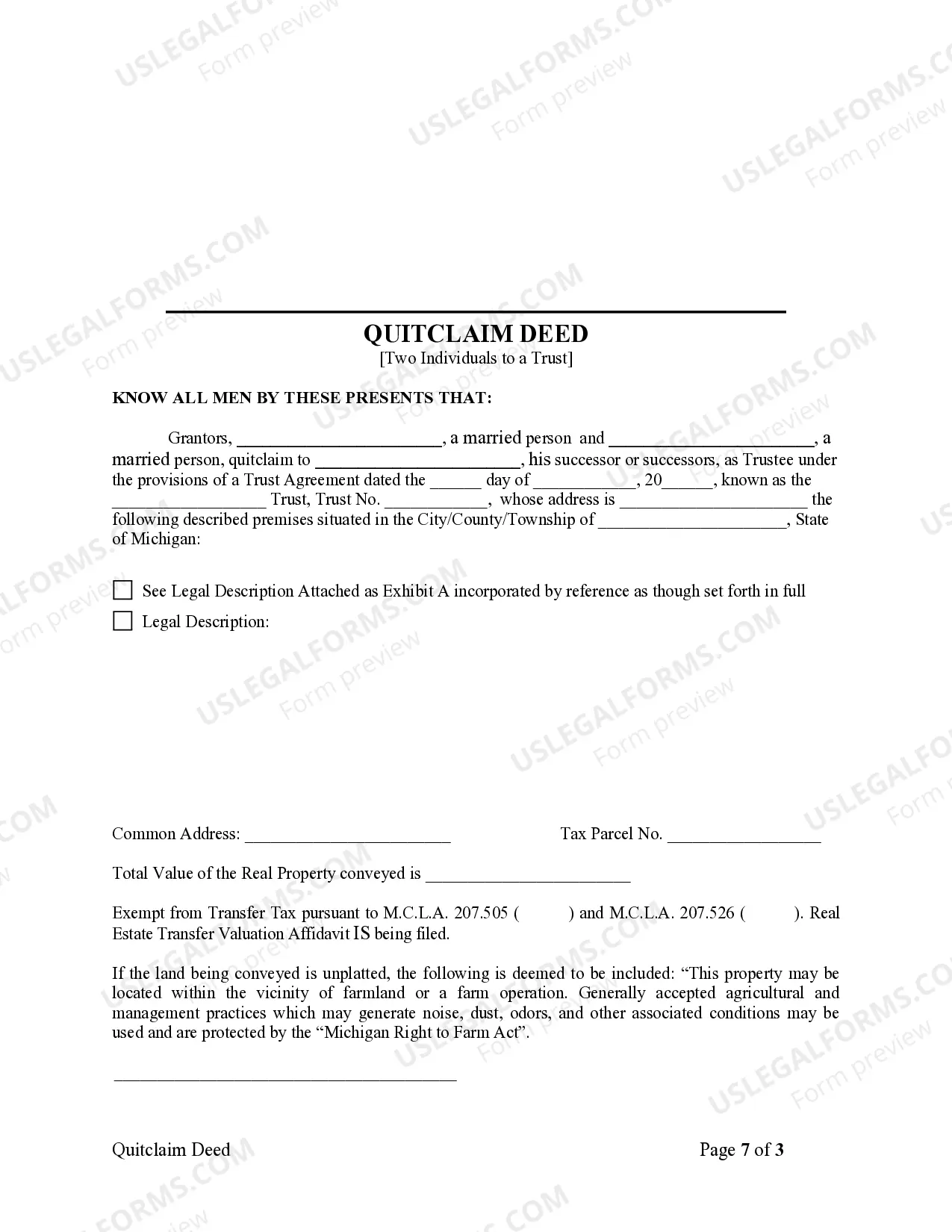

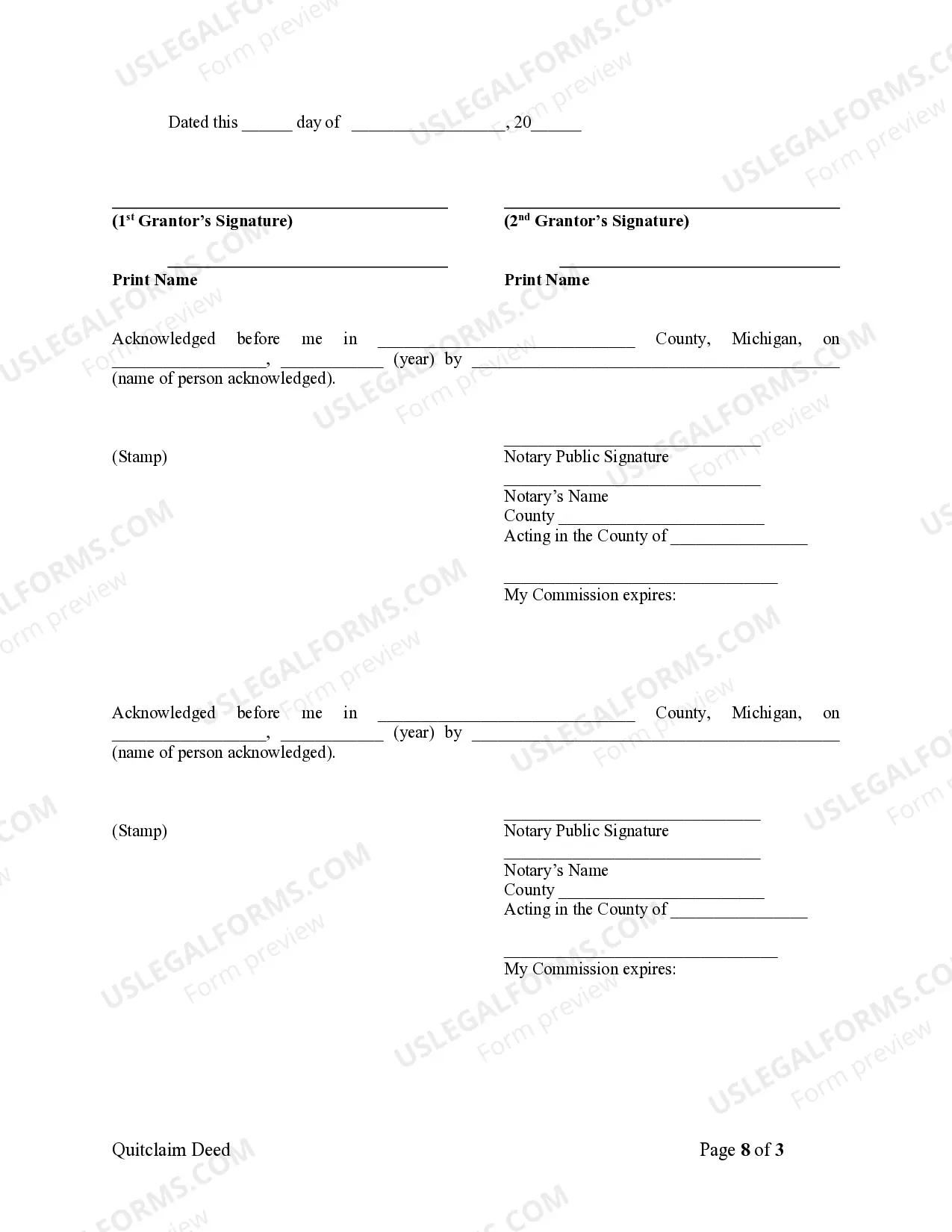

This form is a Quitclaim Deed where the grantors are two individuals and the grantee is a trust. Grantors convey and quitclaim the described property to grantee. This deed complies with all state statutory laws.

A Detroit Michigan Quitclaim Deed — Two Individuals to a Trust refers to a legal document that allows two individuals to transfer property ownership to a trust. This type of deed is commonly used when individuals wish to protect and manage their property assets within a trust structure for various purposes, such as estate planning, asset protection, and avoiding probate. The Detroit Michigan Quitclaim Deed — Two Individuals to a Trust involves a transfer of property ownership rights, where the granters (the individuals transferring the property) surrender their interest in the property to the grantee (the trust). This legal process is typically initiated by executing a written deed, which then needs to be recorded with the appropriate county office in Detroit, Michigan, for it to be legally recognized. There are various subtypes or variations of the Detroit Michigan Quitclaim Deed — Two Individuals to a Trust, including: 1. Inter vivos trust: In this type, the property is transferred to a trust during the lifetime of the granters. It allows the granters to retain control over the property until their death or a specific event stated in the trust document occurs. 2. Revocable trust: With a revocable trust, the granters retain the ability to modify or revoke the trust during their lifetime. This offers flexibility and control over the property and allows for easy transfer of assets to beneficiaries after the granters' passing. 3. Irrevocable trust: Unlike a revocable trust, an irrevocable trust cannot be modified or revoked without the consent of the beneficiaries or some other legal conditions being met. Once the property is transferred to an irrevocable trust, the granters typically give up all rights and control over the property. It is important to consult with a legal professional well-versed in Detroit Michigan real estate and trust law before proceeding with a Quitclaim Deed — Two Individuals to a Trust. This ensures that the document accurately reflects the parties' intentions and complies with all relevant laws and regulations.