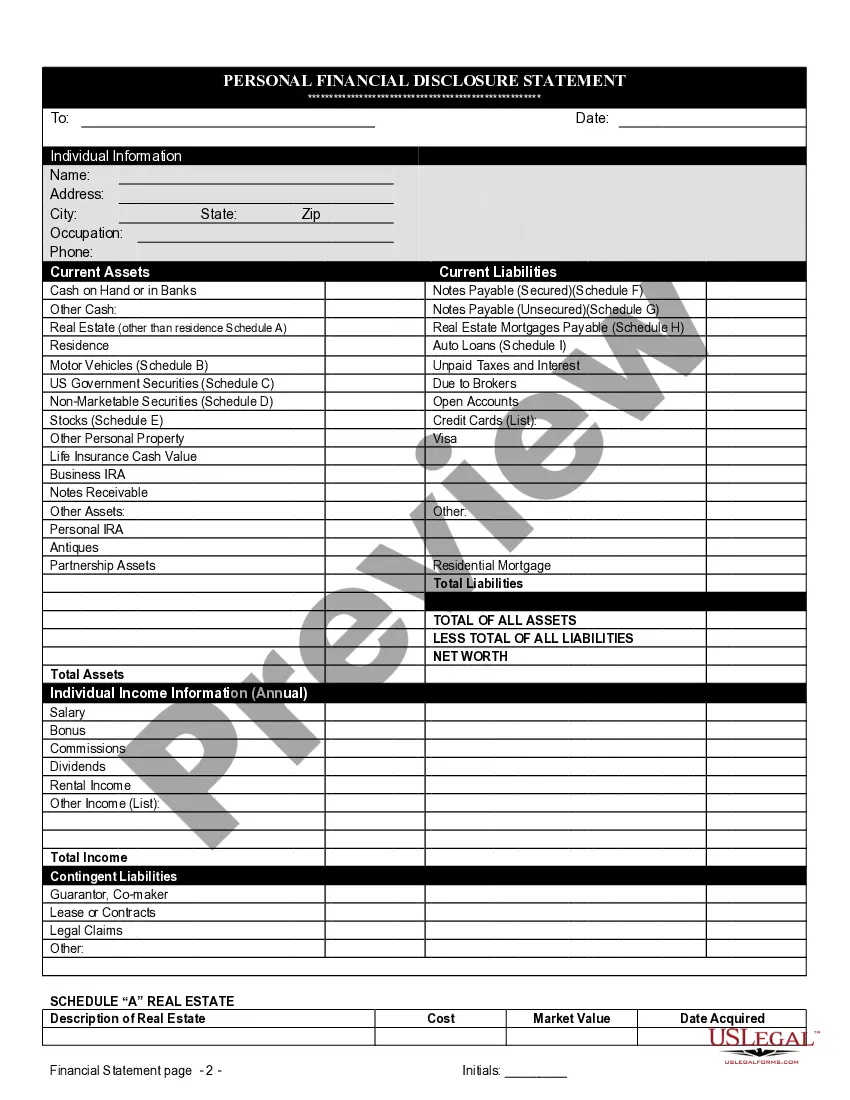

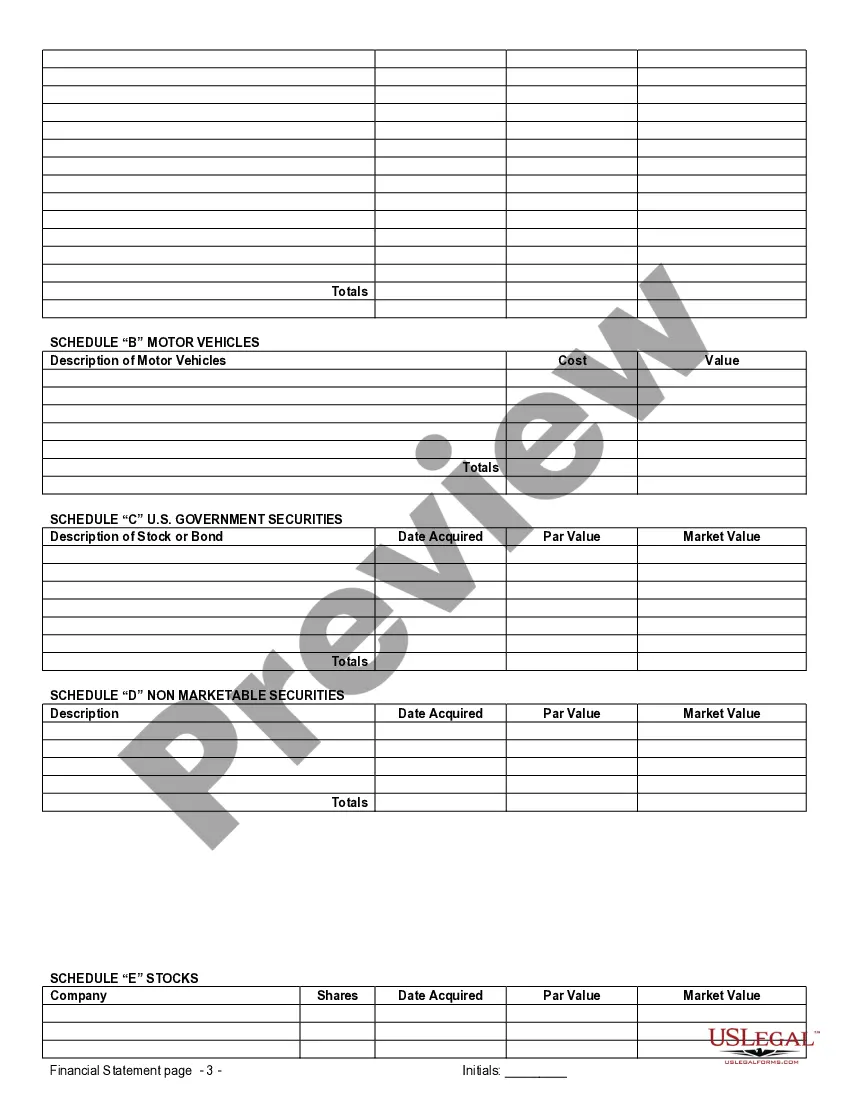

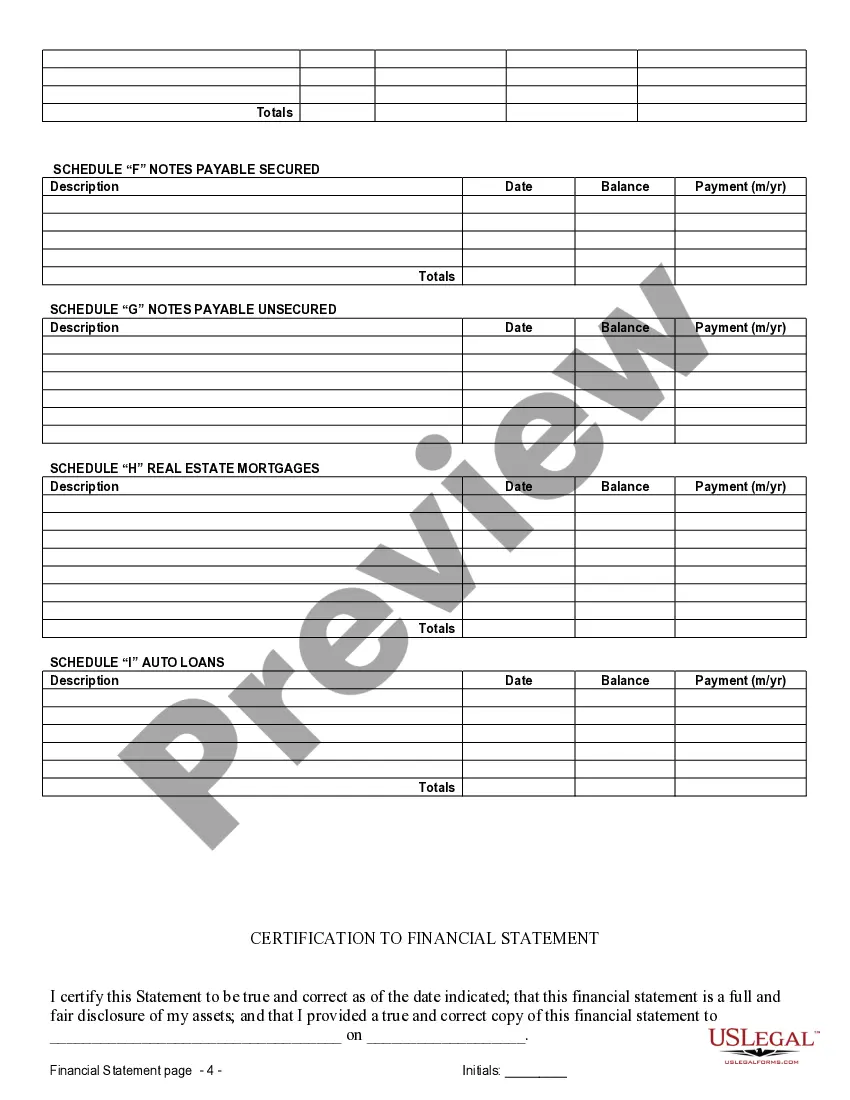

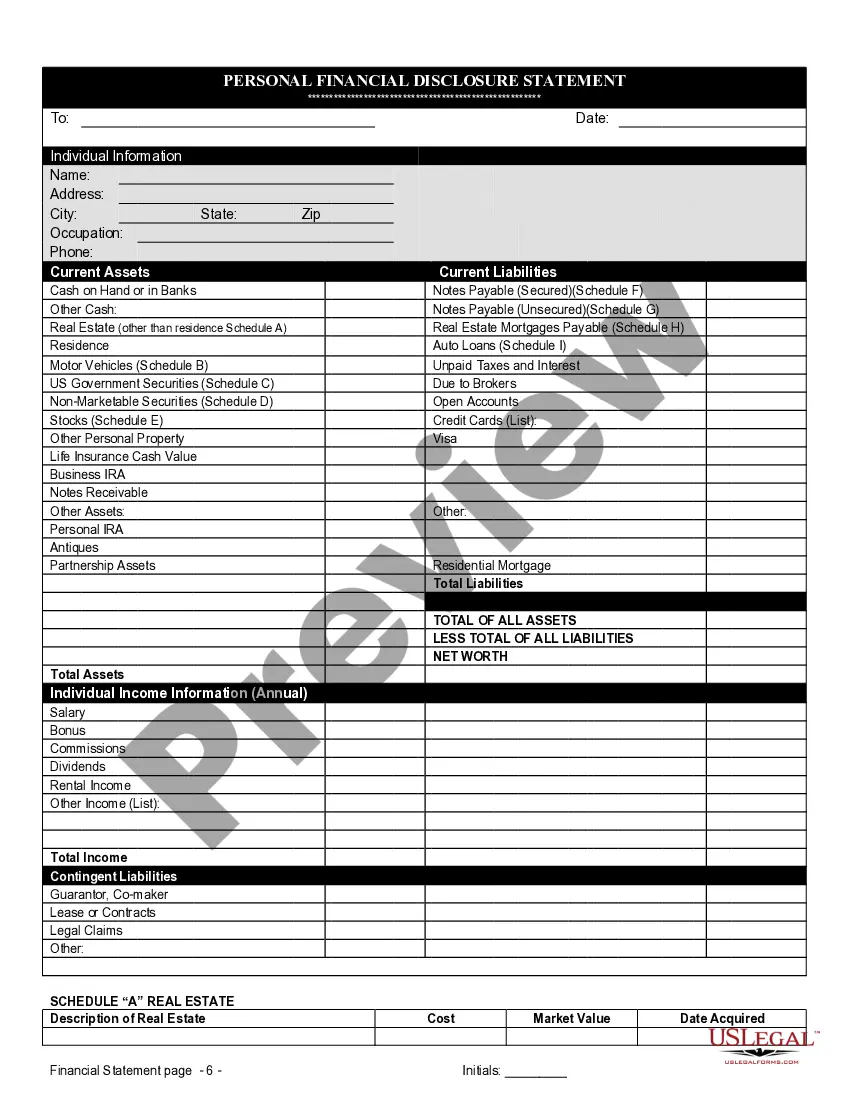

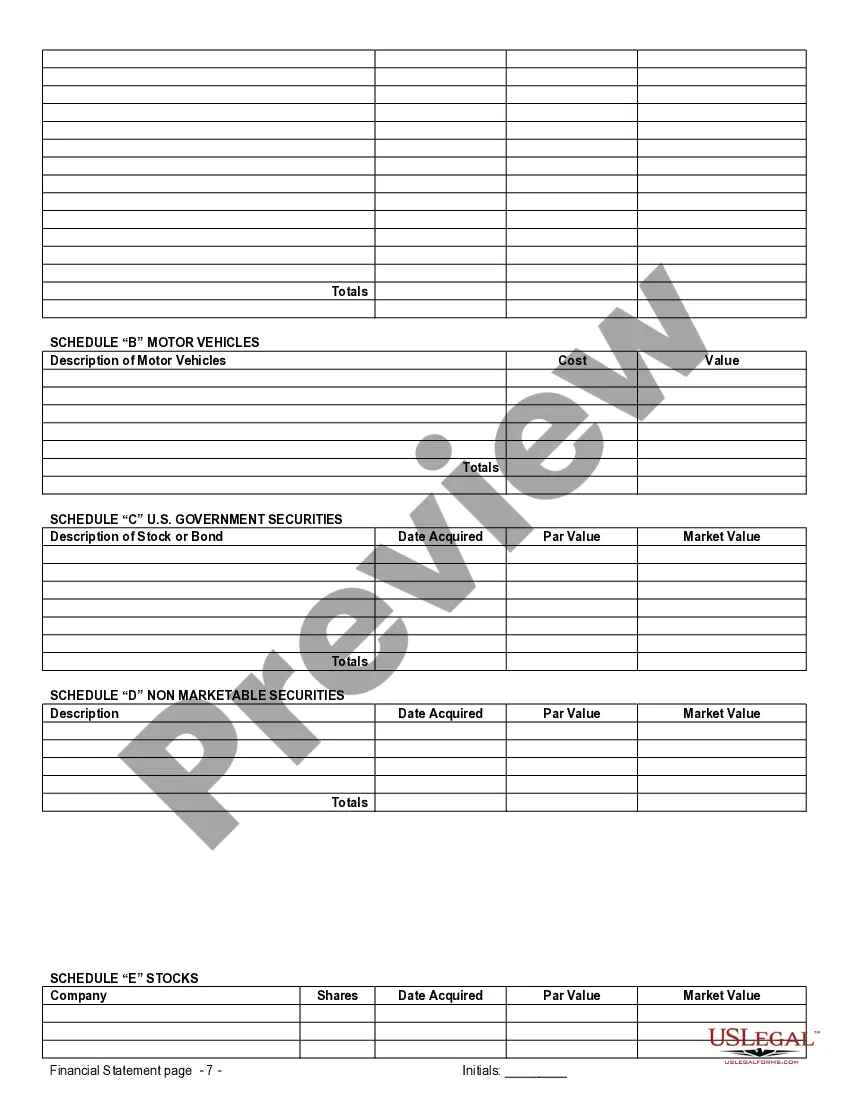

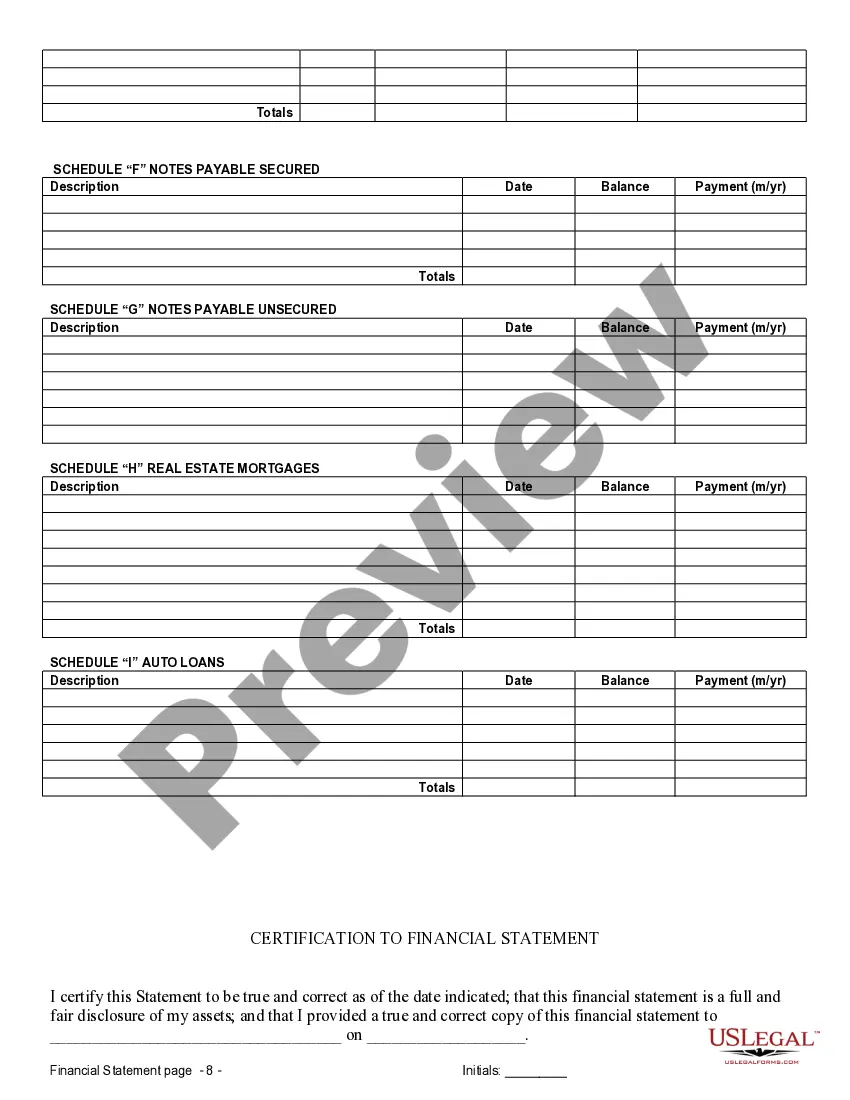

In the context of a prenuptial premarital agreement, a Detroit Michigan Financial Statement refers to a comprehensive document that outlines an individual's financial status. It provides a detailed overview of their income, assets, liabilities, and expenses. The purpose of this statement is to disclose and analyze the financial circumstances of each party involved in the agreement. The Detroit Michigan Financial Statement in connection with a prenuptial agreement is typically prepared by each party seeking to protect their respective interests before entering into marriage. By disclosing their financial information, individuals can establish a clear understanding of their current financial positions and protect their rights in the event of a divorce or separation. There are different types of Detroit Michigan Financial Statements that can be used in connection with prenuptial agreements. These include: 1. Personal Financial Statement: This document provides a snapshot of a person's overall financial condition. It includes information on income, assets (such as real estate, investments, and personal property), liabilities (such as debts and loans), and expenses (including monthly costs of living, such as rent, utilities, and insurance). 2. Bank Statements: Bank statements are an important component of the financial statement. They provide a record of the party's financial transactions, including income deposits, expenses, and account balances. Bank statements offer a factual overview of an individual's financial activity over a specific period of time. 3. Tax Returns: Tax returns provide a comprehensive view of an individual's income, deductions, exemptions, and tax liabilities. They are vital in assessing a party's financial standing and can be used to verify the accuracy of the financial statement. 4. Investment Account Statements: These statements disclose information regarding an individual's investment portfolios, such as stocks, bonds, mutual funds, and retirement accounts. They provide insights into the current value, growth, and performance of these investments and contribute to the overall assessment of an individual's financial worth. 5. Real Estate Valuations: Real estate valuations include appraisals and assessments of any owned properties. These documents provide an estimated market value of the properties and help determine the individual's equity and potential future appreciation or depreciation. It is important to note that the specific requirements for Detroit Michigan Financial Statements in connection with a prenuptial agreement can vary, and it is advisable to consult with an attorney experienced in family law and prenuptial agreements to ensure compliance with local regulations. Additionally, both parties should provide accurate and complete financial information to maintain the validity and enforceability of the prenuptial agreement.In the context of a prenuptial premarital agreement, a Detroit Michigan Financial Statement refers to a comprehensive document that outlines an individual's financial status. It provides a detailed overview of their income, assets, liabilities, and expenses. The purpose of this statement is to disclose and analyze the financial circumstances of each party involved in the agreement. The Detroit Michigan Financial Statement in connection with a prenuptial agreement is typically prepared by each party seeking to protect their respective interests before entering into marriage. By disclosing their financial information, individuals can establish a clear understanding of their current financial positions and protect their rights in the event of a divorce or separation. There are different types of Detroit Michigan Financial Statements that can be used in connection with prenuptial agreements. These include: 1. Personal Financial Statement: This document provides a snapshot of a person's overall financial condition. It includes information on income, assets (such as real estate, investments, and personal property), liabilities (such as debts and loans), and expenses (including monthly costs of living, such as rent, utilities, and insurance). 2. Bank Statements: Bank statements are an important component of the financial statement. They provide a record of the party's financial transactions, including income deposits, expenses, and account balances. Bank statements offer a factual overview of an individual's financial activity over a specific period of time. 3. Tax Returns: Tax returns provide a comprehensive view of an individual's income, deductions, exemptions, and tax liabilities. They are vital in assessing a party's financial standing and can be used to verify the accuracy of the financial statement. 4. Investment Account Statements: These statements disclose information regarding an individual's investment portfolios, such as stocks, bonds, mutual funds, and retirement accounts. They provide insights into the current value, growth, and performance of these investments and contribute to the overall assessment of an individual's financial worth. 5. Real Estate Valuations: Real estate valuations include appraisals and assessments of any owned properties. These documents provide an estimated market value of the properties and help determine the individual's equity and potential future appreciation or depreciation. It is important to note that the specific requirements for Detroit Michigan Financial Statements in connection with a prenuptial agreement can vary, and it is advisable to consult with an attorney experienced in family law and prenuptial agreements to ensure compliance with local regulations. Additionally, both parties should provide accurate and complete financial information to maintain the validity and enforceability of the prenuptial agreement.