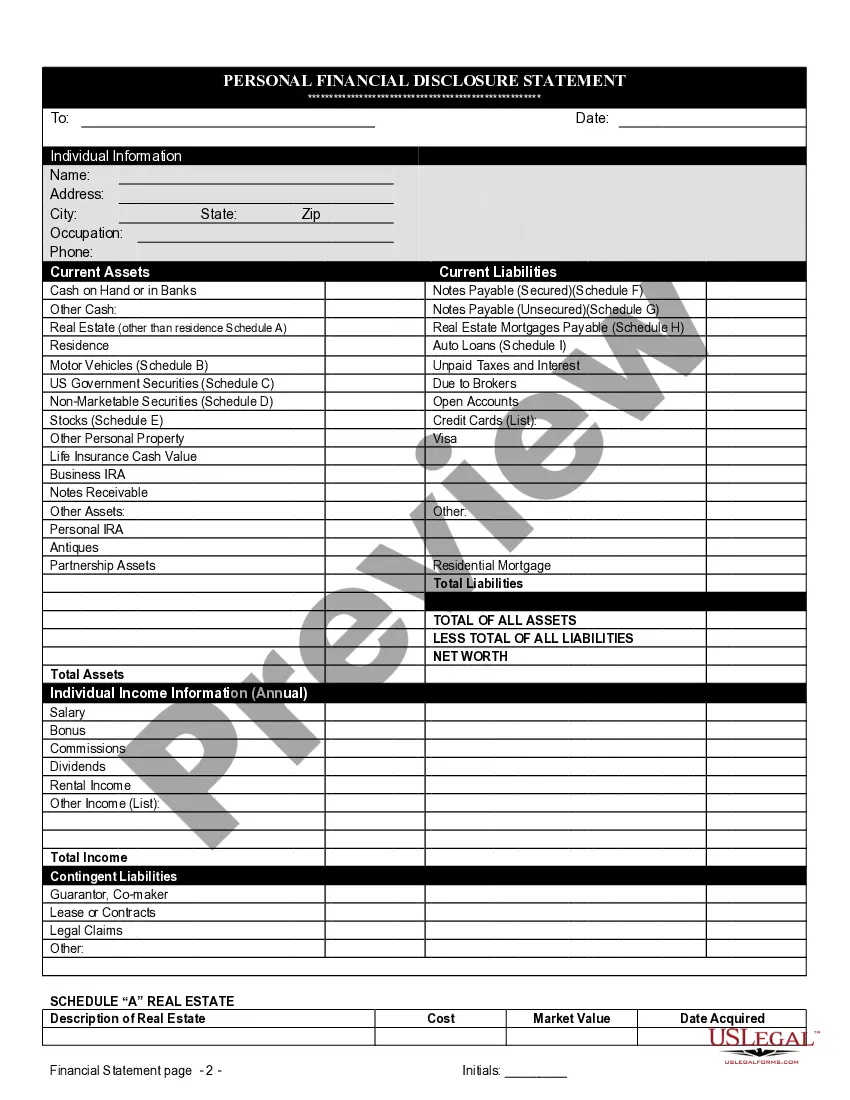

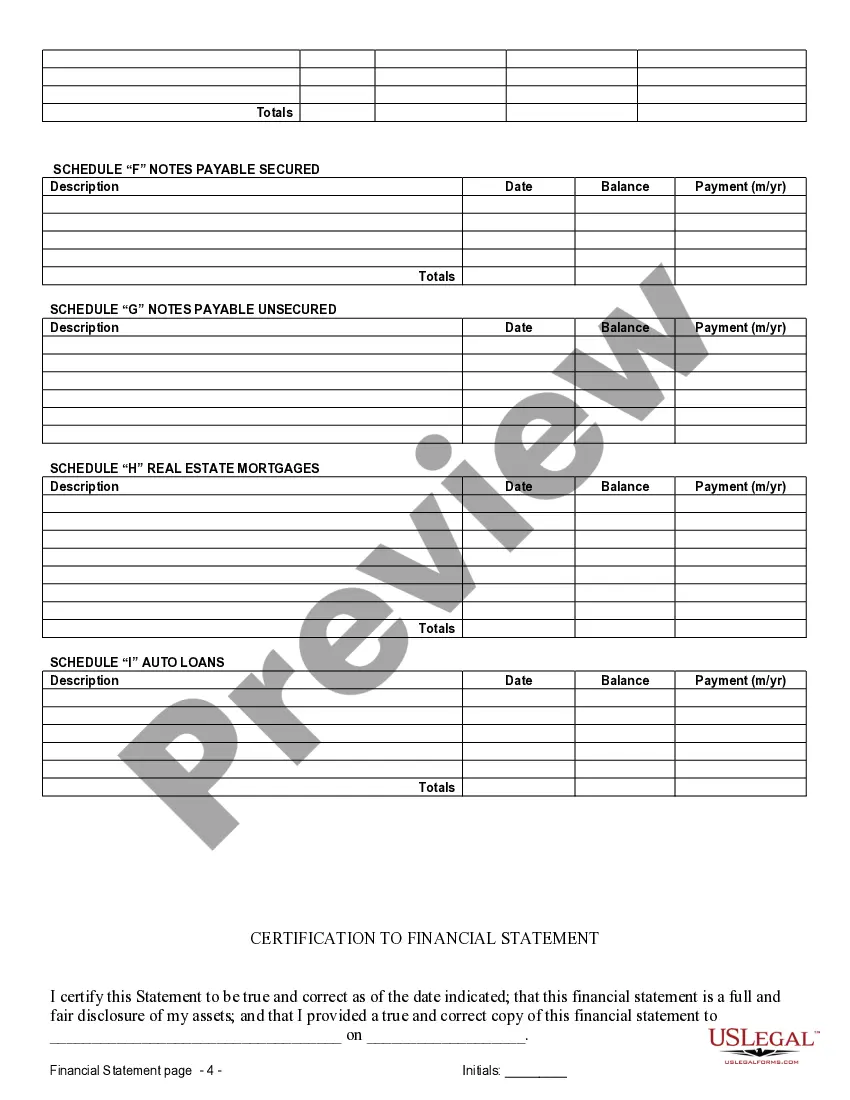

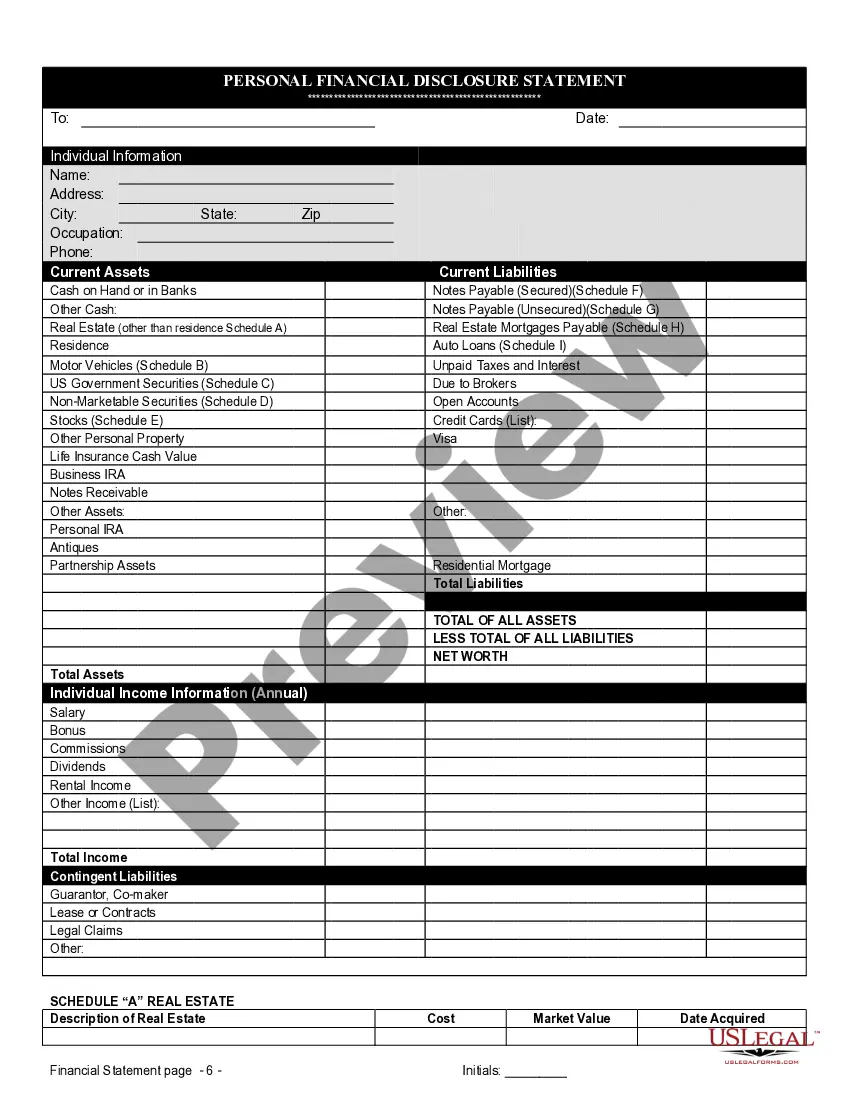

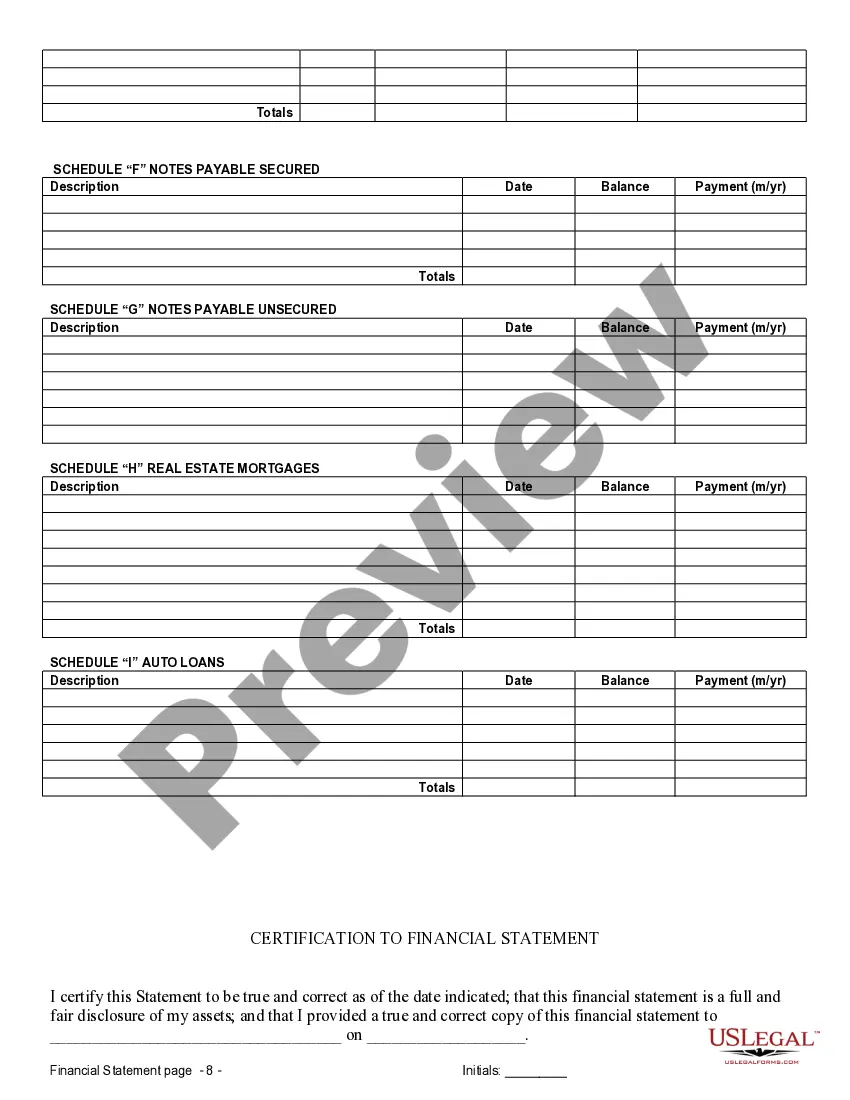

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

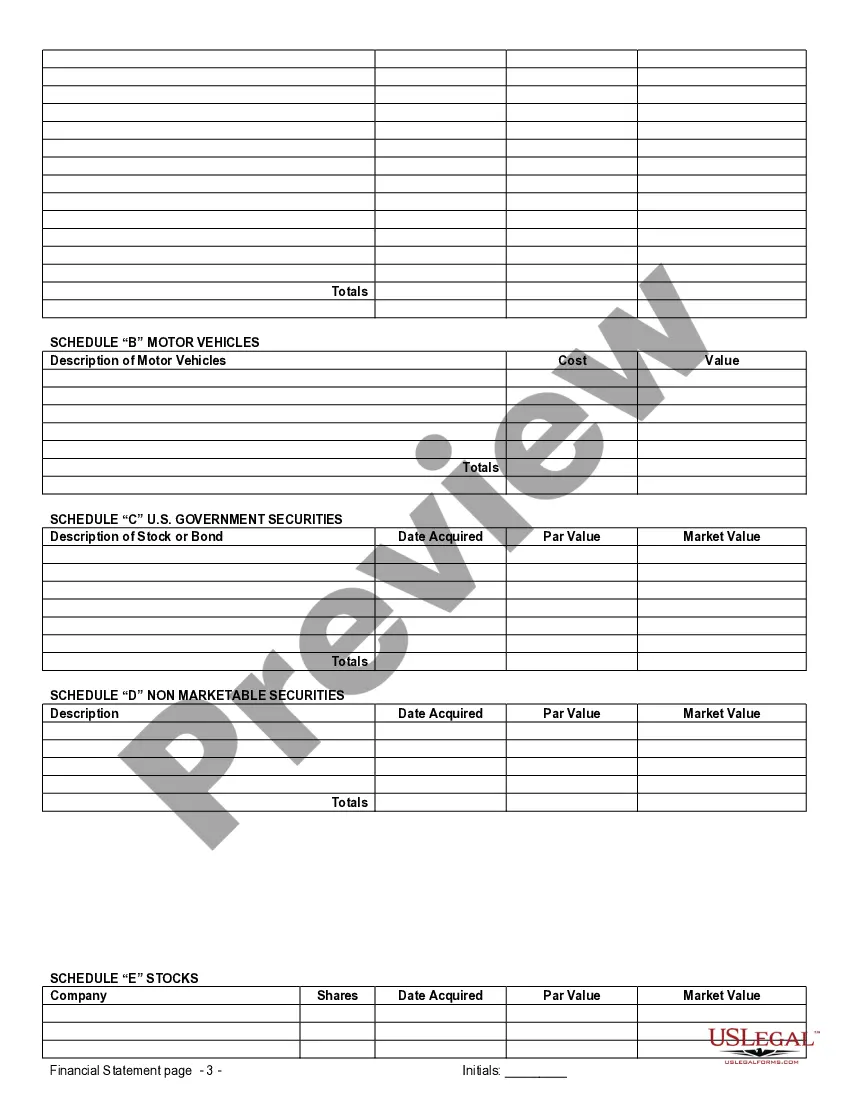

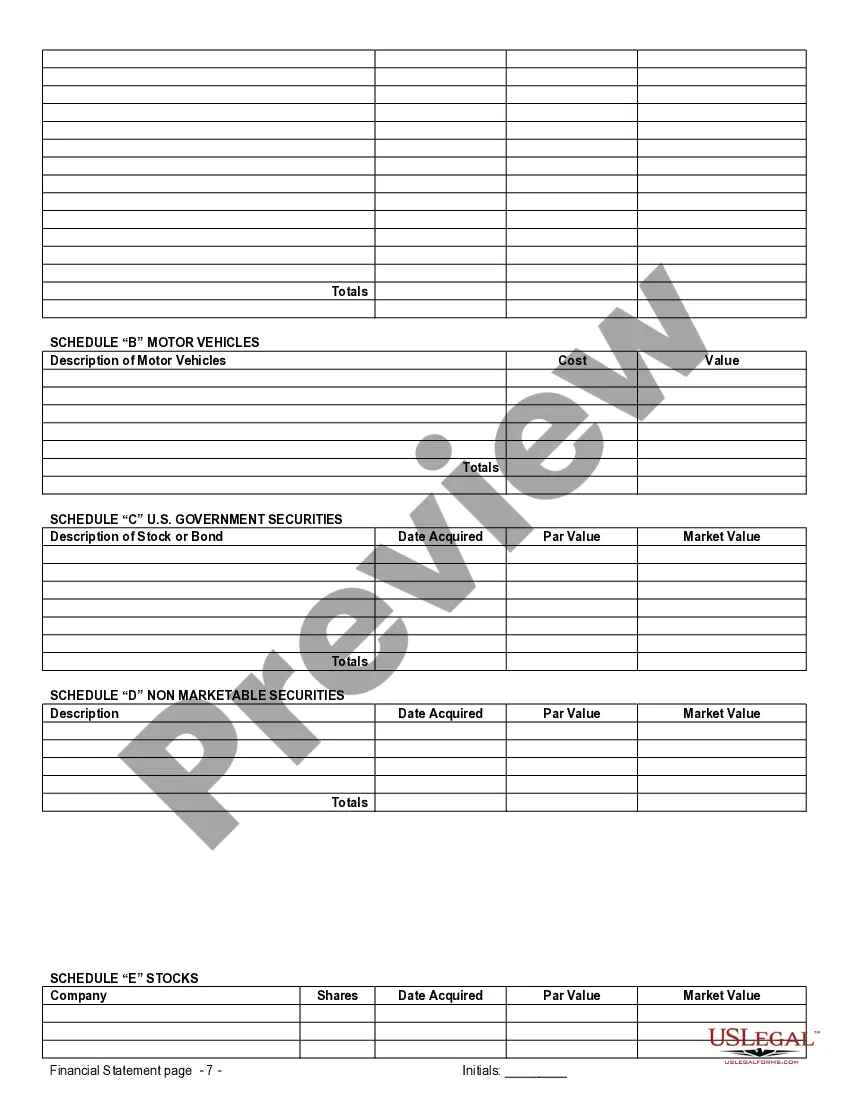

Sterling Heights Michigan Financial Statements only in Connection with Prenuptial Premarital Agreement A financial statement is a crucial document that provides comprehensive details about an individual's or a couple's financial standing. When it comes to the specific context of a prenuptial or premarital agreement in Sterling Heights, Michigan, financial statements take on a particular significance. These statements play a vital role in outlining and safeguarding each party's assets, liabilities, and overall financial status in case the marriage eventually ends in divorce or separation. Sterling Heights Michigan offers various types of financial statements designed explicitly for prenuptial or premarital agreements. These statements enable individuals or couples to disclose and protect their financial interests, ensuring transparency and fairness in marital proceedings. Here are some key types of financial statements commonly utilized in connection with prenuptial agreements: 1. Personal Balance Sheet: A personal balance sheet provides a thorough overview of an individual's or a couple's assets, liabilities, and net worth. It lists all tangible and intangible belongings, such as real estate, vehicles, bank accounts, investments, debts, and more. This document helps in evaluating the current financial situation and predicting the future impact on the marital estate. 2. Income Statement: An income statement highlights the earnings and expenses of an individual or a couple, providing a clear picture of their cash flow. This statement includes details of salaries, bonuses, rental incomes, business profits, as well as regular expenses like mortgage payments, utility bills, insurance premiums, and more. Understanding the income statement aids in determining how financial resources are allocated and protected in the event of a divorce. 3. Tax Returns: Tax returns play a vital role in assessing an individual's or a couple's financial stability and responsibilities. By reviewing tax returns, it becomes possible to ascertain sources of income, deductions, credits, and potential financial liabilities. Analyzing tax returns can help ensure that both parties' financial interests are protected and accurately reflected in the prenuptial agreement. 4. Investment Portfolio: For parties who have substantial investments, providing an investment portfolio is essential. This detailed record includes information on stocks, bonds, mutual funds, retirement accounts, and other investment vehicles. By disclosing this information, it becomes possible to determine how these investments will be divided or protected in the event of a divorce or separation. 5. Business Financial Statements: In cases where one or both parties own a business, including business financial statements is crucial. These documents detail the financial health of the business, including income, expenses, assets, liabilities, and overall profit or loss. Including business financial statements provides transparency and ensures that both parties are aware of the business's value and potential impact on the marital estate. By incorporating these various types of financial statements into a prenuptial or premarital agreement in Sterling Heights, Michigan, individuals and couples can establish an accurate, fair, and legally binding document that outlines financial expectations, protects assets, and minimizes disputes in the unfortunate event of divorce or separation. It is highly recommended consulting with an experienced attorney specializing in family law to ensure that all financial statements are prepared accurately, thoroughly, and in compliance with local laws and regulations.Sterling Heights Michigan Financial Statements only in Connection with Prenuptial Premarital Agreement A financial statement is a crucial document that provides comprehensive details about an individual's or a couple's financial standing. When it comes to the specific context of a prenuptial or premarital agreement in Sterling Heights, Michigan, financial statements take on a particular significance. These statements play a vital role in outlining and safeguarding each party's assets, liabilities, and overall financial status in case the marriage eventually ends in divorce or separation. Sterling Heights Michigan offers various types of financial statements designed explicitly for prenuptial or premarital agreements. These statements enable individuals or couples to disclose and protect their financial interests, ensuring transparency and fairness in marital proceedings. Here are some key types of financial statements commonly utilized in connection with prenuptial agreements: 1. Personal Balance Sheet: A personal balance sheet provides a thorough overview of an individual's or a couple's assets, liabilities, and net worth. It lists all tangible and intangible belongings, such as real estate, vehicles, bank accounts, investments, debts, and more. This document helps in evaluating the current financial situation and predicting the future impact on the marital estate. 2. Income Statement: An income statement highlights the earnings and expenses of an individual or a couple, providing a clear picture of their cash flow. This statement includes details of salaries, bonuses, rental incomes, business profits, as well as regular expenses like mortgage payments, utility bills, insurance premiums, and more. Understanding the income statement aids in determining how financial resources are allocated and protected in the event of a divorce. 3. Tax Returns: Tax returns play a vital role in assessing an individual's or a couple's financial stability and responsibilities. By reviewing tax returns, it becomes possible to ascertain sources of income, deductions, credits, and potential financial liabilities. Analyzing tax returns can help ensure that both parties' financial interests are protected and accurately reflected in the prenuptial agreement. 4. Investment Portfolio: For parties who have substantial investments, providing an investment portfolio is essential. This detailed record includes information on stocks, bonds, mutual funds, retirement accounts, and other investment vehicles. By disclosing this information, it becomes possible to determine how these investments will be divided or protected in the event of a divorce or separation. 5. Business Financial Statements: In cases where one or both parties own a business, including business financial statements is crucial. These documents detail the financial health of the business, including income, expenses, assets, liabilities, and overall profit or loss. Including business financial statements provides transparency and ensures that both parties are aware of the business's value and potential impact on the marital estate. By incorporating these various types of financial statements into a prenuptial or premarital agreement in Sterling Heights, Michigan, individuals and couples can establish an accurate, fair, and legally binding document that outlines financial expectations, protects assets, and minimizes disputes in the unfortunate event of divorce or separation. It is highly recommended consulting with an experienced attorney specializing in family law to ensure that all financial statements are prepared accurately, thoroughly, and in compliance with local laws and regulations.