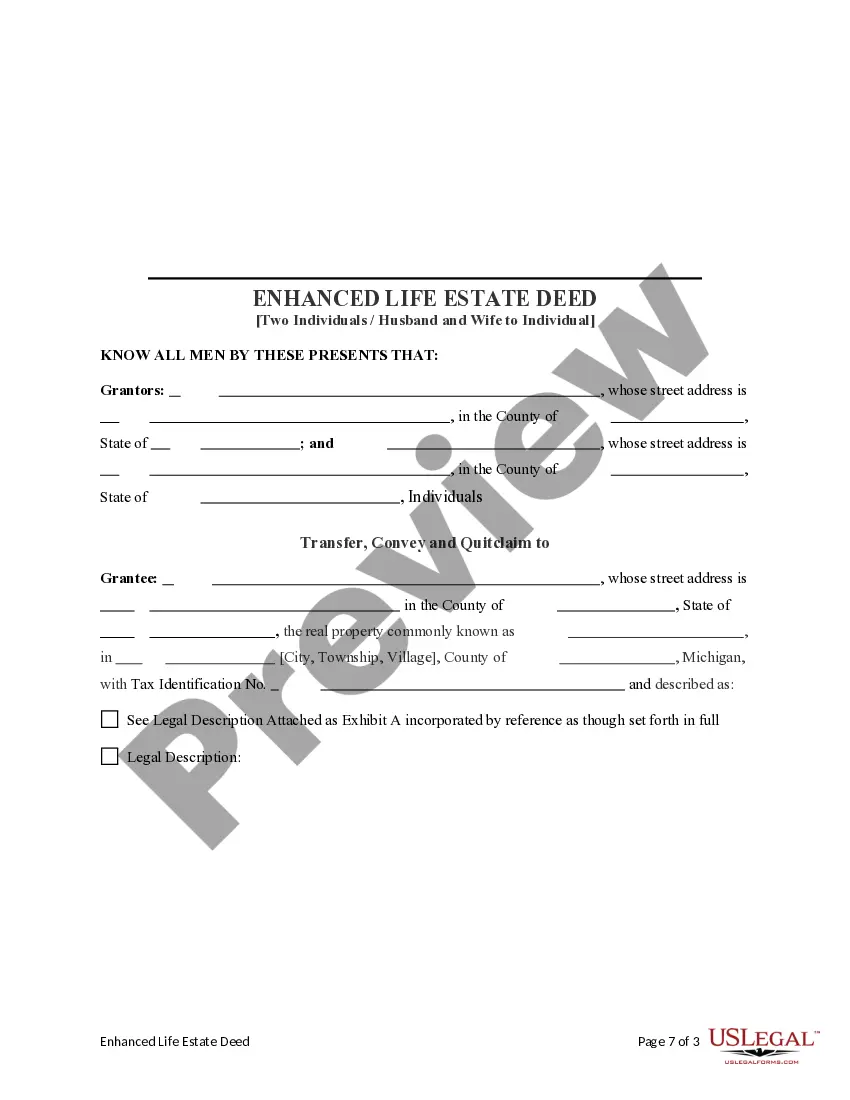

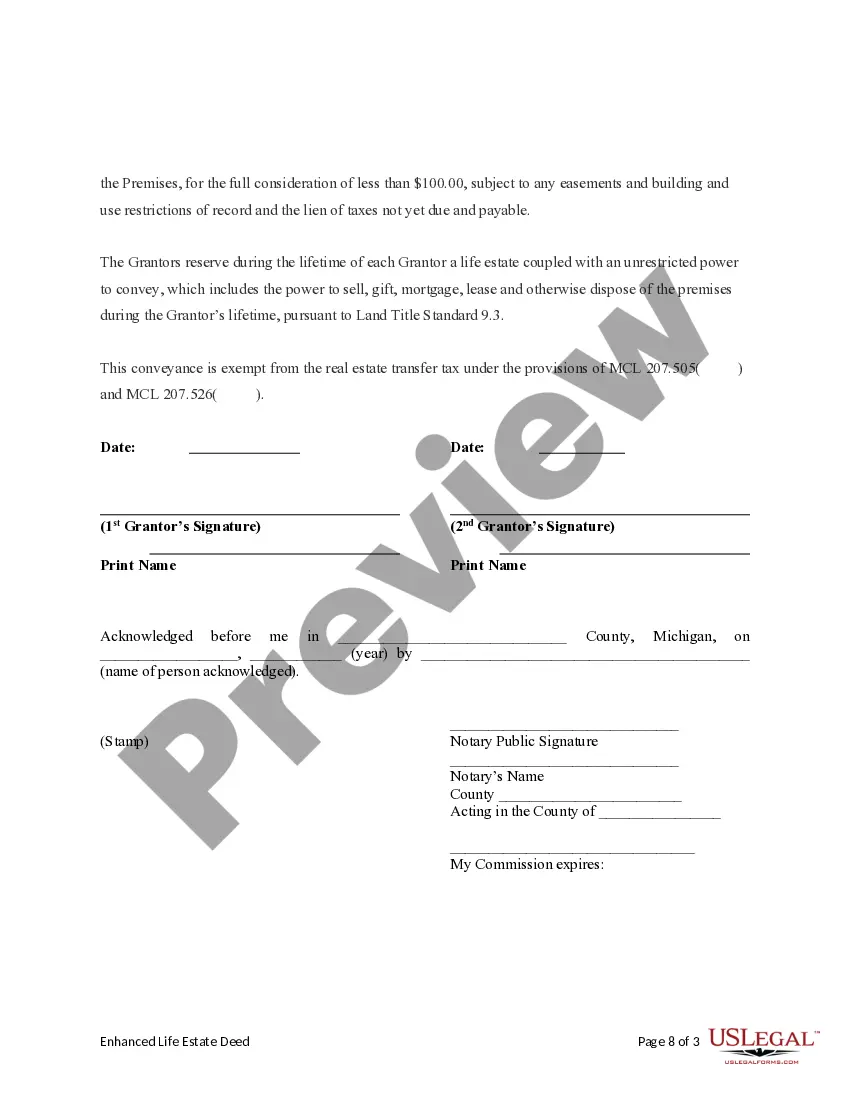

This form is a Quitclaim Deed with a retained Enhanced Life Estate where the Grantors are two individuals or husband and wife and the Grantee is an individual. It is also known as a "Lady Bird" Deed. Grantors conveys the property to Grantee subject to a retained enhanced life estate. The Grantors retains the right to sell, encumber, mortgage or otherwise impair the interest Grantee might receive in the future, without joinder or notice to Grantee, with the exception of the right to transfer the property by will. This deed complies with all state statutory laws.

A Detroit Michigan Enhanced Life Estate or Lady Bird Deed is a legal instrument that allows two individuals, specifically a husband and wife, to transfer their ownership of real property to an individual while retaining the right to use and enjoy the property during their lifetime. This type of deed is a flexible estate planning tool that provides numerous benefits, including avoiding probate, preserving Medicaid eligibility, and securing the property for the individual receiving it. In a Detroit Michigan Enhanced Life Estate or Lady Bird Deed, the husband and wife, who are also known as the granters, convey the property to a third party, referred to as the grantee or remainder man. However, they reserve a life estate for themselves, meaning they have the right to occupy, use, and receive income from the property until their death. This allows them to maintain control and enjoyment of the property while still ensuring its transfer to the designated individual upon their passing. One significant advantage of this type of deed is that it bypasses the need for probate. Upon the husband and wife's death, the property automatically transfers to the grantee without the involvement of the court or the need for a lengthy and expensive probate process. This not only saves time and money but also provides peace of mind to the grantee, as the property transfer is swift and efficient. Another benefit of the Detroit Michigan Enhanced Life Estate or Lady Bird Deed is that it can help preserve Medicaid eligibility. If the husband and wife ever require long-term care and must apply for Medicaid benefits, the property can be excluded from consideration as an asset in their eligibility assessment. This is because they technically do not own the property outright but instead hold a life estate interest. Consequently, the property is shielded from being counted towards their total assets, allowing them to qualify for Medicaid benefits while still preserving the property for the grantee. Additionally, this type of deed guarantees that the property will ultimately transfer to the grantee. Unlike a traditional life estate arrangement, where the grantee's interest only becomes absolute upon the death of the last surviving life tenant, the Detroit Michigan Enhanced Life Estate or Lady Bird Deed allows for the grantee's immediate ownership. This means that the grantee has full control over the property once the deed is executed. This provision ensures security for both the granters and the grantee, as the granters can rest assured knowing the property will be transferred to their chosen individual, while the grantee can enjoy the property without the fear of future complications or disputes. It is important to note that there may be variations or different types of Detroit Michigan Enhanced Life Estate or Lady Bird Deeds, such as those tailored for specific circumstances or individuals. However, the fundamental concept remains the same — the transferors (husband and wife) retain a life estate while conveying the property to an individual (grantee) who gains ownership upon the transferors' death. It is advisable to consult with a knowledgeable attorney or estate planner to understand the specific nuances and legalities of these deeds, as they may vary based on individual situations or legal requirements.