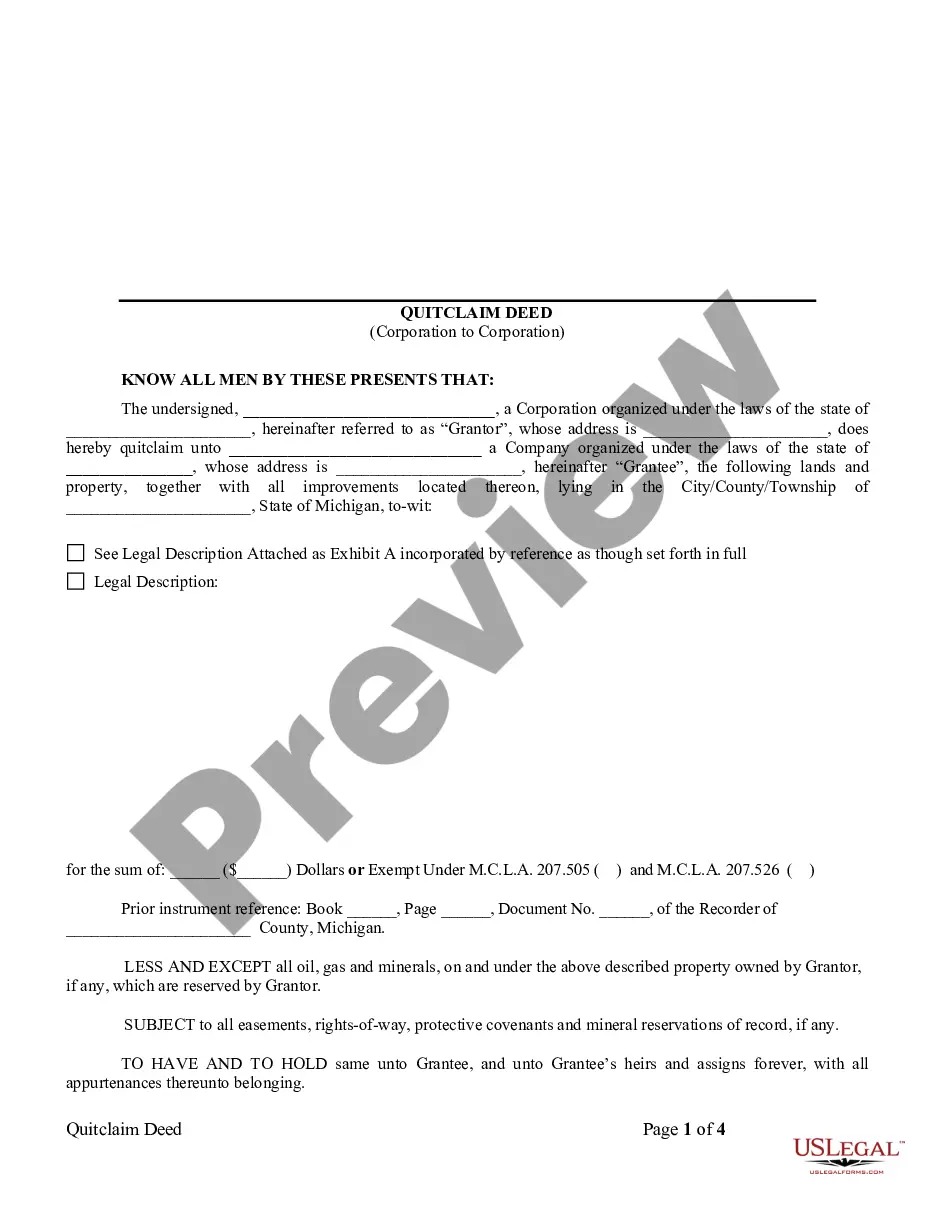

This Quitclaim Deed from Corporation to Corporation form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a corporation. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Ann Arbor, Michigan Quitclaim Deed from Corporation to Corporation: A Comprehensive Guide In Ann Arbor, Michigan, the Quitclaim Deed from Corporation to Corporation is a legally binding document that facilitates the transfer of property ownership rights between two corporate entities. This type of deed is commonly used when corporations need to transfer property assets and remove any potential claims or interests in the property. The Ann Arbor Quitclaim Deed from Corporation to Corporation is characterized by its simplicity and straightforward nature. Unlike other property transfer documents, such as a warranty deed, the Quitclaim Deed does not provide any guarantees or warranties regarding the title's status or any encumbrances on the property. Instead, it merely conveys the "interest" or "claim" that the corporation transferring the property has on it. In the context of Ann Arbor, Michigan, there are various types of Quitclaim Deeds from Corporation to Corporation, which include: 1. Standard Ann Arbor Quitclaim Deed from Corporation to Corporation: This is the most common type of quitclaim deed used for property transfers between corporations. It transfers the interest and ownership rights from one corporation to another, effectively releasing any future claims to the property. 2. Ann Arbor Michigan Quitclaim Deed with Consideration: In some cases, the transfer of property between corporations may involve monetary compensation or other consideration. This type of deed specifies the agreed-upon consideration and acts as evidence of the transaction, ensuring a valid and enforceable transfer. 3. Ann Arbor Michigan Statutory Quitclaim Deed from Corporation to Corporation: This variant of the Quitclaim Deed follows the specific legal requirements and provisions set forth by the state of Michigan. Corporations must adhere to these regulations to ensure a legally valid transfer of property. The process to execute an Ann Arbor Quitclaim Deed from Corporation to Corporation involves several key steps. First, both corporations must agree on the terms of the property transfer and the specific language that will be used in the deed. It is highly recommended consulting with legal professionals, including attorneys or real estate experts, to ensure compliance with all legal requirements. Next, a Quitclaim Deed form available from the Ann Arbor County Clerk's office or other reliable sources should be completed. The deed must include the names and addresses of both corporations involved, a legal description of the property, and a clear statement indicating the transfer of interests from the transferring corporation to the receiving corporation. Once the deed is completed, it must be signed by representatives of both corporations, and their signatures must be notarized to validate the document. Subsequently, the executed deed should be recorded at the Ann Arbor County Clerk's office to make it a matter of public record and provide legal notice to any potential claimants. In conclusion, the Ann Arbor Michigan Quitclaim Deed from Corporation to Corporation is a vital tool for corporations engaging in property transfers. It allows for the seamless exchange of property ownership rights, removing any potential claims or interests. However, it is critical for both corporations involved to seek legal advice and comply with the specific requirements set forth by the State of Michigan to ensure a legally binding transfer.Ann Arbor, Michigan Quitclaim Deed from Corporation to Corporation: A Comprehensive Guide In Ann Arbor, Michigan, the Quitclaim Deed from Corporation to Corporation is a legally binding document that facilitates the transfer of property ownership rights between two corporate entities. This type of deed is commonly used when corporations need to transfer property assets and remove any potential claims or interests in the property. The Ann Arbor Quitclaim Deed from Corporation to Corporation is characterized by its simplicity and straightforward nature. Unlike other property transfer documents, such as a warranty deed, the Quitclaim Deed does not provide any guarantees or warranties regarding the title's status or any encumbrances on the property. Instead, it merely conveys the "interest" or "claim" that the corporation transferring the property has on it. In the context of Ann Arbor, Michigan, there are various types of Quitclaim Deeds from Corporation to Corporation, which include: 1. Standard Ann Arbor Quitclaim Deed from Corporation to Corporation: This is the most common type of quitclaim deed used for property transfers between corporations. It transfers the interest and ownership rights from one corporation to another, effectively releasing any future claims to the property. 2. Ann Arbor Michigan Quitclaim Deed with Consideration: In some cases, the transfer of property between corporations may involve monetary compensation or other consideration. This type of deed specifies the agreed-upon consideration and acts as evidence of the transaction, ensuring a valid and enforceable transfer. 3. Ann Arbor Michigan Statutory Quitclaim Deed from Corporation to Corporation: This variant of the Quitclaim Deed follows the specific legal requirements and provisions set forth by the state of Michigan. Corporations must adhere to these regulations to ensure a legally valid transfer of property. The process to execute an Ann Arbor Quitclaim Deed from Corporation to Corporation involves several key steps. First, both corporations must agree on the terms of the property transfer and the specific language that will be used in the deed. It is highly recommended consulting with legal professionals, including attorneys or real estate experts, to ensure compliance with all legal requirements. Next, a Quitclaim Deed form available from the Ann Arbor County Clerk's office or other reliable sources should be completed. The deed must include the names and addresses of both corporations involved, a legal description of the property, and a clear statement indicating the transfer of interests from the transferring corporation to the receiving corporation. Once the deed is completed, it must be signed by representatives of both corporations, and their signatures must be notarized to validate the document. Subsequently, the executed deed should be recorded at the Ann Arbor County Clerk's office to make it a matter of public record and provide legal notice to any potential claimants. In conclusion, the Ann Arbor Michigan Quitclaim Deed from Corporation to Corporation is a vital tool for corporations engaging in property transfers. It allows for the seamless exchange of property ownership rights, removing any potential claims or interests. However, it is critical for both corporations involved to seek legal advice and comply with the specific requirements set forth by the State of Michigan to ensure a legally binding transfer.