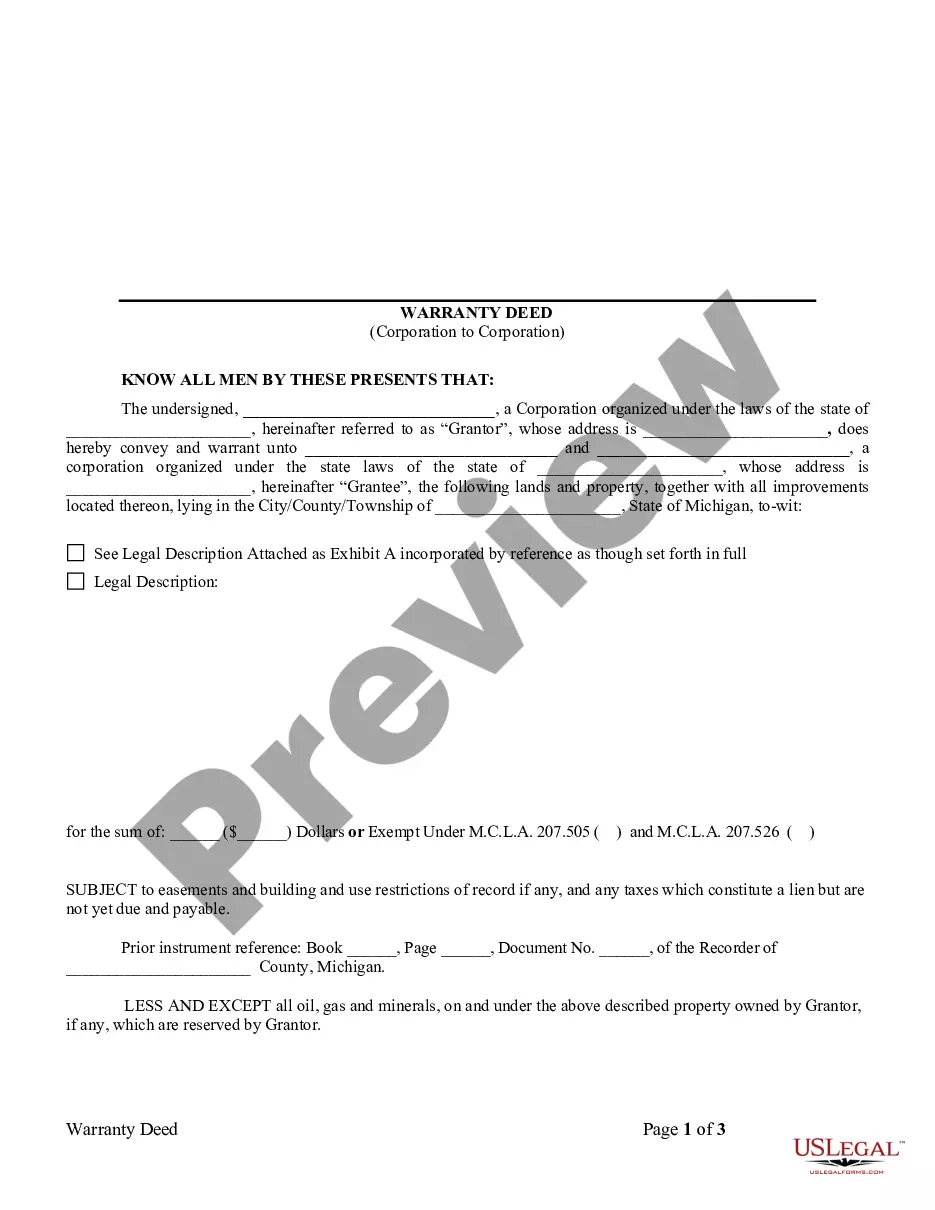

This Warranty Deed from Corporation to Corporation form is a Warranty Deed where the Grantor is a corporation and the Grantee is a corporation. Grantor conveys and warrants the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Sterling Heights Michigan warranty deed from corporation to corporation is a legal document used to transfer the ownership of real estate property from one corporation to another corporation. This type of deed ensures that the property being transferred is free from any encumbrances or undisclosed claims. In this transaction, the corporation selling the property (granter) guarantees that it holds legal title to the property, has the right to transfer it, and will defend the title against any claims. The corporation purchasing the property (grantee) receives the property with the assurance that it has the right to possess and use it without any legal issues. The Sterling Heights Michigan warranty deed provides several key components to protect both parties involved: 1. Granter and Grantee Details: The deed includes the legal names and addresses of the corporation selling the property as the granter and the corporation acquiring the property as the grantee. 2. Property Description: A detailed description of the property being transferred is included in the deed. This typically includes the legal description, such as lot number, block number, and subdivision name, providing an accurate identification of the property. 3. Warranty of Title: The warranty deed guarantees that the granter has legal ownership of the property, possesses the authority to sell it, and will defend the title against any third-party claims or challenges. 4. No Encumbrances: The granter assures that the property is free from any liens, mortgages, or other encumbrances that could affect its marketability or ownership. 5. Consideration: The deed states the consideration or the value exchanged for the property. This could be a specific amount of money, shares of stock, or other assets. Different types of Sterling Heights Michigan warranty deeds from corporation to corporation may include: 1. General Warranty Deed: This is the most common type of warranty deed. It provides the broadest protection to the grantee, as the granter guarantees the title against any claims arising before or during their ownership. 2. Special Warranty Deed: This type of warranty deed guarantees the title only against claims arising during the granter's ownership of the property. Claims arising before the granter took ownership are not covered. 3. Quitclaim Deed: While not technically a warranty deed, it is worth mentioning as it is sometimes used in corporate transactions. A quitclaim deed transfers whatever interest the granter has in the property without providing any warranties or guarantees. In conclusion, a Sterling Heights Michigan warranty deed from corporation to corporation is a legally binding document that ensures a transfer of property is done with clear ownership and without any encumbrances. It is vital for both the granter and grantee to understand the type of warranty deed being used and its specific terms to protect their interests in the transaction.A Sterling Heights Michigan warranty deed from corporation to corporation is a legal document used to transfer the ownership of real estate property from one corporation to another corporation. This type of deed ensures that the property being transferred is free from any encumbrances or undisclosed claims. In this transaction, the corporation selling the property (granter) guarantees that it holds legal title to the property, has the right to transfer it, and will defend the title against any claims. The corporation purchasing the property (grantee) receives the property with the assurance that it has the right to possess and use it without any legal issues. The Sterling Heights Michigan warranty deed provides several key components to protect both parties involved: 1. Granter and Grantee Details: The deed includes the legal names and addresses of the corporation selling the property as the granter and the corporation acquiring the property as the grantee. 2. Property Description: A detailed description of the property being transferred is included in the deed. This typically includes the legal description, such as lot number, block number, and subdivision name, providing an accurate identification of the property. 3. Warranty of Title: The warranty deed guarantees that the granter has legal ownership of the property, possesses the authority to sell it, and will defend the title against any third-party claims or challenges. 4. No Encumbrances: The granter assures that the property is free from any liens, mortgages, or other encumbrances that could affect its marketability or ownership. 5. Consideration: The deed states the consideration or the value exchanged for the property. This could be a specific amount of money, shares of stock, or other assets. Different types of Sterling Heights Michigan warranty deeds from corporation to corporation may include: 1. General Warranty Deed: This is the most common type of warranty deed. It provides the broadest protection to the grantee, as the granter guarantees the title against any claims arising before or during their ownership. 2. Special Warranty Deed: This type of warranty deed guarantees the title only against claims arising during the granter's ownership of the property. Claims arising before the granter took ownership are not covered. 3. Quitclaim Deed: While not technically a warranty deed, it is worth mentioning as it is sometimes used in corporate transactions. A quitclaim deed transfers whatever interest the granter has in the property without providing any warranties or guarantees. In conclusion, a Sterling Heights Michigan warranty deed from corporation to corporation is a legally binding document that ensures a transfer of property is done with clear ownership and without any encumbrances. It is vital for both the granter and grantee to understand the type of warranty deed being used and its specific terms to protect their interests in the transaction.