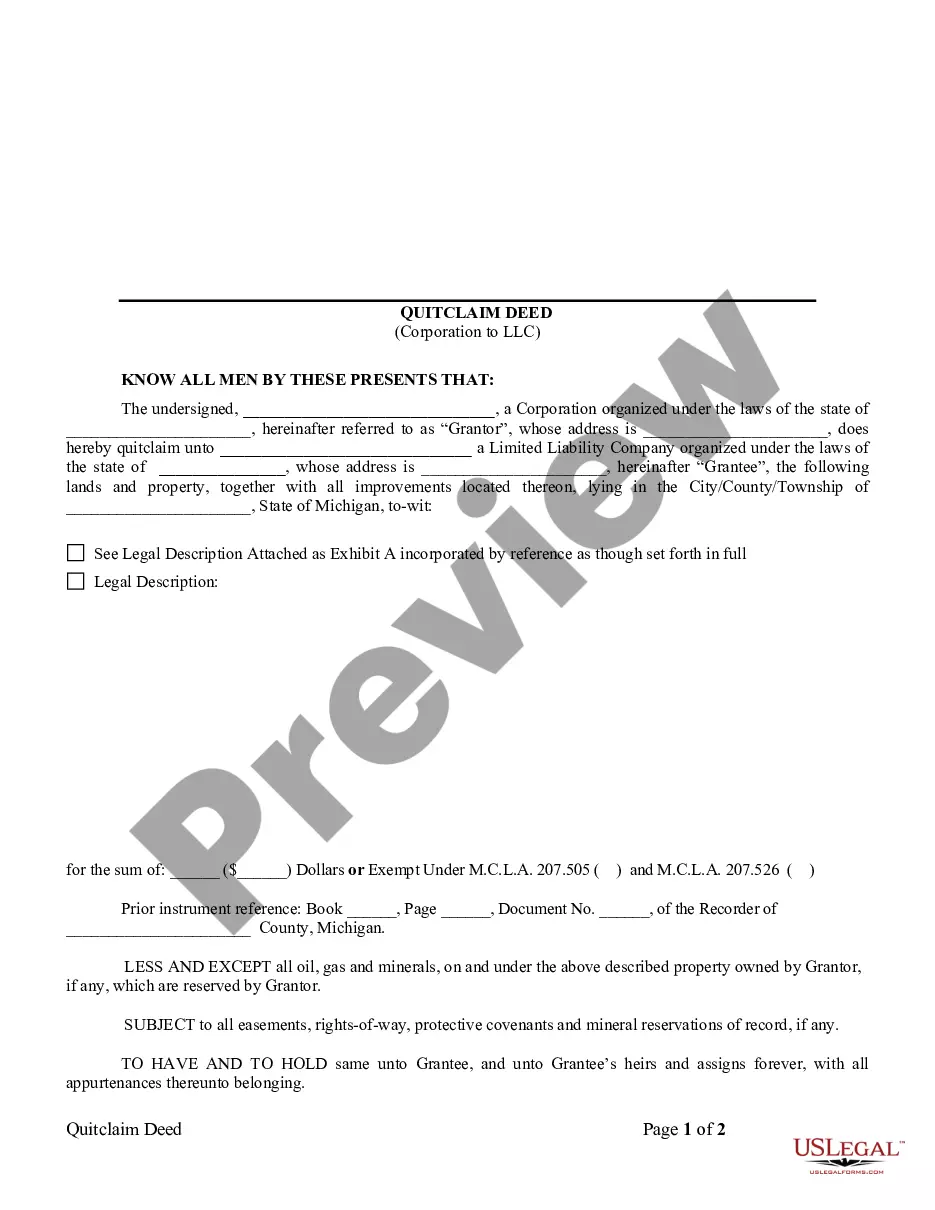

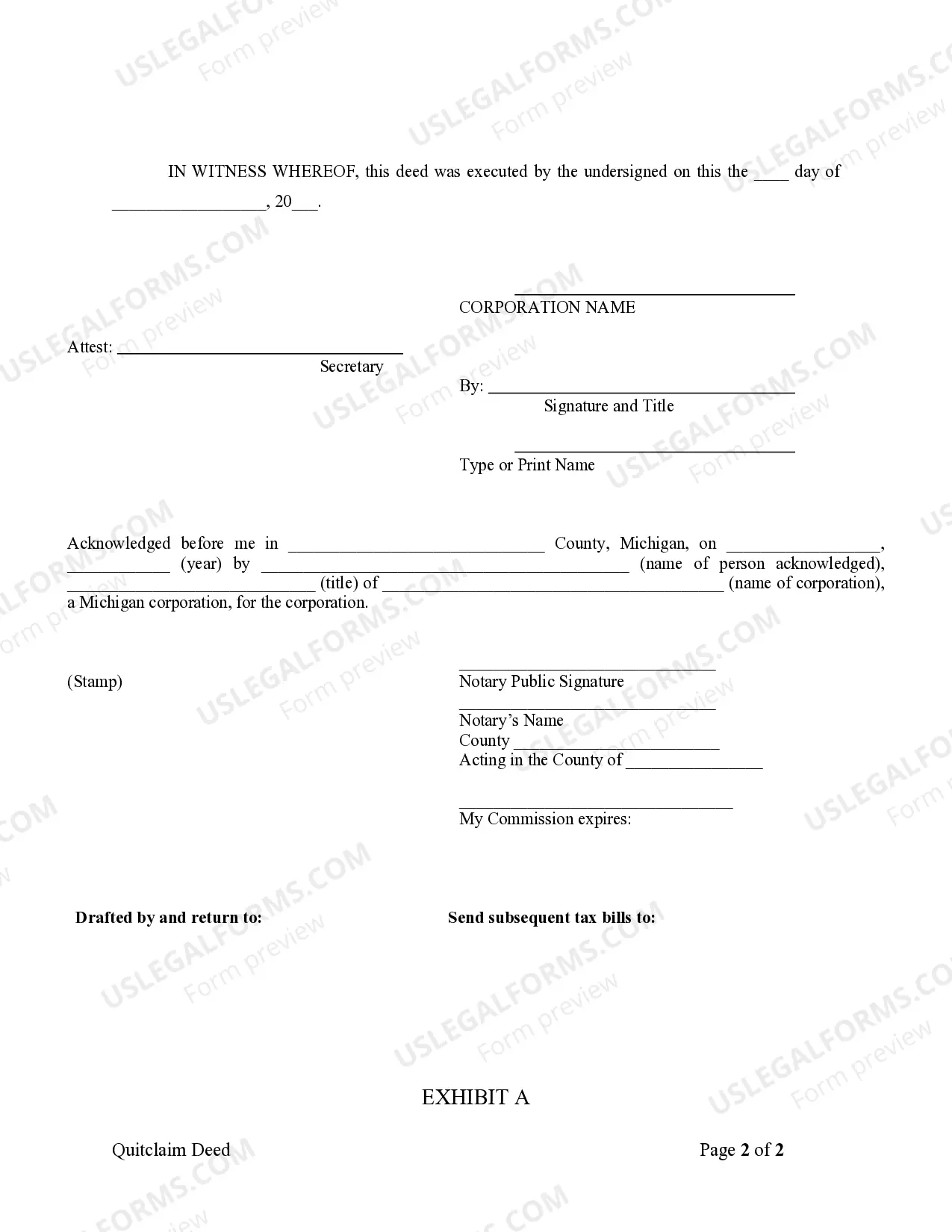

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Sterling Heights Michigan Quitclaim Deed from Corporation to LLC is an important legal document that facilitates the transfer of property ownership rights between a corporation and a limited liability company (LLC). This type of transfer can occur for various reasons, such as transitioning the property into a more flexible and advantageous ownership structure. With a focus on Sterling Heights, Michigan, this detailed description will provide an overview of this type of deed, its purpose, process, and variations. A quitclaim deed is a legal instrument used to transfer an individual or entity's interest or rights in a property to another party. In the context of a Sterling Heights Michigan Quitclaim Deed from Corporation to LLC, this transfer occurs between a corporation and an LLC. This method of transfer allows the corporation to transfer ownership of a property to the LLC, benefiting both entities involved. This type of deed is generally utilized when a corporation wishes to transfer property ownership to an LLC it controls or owns. The process involves the corporation, acting as the granter, conveying its interest in the property to the LLC, acting as the grantee. The deed explicitly states that the transfer is a quitclaim, meaning the corporation is transferring its rights without making any warranties or guarantees regarding the property's title or condition. This specificity differentiates quitclaim deeds from warranty deeds that provide assurances of clear title. The Sterling Heights Michigan Quitclaim Deed from Corporation to LLC is often utilized for a variety of purposes. It allows a corporation to consolidate its assets and liabilities, ensuring better management and organization. By transferring the property to an LLC, the corporation gains the flexibility of the LLC's ownership structure, which typically offers limited liability protection to its members. This limits potential liabilities related to the property and affords greater personal asset protection. Moreover, this type of quitclaim deed permits corporations in Sterling Heights to streamline their operations and take advantage of various tax benefits associated with LLC ownership. With an LLC's pass-through taxation, any income, gains, or losses generated by the property can be reported on the individual members' tax returns rather than the corporation's tax return. This tax flexibility often becomes a significant reason behind a property transfer via a quitclaim deed. Although the Sterling Heights Michigan Quitclaim Deed from Corporation to LLC follows a general process, there might be different variations of this deed based on specific circumstances or objectives. These variations include: 1. Partial Transfer Quitclaim Deed: In cases where a corporation wishes to transfer only a portion of its interest in a property to an LLC, a partial transfer quitclaim deed is utilized. This type of deed allows for a partial transfer of ownership rights while maintaining the corporation's ownership of the remaining portion. 2. Multiple Property Transfer Quitclaim Deed: If a corporation intends to transfer multiple properties to an LLC simultaneously, a multiple property transfer quitclaim deed may be employed. This type of deed facilitates the transfer of ownership rights for several properties to streamline the process and minimize paperwork. 3. Merger/Acquisition Quitclaim Deed: When a corporation undergoes a merger or acquisition, resulting in the transfer of property ownership to an LLC, a merger/acquisition quitclaim deed is used. This type of deed ensures a proper and legally recognized transfer of ownership rights during corporate restructuring. In conclusion, a Sterling Heights Michigan Quitclaim Deed from Corporation to LLC serves as a legal instrument that allows corporations in Sterling Heights to transfer property ownership to LCS they control or own. This type of transfer enables corporations to benefit from the flexibility and tax advantages offered by LLC ownership structures while providing limited liability protection. Various variations of this deed, such as partial transfer quitclaim deeds, multiple property transfer quitclaim deeds, and merger/acquisition quitclaim deeds, cater to specific circumstances and objectives of the transfer.A Sterling Heights Michigan Quitclaim Deed from Corporation to LLC is an important legal document that facilitates the transfer of property ownership rights between a corporation and a limited liability company (LLC). This type of transfer can occur for various reasons, such as transitioning the property into a more flexible and advantageous ownership structure. With a focus on Sterling Heights, Michigan, this detailed description will provide an overview of this type of deed, its purpose, process, and variations. A quitclaim deed is a legal instrument used to transfer an individual or entity's interest or rights in a property to another party. In the context of a Sterling Heights Michigan Quitclaim Deed from Corporation to LLC, this transfer occurs between a corporation and an LLC. This method of transfer allows the corporation to transfer ownership of a property to the LLC, benefiting both entities involved. This type of deed is generally utilized when a corporation wishes to transfer property ownership to an LLC it controls or owns. The process involves the corporation, acting as the granter, conveying its interest in the property to the LLC, acting as the grantee. The deed explicitly states that the transfer is a quitclaim, meaning the corporation is transferring its rights without making any warranties or guarantees regarding the property's title or condition. This specificity differentiates quitclaim deeds from warranty deeds that provide assurances of clear title. The Sterling Heights Michigan Quitclaim Deed from Corporation to LLC is often utilized for a variety of purposes. It allows a corporation to consolidate its assets and liabilities, ensuring better management and organization. By transferring the property to an LLC, the corporation gains the flexibility of the LLC's ownership structure, which typically offers limited liability protection to its members. This limits potential liabilities related to the property and affords greater personal asset protection. Moreover, this type of quitclaim deed permits corporations in Sterling Heights to streamline their operations and take advantage of various tax benefits associated with LLC ownership. With an LLC's pass-through taxation, any income, gains, or losses generated by the property can be reported on the individual members' tax returns rather than the corporation's tax return. This tax flexibility often becomes a significant reason behind a property transfer via a quitclaim deed. Although the Sterling Heights Michigan Quitclaim Deed from Corporation to LLC follows a general process, there might be different variations of this deed based on specific circumstances or objectives. These variations include: 1. Partial Transfer Quitclaim Deed: In cases where a corporation wishes to transfer only a portion of its interest in a property to an LLC, a partial transfer quitclaim deed is utilized. This type of deed allows for a partial transfer of ownership rights while maintaining the corporation's ownership of the remaining portion. 2. Multiple Property Transfer Quitclaim Deed: If a corporation intends to transfer multiple properties to an LLC simultaneously, a multiple property transfer quitclaim deed may be employed. This type of deed facilitates the transfer of ownership rights for several properties to streamline the process and minimize paperwork. 3. Merger/Acquisition Quitclaim Deed: When a corporation undergoes a merger or acquisition, resulting in the transfer of property ownership to an LLC, a merger/acquisition quitclaim deed is used. This type of deed ensures a proper and legally recognized transfer of ownership rights during corporate restructuring. In conclusion, a Sterling Heights Michigan Quitclaim Deed from Corporation to LLC serves as a legal instrument that allows corporations in Sterling Heights to transfer property ownership to LCS they control or own. This type of transfer enables corporations to benefit from the flexibility and tax advantages offered by LLC ownership structures while providing limited liability protection. Various variations of this deed, such as partial transfer quitclaim deeds, multiple property transfer quitclaim deeds, and merger/acquisition quitclaim deeds, cater to specific circumstances and objectives of the transfer.