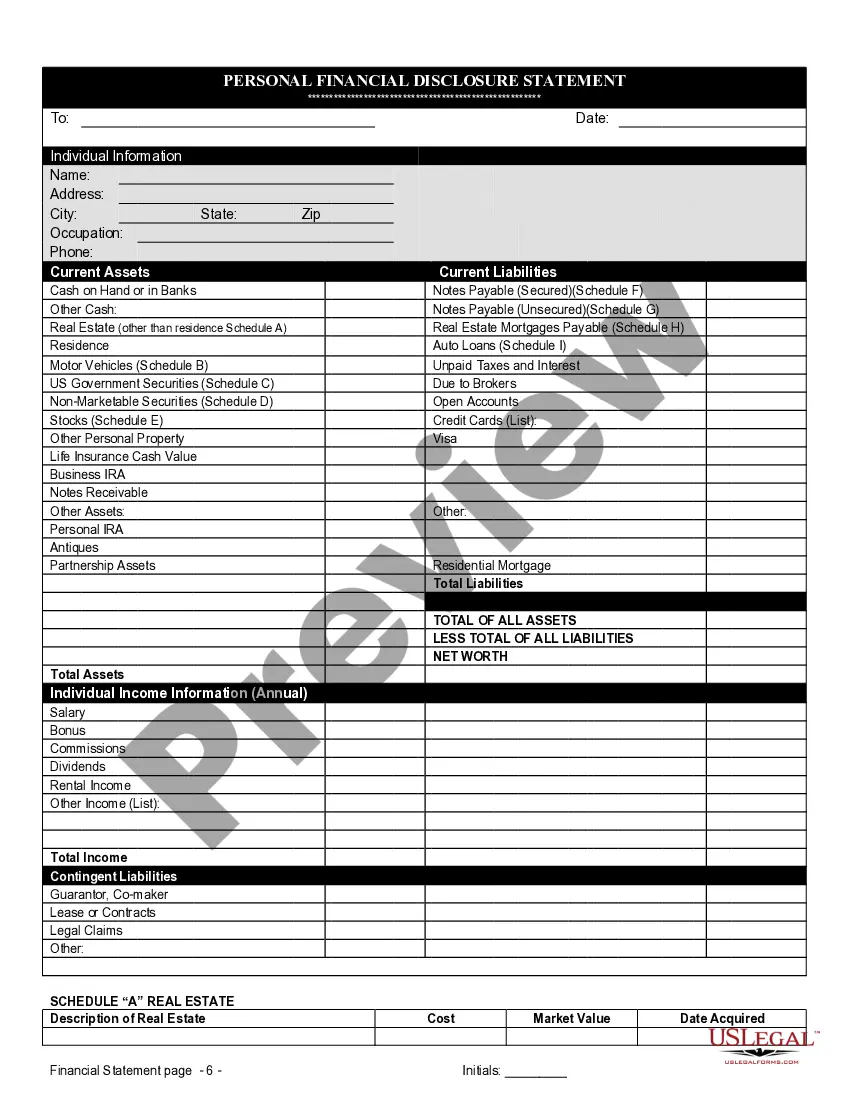

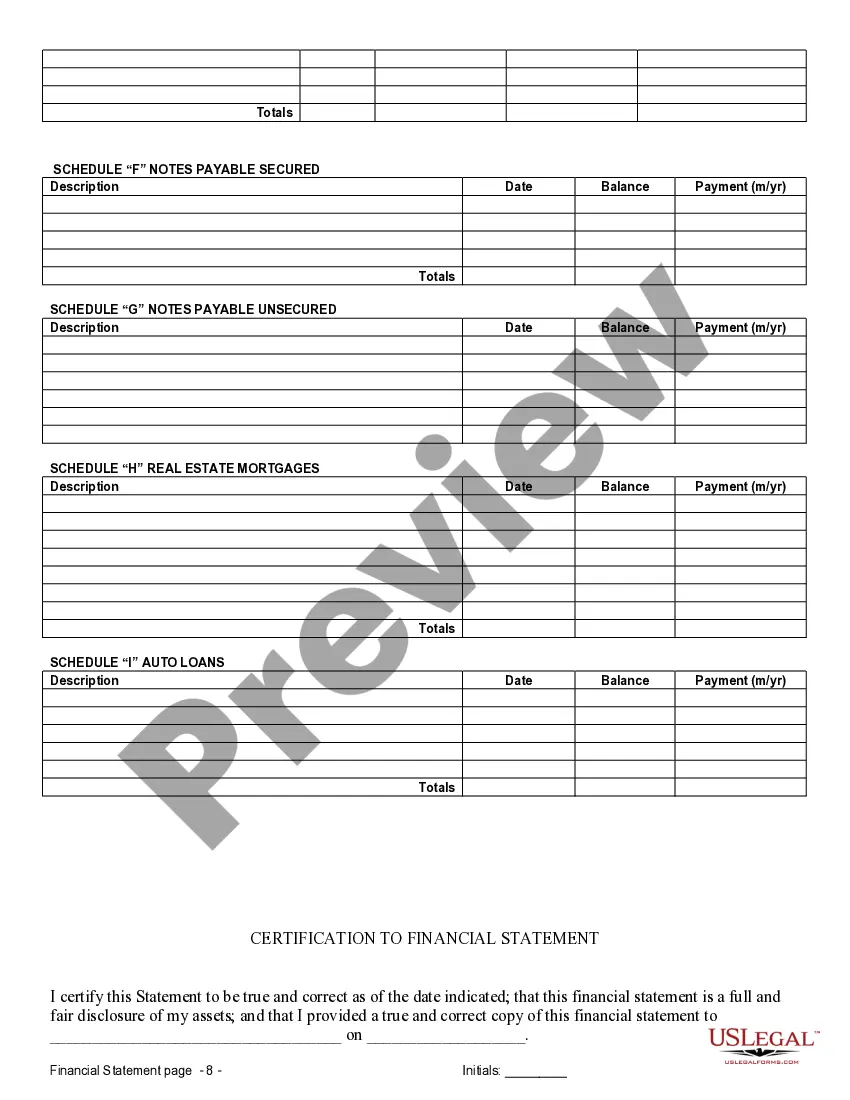

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

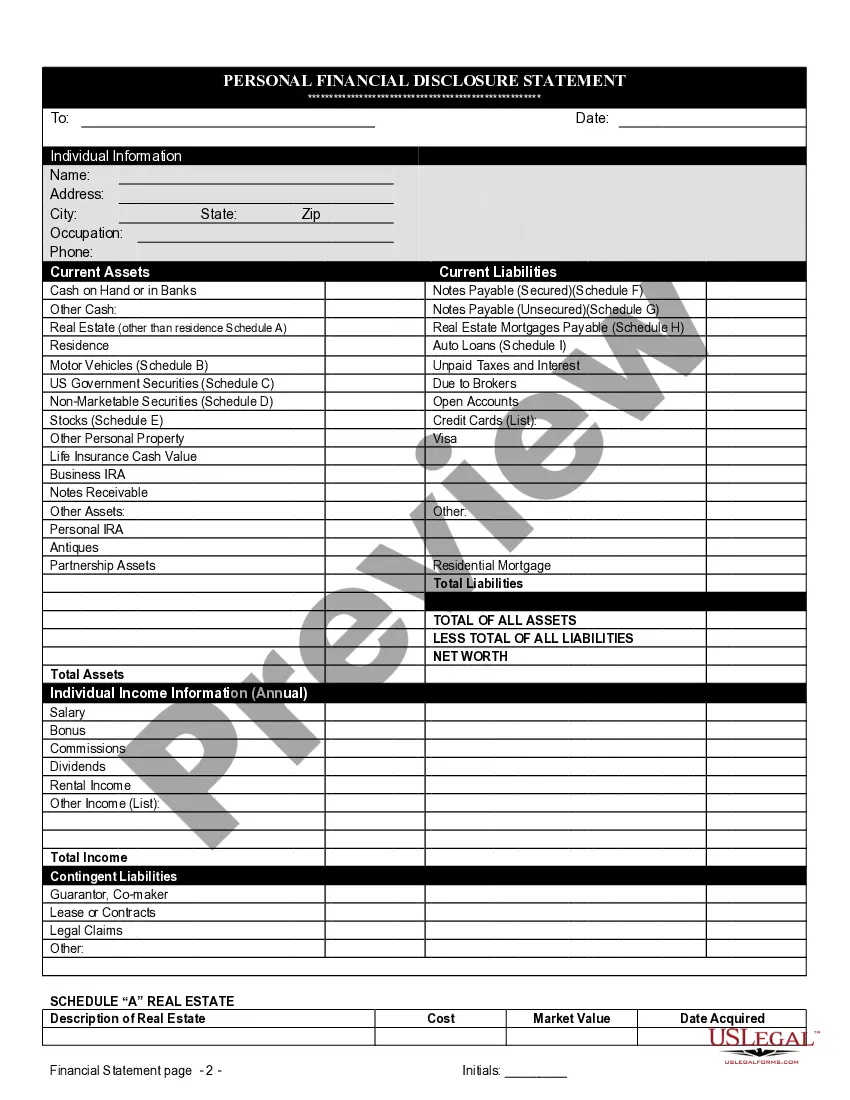

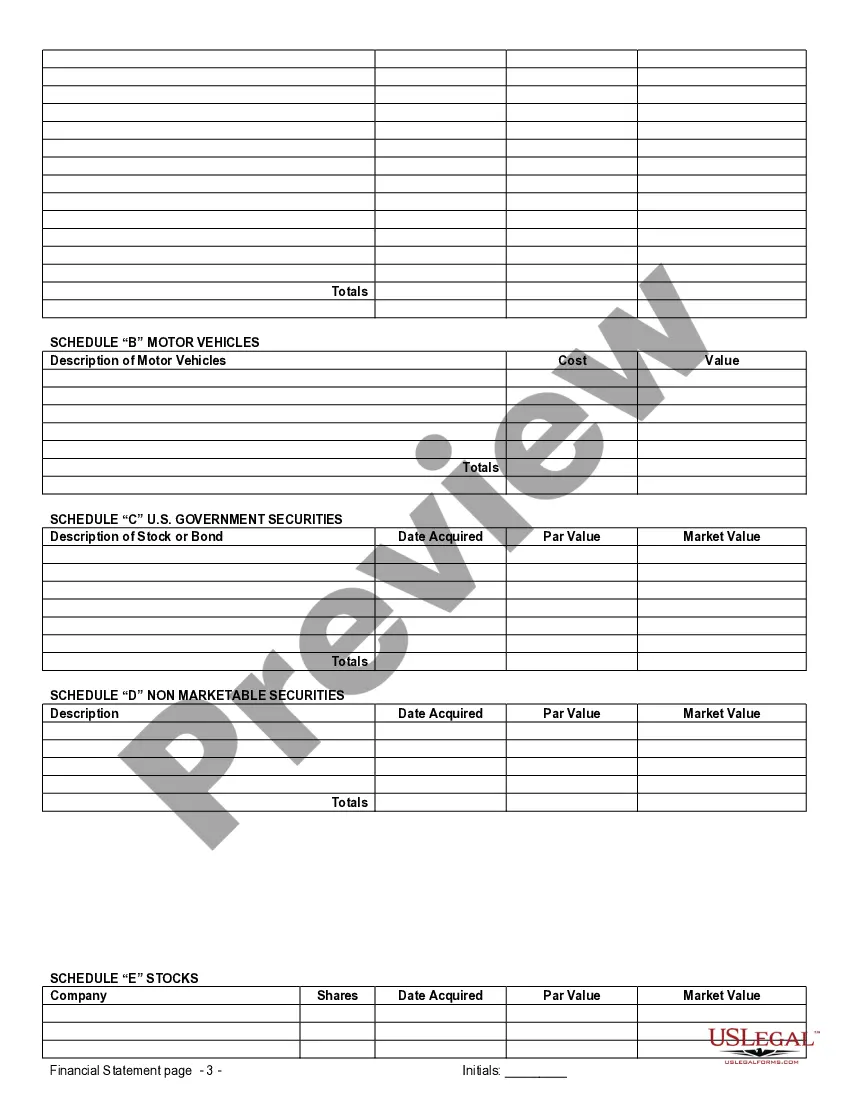

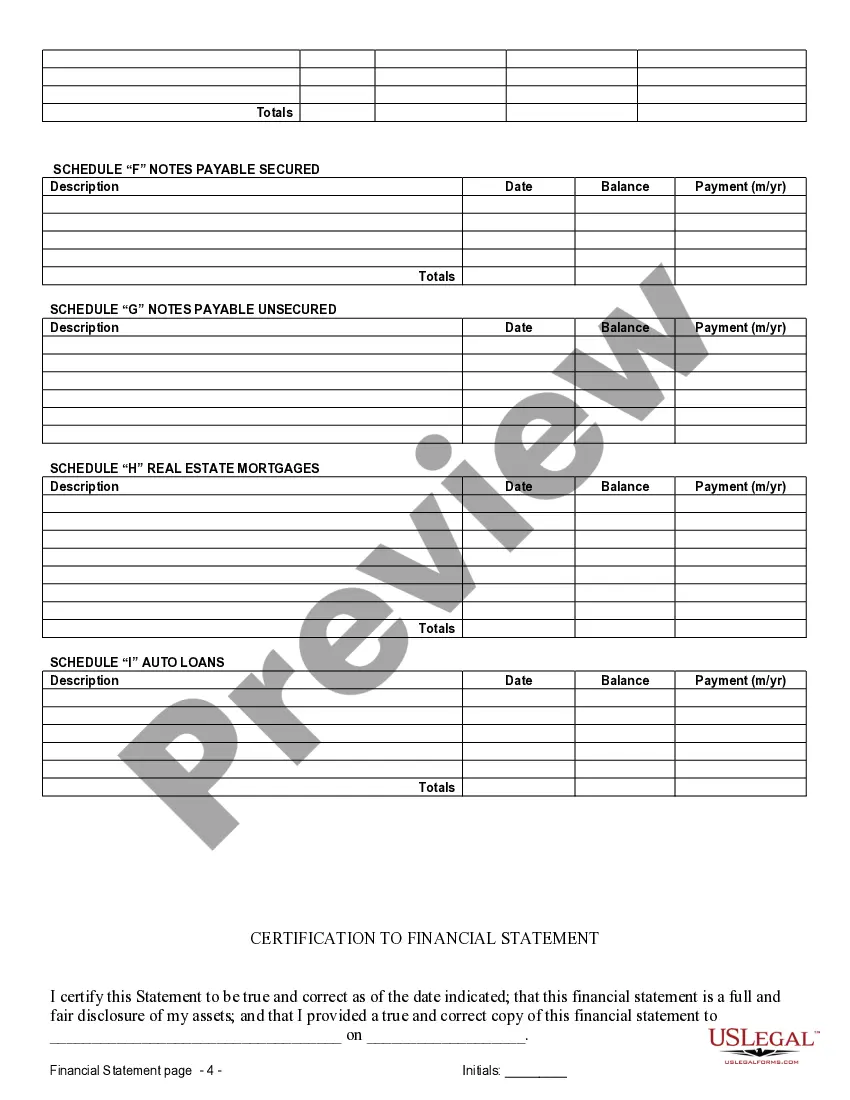

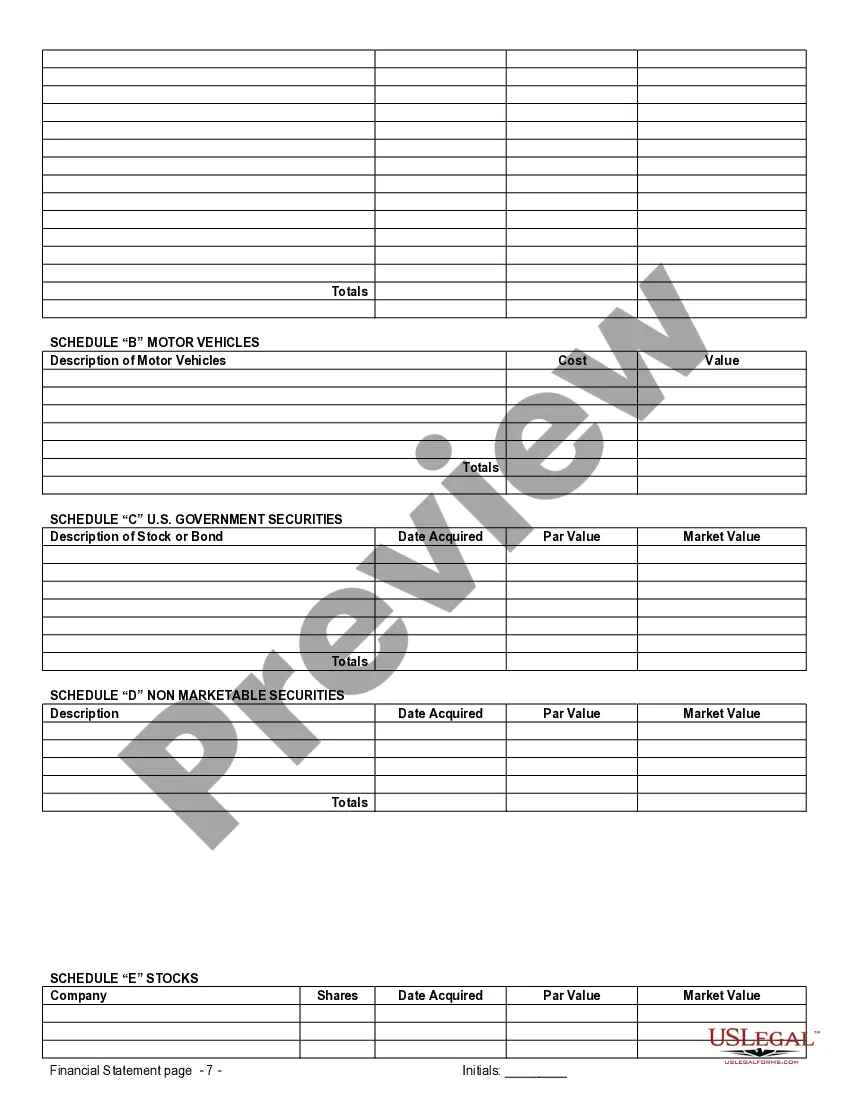

Lansing Michigan Financial Statements in Connection with Prenuptial Premarital Agreement When entering into a prenuptial or premarital agreement in Lansing, Michigan, it is crucial to have accurate financial statements to ensure that both parties have a clear understanding of their assets, liabilities, and financial obligations. These statements serve as a foundation for determining the division of property and spousal support in the event of a divorce. In Lansing, there are various types of financial statements that are commonly used in connection with prenuptial or premarital agreements. These include: 1. Personal Financial Statement: This document provides a comprehensive overview of an individual's financial situation, including their income, expenses, assets, and debts. It helps both parties evaluate the economic impact of the agreement and determine their financial rights and responsibilities. 2. Balance Sheet: A balance sheet is a statement that outlines an individual's assets, liabilities, and net worth at a specific point in time. It provides a snapshot of an individual's financial position and assists in the equitable distribution of assets during a divorce. 3. Income Statement: An income statement presents an individual's income and expenses over a specified period, typically on an annual basis. It helps determine cash flow and supports the assessment of spousal support and maintenance obligations. 4. Tax Returns: Tax returns are vital financial documents that showcase an individual's income, deductions, and tax liabilities. They serve as evidence of an individual's financial situation and aid in assessing tax implications within the prenuptial or premarital agreement. 5. Retirement Account Statements: For individuals who have retirement accounts, such as 401(k)s or individual retirement accounts (IRAs), providing current statements is essential. These statements disclose the total value of the account and help establish the agreed-upon division in the event of a divorce or separation. 6. Property Deeds and Titles: Property deeds and titles certify the ownership of real estate, vehicles, or other valuable assets. Including these documents in the financial statements ensures clarity on the division of property, in case of dissolution of the marriage. 7. Credit Reports: Credit reports provide a comprehensive overview of an individual's borrowing history, outstanding debts, and creditworthiness. They are essential in evaluating potential financial obligations and liabilities that might impact the prenuptial or premarital agreement. In Lansing, Michigan, having accurate and comprehensive financial statements in connection with prenuptial or premarital agreements is vital. These statements disclose the financial realities of both parties, allowing them to make informed decisions and establish fair and reasonable terms for their financial future.Lansing Michigan Financial Statements in Connection with Prenuptial Premarital Agreement When entering into a prenuptial or premarital agreement in Lansing, Michigan, it is crucial to have accurate financial statements to ensure that both parties have a clear understanding of their assets, liabilities, and financial obligations. These statements serve as a foundation for determining the division of property and spousal support in the event of a divorce. In Lansing, there are various types of financial statements that are commonly used in connection with prenuptial or premarital agreements. These include: 1. Personal Financial Statement: This document provides a comprehensive overview of an individual's financial situation, including their income, expenses, assets, and debts. It helps both parties evaluate the economic impact of the agreement and determine their financial rights and responsibilities. 2. Balance Sheet: A balance sheet is a statement that outlines an individual's assets, liabilities, and net worth at a specific point in time. It provides a snapshot of an individual's financial position and assists in the equitable distribution of assets during a divorce. 3. Income Statement: An income statement presents an individual's income and expenses over a specified period, typically on an annual basis. It helps determine cash flow and supports the assessment of spousal support and maintenance obligations. 4. Tax Returns: Tax returns are vital financial documents that showcase an individual's income, deductions, and tax liabilities. They serve as evidence of an individual's financial situation and aid in assessing tax implications within the prenuptial or premarital agreement. 5. Retirement Account Statements: For individuals who have retirement accounts, such as 401(k)s or individual retirement accounts (IRAs), providing current statements is essential. These statements disclose the total value of the account and help establish the agreed-upon division in the event of a divorce or separation. 6. Property Deeds and Titles: Property deeds and titles certify the ownership of real estate, vehicles, or other valuable assets. Including these documents in the financial statements ensures clarity on the division of property, in case of dissolution of the marriage. 7. Credit Reports: Credit reports provide a comprehensive overview of an individual's borrowing history, outstanding debts, and creditworthiness. They are essential in evaluating potential financial obligations and liabilities that might impact the prenuptial or premarital agreement. In Lansing, Michigan, having accurate and comprehensive financial statements in connection with prenuptial or premarital agreements is vital. These statements disclose the financial realities of both parties, allowing them to make informed decisions and establish fair and reasonable terms for their financial future.