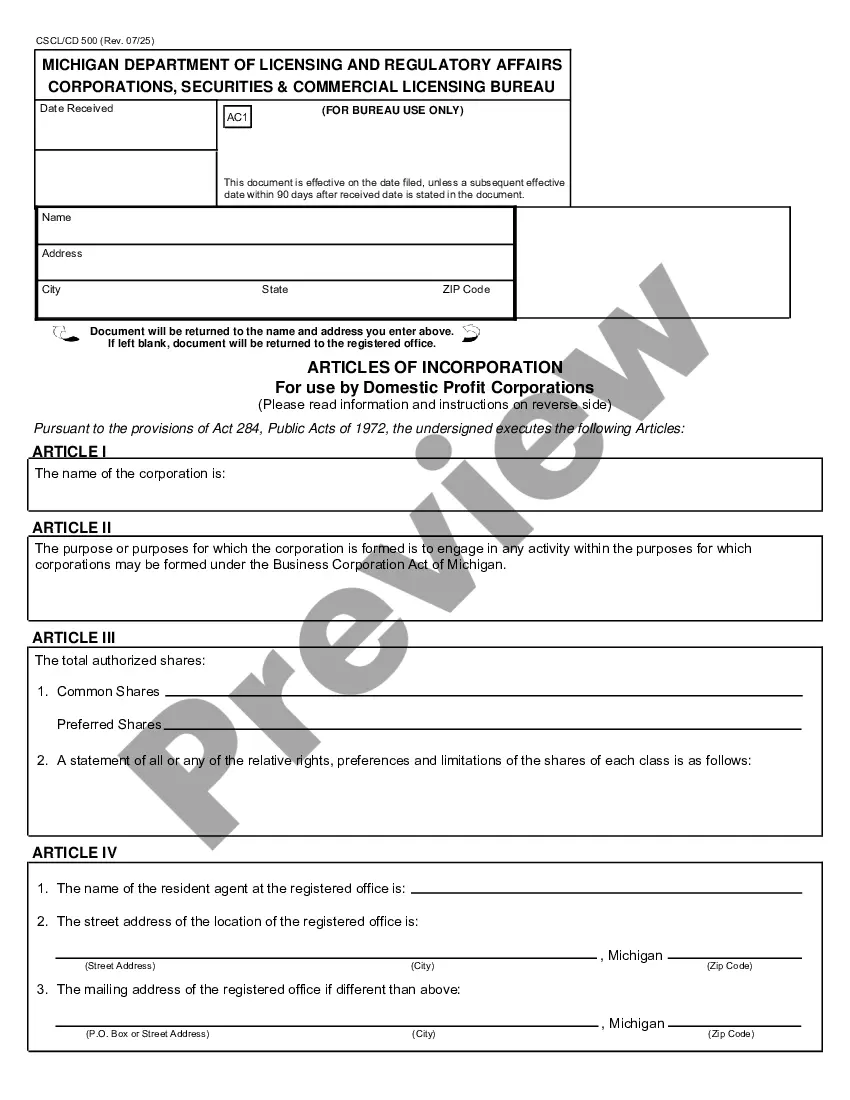

This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new non-profit corporation. The form contains basic information concerning the corporation, normally including the corporate name, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

The Detroit Michigan Articles of Incorporation for Domestic Nonprofit Corporation is a legal document that must be filed with the Michigan Department of Licensing and Regulatory Affairs (LARA) by individuals or groups looking to establish a nonprofit corporation within the city of Detroit. The purpose of these articles is to officially register the corporation with the state and outline its basic structure and operating guidelines. The Articles of Incorporation for Domestic Nonprofit Corporation in Detroit, Michigan, start by including the name of the corporation, which must comply with the state's regulations, including the requirement to contain the word "corporation," "incorporated," or an abbreviation (such as "corp." or "inc."). Next, the articles should include the corporation's registered office and registered agent. The registered office is the physical address where legal documents and official correspondence will be sent, while the registered agent is the individual or entity responsible for receiving these documents on behalf of the corporation. Both the registered office and agent must be located in Detroit. The articles should also contain a statement of purpose, which outlines the nonprofit's charitable, educational, scientific, religious, or other qualifying purposes. This statement must demonstrate that the corporation will operate exclusively for these purposes and will not engage in activities that are in conflict with its nonprofit status. Another important section is the membership provision, which outlines whether the corporation will have members or will be a non-membership corporation. A membership corporation allows individuals to become members and have voting rights, whereas a non-membership corporation does not have members with voting rights. Furthermore, the articles must specify the initial board of directors, including their names and addresses. The board of directors is responsible for making major decisions and overseeing the organization's operations. The number of directors can vary, but it should adhere to the legal requirements set by the state. Additionally, the articles may include provisions regarding the corporation's governing structure, meetings, voting procedures, and other operational matters. These provisions are essential to ensuring the corporation operates smoothly and in compliance with relevant laws and regulations. It should be noted that while the general structure of the articles remains the same, specific requirements and provisions may differ based on the type of nonprofit corporation being formed. Some common variations include religious corporations, public benefit corporations, and mutual benefit corporations. These different types of nonprofit corporations have specific guidelines and requirements that must be addressed in the Articles of Incorporation. In summary, the Detroit Michigan Articles of Incorporation for Domestic Nonprofit Corporation serve as the foundation for establishing and organizing a nonprofit corporation within the city. By filing these articles with the appropriate state agency, the corporation gains legal recognition and can begin pursuing its charitable or educational goals in compliance with the state and federal laws.The Detroit Michigan Articles of Incorporation for Domestic Nonprofit Corporation is a legal document that must be filed with the Michigan Department of Licensing and Regulatory Affairs (LARA) by individuals or groups looking to establish a nonprofit corporation within the city of Detroit. The purpose of these articles is to officially register the corporation with the state and outline its basic structure and operating guidelines. The Articles of Incorporation for Domestic Nonprofit Corporation in Detroit, Michigan, start by including the name of the corporation, which must comply with the state's regulations, including the requirement to contain the word "corporation," "incorporated," or an abbreviation (such as "corp." or "inc."). Next, the articles should include the corporation's registered office and registered agent. The registered office is the physical address where legal documents and official correspondence will be sent, while the registered agent is the individual or entity responsible for receiving these documents on behalf of the corporation. Both the registered office and agent must be located in Detroit. The articles should also contain a statement of purpose, which outlines the nonprofit's charitable, educational, scientific, religious, or other qualifying purposes. This statement must demonstrate that the corporation will operate exclusively for these purposes and will not engage in activities that are in conflict with its nonprofit status. Another important section is the membership provision, which outlines whether the corporation will have members or will be a non-membership corporation. A membership corporation allows individuals to become members and have voting rights, whereas a non-membership corporation does not have members with voting rights. Furthermore, the articles must specify the initial board of directors, including their names and addresses. The board of directors is responsible for making major decisions and overseeing the organization's operations. The number of directors can vary, but it should adhere to the legal requirements set by the state. Additionally, the articles may include provisions regarding the corporation's governing structure, meetings, voting procedures, and other operational matters. These provisions are essential to ensuring the corporation operates smoothly and in compliance with relevant laws and regulations. It should be noted that while the general structure of the articles remains the same, specific requirements and provisions may differ based on the type of nonprofit corporation being formed. Some common variations include religious corporations, public benefit corporations, and mutual benefit corporations. These different types of nonprofit corporations have specific guidelines and requirements that must be addressed in the Articles of Incorporation. In summary, the Detroit Michigan Articles of Incorporation for Domestic Nonprofit Corporation serve as the foundation for establishing and organizing a nonprofit corporation within the city. By filing these articles with the appropriate state agency, the corporation gains legal recognition and can begin pursuing its charitable or educational goals in compliance with the state and federal laws.