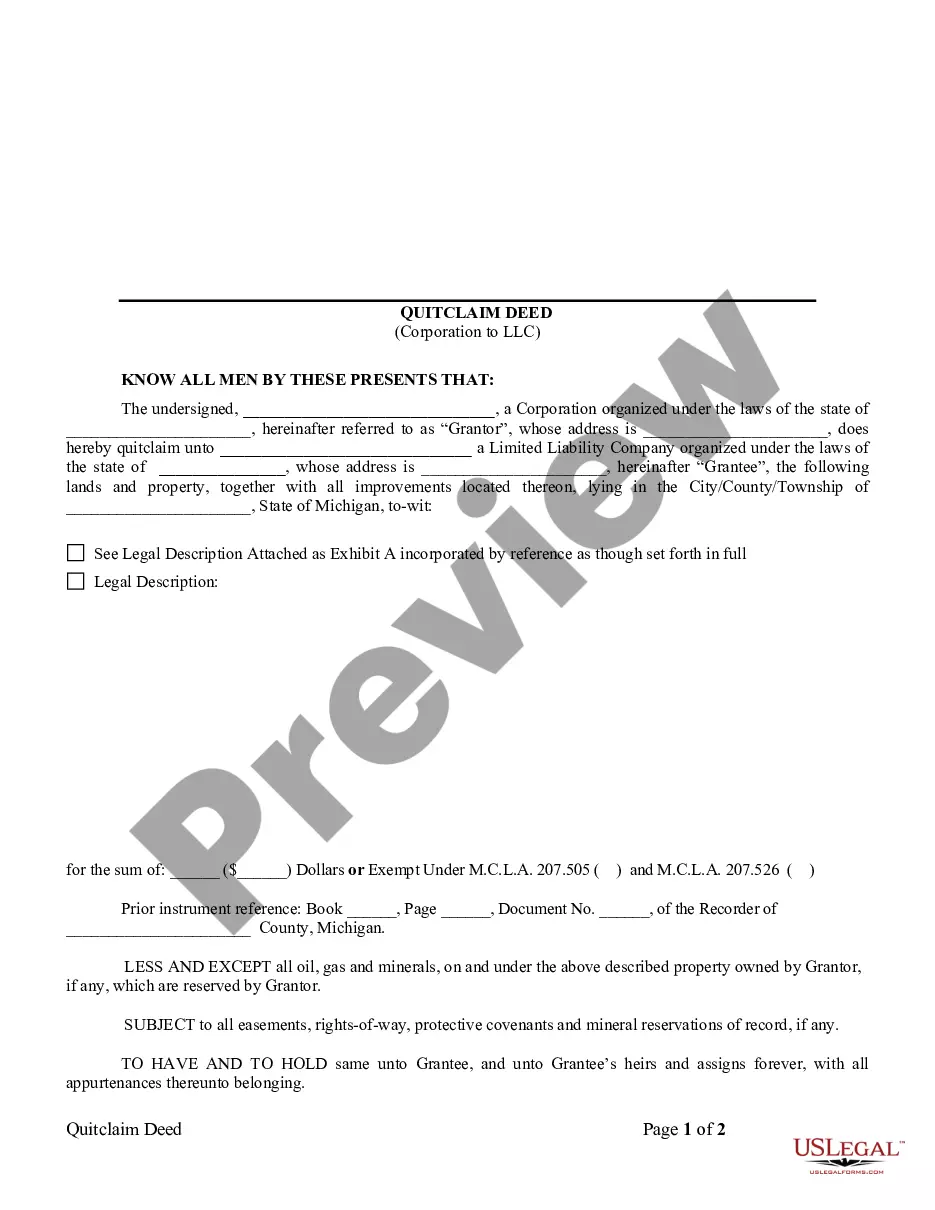

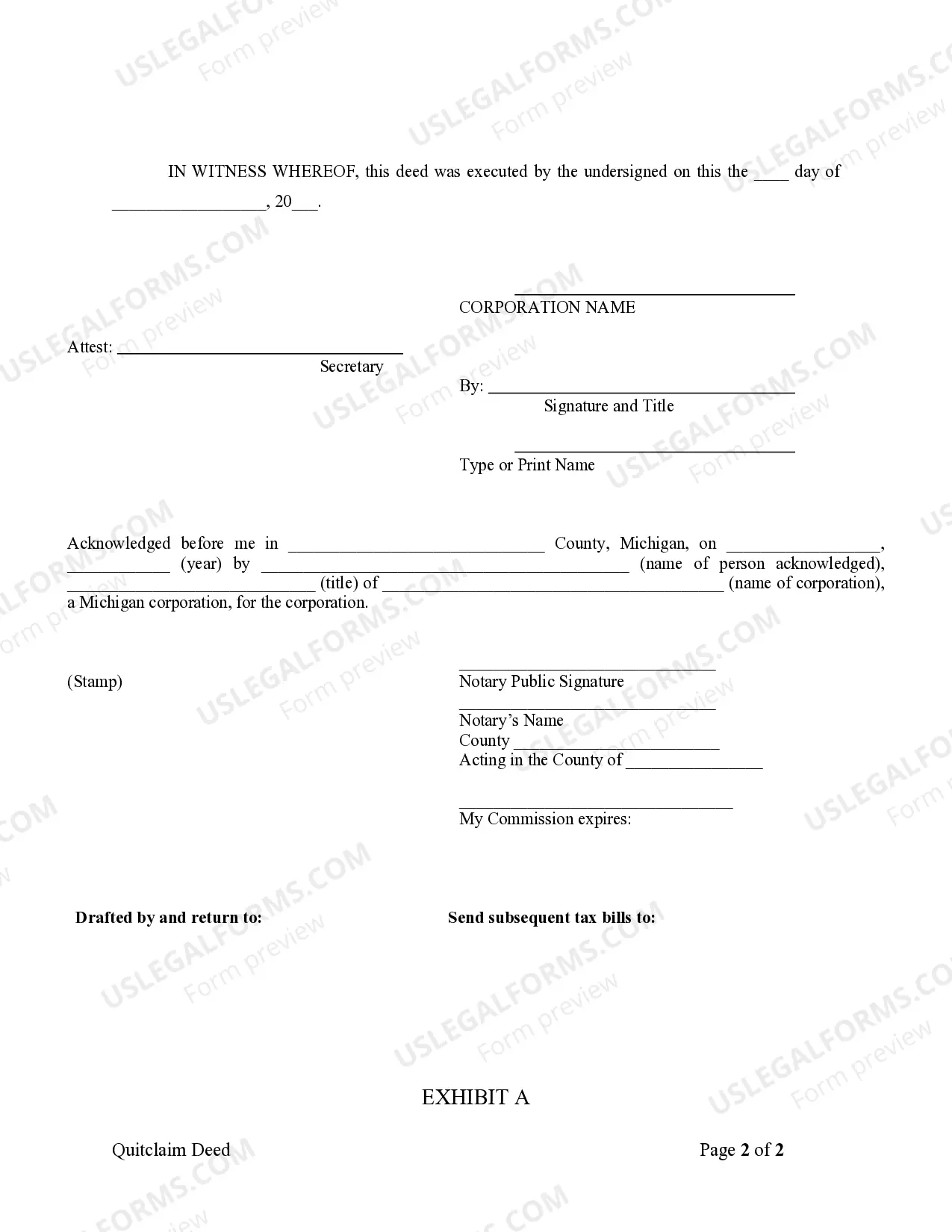

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Grand Rapids Michigan Quitclaim Deed from Corporation to LLC is a legal document that facilitates the transfer of property ownership rights from a corporation to a limited liability company (LLC) in the city of Grand Rapids, Michigan. This type of deed is commonly used when a corporation wishes to transfer or convey their property assets to an LLC they have formed or wish to form. The Quitclaim Deed serves as evidence of the corporation's intent to transfer its interest in the property to the LLC without making any warranties or guarantees regarding the property title. It essentially ensures that the corporation relinquishes any legal claims or rights it may have had over the property. There are several types of Grand Rapids Michigan Quitclaim Deed from Corporation to LLC, each with its own specific purpose and requirements. These include: 1. Grand Rapids Michigan Quitclaim Deed from Corporation to Single-Member LLC: This type of deed is used when a corporation transfers ownership of a property to a single-member LLC, where the LLC has only one owner or member. 2. Grand Rapids Michigan Quitclaim Deed from Corporation to Multi-Member LLC: When a corporation transfers property ownership to a multi-member LLC, where the LLC has multiple owners or members, this type of deed is utilized. 3. Grand Rapids Michigan Quitclaim Deed with Consideration: In some instances, the transfer of property from a corporation to an LLC may involve a monetary consideration, such as a purchase price. A Quitclaim Deed with Consideration outlines the terms of the transfer, including the amount paid by the LLC to the corporation. 4. Grand Rapids Michigan Quitclaim Deed without Consideration: This type of deed is used when there is no exchange of money or other valuable consideration between the corporation and the LLC. It is crucial to consult with a qualified real estate attorney or legal professional when preparing and executing a Grand Rapids Michigan Quitclaim Deed from Corporation to LLC. This ensures that the deed complies with all local and state laws, and that the transfer of ownership rights is properly documented and recorded. Overall, a Grand Rapids Michigan Quitclaim Deed from Corporation to LLC is an essential legal instrument that facilitates the transfer of property ownership from a corporation to an LLC while addressing the unique requirements and considerations involved in such transactions.