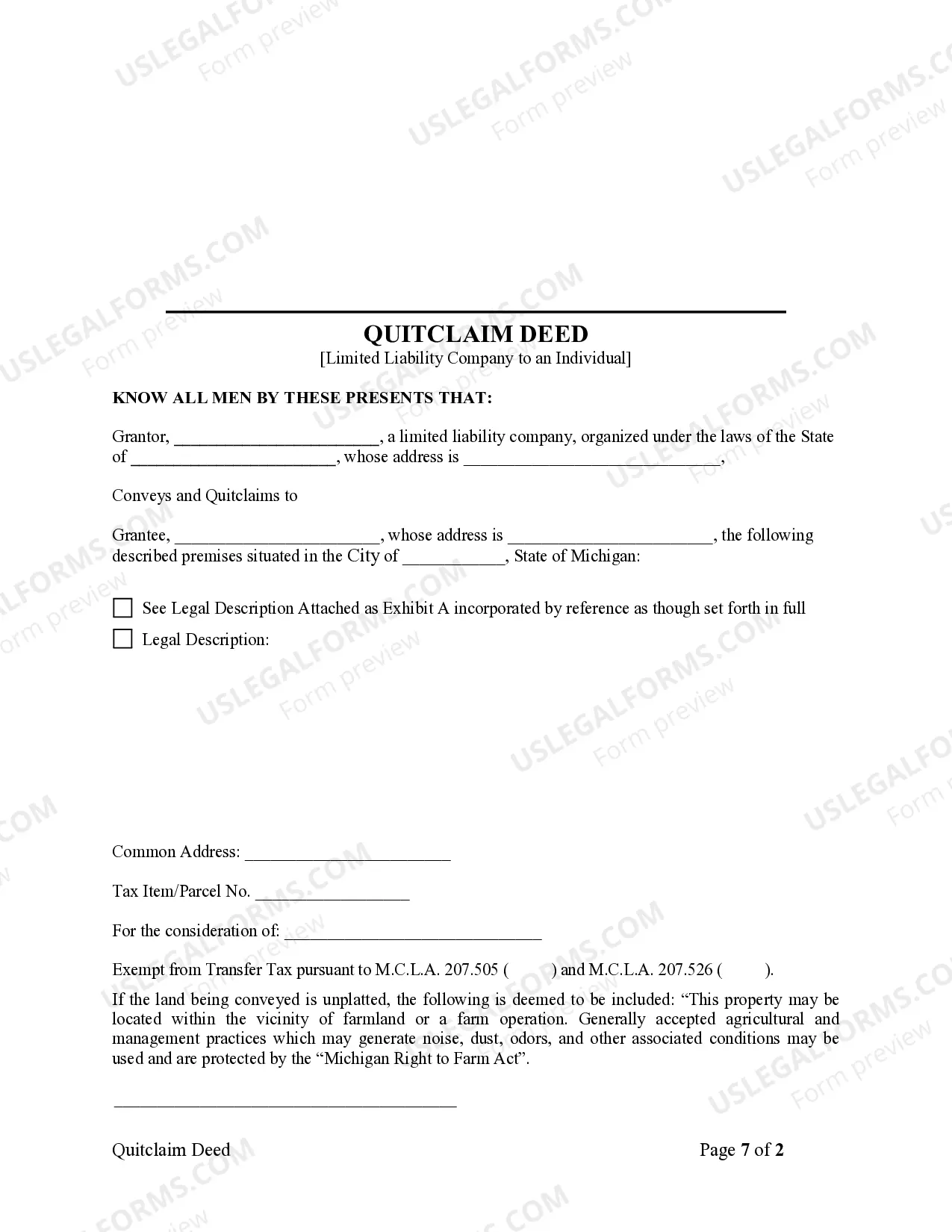

This form is a Quitclaim Deed where the grantor is a limited liability company and the grantee is an individual. Grantor conveys and quitclaims the described property to grantee. This deed complies with all state statutory laws.

A Wayne Michigan Quitclaim Deed — Limited Liability Company to an Individual is a legal document that transfers ownership of a property from a Limited Liability Company (LLC) to an individual. This type of deed is commonly used when a member of an LLC wants to transfer their ownership interest in a property to themselves as an individual. Key characteristics of a Wayne Michigan Quitclaim Deed — Limited Liability Company to an Individual include the following: 1. Ownership Transfer: The deed facilitates the transfer of ownership rights from the LLC to an individual member, allowing them to have personal ownership of the property. 2. Quitclaim Deed: A quitclaim deed is used in this transaction, meaning that the LLC makes no warranties or guarantees about the property's title or condition. The individual receives only the ownership interest held by the LLC at the time of transfer. 3. Limited Liability Company (LLC): The LLC is a legal business entity commonly used to protect the personal assets of its members. Transferring property from an LLC to an individual can have various reasons, such as an individual deciding to exit or dissolve the LLC or consolidating personal ownership. 4. Wayne Michigan: This type of quitclaim deed pertains specifically to properties located in Wayne County, Michigan. The transfer of property ownership is subject to Michigan state laws and regulations. There can be variations of the Wayne Michigan Quitclaim Deed — Limited Liability Company to an Individual based on specific circumstances. For instance: 1. Partial Interest Transfer: An LLC member may decide to transfer only a portion of their ownership interest to themselves as an individual, retaining the remaining interest within the LLC. This can be done for tax purposes or as part of an internal restructuring. 2. Multiple Members: If the LLC has multiple members, each member can individually transfer their ownership interest to themselves or other individuals through separate quitclaim deeds. Each deed would reflect the specific transfer of ownership from the LLC to a particular individual member. 3. Additional Terms and Conditions: Parties involved in the transfer may include additional specific terms and conditions within the quitclaim deed, such as any liabilities the individual member assumes in the property, rights of other LLC members, or restrictions on future property transfers. In summary, a Wayne Michigan Quitclaim Deed — Limited Liability Company to an Individual is a legal instrument used to transfer ownership of a property from an LLC to an individual. It enables LLC members to consolidate personal ownership or exit the LLC altogether. Various types and circumstances of this type of deed exist, including partial interest transfers, multiple members' transfers, and the inclusion of additional terms and conditions based on the parties' agreement.