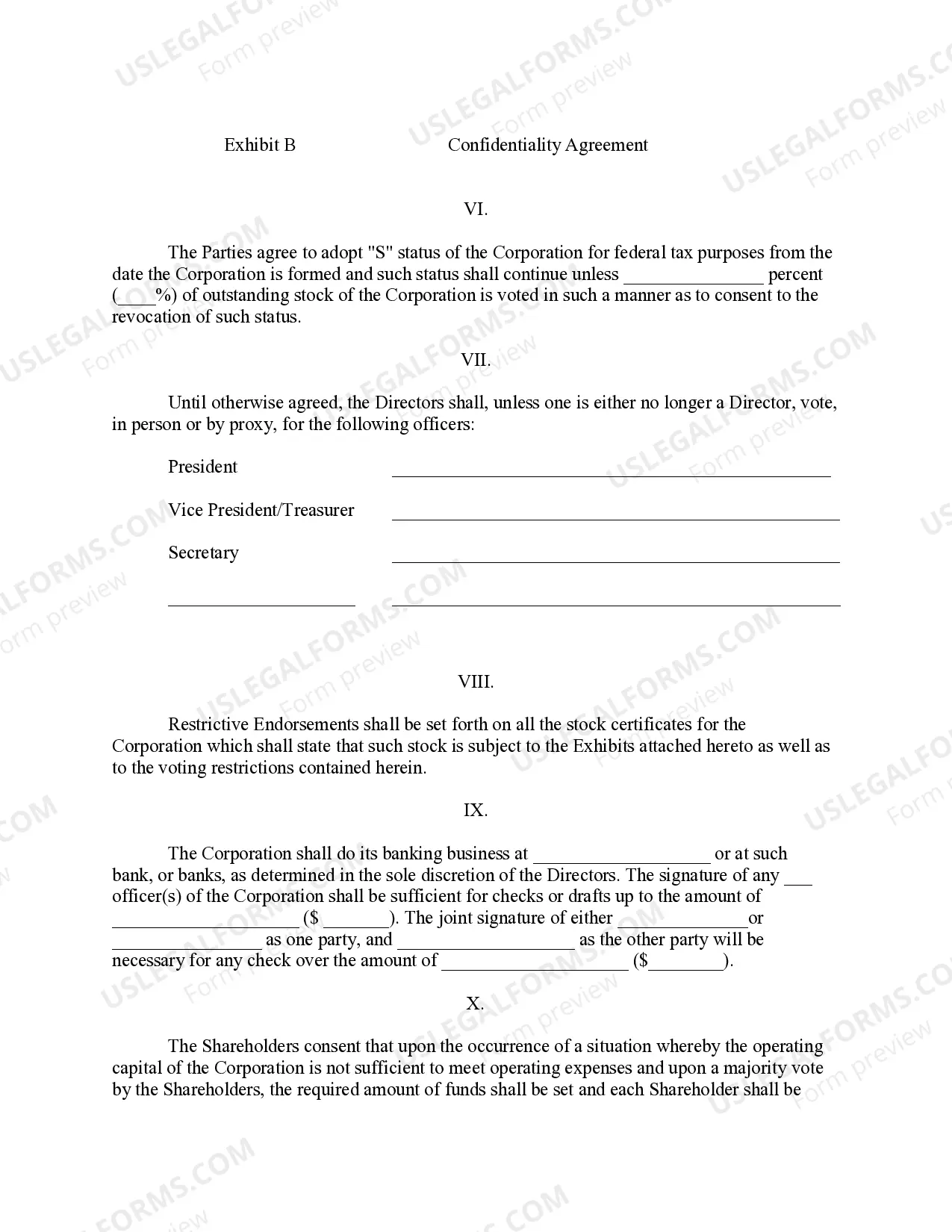

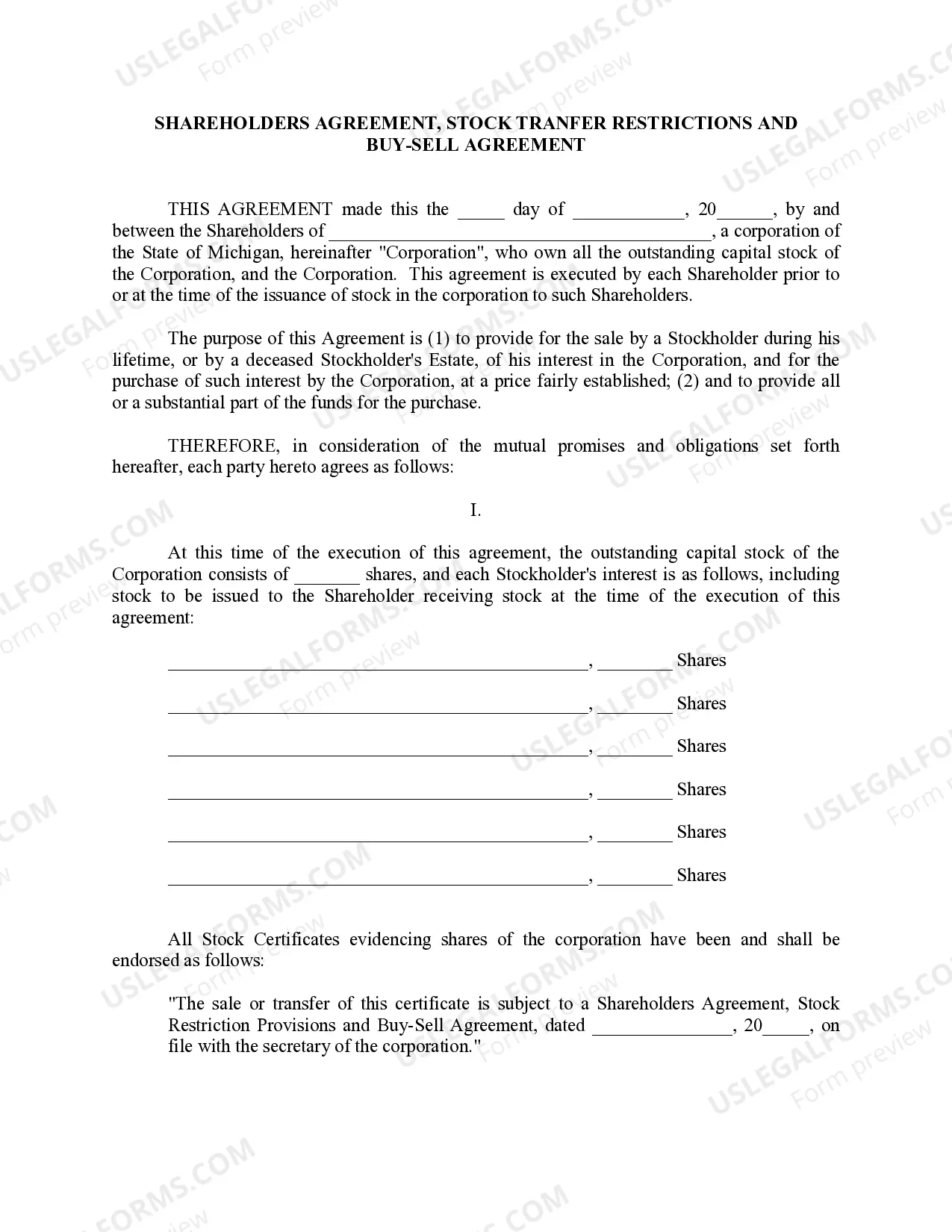

The Shareholders Agreement is signed by the shareholders to agree on how the shares of a deceased shareholder may be purchased and how shares of a person who desires to sell their stock may be obtained by the other shareholders or the corporation. Restrictions on the Sale of stock are included to accomplish the goals of the shareholders to keep the corporation under the control of the existing shareholders.

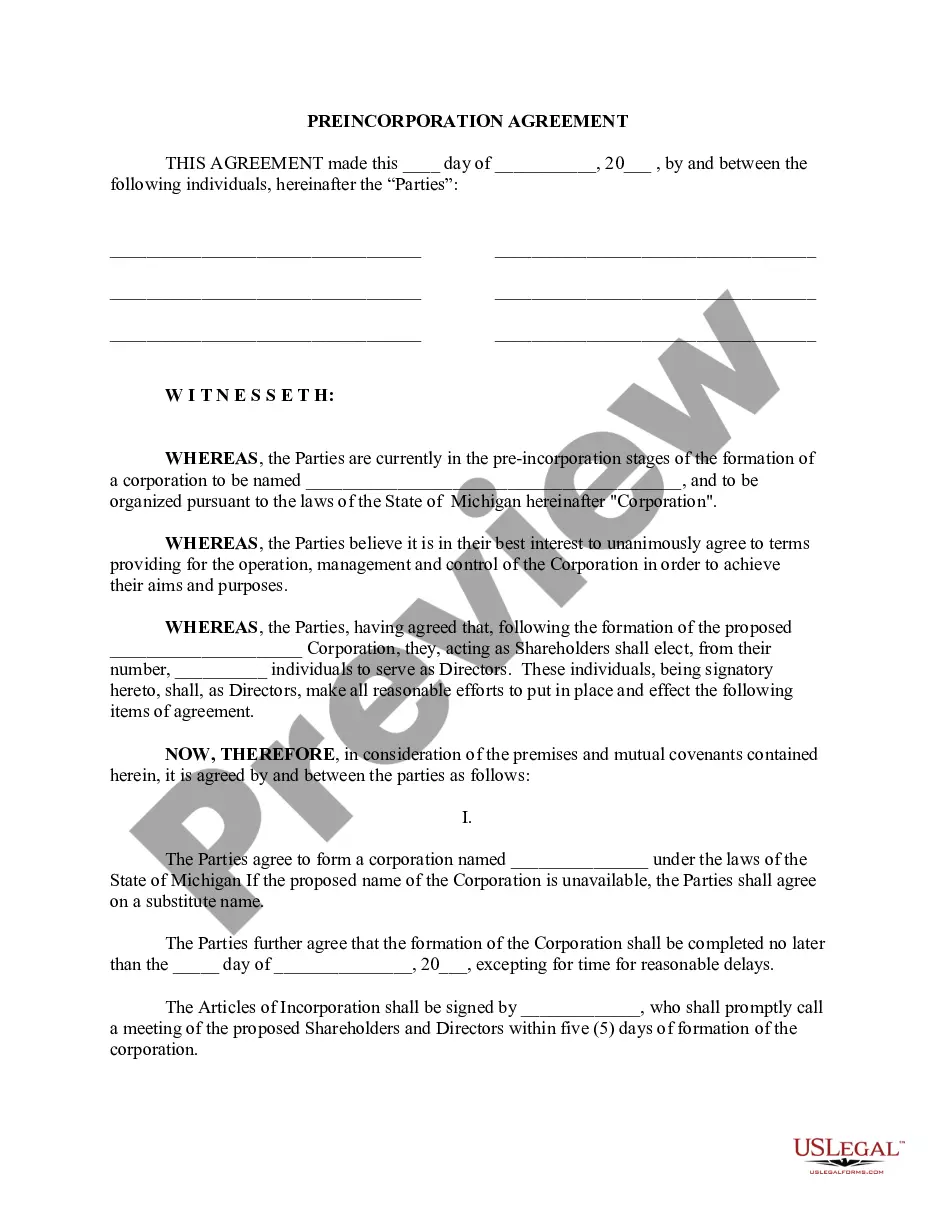

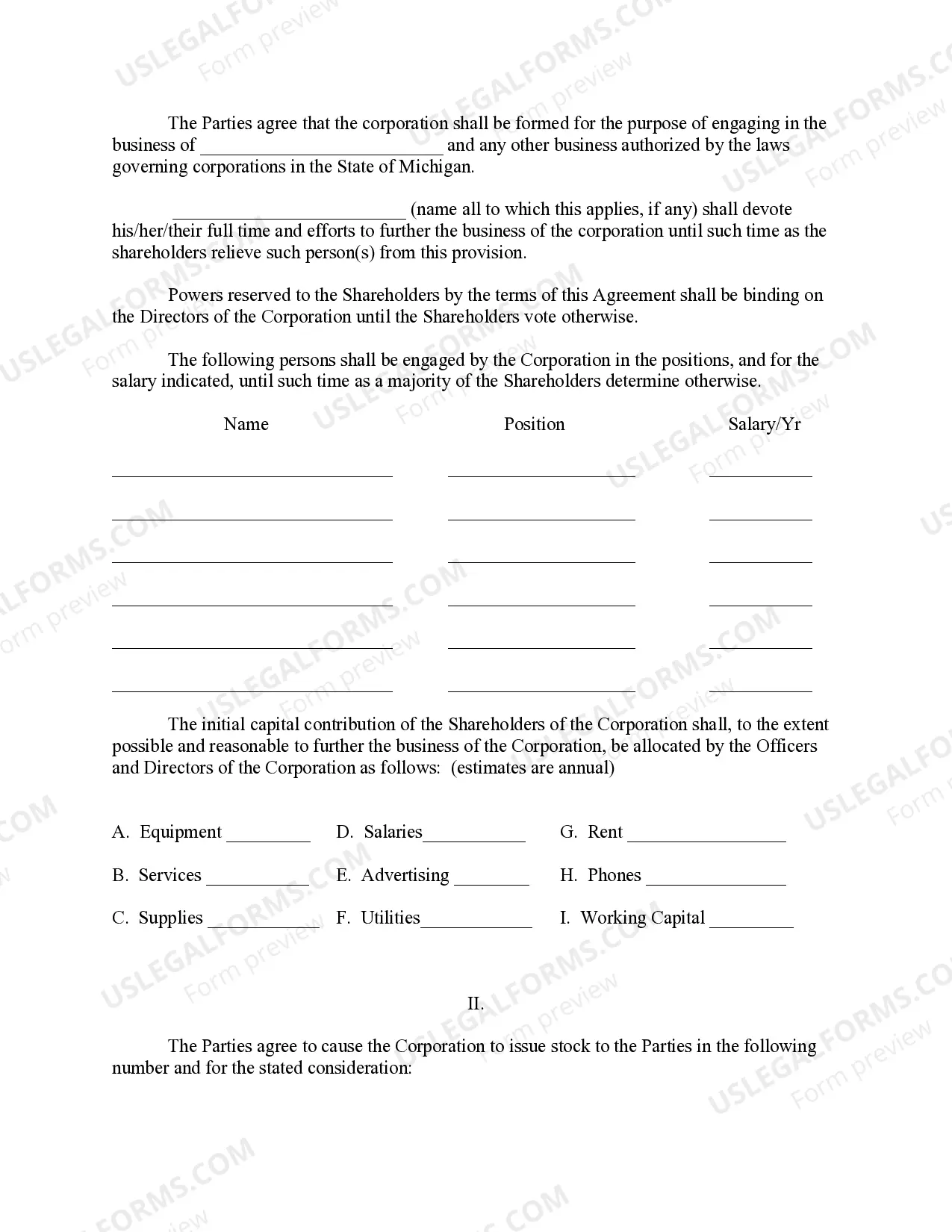

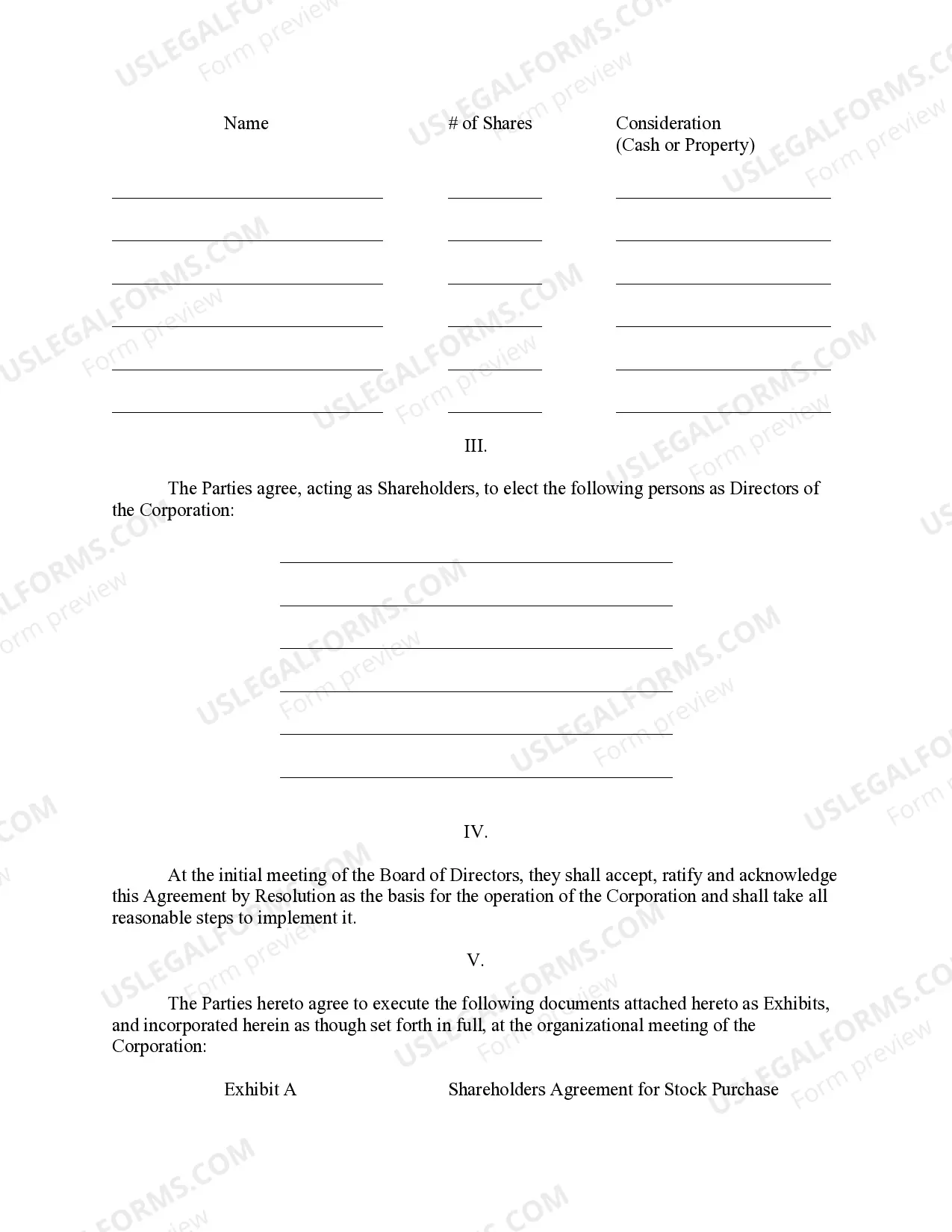

The Confidentiality Agreement is made between the shareholders wherein they agree to keep confidential certain corporate matters. In Oakland, Michigan, the process of establishing a company involves several critical legal documents. These include the Pre-Incorporation Agreement, Shareholders Agreement, and Confidentiality Agreement. Each serves specific purposes in the formation and operation of a business. Let's delve into these documents in more detail and explore the different types available. Pre-Incorporation Agreement: The Pre-Incorporation Agreement is a contractual agreement made between individuals or entities who intend to establish a new company. It outlines the terms and conditions agreed upon by the parties involved prior to the formal incorporation of the business. This agreement typically covers matters such as the company's name, its purpose, share structure, initial capital contribution, roles and responsibilities of founders, and other initial requirements. It lays the foundation for the future legal structure of the company. Shareholders Agreement: The Shareholders Agreement is a vital document that governs the rights and obligations of shareholders in a company. It is designed to ensure effective communication, decision-making, and resolution of disputes among shareholders. Key provisions in this agreement may include rules for voting rights, transferability of shares, dividend distribution, corporate governance, decision-making processes, mechanisms for dispute resolution, and restrictions on competition. The Shareholders Agreement helps protect the interests of all parties involved and provides clarity on each shareholder's rights and responsibilities. Different Types of Shareholders Agreements: 1. Voting Agreement: This type of Shareholders Agreement focuses primarily on setting rules for voting rights and decision-making procedures within the company. 2. Buy-Sell Agreement: A Buy-Sell Agreement outlines the terms and conditions under which shareholders may buy or sell their shares to other shareholders or the company itself. It helps establish a fair process for the transfer of ownership interests. 3. Drag-Along and Tag-Along Agreement: This agreement protects minority shareholders in the case of a majority shareholder's decision to sell the company. The Drag-Along provision allows majority shareholders to force minority shareholders to sell their shares along with them, while the Tag-Along provision grants the minority shareholders the right to join in the sale on the same terms as the majority shareholders. Confidentiality Agreement: A Confidentiality Agreement, also known as a Non-Disclosure Agreement (NDA), is a legal contract that establishes a confidential relationship between parties involved in a business venture, partnership, or any situation where confidential information needs to be shared. It ensures the protection of sensitive and proprietary information from unauthorized disclosure or use by third parties. This agreement typically outlines the scope of the confidential information, the obligations of the recipients, and the duration of the agreement. Different Types of Confidentiality Agreements: 1. Unilateral NDA: This agreement is commonly used when only one party needs to protect their confidential information. The recipient agrees not to disclose or use any received information for any unauthorized purpose. 2. Mutual NDA: In a mutual NDA, both parties agree to protect each other's sensitive information. This type of agreement is used when there is a mutual exchange of confidential information between the parties involved. In conclusion, the Oakland, Michigan Pre-Incorporation Agreement, Shareholders Agreement, and Confidentiality Agreement are crucial legal documents that play a significant role in the establishment and operation of a business. Understanding the different types of these agreements is essential for ensuring legal compliance and safeguarding the interests and rights of all parties involved.

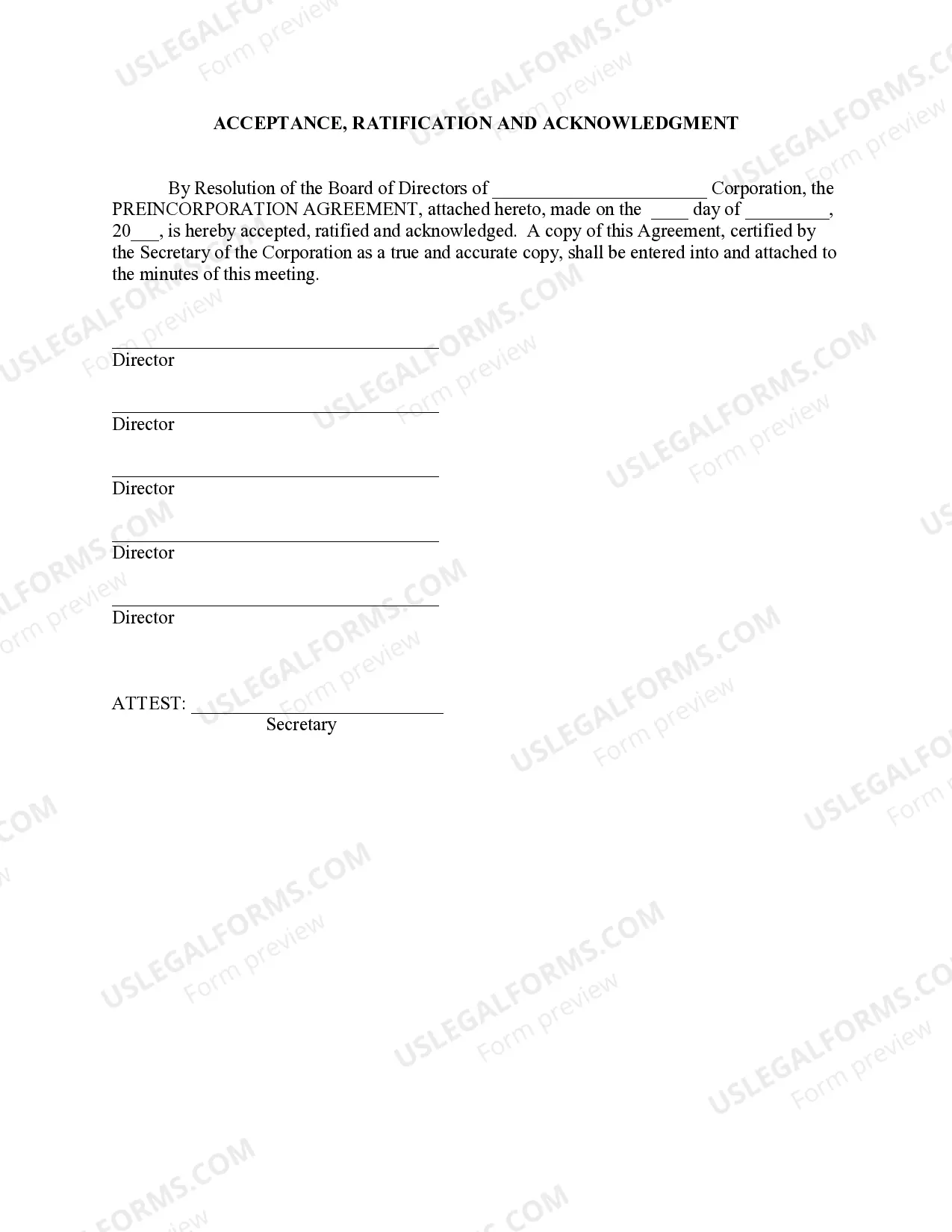

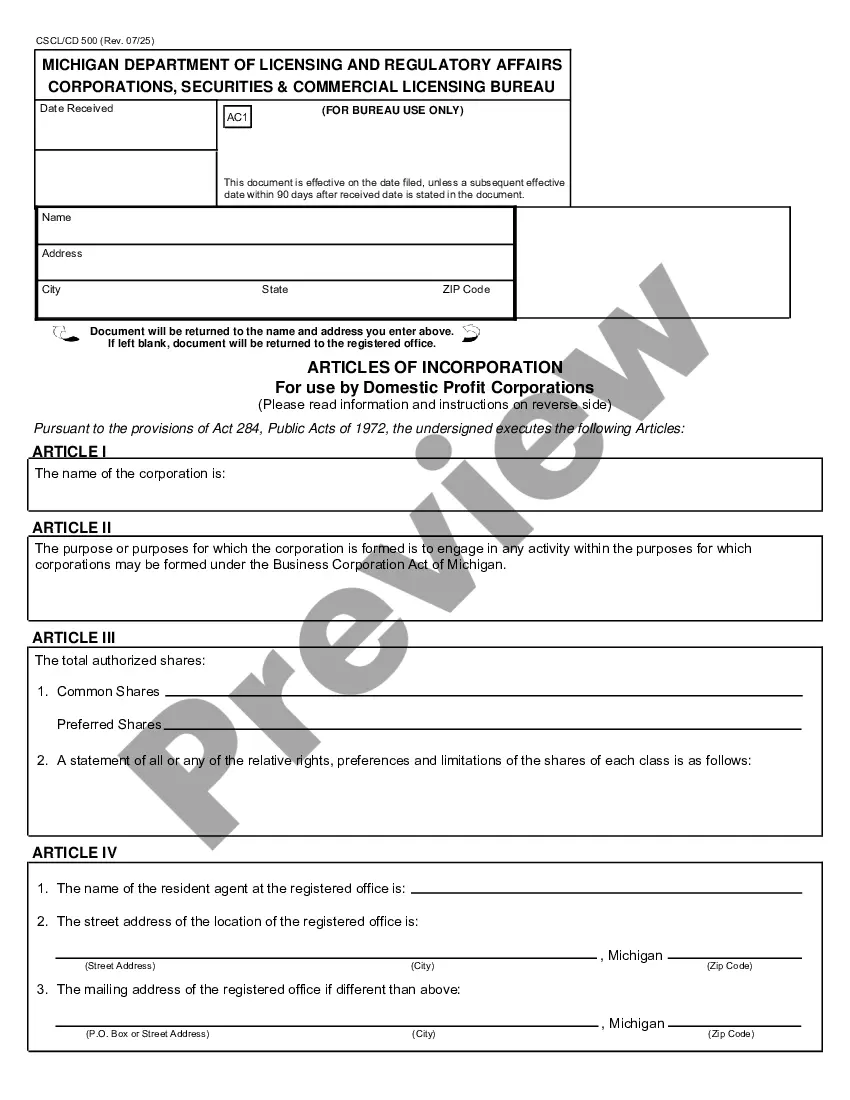

In Oakland, Michigan, the process of establishing a company involves several critical legal documents. These include the Pre-Incorporation Agreement, Shareholders Agreement, and Confidentiality Agreement. Each serves specific purposes in the formation and operation of a business. Let's delve into these documents in more detail and explore the different types available. Pre-Incorporation Agreement: The Pre-Incorporation Agreement is a contractual agreement made between individuals or entities who intend to establish a new company. It outlines the terms and conditions agreed upon by the parties involved prior to the formal incorporation of the business. This agreement typically covers matters such as the company's name, its purpose, share structure, initial capital contribution, roles and responsibilities of founders, and other initial requirements. It lays the foundation for the future legal structure of the company. Shareholders Agreement: The Shareholders Agreement is a vital document that governs the rights and obligations of shareholders in a company. It is designed to ensure effective communication, decision-making, and resolution of disputes among shareholders. Key provisions in this agreement may include rules for voting rights, transferability of shares, dividend distribution, corporate governance, decision-making processes, mechanisms for dispute resolution, and restrictions on competition. The Shareholders Agreement helps protect the interests of all parties involved and provides clarity on each shareholder's rights and responsibilities. Different Types of Shareholders Agreements: 1. Voting Agreement: This type of Shareholders Agreement focuses primarily on setting rules for voting rights and decision-making procedures within the company. 2. Buy-Sell Agreement: A Buy-Sell Agreement outlines the terms and conditions under which shareholders may buy or sell their shares to other shareholders or the company itself. It helps establish a fair process for the transfer of ownership interests. 3. Drag-Along and Tag-Along Agreement: This agreement protects minority shareholders in the case of a majority shareholder's decision to sell the company. The Drag-Along provision allows majority shareholders to force minority shareholders to sell their shares along with them, while the Tag-Along provision grants the minority shareholders the right to join in the sale on the same terms as the majority shareholders. Confidentiality Agreement: A Confidentiality Agreement, also known as a Non-Disclosure Agreement (NDA), is a legal contract that establishes a confidential relationship between parties involved in a business venture, partnership, or any situation where confidential information needs to be shared. It ensures the protection of sensitive and proprietary information from unauthorized disclosure or use by third parties. This agreement typically outlines the scope of the confidential information, the obligations of the recipients, and the duration of the agreement. Different Types of Confidentiality Agreements: 1. Unilateral NDA: This agreement is commonly used when only one party needs to protect their confidential information. The recipient agrees not to disclose or use any received information for any unauthorized purpose. 2. Mutual NDA: In a mutual NDA, both parties agree to protect each other's sensitive information. This type of agreement is used when there is a mutual exchange of confidential information between the parties involved. In conclusion, the Oakland, Michigan Pre-Incorporation Agreement, Shareholders Agreement, and Confidentiality Agreement are crucial legal documents that play a significant role in the establishment and operation of a business. Understanding the different types of these agreements is essential for ensuring legal compliance and safeguarding the interests and rights of all parties involved.