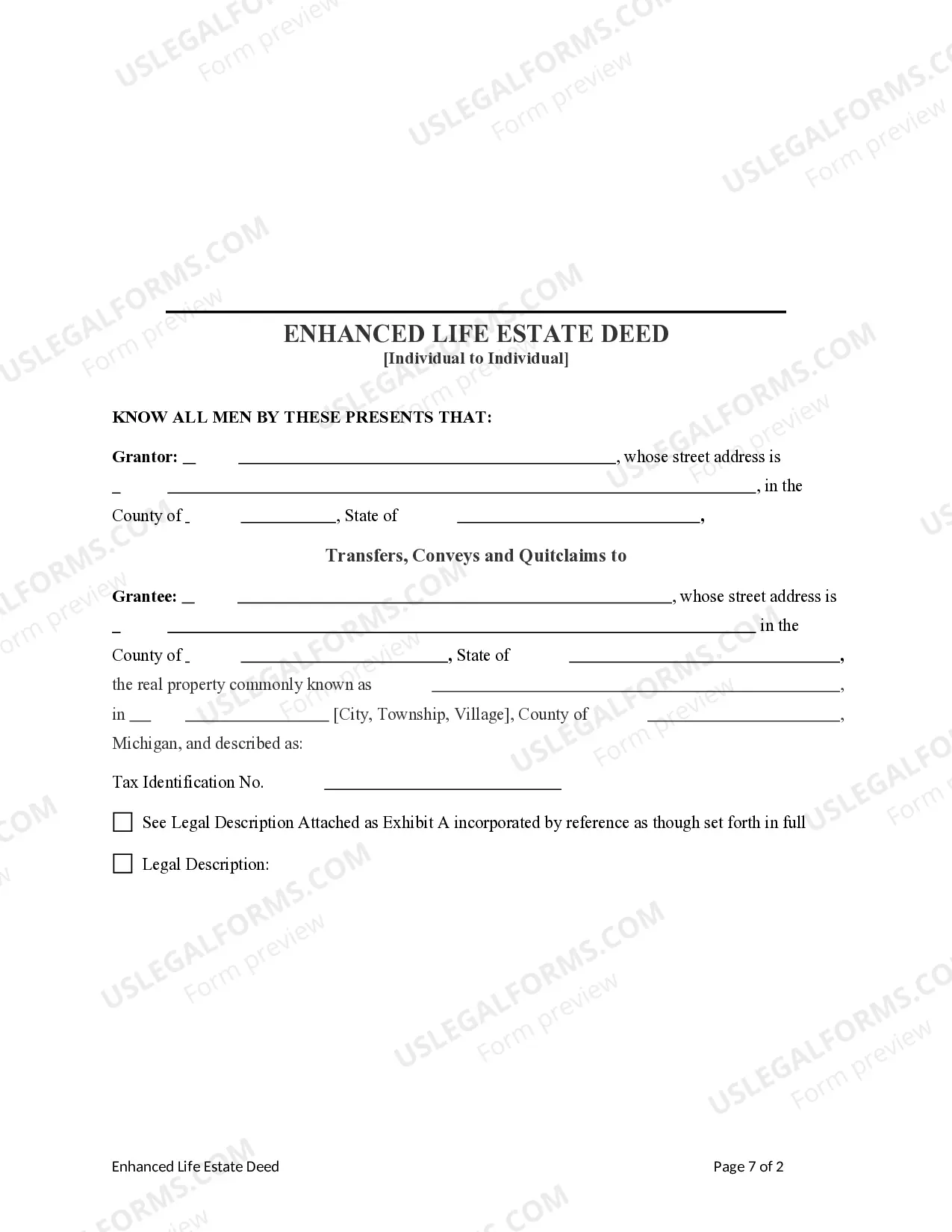

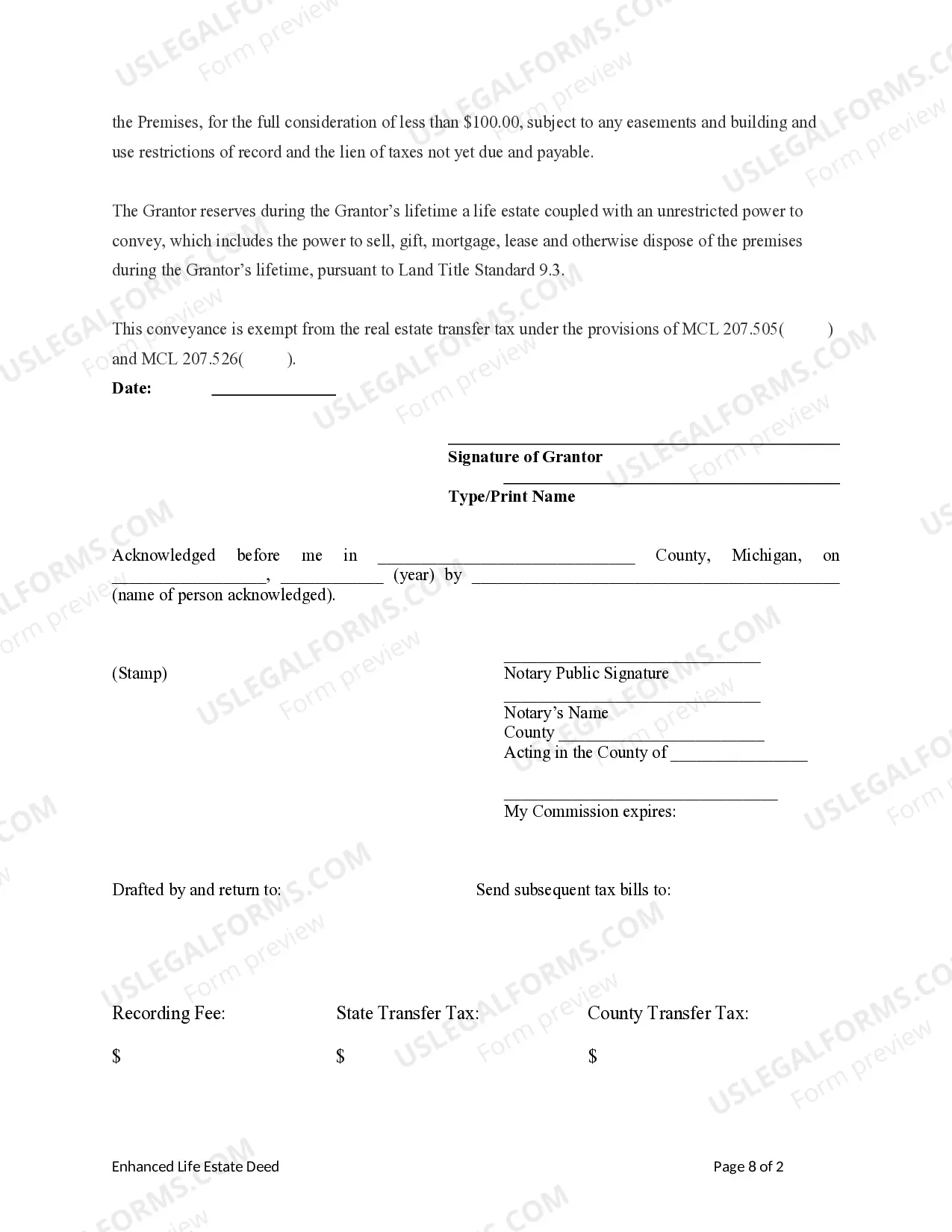

This form is a Quitclaim Deed with a retained Enhanced Life Estate where the Grantor is an individual and the Grantee is an individual. It is also known as a "Lady Bird" Deed. Grantor conveys the property to Grantee subject to an enhanced retained life estate. The Grantor retains the right to sell, encumber, mortgage or otherwise impair the interest Grantee might receive in the future, without joinder or notice to Grantee, with the exception of the right to transfer the property by will. This deed complies with all state statutory laws.

Grand Rapids Michigan Enhanced Life Estate or Lady Bird Deed — Individual to Individual: Understanding the Benefits and Types Grand Rapids, Michigan offers residents and property owners various estate planning tools to ensure seamless transfer of real estate assets. One popular option is the Enhanced Life Estate, commonly referred to as the Lady Bird Deed. This versatile legal instrument allows individuals to transfer real estate to another individual while retaining certain rights and benefits during their lifetime. Let's delve deeper into the concept of Grand Rapids Michigan Enhanced Life Estate or Lady Bird Deed — Individual to Individual and explore its different types: 1. Definition and Purpose: The Grand Rapids Michigan Enhanced Life Estate, or Lady Bird Deed, is a legal document that allows property owners (granters) to transfer real estate to a named individual (grantee) while retaining control and benefits of the property until their death. This unique type of deed avoids probate, facilitates Medicaid planning, and provides tax benefits to the granter. 2. Retained Rights and Benefits: With an Enhanced Life Estate, individuals can retain several crucial rights and benefits, including the ability to live in the property for life, retain complete control over the property, modify or sell the property without the grantee's consent, and preserve their eligibility for government benefits. 3. Avoidance of Probate: One of the key advantages of an Enhanced Life Estate is its ability to bypass the probate process. Upon the granter's death, the property automatically transfers to the grantee, without the need for court involvement, thus saving time and costs associated with probate administration. 4. Medicaid Planning: Another essential benefit of the Lady Bird Deed is its usefulness in Medicaid planning. By transferring the property through an Enhanced Life Estate, individuals can protect their valuable property from being subject to Medicaid recovery, allowing them to retain their eligibility for government-provided healthcare benefits. 5. Tax Benefits: Grand Rapids Michigan Enhanced Life Estate provides potential tax benefits to the granter. By retaining the right to sell or modify the property without the grantee's consent, the individual can avoid triggering gift tax issues that would arise with a traditional transfer. Different Types of Grand Rapids Michigan Enhanced Life Estate or Lady Bird Deed — Individual to Individual: 1. Traditional Enhanced Life Estate Deed: The most common type of Lady Bird Deed in Grand Rapids, Michigan, is the traditional Enhanced Life Estate Deed. It allows the granter to retain the rights and benefits mentioned above while designating a specific individual as the grantee. 2. Joint Tenancy with Enhanced Life Estate Deed: Another variation of the Enhanced Life Estate is the Joint Tenancy with Enhanced Life Estate Deed. In this type, multiple individuals, typically spouses, can be named as grantees, providing them both with the rights and benefits associated with the Enhanced Life Estate. In conclusion, the Grand Rapids Michigan Enhanced Life Estate, also known as the Lady Bird Deed, provides an efficient and flexible way for individuals to transfer real estate assets while maintaining control and benefits during their lifetime. Whether opting for the traditional or joint tenancy variation, this type of deed offers numerous advantages, including probate avoidance, Medicaid planning capabilities, and potential tax benefits. Consider consulting with a qualified estate planning attorney in Grand Rapids, Michigan, to determine which type of Enhanced Life Estate best suits your specific needs.Grand Rapids Michigan Enhanced Life Estate or Lady Bird Deed — Individual to Individual: Understanding the Benefits and Types Grand Rapids, Michigan offers residents and property owners various estate planning tools to ensure seamless transfer of real estate assets. One popular option is the Enhanced Life Estate, commonly referred to as the Lady Bird Deed. This versatile legal instrument allows individuals to transfer real estate to another individual while retaining certain rights and benefits during their lifetime. Let's delve deeper into the concept of Grand Rapids Michigan Enhanced Life Estate or Lady Bird Deed — Individual to Individual and explore its different types: 1. Definition and Purpose: The Grand Rapids Michigan Enhanced Life Estate, or Lady Bird Deed, is a legal document that allows property owners (granters) to transfer real estate to a named individual (grantee) while retaining control and benefits of the property until their death. This unique type of deed avoids probate, facilitates Medicaid planning, and provides tax benefits to the granter. 2. Retained Rights and Benefits: With an Enhanced Life Estate, individuals can retain several crucial rights and benefits, including the ability to live in the property for life, retain complete control over the property, modify or sell the property without the grantee's consent, and preserve their eligibility for government benefits. 3. Avoidance of Probate: One of the key advantages of an Enhanced Life Estate is its ability to bypass the probate process. Upon the granter's death, the property automatically transfers to the grantee, without the need for court involvement, thus saving time and costs associated with probate administration. 4. Medicaid Planning: Another essential benefit of the Lady Bird Deed is its usefulness in Medicaid planning. By transferring the property through an Enhanced Life Estate, individuals can protect their valuable property from being subject to Medicaid recovery, allowing them to retain their eligibility for government-provided healthcare benefits. 5. Tax Benefits: Grand Rapids Michigan Enhanced Life Estate provides potential tax benefits to the granter. By retaining the right to sell or modify the property without the grantee's consent, the individual can avoid triggering gift tax issues that would arise with a traditional transfer. Different Types of Grand Rapids Michigan Enhanced Life Estate or Lady Bird Deed — Individual to Individual: 1. Traditional Enhanced Life Estate Deed: The most common type of Lady Bird Deed in Grand Rapids, Michigan, is the traditional Enhanced Life Estate Deed. It allows the granter to retain the rights and benefits mentioned above while designating a specific individual as the grantee. 2. Joint Tenancy with Enhanced Life Estate Deed: Another variation of the Enhanced Life Estate is the Joint Tenancy with Enhanced Life Estate Deed. In this type, multiple individuals, typically spouses, can be named as grantees, providing them both with the rights and benefits associated with the Enhanced Life Estate. In conclusion, the Grand Rapids Michigan Enhanced Life Estate, also known as the Lady Bird Deed, provides an efficient and flexible way for individuals to transfer real estate assets while maintaining control and benefits during their lifetime. Whether opting for the traditional or joint tenancy variation, this type of deed offers numerous advantages, including probate avoidance, Medicaid planning capabilities, and potential tax benefits. Consider consulting with a qualified estate planning attorney in Grand Rapids, Michigan, to determine which type of Enhanced Life Estate best suits your specific needs.