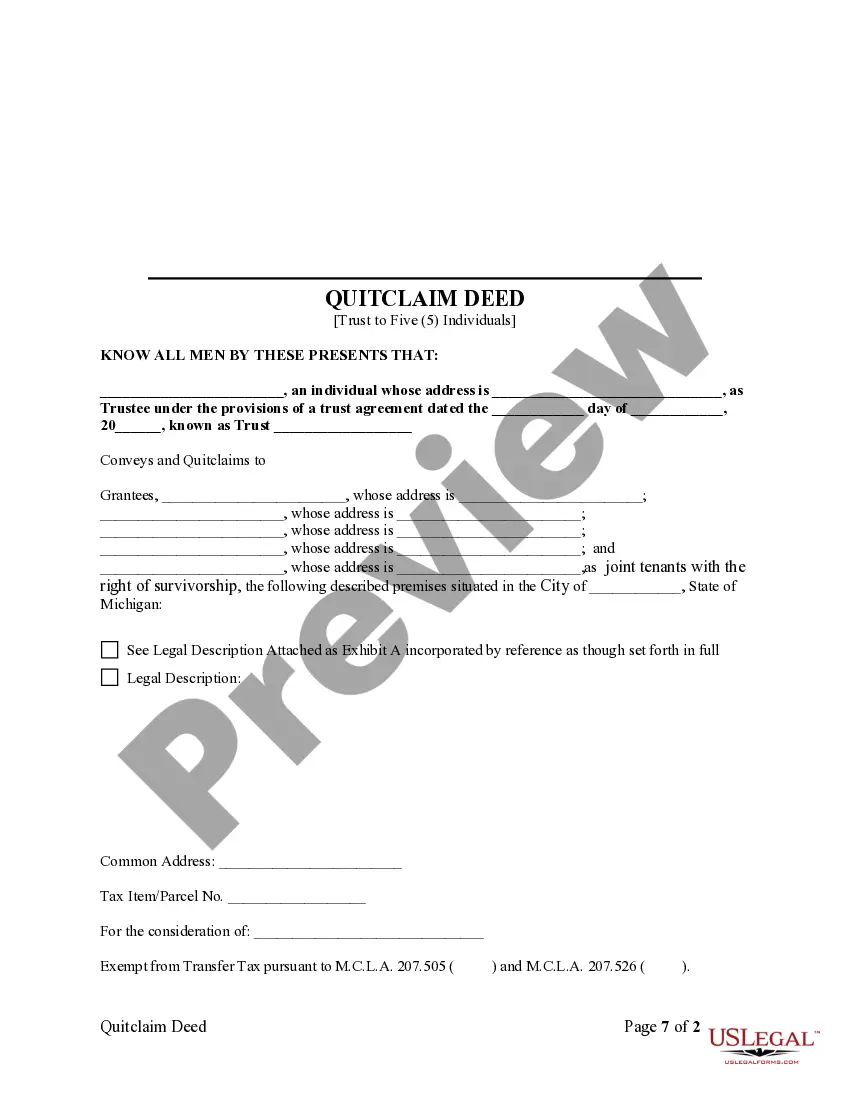

This form is a Quitclaim Deed where the Grantor is a Trust and the Grantees are Five Individuals. Grantor conveys and quitclaims the described property to Grantees. Grantees take the property as joint tenants with the right of survivorship or as tenants in common. This deed complies with all state statutory laws.

A Wayne Michigan Quitclaim Deed from Granter Trust to Five Individual Grantees is a legal document that transfers ownership of a property held in a trust to five specific individuals, known as grantees. This type of deed ensures that the property is distributed according to the granter's wishes outlined in the trust. In Wayne, Michigan, there are two main types of Quitclaim Deeds from Granter Trust to Five Individual Grantees: 1. Wayne Michigan "Individual" Quitclaim Deed from Granter Trust to Five Individual Grantees: This deed is used when the granter wants to transfer property solely to five individuals as specified in the trust agreement. It indicates a clear intention to distribute ownership to those specific grantees. 2. Wayne Michigan "Joint Tenancy" Quitclaim Deed from Granter Trust to Five Individual Grantees: This type of deed establishes joint ownership of the property among the five grantees. In a joint tenancy, if one of the grantees were to pass away, their share would automatically transfer to the remaining grantees, without the need for probate. When creating a Wayne Michigan Quitclaim Deed from Granter Trust to Five Individual Grantees, several important elements need to be included. These keywords are vital when dealing with this type of legal document: 1. Trust Agreement: The initial document outlining the granter's intentions to transfer ownership of the property to the trust, which then enables the distribution to the five individual grantees. 2. Granter: The individual or entity who legally owns the property and decides to transfer it to the trust for distribution to the grantees. 3. Grantees: The five individuals specified in the trust agreement as the intended owners of the property. Their names and relevant details should be clearly stated in the Quitclaim Deed. 4. Property Description: Include a thorough description of the property being transferred, including its legal description, address, and any relevant parcel or survey numbers. 5. Language of Conveyance: The deed should state that the granter is conveying their interest in the property to the grantees, including any rights, title, and interest they hold. 6. Consideration: This section clarifies whether any money or other valuable consideration is being exchanged as part of the transfer. In most cases of a Quitclaim Deed, no consideration is involved as the transfer is typically a gift or part of an estate plan. 7. Execution and Notarization: Ensure that the Quitclaim Deed is properly executed by the granter, signed in the presence of witnesses, and notarized to validate its authenticity. It is crucial to consult with a qualified attorney or real estate professional familiar with Wayne's specific laws and regulations to ensure that the Quitclaim Deed adheres to all legal requirements.