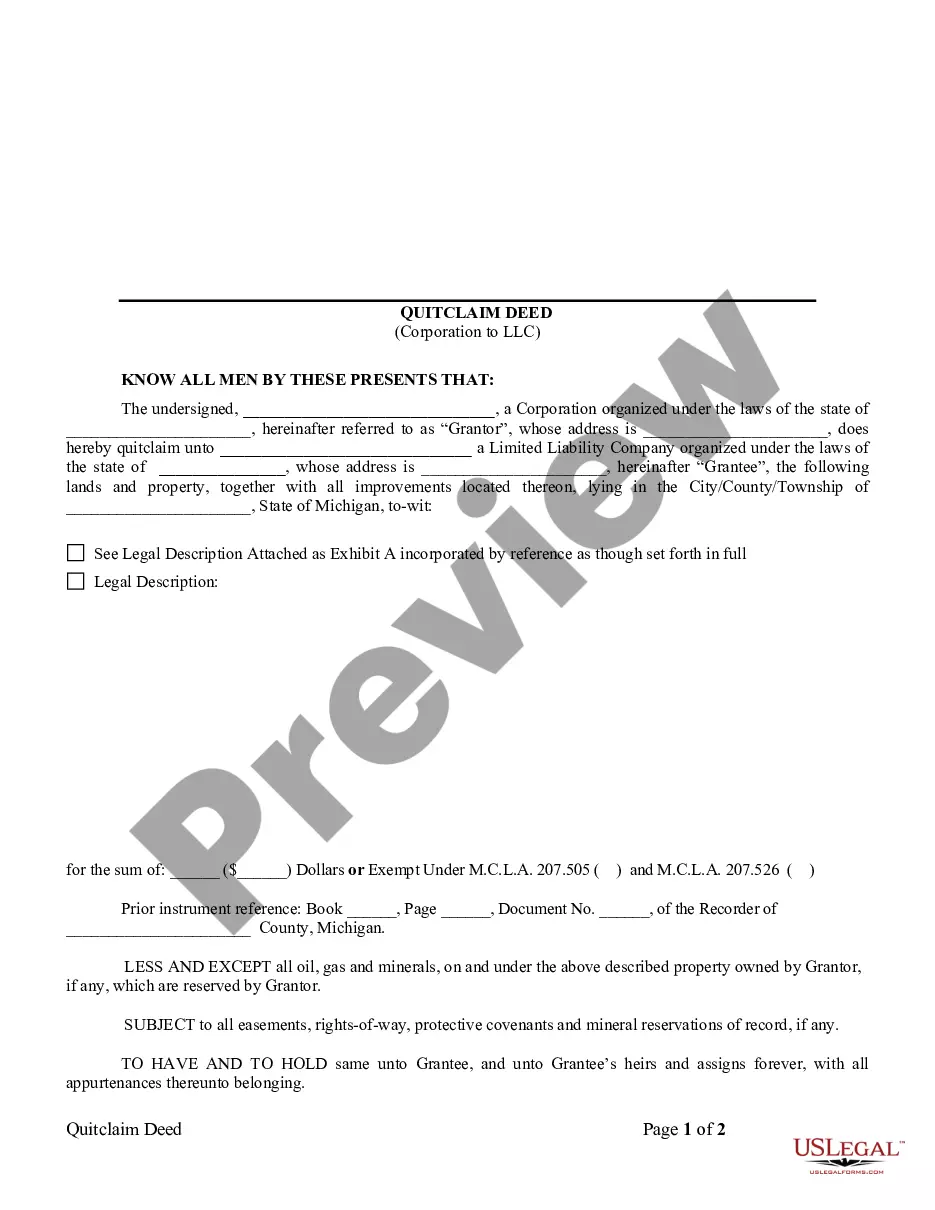

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

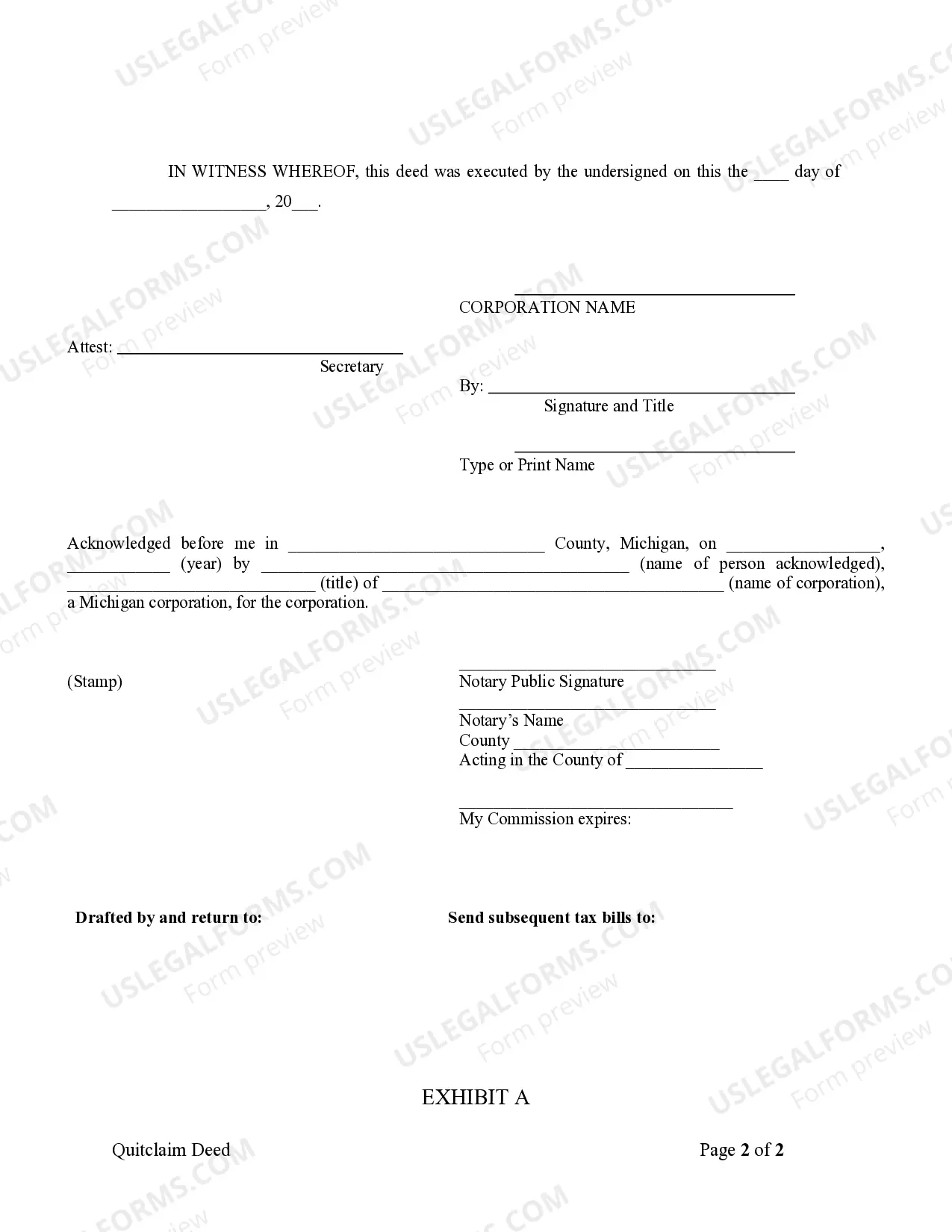

An Oakland Michigan Quitclaim Deed from Corporation to LLC is a legal document that facilitates the transfer of ownership of a property or real estate from a corporation to a limited liability company (LLC) in the county of Oakland, Michigan. This type of deed typically has specific requirements and considerations that must be fulfilled to ensure a legitimate transfer of ownership. In Oakland County, Michigan, there are two common types of Quitclaim Deeds that may be used for this specific transaction: Traditional Oakland Michigan Quitclaim Deed from Corporation to LLC and Enhanced Oakland Michigan Quitclaim Deed from Corporation to LLC. The Traditional Oakland Michigan Quitclaim Deed, also known as a basic quitclaim deed, is a straightforward legal document used to transfer the ownership rights of a property from a corporation to an LLC. It operates on the principle of "quitclaim," meaning that the corporation gives up any rights or claims they have on the property to the LLC. The Enhanced Oakland Michigan Quitclaim Deed from Corporation to LLC is a more comprehensive form that provides additional protection and clarity during the transfer of ownership. It contains additional provisions, such as warranties or guarantees related to the property's title, which serve to protect the LLC in case of any future claims or disputes. When executing an Oakland Michigan Quitclaim Deed from Corporation to LLC, certain essential details need to be included: 1. Identification of the property: The deed should clearly identify and describe the property being transferred, providing specific details such as address, legal description, and parcel number. 2. Names and addresses: The full legal names and addresses of both the corporation and the LLC involved in the transfer must be stated accurately. 3. Consideration: The consideration, which refers to the value or compensation for the transfer, should be listed. In most cases, this can be a nominal amount or even a statement indicating the transfer is being performed without consideration. 4. Signatures: Signatures of authorized representatives from both the corporation and the LLC are required to make the deed valid. These representatives should have the legal authority to bind their respective entities. 5. Notarization and Witnessing: In Michigan, a quitclaim deed must be notarized and witnessed by at least two individuals, guaranteeing its authenticity and compliance with legal requirements. It is crucial to consult with a qualified attorney or a licensed real estate professional when preparing or executing an Oakland Michigan Quitclaim Deed from Corporation to LLC. They will ensure that all necessary legal steps are followed, protecting the interests of both parties involved in the transfer of ownership.