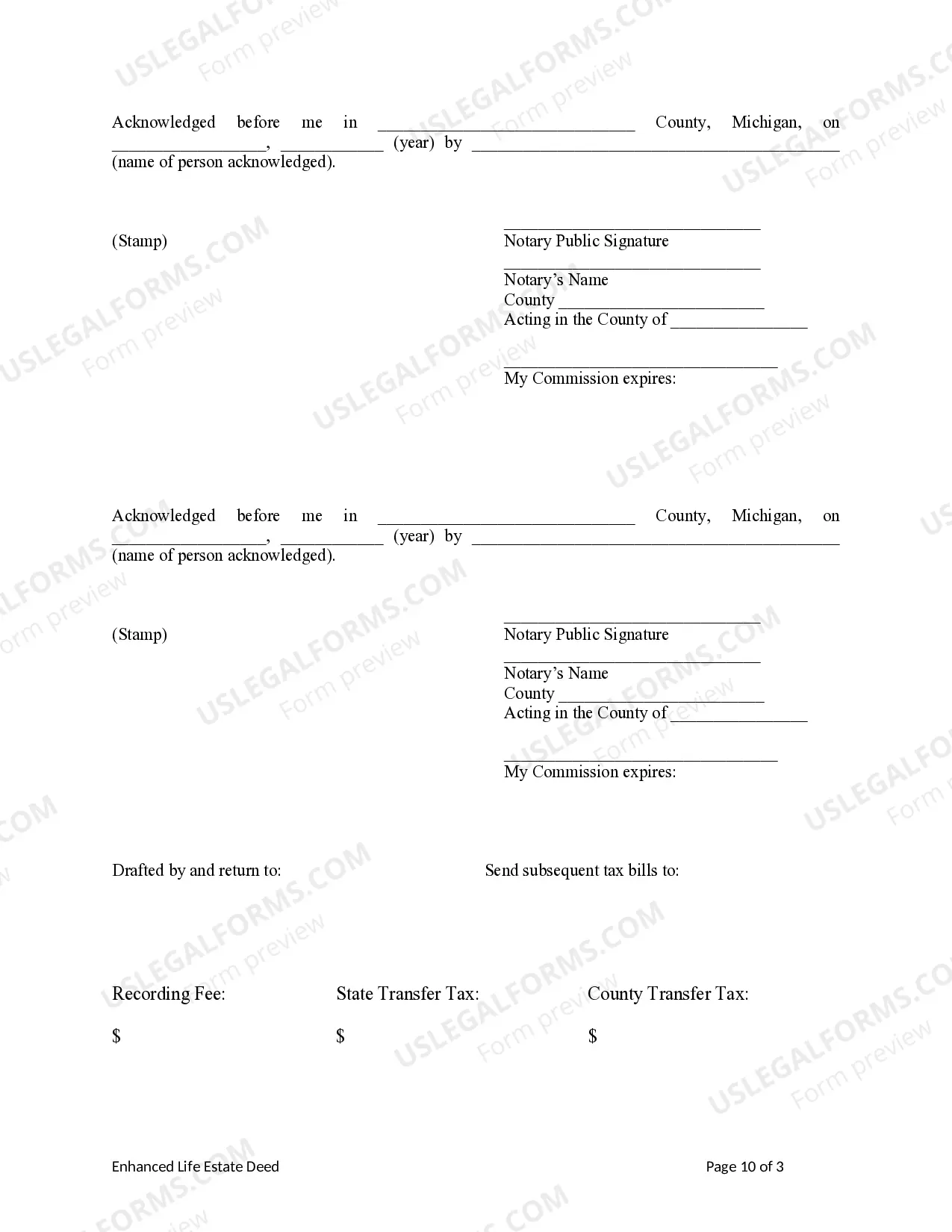

This form is a Enhanced Life Estate Deed, a.k.a. a Lady Bird Deed, where the Grantors are two individuals, or husband and wife, and the Grantees are four (4) individuals. This transfer is revocable by either Grantor until their death and effective only upon the death of the last surviving Grantor. This deed complies with all state statutory laws.

The Detroit Michigan Enhanced Life Estate Deed — Husband and Wife / Two Individuals to Four Individuals is a legal document that facilitates the transfer of ownership of a property from a married couple or two individuals to four individuals, while retaining certain rights and privileges for the original owners. It offers a financial planning tool to ensure the smooth transition of real estate assets and provides specific benefits for the original owners. This type of deed is also commonly known as a Lady Bird Deed, which allows a married couple or two individuals (the granters) to transfer their property to four individuals (the grantees) while reserving a life estate for themselves. A life estate ensures that the original owners have the right to live on and use the property until their deaths. This type of deed is "enhanced" because it includes provisions that can help protect and preserve Medicaid eligibility for the original owners, in the event long-term care becomes necessary. By using this type of deed, the granters can avoid the need for probate and potentially reduce tax consequences that come with transferring property to heirs or beneficiaries through a will or traditional deed. This efficient transfer of ownership can help save time and money, while ensuring that the intended beneficiaries receive the property seamlessly. Key features of the Detroit Michigan Enhanced Life Estate Deed — Husband and Wife / Two Individuals to Four Individuals include: 1. Retention of control: The granters maintain control over the property during their lifetimes, including the ability to sell, mortgage, or lease the property if they wish to do so. 2. Right of possession: The granters have the exclusive right to live on and use the property until they pass away. This right is often referred to as a life estate. 3. Enhanced Medicaid planning: The inclusion of specific language in the deed can help preserve the original owners' Medicaid eligibility. Medicaid is a government program that provides healthcare assistance to low-income individuals and families, particularly in relation to long-term care costs. 4. Transfer of ownership: Upon the granters' death, the property automatically passes to the four individuals designated as grantees in the deed. This transfer occurs outside the probate process, streamlining the distribution of assets. 5. Protection from creditors: The enhanced life estate deed also provides potential protection against creditors' claims. The property held in the life estate is generally shielded from being used to satisfy the granters' debts or obligations. It is essential to consult an experienced attorney in Detroit, Michigan, for guidance on properly executing the Enhanced Life Estate Deed — Husband and Wife / Two Individuals to Four Individuals.