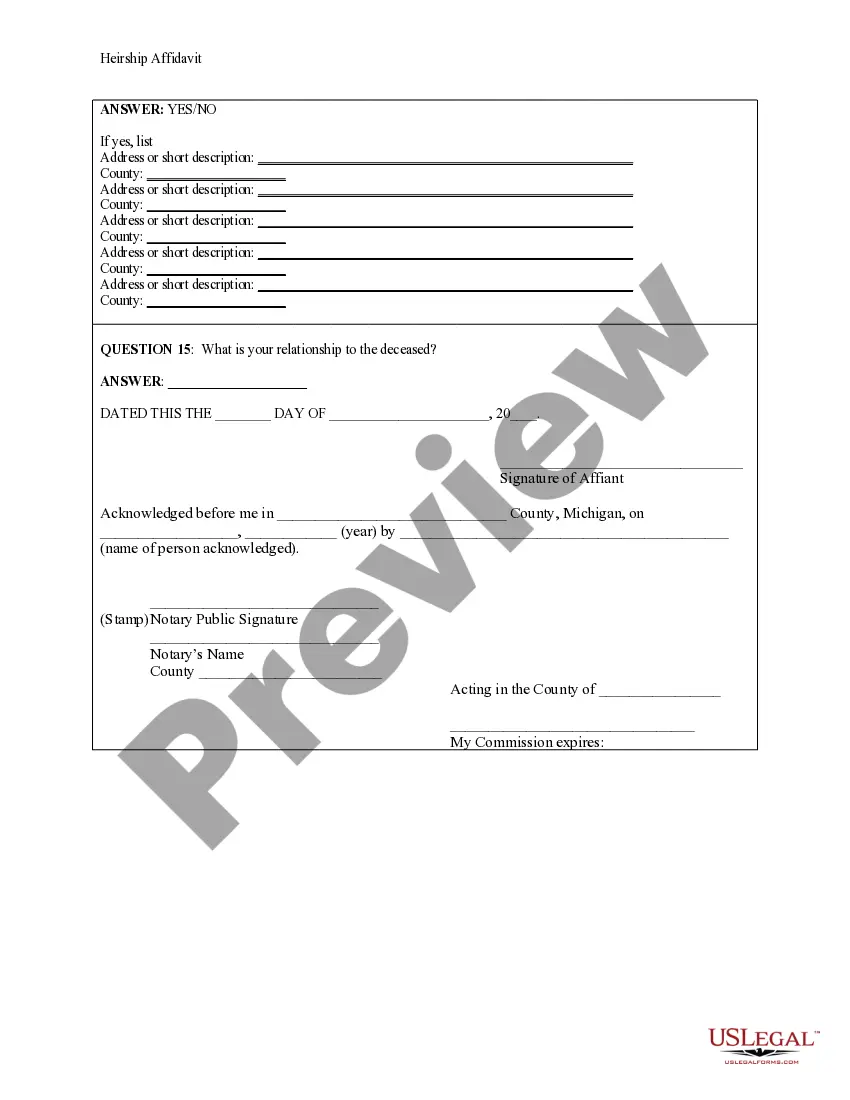

This Heirship Affidavit form is for a person to complete stating the heirs of a deceased person. The Heirship Affidavit is commonly used to establish ownership of personal and real property. It may be recorded in official land records, if necessary. Example of use: Person A dies without a will, leaves a son and no estate is opened. When the son sells the land, the son obtains an heirship affidvait to record with the deed. The person executing the affidavit should normally not be an heir of the deceased, or other person interested in the estate.

Detroit Michigan Heirship Affidavit - Descent

Description

How to fill out Michigan Heirship Affidavit - Descent?

Regardless of social or career standing, finishing legal documents has become a regrettable requirement in the current society. Frequently, it's nearly unfeasible for an individual lacking any legal knowledge to generate such documents from scratch, primarily because of the complicated language and legal subtleties involved.

This is where US Legal Forms steps in to assist. Our service offers an extensive collection of over 85,000 ready-to-use, state-specific forms that are applicable for nearly every legal scenario. US Legal Forms is also a valuable resource for associates or legal advisors who aim to save time by utilizing our DIY documents.

Whether you require the Detroit Michigan Heirship Affidavit - Descent or any other documentation that would be appropriate in your region, US Legal Forms has everything accessible. Here’s how to obtain the Detroit Michigan Heirship Affidavit - Descent swiftly using our trustworthy platform. If you are already a member, you can proceed to Log In to your account to download the required form.

You're all set! Now you can proceed to print the form or fill it out online. If you encounter any difficulties finding your purchased documents, you can easily locate them in the My documents section.

No matter what issue you're looking to address, US Legal Forms is here to assist you. Give it a try now and experience it for yourself.

- Confirm that the form you have selected is tailored to your area since the laws of one area do not apply to another.

- Examine the form and read a brief summary (if provided) of the situations for which the document can be utilized.

- If the chosen form does not fulfill your needs, you can restart and look for a more suitable form.

- Click Buy now and select the subscription plan that best fits your needs.

- Use your credentials or sign up for a new account.

- Choose your payment method and continue to download the Detroit Michigan Heirship Affidavit - Descent once the payment is finalized.

Form popularity

FAQ

If you do not have a surviving spouse, your children inherit your estate in equal portions. If there are no surviving children, your surviving grandchildren, siblings, or parents will be entitled to the estate, according to specific provisions in the Michigan statute.

Statutes say that probate should be finished within one year, but special circumstances may cause it to go longer.

If there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

The dollar limit can change each year. If a person dies in 2022 an estate must be valued at $25,000 or less to be small. If a person died in 2020 or 2021, an estate must be valued at $24,000 or less. If a person died in 2019 or 2018, an estate must be valued at $23,000 or less.

Obtaining a Grant of Probate is needed in most cases where the total value of the deceased's estate is deemed small... Going through the process of probate is often required to deal with a person's estate after they've passed away.

When an individual dies with or without a will, the state probate courts in Michigan administer the estate. Any assets held without a beneficiary, joint owner or in trust will pass through probate. A will directs who will get the assets and who is in charge of the administration.

A Michigan small estate affidavit is a document that allows a petitioner, known as an ?affiant,? to stake a claim on property from the estate of a deceased loved one, known as the ?decedent.? In Michigan, this process is available to estates that have a value of $15,000 ? as adjusted for cost of living (see below) ? or

If there is no will, or the person named in the will isn't available or willing to serve, the probate court will appoint someone to serve as personal representative. The surviving spouse, if any, has first priority to be appointed as personal representative if he or she inherits under the will. Mich.

The line of inheritance begins with direct offspring, starting with their children, then their grandchildren, followed by any great-grandchildren, and so on. The legal status of stepchildren and adopted children varies by jurisdiction.

Assets owned in the deceased's name only (such as real estate, bank accounts, stocks and bonds) and personal property exceeding $15,000 generally have to go to probate court. Michigan law also allows for a streamlined probate process in the case of smaller estates under a certain value.