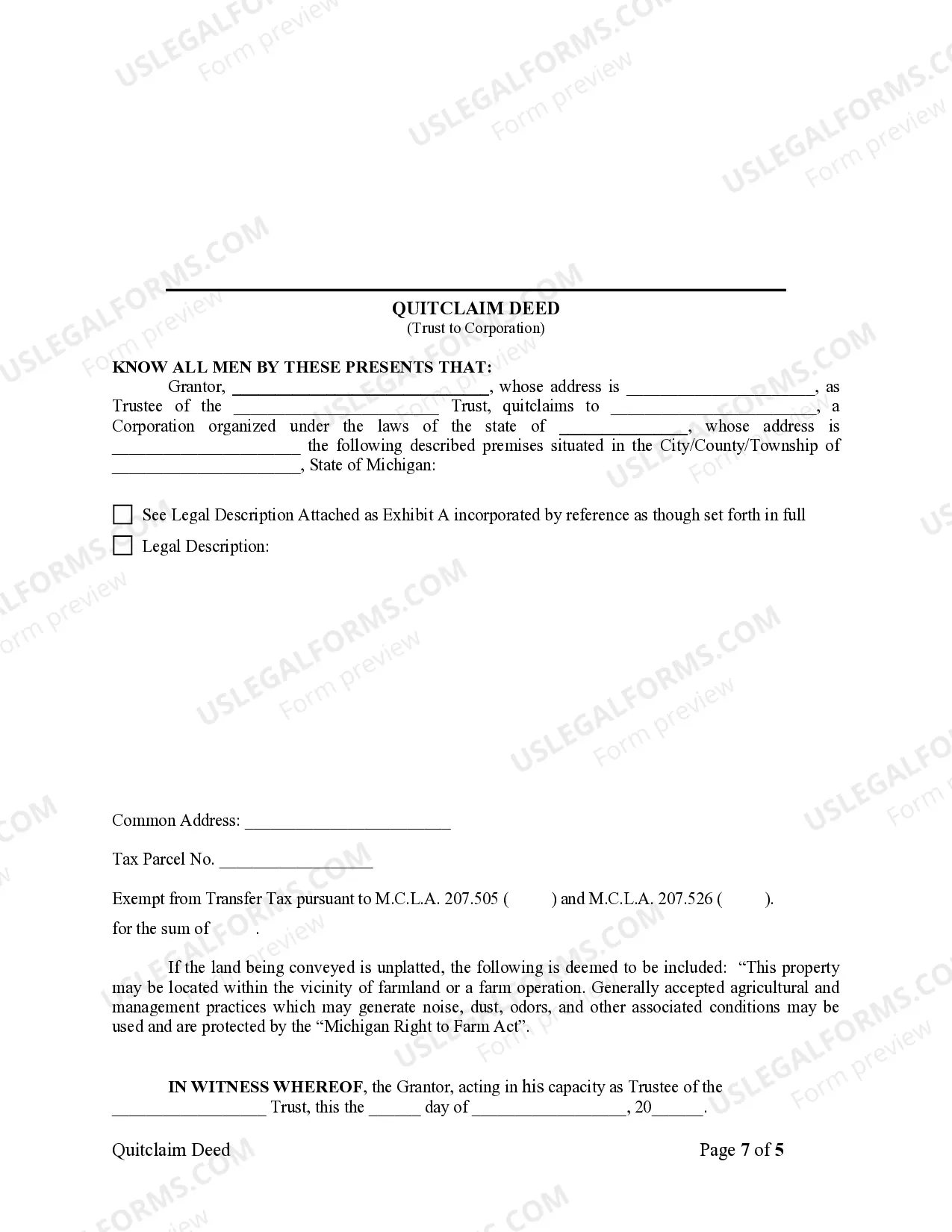

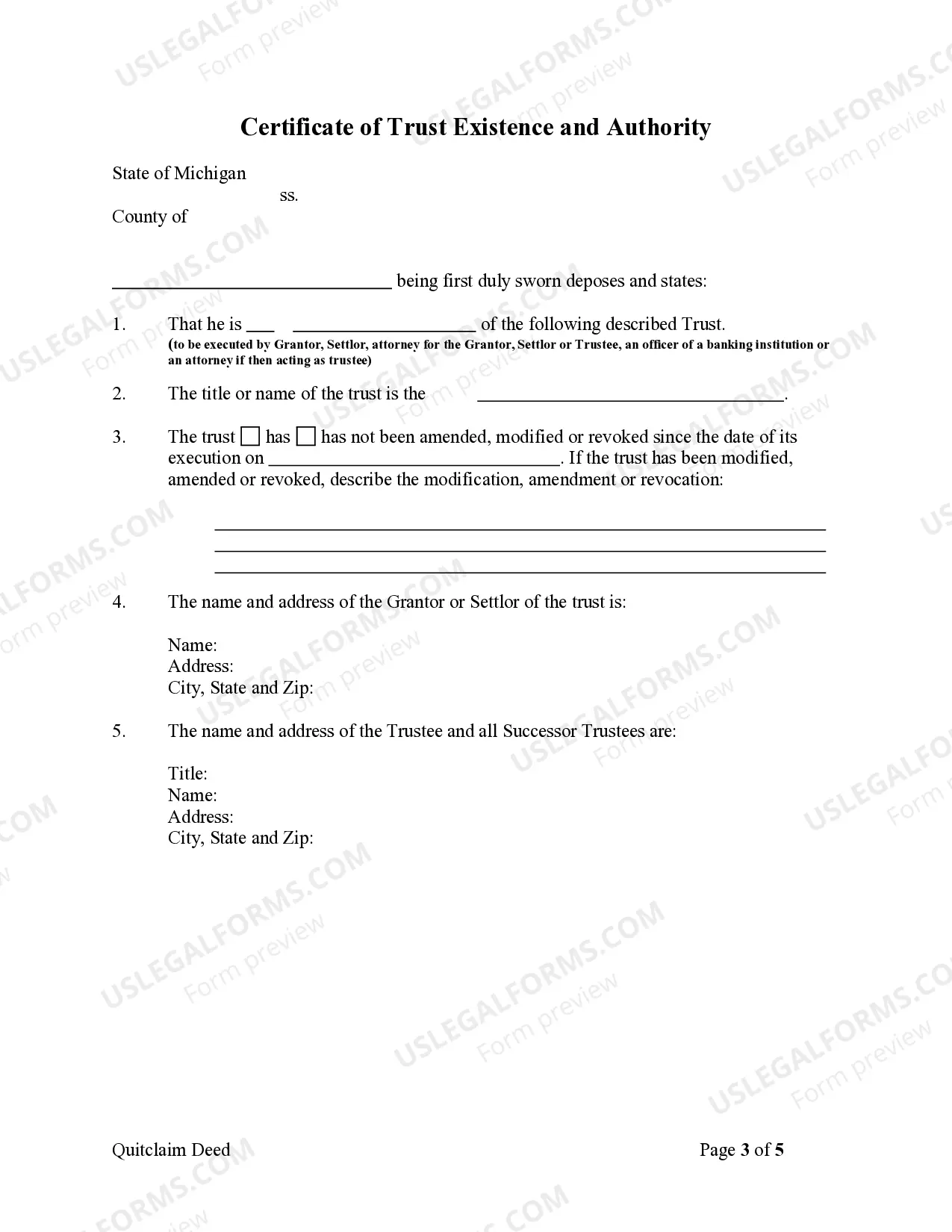

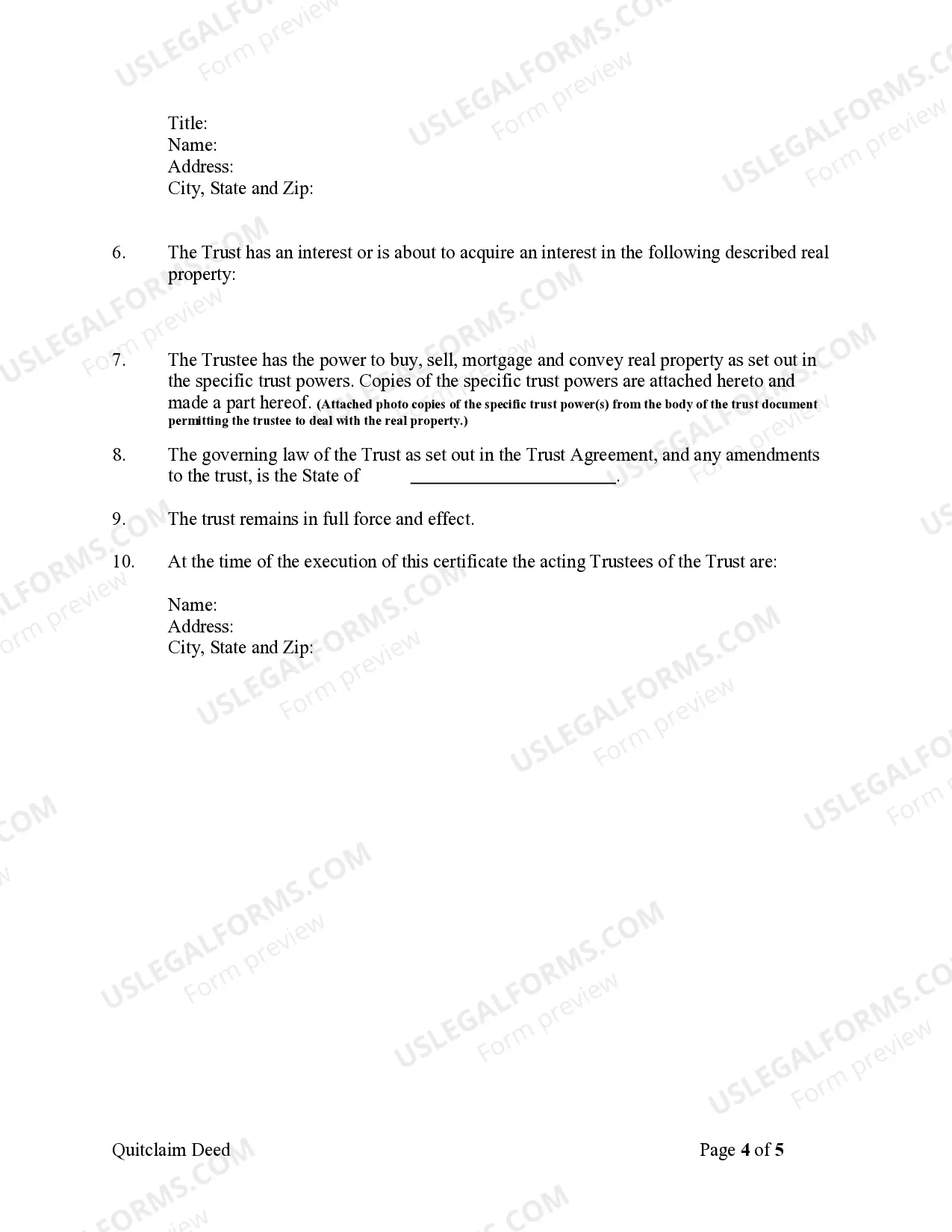

This form is a Quitclaim Deed where the grantor is a Trust and the grantee is a Corporation. Grantors convey and quitclaim the described property to grantee. This deed complies with all state statutory laws.

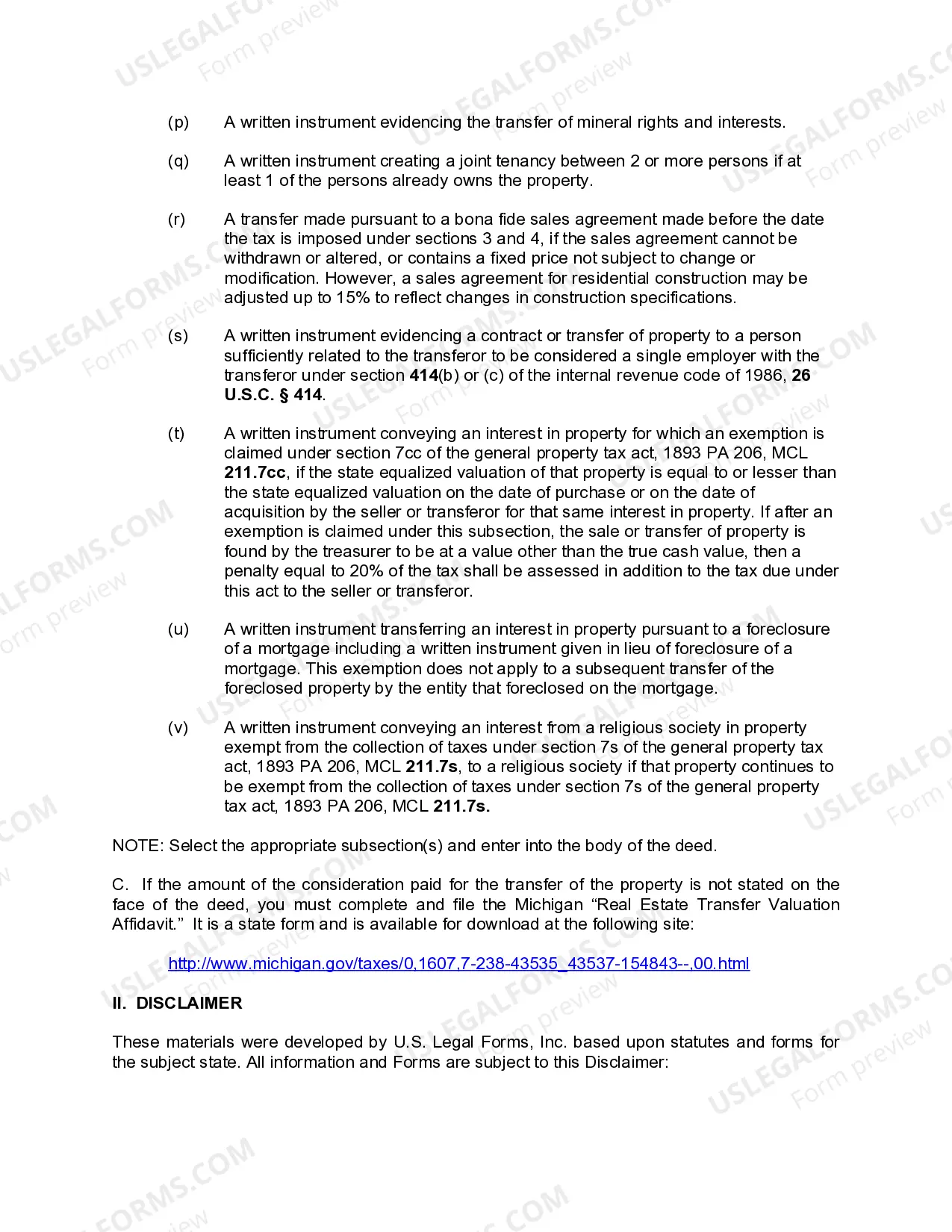

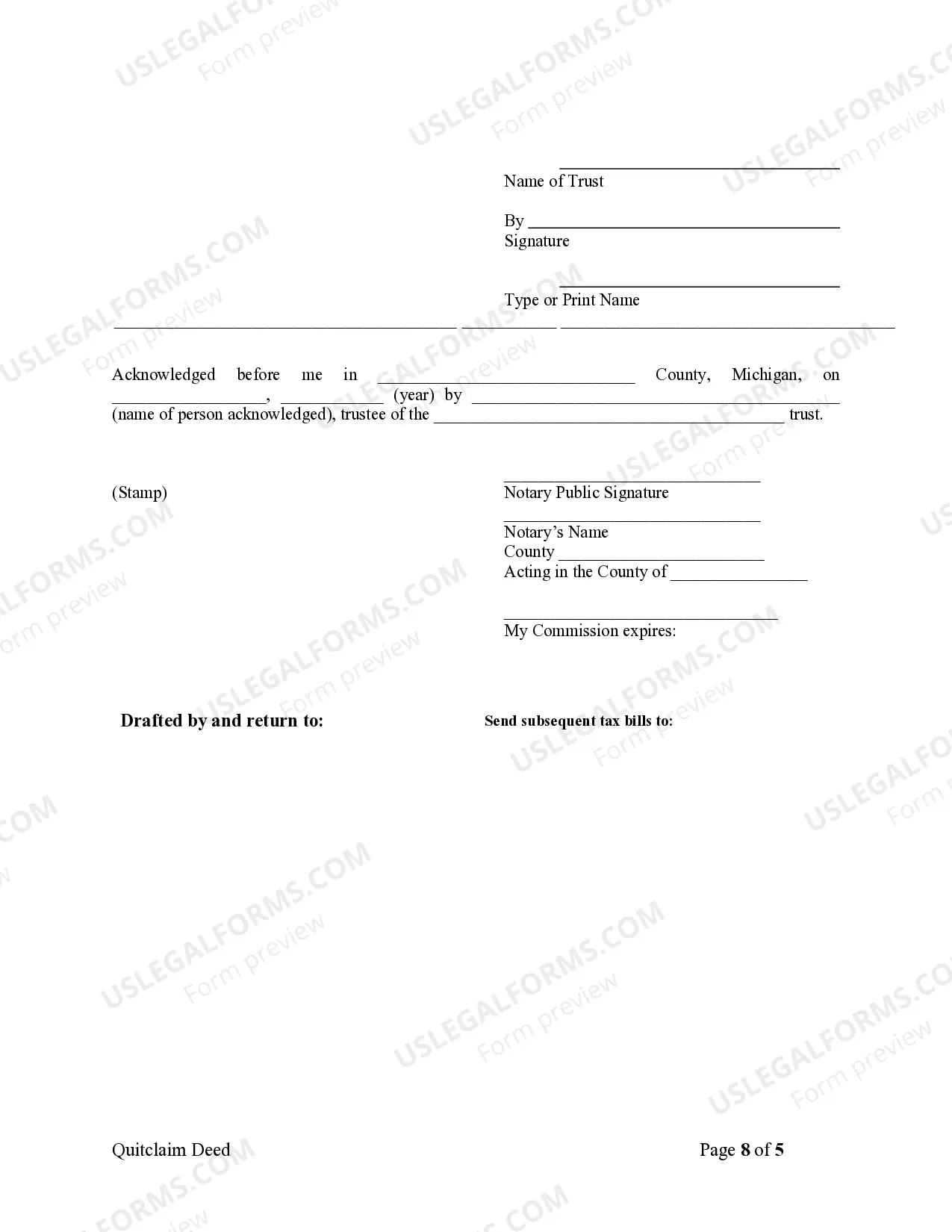

A Lansing Michigan Quitclaim Deed — Trust to a Corporation is a legal document that transfers ownership of real estate from a trust to a corporation using a quitclaim deed. This type of deed is commonly used when the trustee of a trust decides to transfer the property to a corporation for various reasons, such as asset protection or organizational restructuring. The Lansing Michigan Quitclaim Deed — Trust to a Corporation can be categorized into two main types: 1. Standard Lansing Michigan Quitclaim Deed — Trust to a Corporation: This is the most common type of quitclaim deed used in Lansing, Michigan, to transfer ownership from a trust to a corporation. It involves the trustee executing the deed and conveying the property to the corporation, relinquishing any claim or interest in the property. 2. Enhanced Lansing Michigan Quitclaim Deed — Trust to a Corporation: In some cases, a more comprehensive quitclaim deed might be required to ensure that the transfer is legally binding and provides additional protections. The enhanced deed may include additional provisions, warranties, or indemnifications to safeguard the interests of both the trust and the corporation. When executing a Lansing Michigan Quitclaim Deed — Trust to a Corporation, it is essential to follow the legal requirements and procedures of the state. These include but are not limited to: — Accurate identification of the trust by including the name and date of the trust agreement. — Properly identifying the corporation by providing its legal name and registered address. — Providing a detailed legal description of the property being transferred, which includes the property's boundaries and any physical structures. — Obtaining the necessary signatures, including those of the trustee and any other required parties. — Notarizing the deed to ensure its validity and authenticity. — Filing the quitclaim deed with the appropriate Lansing, Michigan county recorder's office. By executing a Lansing Michigan Quitclaim Deed — Trust to a Corporation, the trust transfers the property's ownership to the corporation, allowing the corporation to assume responsibility for any associated liabilities, including taxes, mortgages, or other encumbrances. Overall, a Lansing Michigan Quitclaim Deed — Trust to a Corporation is a valuable tool for individuals or organizations looking to transfer property ownership from a trust to a corporation in Lansing, Michigan. It is vital to consult with legal professionals experienced in real estate law to ensure compliance with all applicable regulations and to safeguard the interests of all parties involved in the transaction.A Lansing Michigan Quitclaim Deed — Trust to a Corporation is a legal document that transfers ownership of real estate from a trust to a corporation using a quitclaim deed. This type of deed is commonly used when the trustee of a trust decides to transfer the property to a corporation for various reasons, such as asset protection or organizational restructuring. The Lansing Michigan Quitclaim Deed — Trust to a Corporation can be categorized into two main types: 1. Standard Lansing Michigan Quitclaim Deed — Trust to a Corporation: This is the most common type of quitclaim deed used in Lansing, Michigan, to transfer ownership from a trust to a corporation. It involves the trustee executing the deed and conveying the property to the corporation, relinquishing any claim or interest in the property. 2. Enhanced Lansing Michigan Quitclaim Deed — Trust to a Corporation: In some cases, a more comprehensive quitclaim deed might be required to ensure that the transfer is legally binding and provides additional protections. The enhanced deed may include additional provisions, warranties, or indemnifications to safeguard the interests of both the trust and the corporation. When executing a Lansing Michigan Quitclaim Deed — Trust to a Corporation, it is essential to follow the legal requirements and procedures of the state. These include but are not limited to: — Accurate identification of the trust by including the name and date of the trust agreement. — Properly identifying the corporation by providing its legal name and registered address. — Providing a detailed legal description of the property being transferred, which includes the property's boundaries and any physical structures. — Obtaining the necessary signatures, including those of the trustee and any other required parties. — Notarizing the deed to ensure its validity and authenticity. — Filing the quitclaim deed with the appropriate Lansing, Michigan county recorder's office. By executing a Lansing Michigan Quitclaim Deed — Trust to a Corporation, the trust transfers the property's ownership to the corporation, allowing the corporation to assume responsibility for any associated liabilities, including taxes, mortgages, or other encumbrances. Overall, a Lansing Michigan Quitclaim Deed — Trust to a Corporation is a valuable tool for individuals or organizations looking to transfer property ownership from a trust to a corporation in Lansing, Michigan. It is vital to consult with legal professionals experienced in real estate law to ensure compliance with all applicable regulations and to safeguard the interests of all parties involved in the transaction.