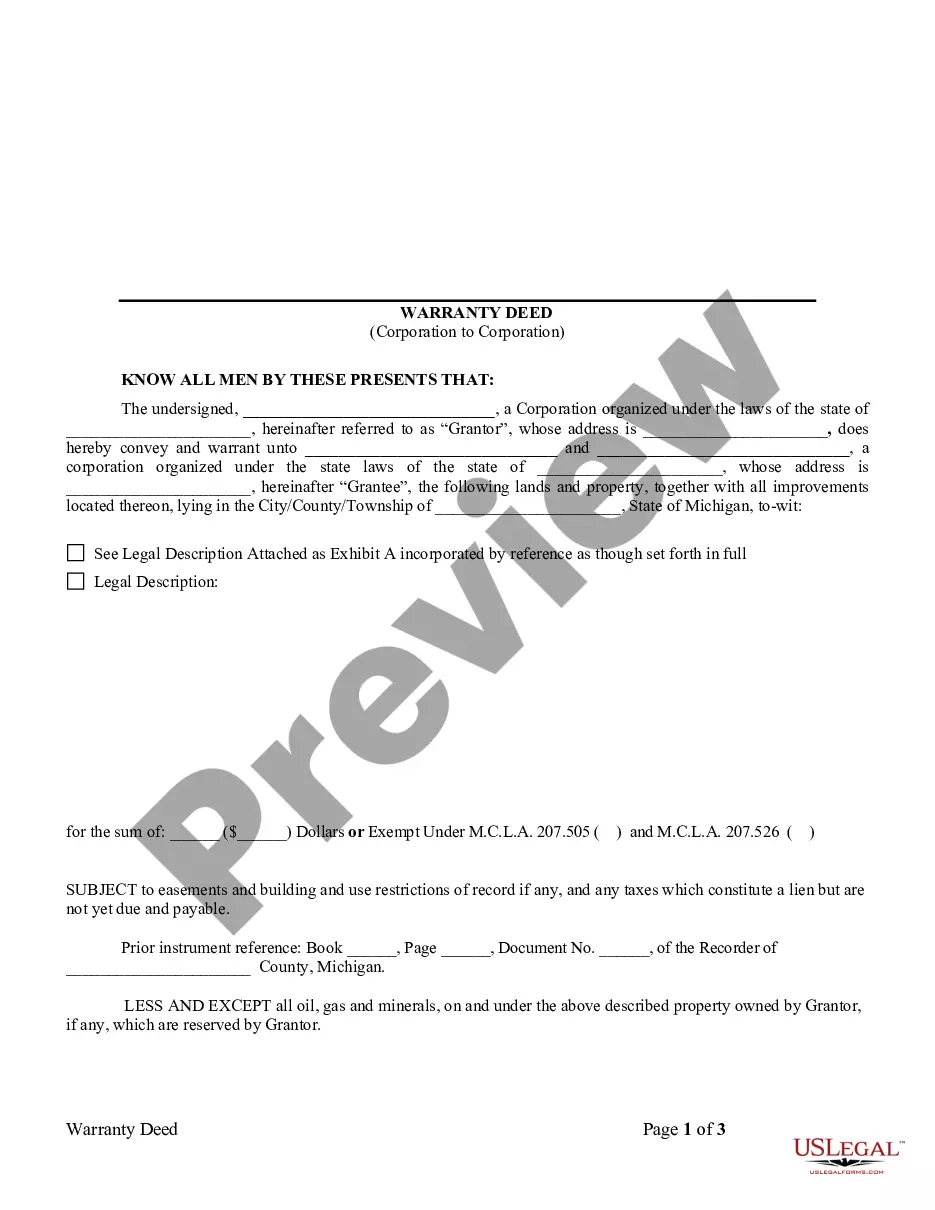

This Warranty Deed from Corporation to Corporation form is a Warranty Deed where the Grantor is a corporation and the Grantee is a corporation. Grantor conveys and warrants the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Wayne Michigan Warranty Deed from Corporation to Corporation is a legal document that transfers ownership of real property from one corporation to another. The deed provides a guarantee to the new corporation that the property is free and clear of any encumbrances or claims, except those specifically mentioned in the deed. This form of deed ensures that the transferring corporation has good and marketable title to the property being conveyed. In Wayne, Michigan, there are different types of Warranty Deeds from Corporation to Corporation, including: 1. General Warranty Deed: This type of deed provides the broadest form of protection to the grantee (the receiving corporation), as it guarantees the title against any defects that may have arisen during the entire history of ownership. It offers the highest level of assurance to the buyer and grants the widest range of covenants. 2. Special Warranty Deed: This deed provides a lesser degree of protection compared to a general warranty deed. It assures the purchaser that the granter (transferring corporation) has not caused any title defects or encumbrances during their ownership, but does not cover any issues that may have existed prior to their ownership. 3. Quitclaim Deed: While not a warranty deed, a Quitclaim Deed may also be used for transfers between corporations. This deed simply transfers the granter's interest in the property to the grantee, without any warranties or guarantees regarding the title. When preparing a Wayne Michigan Warranty Deed from Corporation to Corporation, it is essential to include relevant details such as the names of the transferring and receiving corporations, the legal description of the property, and the consideration (if any) being exchanged. The deed should also mention any existing encumbrances, liens, or restrictions on the property. It is recommended to consult with an experienced attorney or a qualified professional to ensure the deed is prepared correctly in accordance with Michigan state laws and to address any specific requirements or variations that may be applicable in Wayne.